Blockchain technology has been instrumental in disrupting various industries. Initially used in the now-popular Bitcoin cryptocurrency, numerous ventures and projects are now using it to drive innovation in their respective markets. One such venture is Akropolis– a blockchain-oriented startup that aims to enact real change in the pension market. Pensions are currently facing major issues caused by outdated principles and blockchain may yet be the technology it needs to keep the industry afloat.

What’s the Problem with the Pension Market?

According to research by various institutions, the world is steadily moving towards a retirement crisis. The World Economic Forum (WEF) estimated that the pension savings gap is set to increase from $70 trillion in 2015 to $400 trillion by 2050. The banking giant Citigroup also reported that the average level of unfunded government pension liabilities in 20 OECD countries reaches about 190% of GDP, surpassing government debt amounting to 109% of GDP.

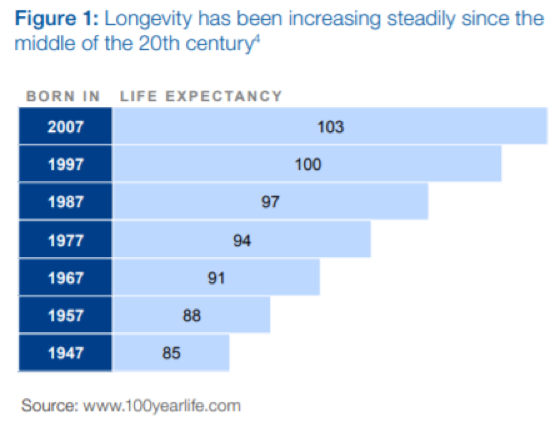

Among the main reasons for this is a higher life expectancy due to the developments in the healthcare sector. Living a longer life should be a positive thing but retirees have to afford it. The problem is, the market is not ready for this shift. Assumptions about retirement planning are outdated that many workers are just saving up for the bare minimum. Inflation and longer life expectancy combined are set to demand much more out of workers’ portfolios.

The industry also suffers from an abundance of malicious actors who compromise funds. In addition, social security has been hampered by bad fund management. Today, the majority of social security systems and pension plans are underfunded which threaten the financial stability of several generations of workers.

Solving the Pensions Problem through Blockchain

The retirement market is in dire need of a major change.

Akropolis understands the magnitude of the brewing crisis and believes that blockchain can be the transformative force that solves these issues. The venture is set to offer a blockchain-based infrastructure that decentralizes pensions. The platform gathers fund managers, institutional users, individual users, and developers under a single ecosystem that provides increased transparency and efficient processes.

First, it provides more people with access and control over their pensions. With its protocol, Akropolis provides users with a decentralized marketplace. This serves as a secure venue for users to shop around for pension products that best fit their needs. Users will also be able to comprehensively manage their pension portfolios online.

Second, it provides transparency in the transactions made on the platform. Through blockchain, portfolios can be audited by users at any time unlike with traditional funds which rarely provide members with up-to-date information regarding their individual accounts. At its initial stages, Akropolis will be using Ethereum as its blockchain but it is working on becoming a blockchain-agnostic technology that works on other protocols like Cardano and EOS.

Third, it encourages positive behavior from funds and fund managers. Institutional users have to go through a vetting process to ensure their legitimacy. A reputation system rates them based on good performance and trustworthy behavior. Pension funds and fund managers are also provided with mechanisms that help them connect with clients.

Transparency and security could help drive better fund performance and provide the stability pensions need. Sustainability is key for pensions to be able to provide for retirees’ financial needs.

AKT Token Sale

To make this possible, Akropolis is conducting a token generation event, during which it will make 360 million Akropolis External Token (AKT) tokens available to interested contributors. The venture aims to raise $25 million from the event putting the initial sale price of $0.069 per AKT.

AKT will be a functional token that will give users the access to the platform. With AKT tokens, platform users will be able to buy pension-related services, pay fees, and use it in staking processes.

The sales cap represents 40 percent of the 900 million total supply of AKT. The rest of the AKT tokens are allocated as follows: 10 percent to advisors and early supporters, 10 percent for marketing and development, 20 percent for reserves and partnerships, and 20 percent for the team.

Besides AKT, the Akropolis platform also features the Akropolis Internal Token (AIT). These are stable tokens used internally for various purposes. As any stable coin, AIT aims to address volatility issues. Users will also be able to obtain AIT tokens when transferring funds to the system. For the token sale, however, only AKT tokens will be made available.

The private pre-sale has already successfully concluded. Investors will still be able to buy tokens in the upcoming public sale which is expected to happen soon. The public sale has recently been pushed back as the group works towards regulatory compliance in Gibraltar, where Akropolis is headquartered.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

The post Akropolis to Reform Pension Market with Blockchain appeared first on Global Coin Report.

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube