As anyone who has ever sought to lend crypto will attest, significant variance exists in the APR offered to lenders. Indeed, the spectrum can swing from 1% to 8% – even when it’s the same asset being loaned across platforms such as Coinbase, Poloniex, Compound and Dharma. As a consequence, would-be lenders seeking passive income must shop around for the best offer. Here are six high-interest options for lenders.

Also read: Low Interest Rates Provide Precarious Protection Against Crisis, World Bank Warns

It Pays to Shop Around

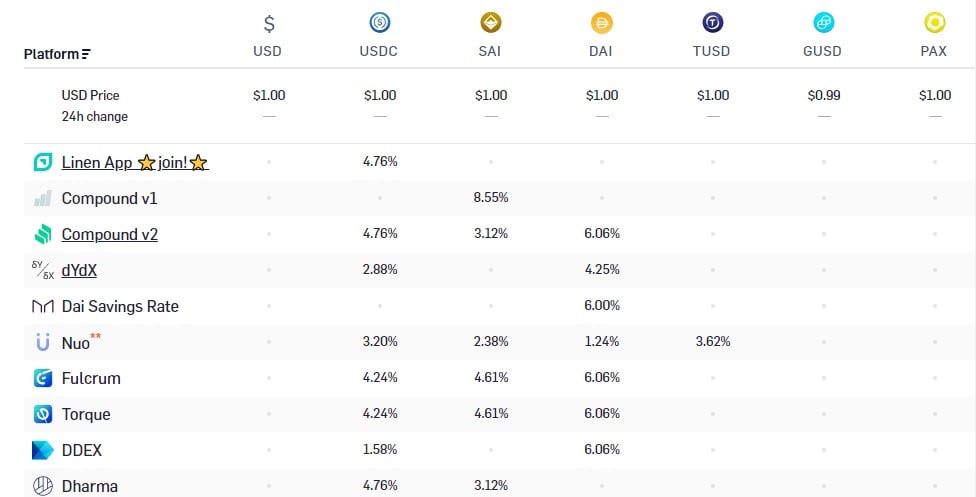

There’s a lot of options to factor in with crypto lending over and above the quoted APR. You can choose between custodial and noncustodial, monthly, quarterly, and annual interest, and various cryptos from BTC to stablecoins. Platforms such as Loan Scan mercifully make the task easier by enabling a side-by-side comparison of the best options for lenders. There’s also information for borrowers seeking the most attractive terms. Below are some of the best high-yield options presently available to lenders.

Nexo

While the majority of lenders offer varying rates depending on the currency, Nexo is different – its 8% guarantee holds true across fiat currencies like USD, EUR and GBP as well as popular stablecoins such as USDC, USDT, SAI, TUSD, and PAX. The platform has just added EOS to the list of available collateral for its Instant Crypto Credit Lines, enabling holders to spend the dollar value of their EOS without selling it.

With Nexo, you can withdraw your funds whenever you want without penalty, just like a regular bank account. Given that 8% is the highest rate quoted by Loan Scan, Nexo’s custodial lending platform is worth your attention. All the more so if you own Terra: thanks to last year’s partnership between the two companies, Terra is offering to augment Nexo’s 8% interest rate with additional returns funded by its seigniorage model, enabling Terra holders to enjoy double-digit yearly returns on Nexo.

Celsius

Celsius almost manages to emulate Nexo by offering a fixed rate across most stablecoins: 7% for TUSD, GUSD, PAX, and USDC. The rate is well below that for SAI though, standing at 3.1%. Of course, you can collateralize non-stablecoins too, with Celsius offering 2.8% interest for ETH, 3.05% for BTC, 2.9% for XRP, and 3.15% for ZRX. A custodial system, Celsius recently hit the headlines by confirming it had handed out more than $4.25B in crypto loans last year, including over $2B in the course of 90 days. It also paid out over $5M in interest income.

Crypto.com

Acquired by Monaco in 2018, Crypto.com offers an impressive interest rate of 6% on three stablecoins (USDC, TUSD and PAX) and three of the most popular digital currencies (ETH, BTC and XRP), making it an appealing option for a broad spectrum of investors and hodlers. You can avail yourself of even better rates when you stake MCO tokens.

Blockfi

Blockfi specializes in providing clients with access to high-interest crypto accounts and low-cost credit products. Until recently, Blockfi only supported two currencies, namely ETH, for which the rate is 4.1% for deposits below 1,000 ETH (and 0.5% for everything above), and BTC, which stands at 6.2% for holdings less than 10 BTC, with everything above that earning 2.2%. However, in 2020 the company aims to add five to ten new assets including USDC (8.6%) and litecoin (3.78%). Be advised, Blockfi has had to cut rates more than once due to depositor demand outstripping borrower supply.

Coinlist

Founded in San Francisco in 2017, originally as a capital-raising platform, Coinlist is now all over the stablecoin market, offering the same rate of 5.84% interest on USDC, SAI, TUSD, GUSD, and PAX. It also furnishes users with 2.92% on ETH and BTC, 5.11% on ZRX, XRP and REP, and 3.65% on Brave’s BAT. It’s worth having a look at their website too, as they seem to be adding tokens all the time.

DAI Savings Rate now 6%

That’s the highest it’s ever been

That means you can lock up your DAI in a savings contract & earn 6% per year with no additional risk

Maybe better yet…

Wrap it in cDAI & earn the 6% without locking it up. cDAI can be transferred & spent!#bankless

— Ryan Sean Adams – rsa.eth (@RyanSAdams) January 8, 2020

It’s little wonder crypto owners are seeking to generate a passive income by putting their crypto to work via high-interest paying loans. Of course, that isn’t the only thing driving the crypto lending market: traders are also borrowing crypto to overcome capital inefficiencies. The crypto space currently offers significantly higher interest rates than the fiat world, with platforms like Cred allowing people to earn up to 10% on their BTC and BCH holdings.

Aspiring lenders seeking to profitably deploy their crypto holdings should keep an eye on interest rates, which are subject to change, and be sure to read the small print.

Have you tried crypto lending or borrowing? If so, what platforms do you recommend? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post 6 High Interest-Paying Options for Crypto Lenders appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube