The digital economy is flourishing thanks in large part to the concepts laid out in Satoshi Nakamoto’s Bitcoin whitepaper. This whitepaper introduced the concept of a decentralized cryptocurrency to the market and ushered in the digitization of the global economy. Because of this, many people would argue that the Bitcoin whitepaper rightfully earns the title of a historical document.

This unique document has started a decade-long digital transformation of the traditional financial system by providing the world with a viable alternative to the current models in practice. Let’s take a moment to examine this game-changing whitepaper.

The Abstract

The first section of the Bitcoin whitepaper is a summary of BTC’s purpose, including how it alleviates the need for third-party financial institutions. This introduction to the concept of Bitcoin is also the most quoted section of the whitepaper. Here, Satoshi states in reference to Bitcoin:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Satoshi then briefly explains how a hash-based proof-of-work system functions. He includes a description of how the longest chain is considered the valid chain. The valid chain is the chain which the network will continue to add transaction data to during the mining process. Satoshi also first mentions the blockchain’s reliance on honest nodes. Fifty-one percent of the network’s total hash power must remain honest for BTC’s network to remain secure.

The Introduction

In this section, Satoshi explains the problems with the current trust-based economic model. Specifically, he mentions the inability to perform irreversible transactions, even though many services rendered are irreversible. This irreversibility creates the need for more third-party protections that increase transaction costs. Satoshi saw this loophole in the current economic status as a way for central bankers to continue to control the fate of the economy indefinitely.

After pointing out the errors in the current model, Satoshi explains how a hash-based algorithm could remove the need for trust in the system and replace it with a mathematical equation. This cryptographic equation could be used to verify the validity of the virtual currency transactions. Satoshi mentions again the importance of keeping at least fifty-one percent of the hashing power from becoming centralized to ensure the network’s security

Transactions

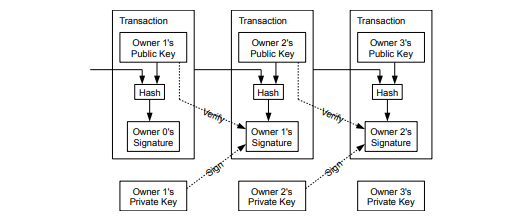

The transactions section of Satoshi’s whitepaper explains the problems associated with double spending. He covers how the current method of reducing double spending requires a centralized bank or mint to maintain and review all transactions and ensure that the funds are available. This system depends solely on the trust of the third-party.

Bitcoin Whitepaper Transaction Protocol Diagram

In this scenario, it’s the banks which maintain the records and validate transactions. In Satoshi’s vision, the scenario reverses. All transactions undergo verification via a public ledger utilizing a hash-based proof-of-work system. This system provides the BTC financial structure with more transparency by creating an open ledger where everyone on the blockchain can verify a transaction via the mining process.

Timestamp Server

Satoshi proposes the use of a timestamped server to capture a record of the transaction hashes and then publish them. The timestamp provides hard evidence that the data existed at that time. Each timestamp contains data from the previous timestamp. A distributed ledger known as a blockchain is where the timestamped blocks get published.

Proof-of-Work

Satoshi cites Adam Back’s early cryptocurrency attempt, Hashcash, when he introduces the proof-of-work section of the Bitcoin whitepaper. The proof-of-work system involves a mathematical equation. Nodes compete against each other to figure out the equation, thereby, adding the next block to the blockchain. Bitcoin uses the SHA-256 hashing algorithm. The answer to this equation must start with four zeros and requires an intensive amount of computing power.

Satoshi explains how the network would maintain its integrity as long as the majority of nodes remain honest. As long as fifty-one percent of the nodes aren’t working together to orchestrate an attack on the network, Bitcoin’s blockchain remains secure. As the hashing power increases, the network difficulty also increases. This increase in difficulty ensures that BTC’s block time stays at around 10 minutes.

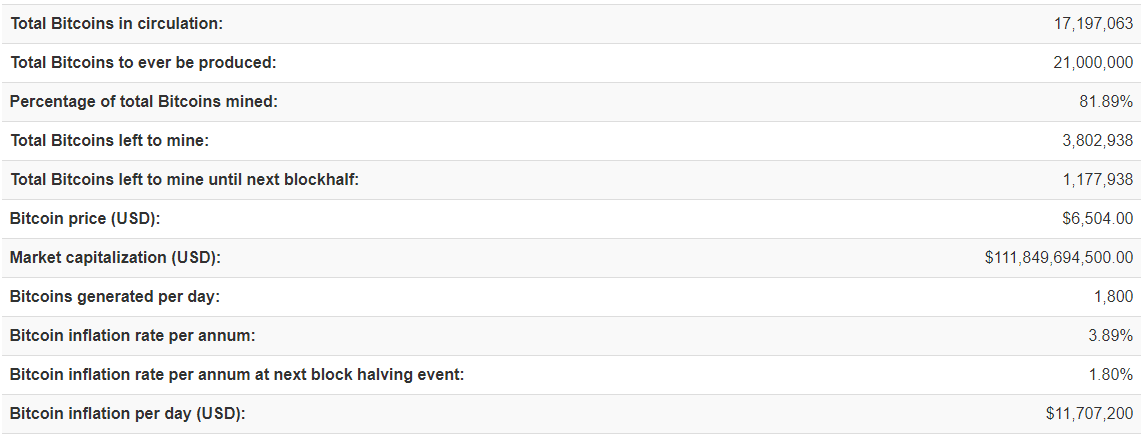

Bitcoin Reward Data via Bitcoin Block Reward

Network

The Bitcoin network is surprisingly simplistic in its design. Satoshi took this section to layout the exact flow of the network. Here are the six steps he lists:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash

Nakamoto explains how the BTC network reacts in the event of conflicting chains. Nodes are to consider the longest chain as the valid chain. Transactions get applied to the chain based on their order of arrival. If two nodes broadcast conflicting chains at the same time, the longest chain is validated. The other chain gets saved, and if it becomes the longest chain when the next block gets added, it is then the valid chain.

Incentive

Nodes receive rewards for being the first to solve the proof-of-work algorithm and add the next block to the blockchain. Originally this was fifty Bitcoin. Today, the mining reward is 12.5 Bitcoin. Nakamoto explains how mining for BTC is similar to mining for gold, in that you spend resources to conduct both mining activities. In other words, miners pay for their efforts in computing power and electricity costs.

This incentive system makes it impractical for a fifty-one percent hack to occur. Satoshi explains that the attacker would benefit more from continuing to mine and receive new BTC rather than undermining the system, which would, consequently, undermine their wealth.

Reclaiming Disk Space

Satoshi was well aware that the blockchain could grow to be gigantic. To alleviate future storage concerns, he proposed a method in which old blocks save with the majority of their transaction data discarded. Satoshi describes how the average PC utilizes 2GB of ram in 2008. Then, using Moore’s law, he estimated a 1.2GB increase per year in computing power.

Simplified Payment Verification

Satoshi then proposes a method in which nodes can quickly verify transactions without confirming the entire blockchain transaction history. Nodes are permitted to keep a block header of the longest chain’s transactions. Again, Satoshi mentions the importance of keeping the BTC blockchain decentralized. This time he describes how an attacker could overpower the network for a certain period if they gain fifty-one percent control.

Combining and Splitting Value

Bitcoin transactions contain multiple inputs and outputs which allows you to combine or split transactions to reduce congestion on the blockchain. Most transactions combine inputs from multiple locations. There are only ever two outputs. One is the payment, and the other would be any change from the transaction.

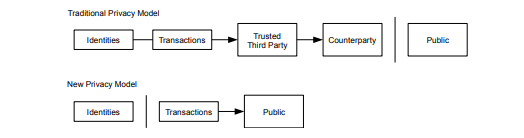

Privacy

Bitcoin isn’t anonymous. You can track and trace Bitcoin transactions using any number of blockchain forensic tools. However, Satoshi’s whitepaper includes a section on how to anonymize BTC. Here he explains that you could make the public keys private. In this way, BTC could operate similarly to the stock market in that people could see the transaction size and direction but would be unable to determine the sender or receiver.

Bitcoin Whitepaper Privacy Diagram

Calculations

The calculations section of the whitepaper includes some hacking scenario equations. Satoshi argues that the network can get hacked briefly, but those honest nodes would eventually return the network to its integral state. He also utilizes complex equations to showcase how the fabricated chain would be unable to remain the longest chain, as long as honest nodes continue to add information to the valid chain.

Conclusion

The conclusion of the Bitcoin whitepaper centers on the ability to remove third-party organizations from transactions. Satoshi explains how his system allows a node to come and go as it requires. He ends by describing how you should use the consensus mechanism to determine any incentive or rule changes in the Bitcoin protocol.

References

Satoshi includes a brief references section at the end of his whitepaper. Many of the individuals responsible for his cited works, such as Adam Beck, went on to become major developers in the BTC project.

Satoshi and the Bitcoin Whitepaper

Most would agree that the Bitcoin whitepaper was the first step in the digitization of the global economy. Since its entry into the market nine years ago, Bitcoin has managed to become a household name. The cryptomarket is still in its fledgling state, but many predict that BTC will remain relevant.

The post A Look at the Now Famous Bitcoin Whitepaper appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube