The cryptocurrency market space can be boring if you are trying new product types. FTX, one of the most popular cryptocurrency derivative exchanges, introduced crypto leveraged tokens. In this article, we look at what they are and how they work.

What are FTX crypto leveraged tokens?

Leverage trading is a popular type of trading in traditional finance. It has also found its way into cryptocurrency markets mainly through trading futures.

Leverage trading is popular because it allows traders to make profits with less capital compared to spot trading. FTX provides a cryptocurrency derivatives product that makes leverage trading straightforward and more accessible.

FTX crypto leverage tokens are tokenized positions on the blockchain. These tokens give you leveraged exposure to the market, without the need to manage a leverage position.

These leveraged tokens are ERC20 tokens on the ethereum blockchain. Leveraged tokens present an innovative opportunity for people to trade with leverage. Traders do not have to think of other factors like margin, collateral, and liquidation.

You can buy, store, transfer, and sell leveraged tokens like any other ERC20 token. For instance, the bitcoin BULL is a token with 3x long exposure to the bitcoin price. When bitcoin’s price goes up 1%, the price of the BULL token goes up by 3%. On the other hand, when bitcoin drops by 1%, the BULL token’s price decreases by 3%.

The opposite of the bitcoin BULL token is the bitcoin BEAR token. The BEAR token has 3x short exposure to the bitcoin price. When the price of the underlying asset, bitcoin, goes down 1%, the bitcoin BEAR token price goes up 3%, and when the price goes up 1%, it goes down 3%.

FTX leveraged tokens are one of the most popular crypto derivatives on the exchange.

How does it work?

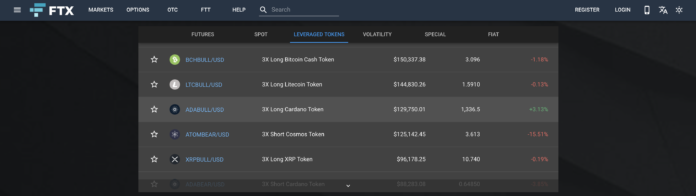

As explained earlier, each token is a leveraged position of an underlying asset. Here are examples of various leveraged tokens on FTX:

- ETHBULL – 3x long ethereum token.

- ETHBEAR – 3x short ethereum token

- LINKBULL – 3x long link token

- MATICBEAR – 3x short matic token

- EOSBULL – 3x long ethereum token

- and much more +

For example, if you purchase $100 worth of LINKBULL, the token that gives you a 3x long exposure to ChainLink (LINK). The purchase will trigger the account that represents the token to open a 300 USD position on the LINK/USD perpetual futures.

A similar process occurs when a trader redeems a leveraged token. However, issues related to issuing and redemption are mostly well understood by experienced users.

There are advantages that come with using FTX crypto leveraged tokens. With traditional leverage positions, the trader is solely responsible for managing risk. Leveraged tokens remove the worry about risk factors like margin and liquidation.

What’s more, FTX leveraged tokens can be traded on several exchanges since they are just like regular tokens. Further, you can buy them and keep them for a longer period of the exchange and in any ethereum supported wallet. This architecture means that you do not need to rely on the exchange to keep trading with leverage.

Some risks are associated with trading leveraged tokens too. It is always recommended that you trade responsibly, understanding how the market operates.

How to trade FTX leveraged tokens

To get started with trading leverage tokens, you have to register on FTX.com to get started. (By using our FTX link, you get a 5% discount on trading fees).

It is best practice to set up two-factor authentication (2FA) to add an extra layer of protection to your account.

If you intend to trade more than $1,000 on FTX, you will have to go through the KYC verification process. This takes a few minutes to complete.

After, you can begin to trade crypto leveraged tokens on FTX.

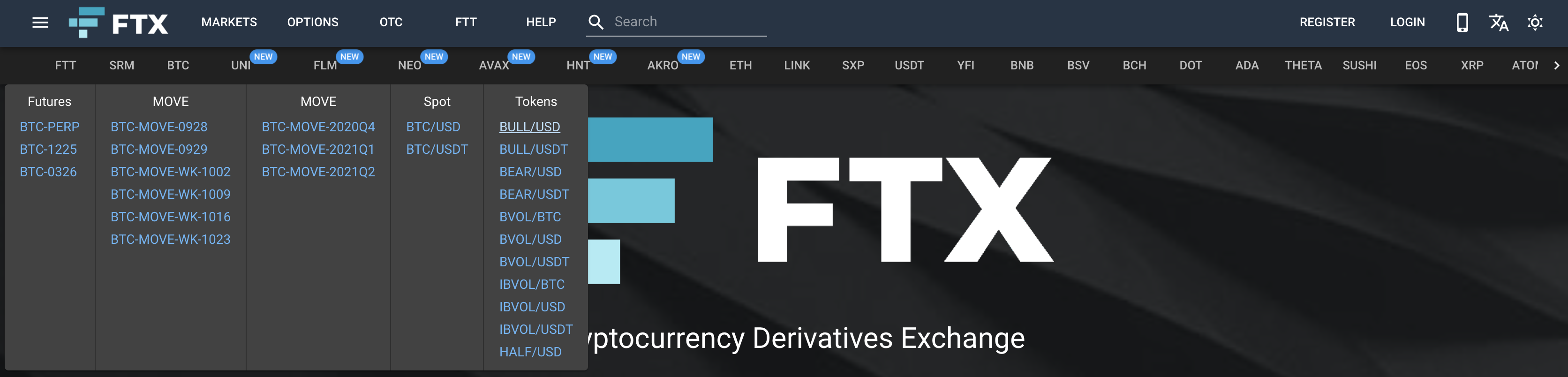

To find a leveraged token, you can use the FTX homepage. The homepage has a tab of different markets and a list of trading pairs in each market. Select ‘leveraged tokens’ and scroll through to find your token or pair.

You can also use the assets bar at the top of the exchange to find the cryptocurrency you want to trade. A click on the asset will bring a popup menu with all the markets and derivative products you can trade. You can select the leveraged token trading pair from there.

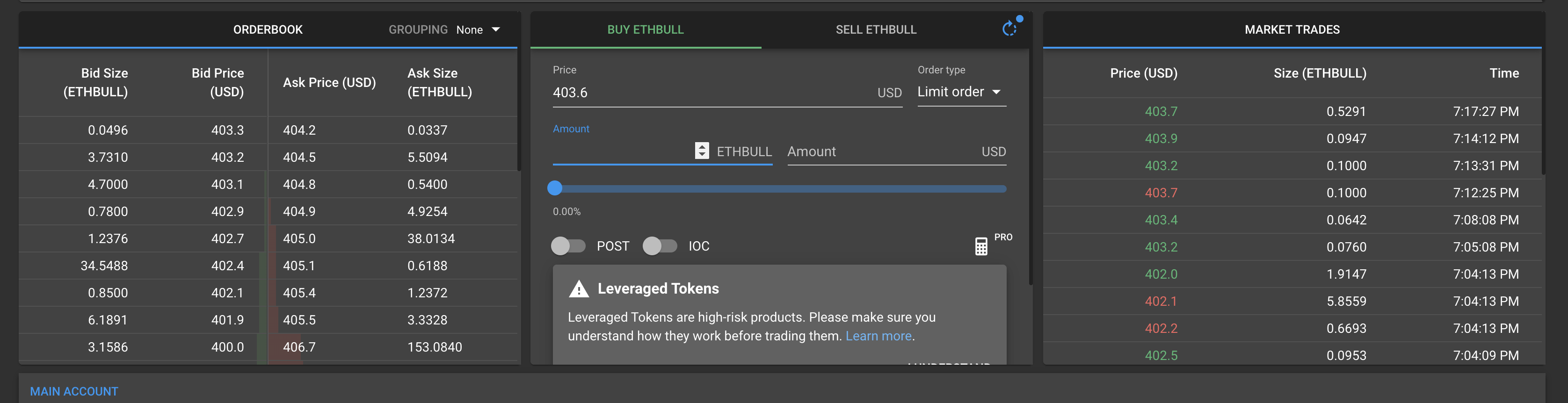

Now that you on the trading interface, you can purchase or sell your FTX crypto leveraged tokens.

Bottom Line

As cryptocurrency evolves, derivative products like this open up several ways through which traders can make a profit. FTX is leading the derivatives market in the crypto world with other innovative products like MOVE, options, and more besides leveraged tokens.

You should also read these articles on FTX:

The post An Introduction To FTX Crypto Leveraged Tokens appeared first on BlockNewsAfrica.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube