During the first month of the new year, the research firm Tokeninsight published its “Mining Industry Annual Research Report,” which covers the competitive bitcoin mining sector. Tokeninsight’s study highlights the fact that BTC’s hashrate increased by 80% in 2019, even though BTC’s year-over-year average price dipped by 1.9%. Tokeninsight’s report also notes that more than 73% of the market share of ASIC mining hardware stems from China.

Also Read: Mining Report Shows 65% of Bitcoin’s Hashpower Stems From China

SHA-256 Hashrate Grows 80%, ASIC Hardware Improves, and 70% of the Mining Industry Leverages Renewable Energy

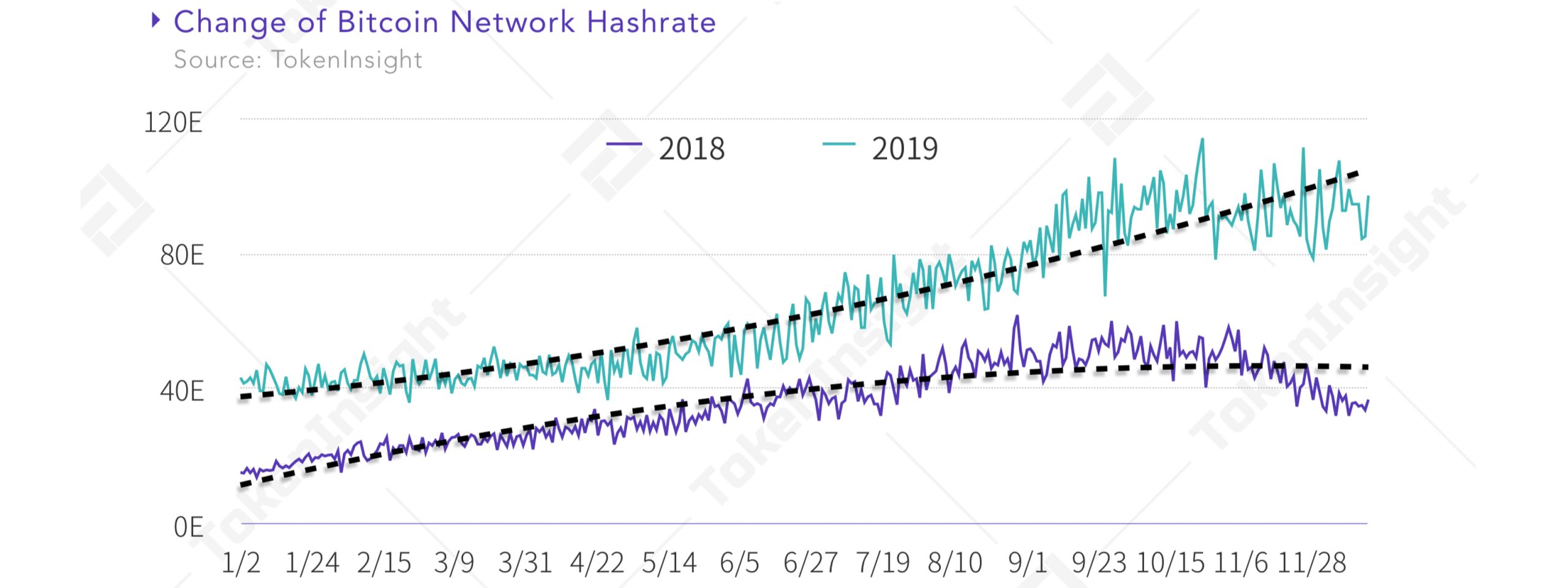

Tokeninsight is an independent organization “dedicated toward providing accurate data, ratings, and analytics” when it comes to the cryptocurrency ecosystem. The researchers have recently published the company’s annual mining industry report that discloses a range of figures from 2019. It also details the firm’s predictive outlooks for certain aspects of the mining ecosystem in 2020. The report is based on public sources and data as well as information from industry heavyweights like Antpool, Viabtc, and Poolin. The study shows how BTC’s hashrate surpassed 100 exahash last year and continues to climb.

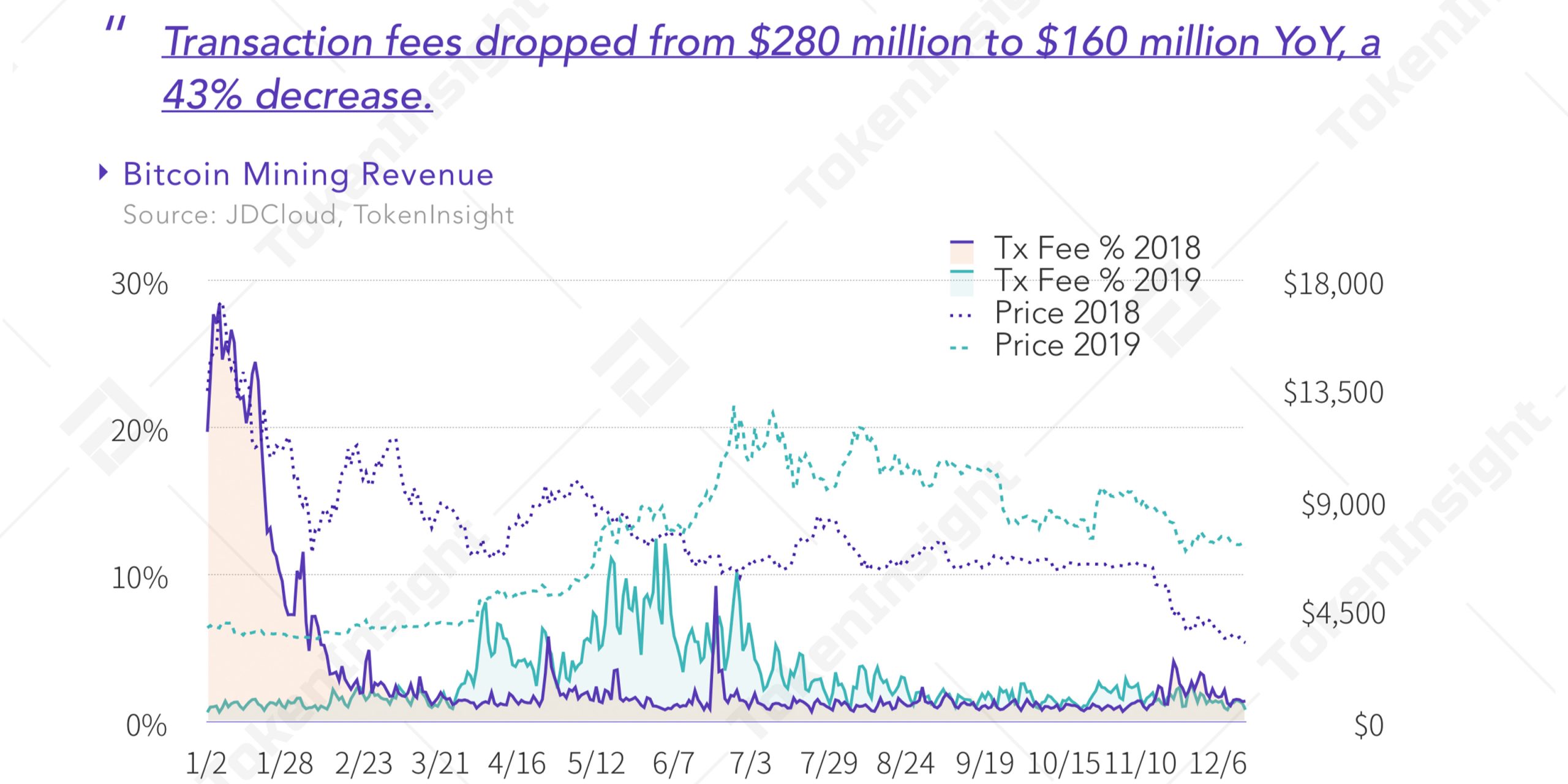

Tokeninsight’s report indicates that the BTC’s yearly average hashrate spiked by more than 80% in 2019. Transaction fees on the BTC network were lower and during the course of 2019, miners only accrued $160 million in fees as opposed to 2018’s $280 million. Tokeninsight emphasizes the fact that single unit mining rigs produced by the world’s top ASIC manufacturers became far more efficient last year.

“The performance improvement of the mining hardware is part of the reasons, and the profitability of the Bitcoin mining segment is another contributing factor,” Tokeninsight’s report notes. “The average ROI of the mining industry is about 1 year, and the profitability is incomparable with the traditional industry.”

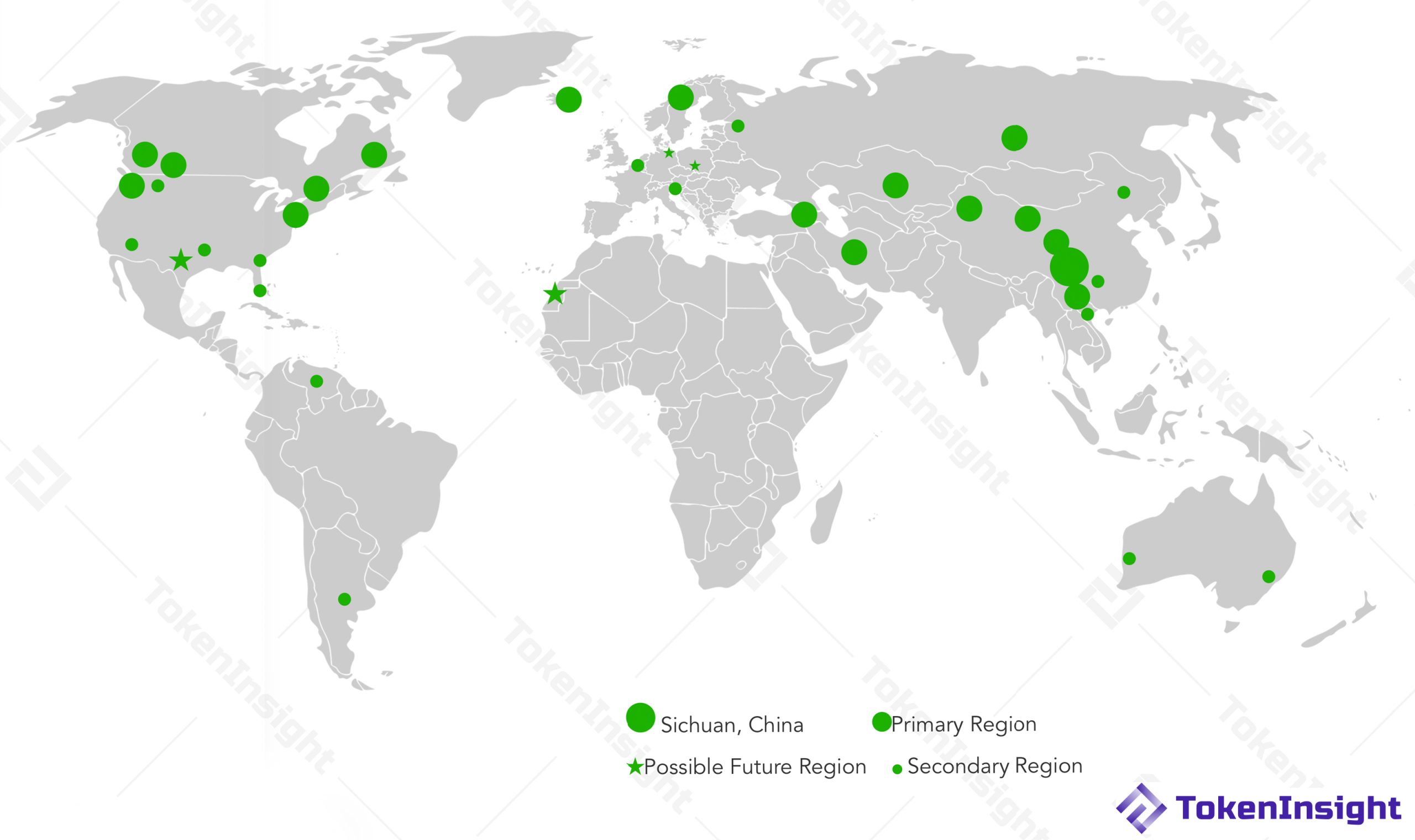

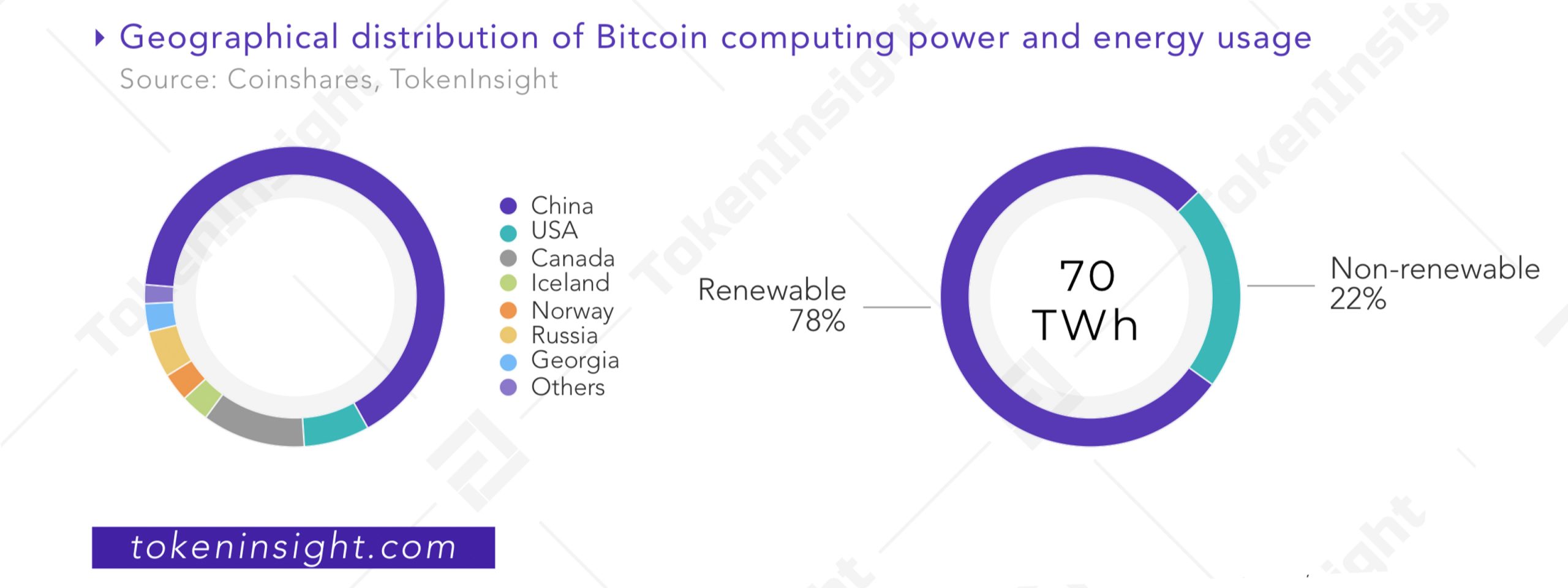

Similar to the last Coinshares H2 mining report, the Tokeninsight mining study highlights that China is the most dominant region of bitcoin miners. “Geographically, the Bitcoin network hashrate is mainly distributed in the following regions: China, the United States, Canada, Northern Europe, Russia, and Georgia,” the report highlights. Additionally, most of the electrical consumption used for mining is renewable energy sources, as 70% of the mining industry levies renewables Tokeninsight notes. Another discussion brought up in the mining study is the future of BTC’s third halving. “After the 3rd halving, the Bitcoin inflation rate will decrease to ~ 1.7%, which is much lower than 4.8% – 6.2% (Gold) and 5% (M1) issue rate,” the researchers stress.

China Dominates the ASIC Manufacturing Game, Competing for Next-Gen Chips, and the Growth of Cloud Mining and Comprehensive Service Providers

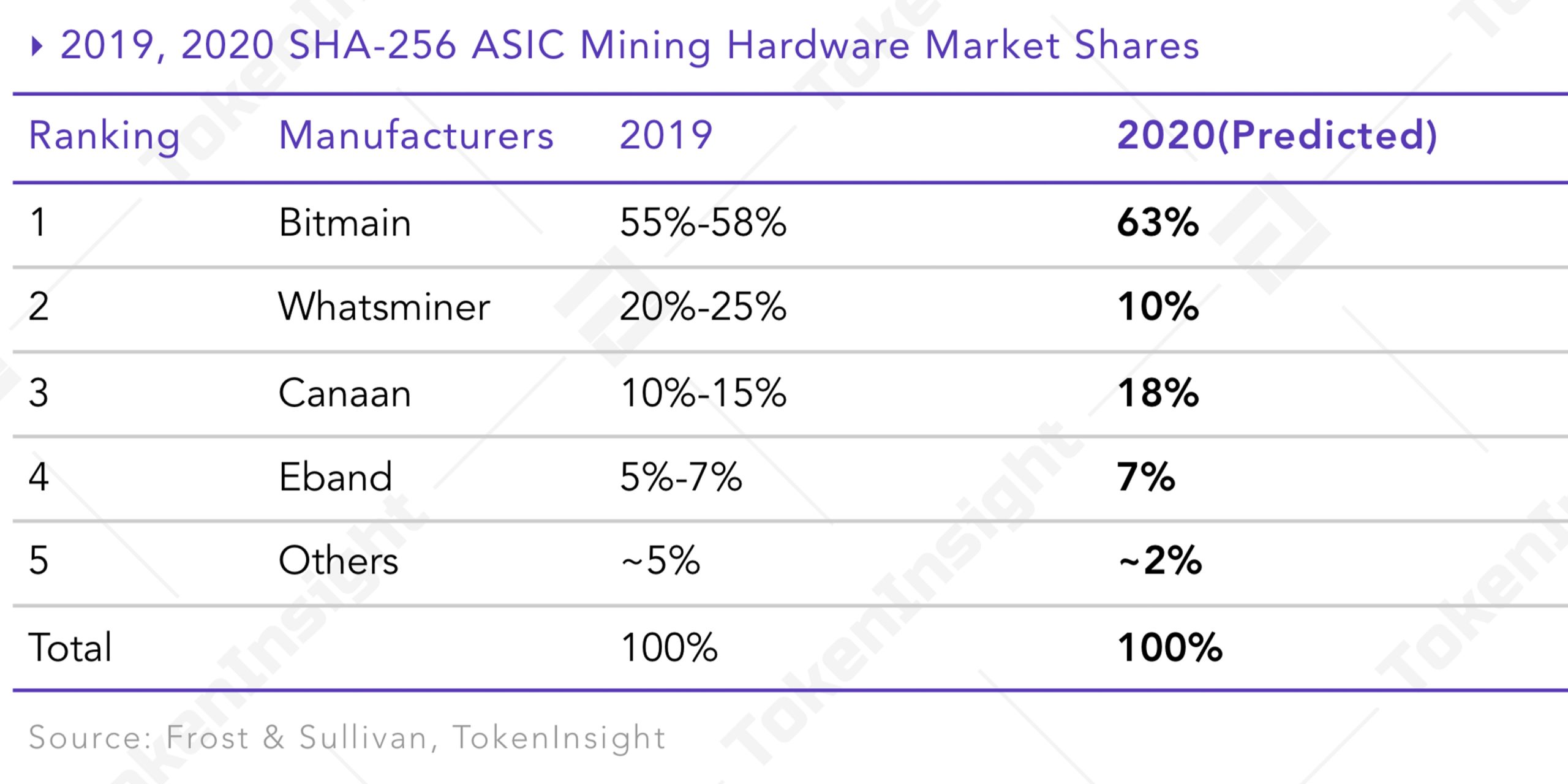

Other insights from the report show that China accounts for 73% of ASIC manufacturing worldwide, and alongside this, the future of the cloud mining market “is outside of China.” By conducting several interviews and market surveys, the firm believes that it’s able to predict the market share of the top five ASIC manufacturers. Tokeninsight thinks Bitmain will capture 63% of 2020’s market share followed by Microbt (10%), Canaan (18%), Ebang (7%), and others (2%). “The distribution of SHA-256 ASIC mining hardware manufacturers is concentrated, and the top four manufacturers in 2019 accounted for more than 95% of the total market,” the report asserts.

Similar to news.Bitcoin.com’s recent reports on next-generation semiconductors, Tokeninsight says that “the support of chip makers will largely determine the success or failure of mining hardware manufacturers.” The study notes that Samsung and Taiwan Semiconductor Manufacturing Company (TSMC) are the main suppliers of these chips. And because firms like Apple and Samsung need the best chips for new smartphones, there’s a shortage when it comes to next-generation chips. “At present, 5nm chips are already in the tape-out stage, and 5nm mining hardware may be released early next year,” the study explains. Tokeninsight’s report adds:

Whether it is TSMC’s 5nm, 7nm chips or Samsung’s 8nm chips, the chip supply is relatively in shortage, and at the same time, mining hardware manufacturers also have to compete with mobile phones for chips supply.

The remainder of the report explains how mining pools are not “well structured,” and in the future they will likely partner with independent third-party agencies Tokeninsight predicts. Right now, altcoins that don’t leverage the SHA-256 algorithm are still dominated by GPU and CPU miners mainly from Europe and the U.S. The study’s 2020 outlook predicts that in the future, mining pools will start integrating more types of altcoin mining and GPU/CPU to FPGA “could be occupied by ASIC mining in the long run.” Tokeninsight expects cloud mining products will grow and reach a “broader market,” while 2020 will possibly see “mining farms located outside of China” growing at a faster pace.

The biggest takeaway from Tokeninsight’s 2020 annual mining report shows the firm believes comprehensive service providers dedicated to the mining industry will grow exponentially. “Problems in the cryptocurrency mining industry have spawned a series of comprehensive mining service providers and they are trying to provide one-stop solutions for the industry,” Tokeninsight’s research notes. Tokeninsight’s study shows that mainstream assistance may bolster this trend with benefits like the Nasdaq-listed Canaan Creative stock. Overall, the 25-page report shows that the cryptocurrency mining industry looks unlikely to slow any time soon.

What do you think about Tokeninsight’s annual mining report? How do you envision the mining ecosystem growing in 2020? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any ideas, software, mining rigs, mining rig manufacturers, websites, concepts, content, goods or services mentioned in this article.

Image credits: Shutterstock, Pixabay, Wiki Commons, Fair Use, Tokeninsight’s mining report.

Did you know you can earn BTC and BCH through Bitcoin Mining? If you already own hardware, connect it to our powerful Bitcoin mining pool. If not, you can easily get started through one of our flexible Bitcoin cloud mining contracts.

The post Mining Report Highlights China’s ASIC Manufacturing Improvements and Dominance appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube