There have been many speculations regarding Bitcoin and market manipulations, with many believing that those of the wealthier persuasion are behind the most significant moves of BTC.

Whales are traders that hold significant amounts of crypto, and Bitcoin whales are obviously among the richest people due to the high value of the coin.

The Entire Rise of Bitcoin Was Allegedly Due to One Whale

Back in November 12, 2017, 25,000 Bitcoins, which was worth $159 million at the time, were moved to one online exchange. When the news broke out online, Bitcoin traders were speculating that the owner intended to sell the digital currency.

According to a forensic study made by finance professors, John Griffin and Amin Shams, they determined that Bitcoin’s 2017 boom was started mostly by “one large player.” The market manipulator is still unidentified.

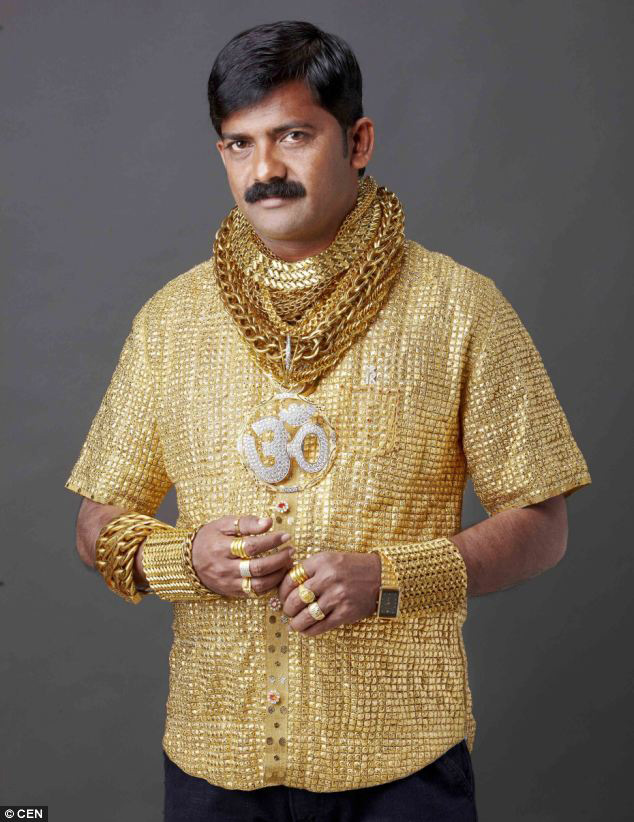

So many trading secrets behind those eyes

So many trading secrets behind those eyes

The professors scrutinized more than 200 gigabytes of historical transaction data between BTC and USDT and noticed a pattern.

“We find that the identified patterns are not present on other flows, and almost the entire price impact can be attributed to this one large player,” said Griffin and Shams. “We map this data across both blockchains and find that the one player or entity (labeled as 1LSg throughout the paper) is behind the majority of the patterns we document.”

Griffin and Shams identified that the source of the patterns came from “One large account at Bitfinex.” The study showed that the trader used the exchange to manipulate demand for Bitcoin via “extreme” flows of tethers.

The study revealed that the manipulation coincided when BTC hit its all-time high of nearly $20,000 in December 2017.

A later study published by cryptocurrency asset manager Bitwise for the SEC, also showed that 95% of Bitcoin spot trading is faked. The survey concluded that only $273 million out of the $6 billion reported for the average daily BTC volume was genuine.

Who Owns Bitcoin?

Source: Quora

Around 40 percent of Bitcoin is owned by approx. 1,000 users. According to Aaron Brown, former managing director and head of financial markets research at AQR Capital Management, some of these 1,000 owners might be thinking of selling nearly half of his or her holdings, says.

Also, these whales might synchronize their market orders or announce their intentions beforehand to a select group of equally rich friends. Most of the large BTC owners have known one another for years, and they can potentially gang together to induce market crashes or booms.

“I think there are a few hundred guys,” said managing partner at Multicoin Capital, Kyle Samani. “They all probably can call each other, and they probably have.” According to Gary Ross, a securities lawyer at Ross & Shulga, as Bitcoin is not a security, there are no prohibitions against groups joining to buy and push the price up and then cash out minutes later.

Samani constantly monitors the trading activity of the addresses belonging to the biggest investors, and when he notices activity, he calls the potential sellers to get the reasons why they intend to sell.

Some funds directly buy another fund’s crypto, without going into the open market in order to not impact the price of the assets they are transferring. “Investors are generally more forthcoming with other investors,” said Samani. “We all kind of know who one another are, and we all help each other out and share notes. We all just want to make money.”

As small investors do not have the finances to get into hedge funds or have a multimillionaire in their phonebook, they are left to guess the motives and plans of the whales.

“There’s no transparency to speak of in this market,” says Martin Mushkin, a lawyer specialized in bitcoin. “In the securities business, everything that’s material has to be disclosed. In the virtual currency world, it’s very difficult to figure out what’s going on.”

Whales can crash the prices by selling even a fraction of their holdings. But in what other ways can they manipulate bitcoin?

Pump and Dumps

Pump and Dumps is a common tactic in which the cryptocurrency market is manipulated by whales. The person buys over the course of several days large amounts of bitcoin to increase its price on trading charts. The price gains will attract more investors and new money to fuel the price even further.

When the whale has seen the asset reach its desired price, it then starts the dumping process, which will occur in several stages. The trader will dump once, and investors will see this as a temporary dip, and ‘buy the bottom’ and keep the price up for a bit.

Sell Walls

Sell walls is when a whale has inside information of news that will positively impact the price of bitcoin before it is released to the public. Therefore, the whale will first look to buy the coin at a low price. First, he will create a huge sell wall, which will prompt investors to sell. Investors will be able only to place the orders under the sell wall, not above it. The sell orders placed by the investors will be filled by the whale, get the coin at a lower price, and resell it when price increases after the information are made public.

Wash Trades

Wash trading is when you basically trade with yourself by placing buy and sell orders with exact amounts in a small time-frame. This is done in order to drive the price of the crypto up or down, or just artificially enhance the trading volume.

Spoofing

Spoofing involves placing a large order to fake market optimism or pessimism and cancel the moment the actual price gets anywhere near it.

Painting the Tape

The principle is the same as with wash trading, but there are more participants. Mark Karpelès confessed in court that he was guilty of such practice, as he used “Willybot” to pump up the Bitcoin price on his now-defunct exchange Mt. Gox back in 2013.

Dark Pools

Dark pools are private exchanges where only big players, such as financial institutions or rich investors can make anonymous trades. When trading on a dark pool, this activity does impact the price of the coin on public markets.

This enables dark pool investors to gather huge amounts of a coin without the public market being aware of this. The use of dark pools allows whales to participate in predatory trading activities, such as the aforementioned sell walls.

Conclusion

As the bitcoin market is still young, it is more susceptible to manipulation compared to traditional markets. Obviously, the ones that own the most bitcoin, which are usually part of wealthier circles, are able to manipulate the market to their whims, but the rest of the 60% of Bitcoins are distributed across a vast network of crypto enthusiasts. So, there is no way of knowing for sure if bitcoin’s movements are dictated by the rich of our society.

Featured image: Sick Chirpse

coindoo.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube