These days, it’s taken as a given that KYC must be endured to trade cryptos on centralized exchanges. In fact, there are still dozens of exchanges you can access without having to risk your personal documents and identity. The following guide examines six such platforms, and considers precautions you should take when using KYC-less crypto exchanges.

Also read: BTC Hashrate Follows Price Drop – 20% Lower Before Bitcoin Halving

Keep Your Privacy, Swap Your Crypto

Know Your Customer (KYC) legislation requires businesses to verify the identity of individuals using their service, particularly where the transmission of money is involved. This includes virtual currencies. As a result, the majority of crypto exchanges now enforce KYC. However, it is not mandatory to use a KYC exchange (also referred to as “surveillance exchanges” by their detractors) to trade. A number of exchanges legally operate in jurisdictions that do not mandate KYC, or have no official headquarters, placing them in a grey area in terms of legal obligations.

Generally speaking, KYC exchanges that are fully regulated offer better protections for their customers, and there may be greater redress in the event of something going wrong, such as a hack. However, this does not mean that KYC-free exchanges are less trustworthy; it is the duty of each trader to perform their due diligence and choose a reputable exchange.

It is not the case that only shadowy individuals seek KYC-less exchanges, such as for tax evasion or criminal purposes. In fact, many traders flock to these platforms because they recognize that KYC requirements make everyone less safe through creating a honeypot for hackers. If you value your privacy, and wish to keep your personal details out of the reach of busybodies and criminals, it makes sense to seek platforms where you can exercise your right to trade cryptocurrencies in peace. Here are six exchanges that fit the bill.

Nominex

Low fees, a fast trading engine and advanced bidding tools are among the features that Nominex flaunts. Up to 3 BTC a day can be deposited and withdrawn without requiring KYC. The Seychelles-based exchange (registered in the same locale as Bitmex) operates a popular affiliate program, offers demo accounts for traders finding their feet, and is about to launch daily trading tournaments.

Stop, Stop Limit, Trailing Stop, and Scaled are among the order types that can be placed on Nominex. There’s 24-hour customer support and trading fees are reduced by 50% for holders of the native NMX token.

Bybit

Bybit is a popular derivatives exchange that could become a lot more popular if Bitmex introduces KYC, as has been rumored. Founded in Singapore, Bybit doesn’t require KYC, although U.S. residents are excluded from trading. Its most popular product is its BTC-USD perpetual swap, although Bybit also offers futures for XRP, EOS, and ETH. Bybit features a clean and intuitive layout and good customer support that operates around the clock and in multiple languages.

One of the best things about Bybit is its guides to margin trading. These help traders learn the terms, tricks and tips required to effectively swap derivatives products. There’s a Bybit mobile app available on the iOS and Google Play stores, while regular trading competitions keep things fresh.

Binance

The world’s largest cryptocurrency exchange is also a bastion of KYC-less trading. There are some caveats though. For one thing, U.S. citizens must trade on Binance US, which comes with KYC. Moreover, there are signs that Binance may transition to full KYC at some stage as it’s compelled to comply with the numerous jurisdictions where it operates. For now, though, spot trading can be accessed without requiring KYC, and you can withdraw up to 2 BTC per day. For margin trading, however, as well as various other Binance products, KYC is required.

Bitmax

Bitmax is a popular altcoin exchange that’s carved out a niche since launching in 2018. There’s reasonable liquidity, margin trading, a wide range of coins listed, and a native BTMX token that provides discounted trading fees and other benefits. The exchange holds regular airdrops and allows users to earn USDT for lending BTMX. Fiat deposits can be made with credit or debit card and there’s no KYC requirement, with a 2 BTC daily withdrawal limit.

Kucoin

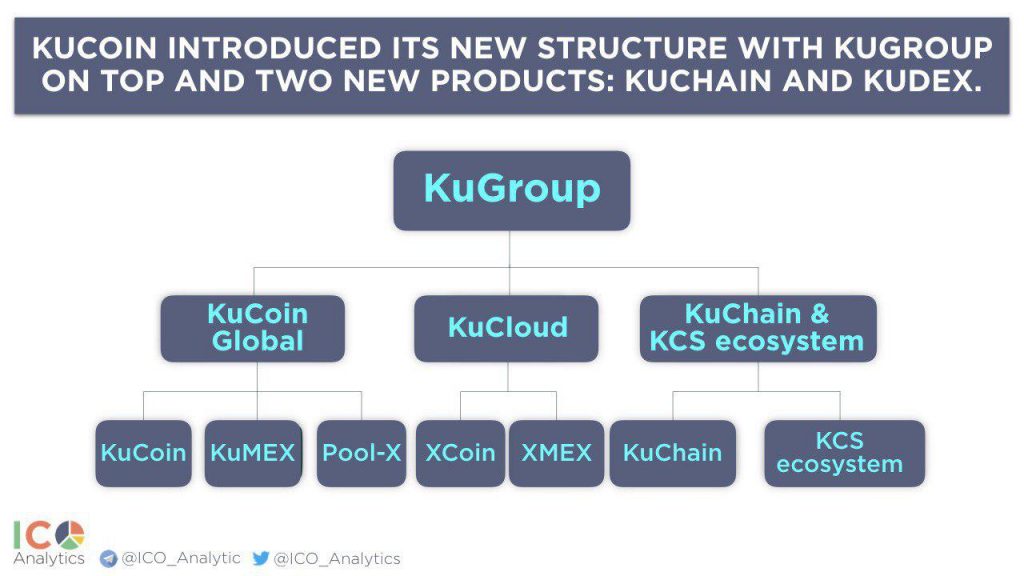

Many exchanges operate partial KYC, Kucoin among them. What this means is that most traders will not be required to complete verification unless there is suspicious activity or in the case of them wishing to exceed the 2 BTC daily trading limit. Like leading exchanges Binance and Huboi, Kucoin has transitioned into a crypto company that offers a broad range of services, operating under various subdivisions. Although the liquidity could be better, Kucoin has a lot of things in its favor. It’s easy to use for one thing and lists a number of tokens that aren’t available on major exchanges.

Bitcoin.com Exchange

There’s a lot more to exchange.Bitcoin.com than merely the ability to sign up without undergoing KYC. BCH trading pairs, SLP tokens, and useful assets that aren’t available on other platforms are among its many attributes. There’s also the strength of the Bitcoin.com brand, which gives the exchange greater credibility than some of the other KYC-less platforms on the market. The clean and intuitive interface is free of clutter, and there’s a community feel to Bitcoin.com Exchange, which is particularly popular with BCH proponents.

DYOR and Don’t Leave All Your Crypto on Exchanges

It’s important to do your own research before signing up for a cryptocurrency exchange. Read reviews, check its policies on accessing the platform from different countries, and determine the quality of its customer support. Finally, and this applies to using all centralized exchanges, regardless of KYC, don’t leave all your crypto on there. Only deposit what you actively need for trading purposes and keep the rest of your stack in a noncustodial wallet. Trade safe, be smart, and keep your identity private by avoiding surveillance exchanges.

What KYC-free exchanges do you recommend? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post 6 Cryptocurrency Exchanges That Don’t Require KYC appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube