Bitcoin price this week surged by over $1,000 in a single day, taking the cryptocurrency hurdling toward 2019 highs. At the same time, the stock market that’s traded lock and step with the crypto asset all throughout 2020, dropped hard. The phenomenon is something top crypto analysts had called for, who now expect Bitcoin to break out into a bull market.

But before crypto investors get their hopes up too quickly, here’s a deep dive into the possible decoupling of the stock market and Bitcoin correlation, and what that might mean for both asset classes.

Crypto Correlation With The S&P 500 Diverges, Is The Decoupling Here?

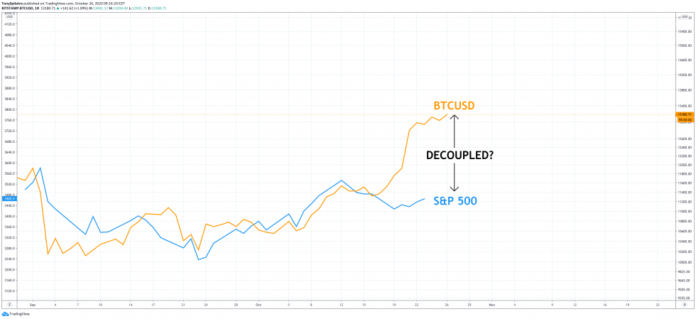

Last week, Bitcoin took the world of finance by storm, when it exploded by over $1,000 in a single day, taking out 2020 highs and targeting last year’s peak. And while the move itself was enough to cause plenty of chatter, much of the discussion was centered around the cryptocurrency’s sudden divergence in correlation with the S&P 500.

RELATED READING | ALWAYS ON: BITCOIN TO SURPASS S&P 500 TRADING TIME WITHIN TWO YEARS

Starting ahead of Black Thursday, the crypto market and stock market topped out in early 2020, then suffered a catastrophic collapse. Bitcoin dropped well over 50% in 24 hours, and the stock market saw its worst quarterly close on record just after setting an all-time high.

The leading cryptocurrency by market cap possibly decouples the ongoing stock market correlation | Source: BTCUSD on TradingView.com

The correlation has remained since after years of acting as an uncorrelation or anti-correlated asset, until now. The latest rally in Bitcoin took place while the stock market began to stumble. The two vastly different asset classes have only continued to diverge, with crypto getting stronger and major stock indices getting weaker.

Analysts had been calling for such a scenario to take place, pointing to ongoing Bitcoin adoption and network effect as the driver behind the divergence. For example, daily active BTC addresses have grown considerably, along with non-zero BTC addresses. More Bitcoin is also being moved off exchanges, so there’s less to be sold into the market. But is it far too soon to be calling it quits on the correlation?

But are analysts jumping the gun that the correlation has ended? | Source: BTCUSD on TradingView.com

Can A Bitcoin Bull Market Begin, While The Stock Market Tops?

Unfortunately for hopeful crypto investors, this isn’t the first time since the correlation began where Bitcoin diverged, but ultimately the two caught up with one another somehow. In past instances, Bitcoin price has led the S&P 500 in moving up.

RELATED READING | BITCOIN SETS NEW ALL-TIME HIGH IN THESE GLOBAL CURRENCIES

The divergence can last up to an entire month before the S&P 500 catches up. If the leading cryptocurrency is now a leading indicator for the stock market, it appears to suggest a rally in stocks is less than three weeks away.

What exactly does this sudden and unusual correlation mean for crypto? | Source: BTCUSD on TradingView.com

Another scenario is possible, however. Few stock market analysts exist that don’t claim the asset class is in a bubble that is nearing a burst. If and when it happens, the stock market could enter its first ongoing bear market in over 90 years. And if that’s the case, can Bitcoin really begin a new bull run?

It is possible, and given Bitcoin’s infrequency history tracing this closely, shaking off the correlation and decoupling could be here. But if the uncanny correlation continues, a bubble bursting in stocks could send Bitcoin and cryptocurrency back into a bear market.

Featured image from Deposit Photos, Charts from TradingView.com

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube