Venezuela’s inflation rate topped 130,000% in 2018 as peer-to-peer Bitcoin and Dash transactions reached new all-time highs month after month.

Bitcoin Thrives in Broken Economies

For the past few years, the Venezuelan economy has been rocked by political and economic instability that has led to shortages of food and medicine, nationwide blackouts, riots and unstoppable hyperinflation that rivals that of the Zimbabwe dollar in the 1990s.

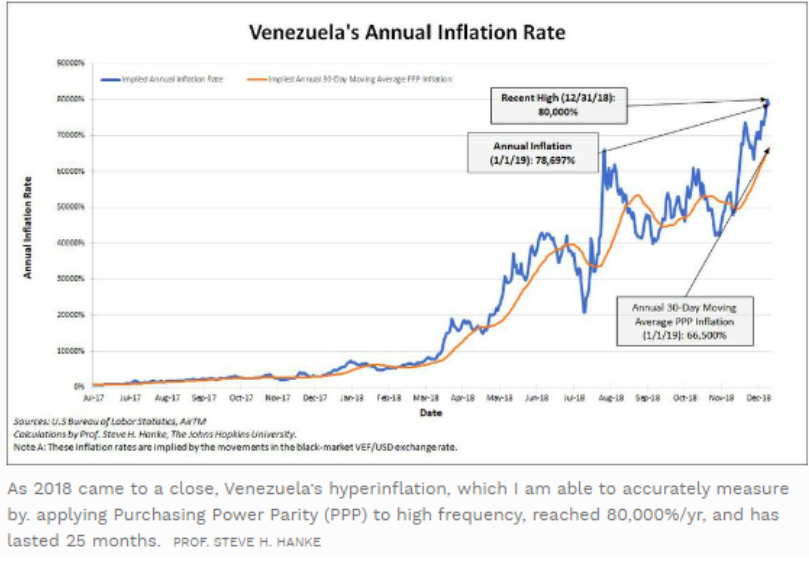

In fact, Venezuela had the highest inflation rate of 2018 and at its peak, it was 130,060%. Surprisingly, in May 2019 Venezuela’s central bank publicly published economic data for the first time since 2015 and the data shows that Venezuela’s inflation rate in 2016 was 274%, 863% in 2017 and 130,060% in 2018.

Hyperinflation in Venezuela is so bad that most citizens have to spend all their money immediately because if they hold off for a few days the currency will continue to lose value against the rising price of basic daily staples.

The majority of Venezuelans do not trust the bolivar, and in the past those who were unable to spend their income on the spot sought to purchase gold or the US dollar as a hedge against inflation.

Both options come with risks as organized crime and price gouges are always prepared to take advantage of those holding physical currency.

Crypto Finds a Real World Use Case in Latin America

Fortunately, cryptocurrencies are easier to ‘hold’ and have become a safer option embraced by a growing number of Venezuelans. Both Dash and Bitcoin have become popular mediums of exchange and store of value currencies.

A recent study from the Ledger Journal investigated the role Bitcoin played in countries experiencing economic uncertainty and contributing analyst Jackie Johnson found that:

In countries where residents are under pressure from economic mismanagement, Bitcoin trading becomes critical. Two factors drive Bitcoin trading: one, there is pressure to purchase Bitcoin using local currency before it loses even more value; and two, there is a need to redeem for the local currency either past purchases or purchases made outside the country by friends/family, enabling residents to cope with rising prices. This results in an increase in Bitcoin trading in the local currency.

Johnson’s findings are supported by data from LocalBitcoins which shows explosive growth in the number of peer-to-peer Bitcoin transactions and all throughout 2018 and 2019 Venezuela and Argentina have continuously notched new all-time highs for peer-to-peer Bitcoin transactions.

Despite the growth in Bitcoin transactions Venezuelan economist Danial Arraez says that mass adoption is still a distant target. Arraez said:

In the country there is still not enough adoption of bitcoin, because with few exceptions, cryptocurrencies, including bitcoin and altcoins, are, in most cases, a proxy currency (substitute) to facilitate fiat exchange, with the USD-VES pair being the most traded, but without being able to set aside the VES-CLP (bolivars in Chilean pesos), VES-COP (in Colombian pesos), VES-ARS (in Argentine pesos), VES-BRL (in Brazilian real) and VES-PEN (in Peruvian sol) pairs.

Interestingly, a Rhythm, a popular crypto analyst recently tweeted that if a person held $1 million worth of Venezuelan bolivars since 2013, this amount would now be worth less than $0.37.

Bitcoin might not have reached the level of mass adoption in Latin America, but if the situation doesn’t change it appears that will only be a matter of time before it does.

Do you think Bitcoin mass adoption will first occur in Latin America or a different region? Share your thoughts in the comments below!

Images from Bitcoinist Image Library, Twitter: @RhythmTrader, Shutterstock

The post P2P Bitcoin And Dash Transactions Soar In Venezuela appeared first on Bitcoinist.com.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube