City Index is a global provider for CFD trading, spread betting, and forex trading. It has more than 30 years of experience and a reputation for delivering reliable and fast execution. This London-based provider was established in 1983 in the UK and is a world leader for spread betting, as well as CFD and forex trading. In addition to offering access to more than 12,000 markets, including Cryptocurrency, shares, forex, indices, and commodities.

City Index aims to provide traders with tools that are necessary to improve their trading skills. They have a commitment to delivering market-leading services with transparent, fair pricing, plus comprehensive customer support.

Please Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

City Index at a Glance

| Broker | City Index |

| Regulation | FCA (UK), MAS (Singapore) & ASIC (Australia) |

| Minium Initial Deposit |

£100 |

| Demo Account |

Yes |

| Asset Coverage | CFD markets: Forex, Indices, Shares & Cryptocurrencies |

| Leverage | Varies |

| Trading Platforms | Web Trader, Desktop (Windows), MetaTrader 4 |

City Index’s Parent Company

The parent company of City Index is GAIN Capital Holdings Inc., which is on the New York Stock Exchange as GCAP. This is among the largest institutional and retail trading providers worldwide and was founded in 1999. Additionally, GAIN Capital has earned a strong track record for providing institutional and retail customers with trading services. The fact that GAIN Capital is a publicly listed company on the New York Stock Exchange provides traders with extra confidence. This is enhanced by the fact that GAIN Capital is regulated in eight different jurisdictions around the world. GAIN Capital also consistently meets the highest standards for corporate governance, disclosure, and financial reporting.

To get a feel for the size and reliability of GAIN Capital, consider that the company has more than 150,000 retail traders around the world and $978 million in client assets. As of Q4 2016, GAIN Capital had $1.430 billion in total assets, a total customer equity of $945.5 million, and available cash and liquidity of $182.9 million, with a minimum regulatory capital requirement of $113 million. GAIN Capital’s headquarters are in Bedminster, New Jersey, and the company has a global presence with more than 800 staff members around the world.

Accounts Types

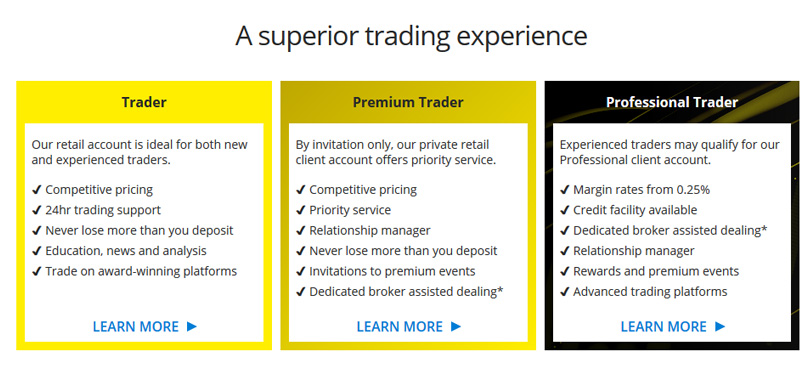

City Index has offices in the UK, Australia, Singapore, and the Middle East, with accounts from each office being slightly different. The Australian and Singaporean offices only offer Trader and Premium Trader accounts, while the UK and Middle East offices also offer Professional Trader Accounts. All offices offer CFD trading, and the UK office is the only one to also offer spread betting.

UK and EU residents can open an account with the UK, Australia, or Middle East office. UK and Middle Eastern accounts have mandatory negative balance protection, while Australia and Singapore accounts only offer optional risk management features.

Regular Trader accounts have negative balance protection, a 50 percent margin closeout, and best execution.

Demo Accounts

There are demo accounts available on City Index for CFD, spread betting, spread bet and MT4, and joint CFD accounts. Demo accounts come with £10,000 in virtual money and unlimited access for 12 weeks. You cannot extend a demo account’s duration, but City Index does offer the choice of applying for another one if you need more practice trading.

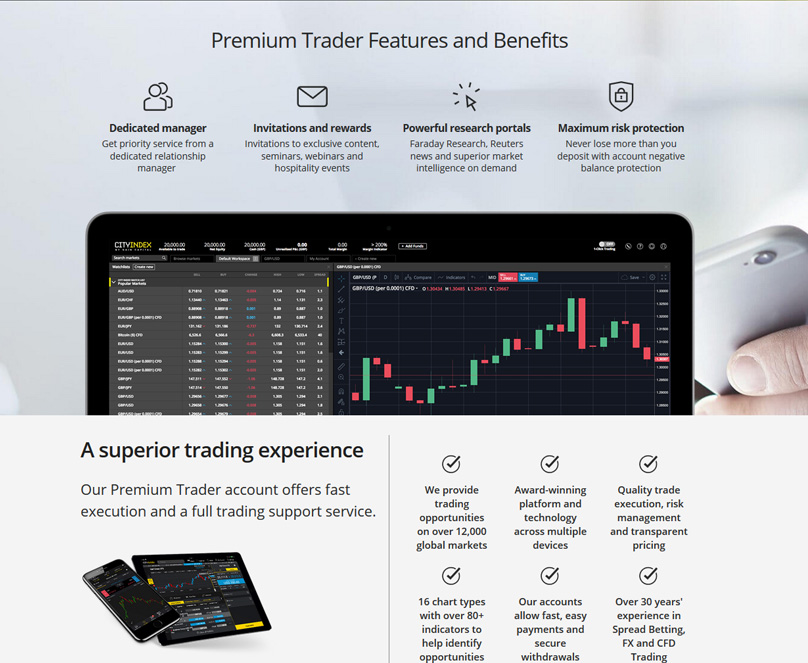

Premium Trader Accounts

The premium trader account is by invitation only. It delivers priority service and a dedicated relationship manager for active retail clients. There is also risk management on each trade you place, competitive pricing, and the knowledge that you will never lose more money than your deposit.

Premium traders get access to exclusive content, webinars, seminars, and hospitality events. These clients also get access to powerful research, including Faraday Research, superior market intelligence, and Reuters news.

To become a premium trader, you must be an active trader who keeps an account balance of at least £10,000. Once you meet these requirements, you can either wait for an invitation or contact City Index to speed up the process.

Professional Trader Accounts

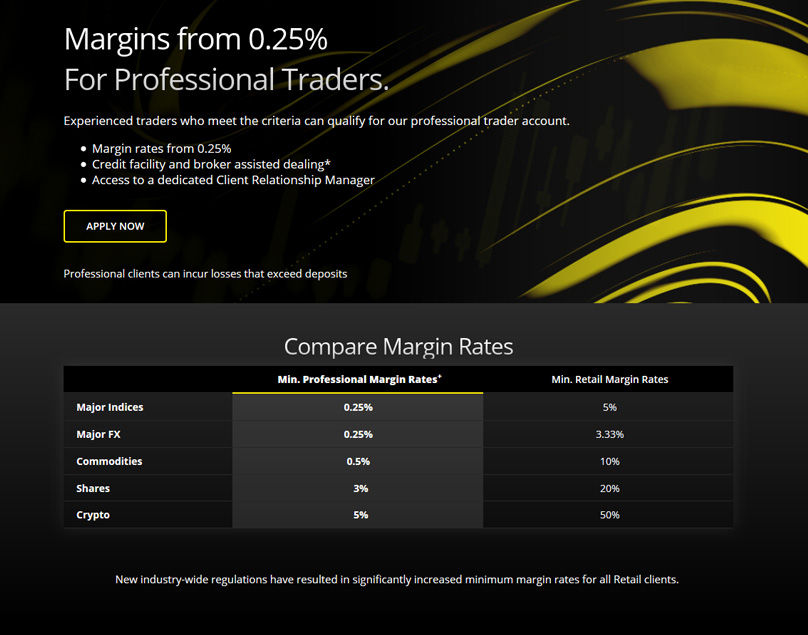

Experienced traders who qualify can have a professional trader account on City Index. This type of account delivers credit facility as well as broker-assisted dealing and a dedicated client relationship manager. These accounts also have margin rates as low as 0.25 percent, but you should keep in mind that professional clients can accumulate losses exceeding deposits.

Even with the recent industry-wide regulations, professional traders have exceptional margin rates, with a minimum of 0.25 percent for major indices and major forex, 0.5 percent for commodities, 3 percent for shares, and 5 percent for crypto. These minimum margin rates are up to 20 times better than those of retail clients.

Additionally, professional traders with City Index receive loyalty rewards, such as premier hospitality invitations and other rewards. There is extra financial flexibility thanks to the credit facility, and professional traders get priority service.

To become a professional trader, just fill out the quick application form and wait for approval. To qualify, you must meet two of the following three criteria: make an average of 10 transactions of a significant size each quarter during the past four quarters, have a financial instrument portfolio that is over €500,000 (including cash deposits), and have worked in the financial sector for at least a year in a position that required you to have knowledge for trading leveraged products.

Although there are not the same legal requirements for professional traders as typical retail clients, City Index continues to keep client money segregated from its own funds, employ the best execution methods, and make available the key information documents, and it does not change the detail of trade confirmations.

However, there are some waivers of FCA protections with professional trader accounts. This includes the fact that mandatory changes made to product features that are designed to protect retail clients are not mandatory for professional clients, such as margin closeout levels and negative balance protection. There may be more sophisticated language used with professional traders, and City Index will assume that professional traders have necessary experience levels and knowledge to understand the risks of trading leveraged products. As a professional trader, you maintain your FSCS protection.

It is also noteworthy that professional traders have access to some resources and platforms that traders and premium traders do not. In terms of platforms, there is support for the AT Pro and Meta Trader 4 platforms, and there are extra tools available from Dataminr.

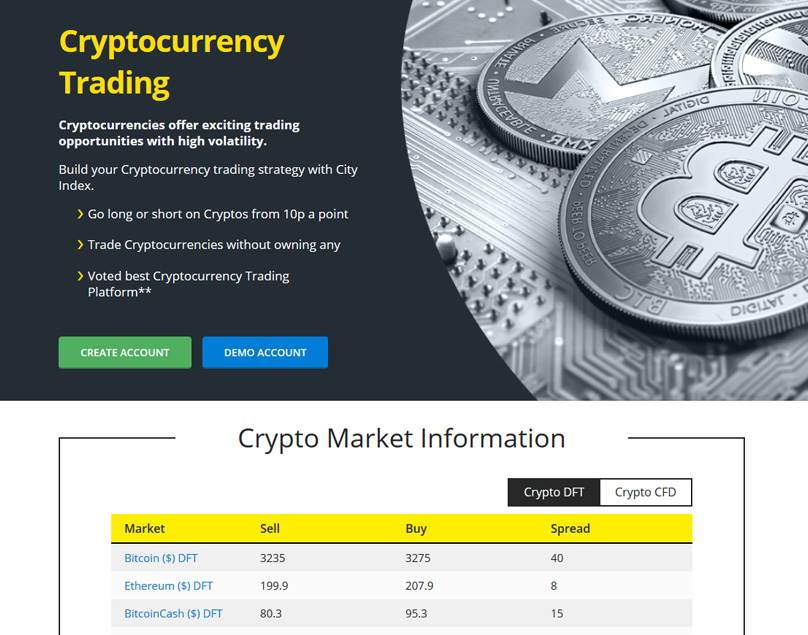

What Markets Can You Trade with City Index?

With City Index, you have access to more than 12,000 spread bet and CFD markets, including indices, shares, forex, commodities, and cryptocurrencies. If you open an account with the Australia or Singapore offices, access is slightly reduced to more than 4,500 CFD markets of the same type. Those with accounts from the Middle East office have access to more than 100 CFD markets, including commodities, forex, and indices.

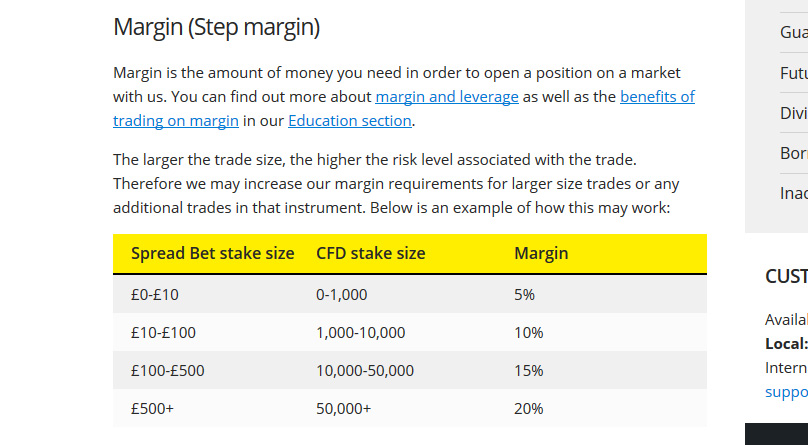

Minimum Leverage & Margin

The minimum leverage and margin for City Index depend somewhat on the office you have the account with, as well as the market. Retail clients with accounts from the UK have a 5 percent minimum margin and 20:1 leverage for major indices, 3.33 percent and 30:1 for major FX, 5 percent and 20:1 for commodities, 20 percent and 5:1 for shares, and 50 percent and 2:1 for cryptocurrencies.

For accounts from the Australia office, these figures are 0.5 percent and 200:1, 0.5 percent and 200:1, 0.5 percent and 200:1, 5 percent and 20:1, and 25 percent and 4:1, respectively. For Singapore, they are 5 percent and 20:1, 2 percent and 50:1, 20 percent and 5:1, 10 percent and 10:1, and 25 percent and 4:1.

The Middle East office does not support shares or cryptocurrencies. However, it has 5 percent and 20:1 for major indices, 3.33 percent and 30:1 for major FX, and 5 percent and 20:1 for commodities.

Trade Execution on City Index

City Index has a best execution policy, which means that it always provides you with the quickest execution on every trade. Additionally, if the price moves in a direction that is in your favor during processing, City Index will execute the order at the improved price. Trade execution with City Index includes the ability to simultaneously go short and long, price improvement technology, and access to a range of flexible order types.

City Index also makes it possible to use unrealized profits from your open positions in the form of margin for new positions, letting you maximize trading resources. There is also a futures roll-over discount, the ability to scale in or out of trades by doing so in increments (either a FIFO or non-FIFO basis), and a closeout level where City Index always tries to close out your trades when funds drop below 50 percent of the margin requirement. This will help protect against negative balances but should not replace a stop loss.

City Index Spreads

Spreads for major indices on City Index go from 0.4, although they go from 2 with the Middle East office. Spreads on major forex are from 0.6 in the UK and Australia, 0.5 in Singapore, and 3 in the Middle East. Regardless of location, commodities spreads are from 0.06, shares have spreads from 0.1, and cryptocurrencies have spreads from 0.8.

City Index Deposits & Withdrawals

City Index recommends a minimum deposit of at least £100 or enough to cover the margin of your first trade. You can fund your City Index account using Visa or Mastercard credit cards; debit cards from Mastercard, Visa, Maestro, or Electron; or a bank transfer. There is no charge for making a deposit to your City Index account, although credit card providers may charge a fee. Keep in mind that you can only deposit funds in the same base currency as your source account, but you can have up to three cards linked to your account.

When it comes time to withdraw funds, remember that they must go back to the same source as original funding. There is a minimum withdrawal amount of £50 or the full available account balance, whichever is less. With online withdrawals, you cannot withdraw more than £20,000 in one transaction, and this is also the maximum withdrawal amount online via credit cards in 24 hours. You can withdraw more than these limits by contacting client management. There are no fees for withdrawals.

City Index Fees

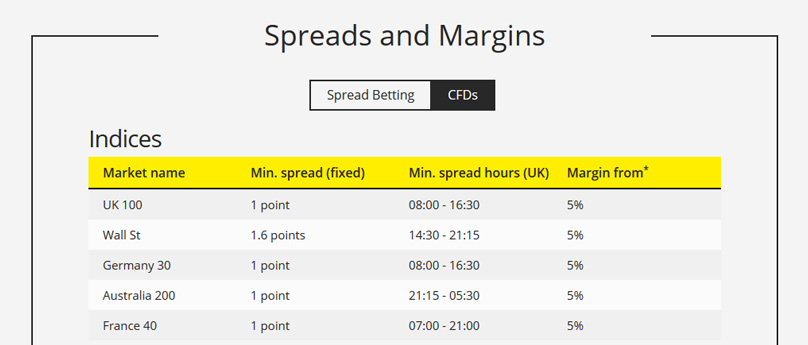

As with most similar brokers, City Index makes its profit via spreads instead of commissions. City Index is highly transparent about its charges across markets, and you can view specific information for each market. The list of spreads and margins are divided into spread betting and CFDs and then by asset type. For each, you will find information such as the minimum spread (fixed), the minimum spread hours, the margin from (%), the spread on each side (DFT), the average spread, overnight finance (%), spread pricing (fixed or around market spread), CFD spread, and/or CFD commission/minimum, depending on the market type and whether it is a CFD or spread betting.

You will notice that there are both fixed as well as variable spreads available. Margins for retail clients start at 3.33 percent. Financing charges follow the benchmark in the UK for financing, which is LIBOR +/-2.5 percent. To give some examples of rates, consider an example from each category for spread betting. In indices, the UK 100 has a fixed minimum spread of 1 point between 8:00 and 16:30 and a margin from 5 percent. In shares, Amazon has a 4-cent spread on each side and margin from 20 percent. In forex, EUR/USD has a minimum spread of 0.5, an average spread of 0.69, and a margin from 3.33 percent.

Bitcoin ($) has a spread from $40, margin rates from 50 percent, and overnight finance of 0.08 percent. For commodities, US Crude Oil has a spread of 0.4 points (around market), spread pricing around market spread, and margin from 10 percent. For metals, gold has a minimum spread of 0.3 points around market spread and margin from 5%. In bonds, UK Long Gift has a minimum fixed spread of 0.03 points and margin from 20 percent. For interest rates, Eurodollar has a minimum fixed spread of 0.02 points and margin from 20 percent. These figures are similar for CFD prices, although Amazon has a CFD commission of 0.15 percent with a minimum of $25 instead of the spread.

Got both forex and CFDs, City Index always applies commercially reasonable rates for currency conversions. The rates used are always clearly disclosed on statements and contract notes. These conversions do not matter for spread betting accounts since all trades occur in a single base currency. City Index offers a futures rollover discount of 50 percent on the spread when you automatically roll the futures contract upon expiry. For CFDs, this is done via the phone while spread bets can be done in the platform.

When you place a Guaranteed Stop Loss Order, there is no upfront charge. Instead, you only pay the premium if the GSLO gets triggered. The details of the charges for triggered Guaranteed Stop Loss Orders are on the market information sheets via the trading platform. For some examples, the current charge for UK 100 CFD is three times the quantity of CFDs charged in the base currency. For EUR/USD CFDs (per 0.0001), it is four times the number of CFDs charged in the base currency. For Barclays share CFD, it is 0.25 percent of the notional trade volume. Finally, for US Crude Oil CFD, it is four times the quantity of CFDs in the base currency.

If your City Index account is inactive for at least 12 months or more, City Index will charge a monthly inactivity fee equal to £12. If your cash balance is less than this, the inactivity fee will be equal to your cash balance.

Trading Platforms

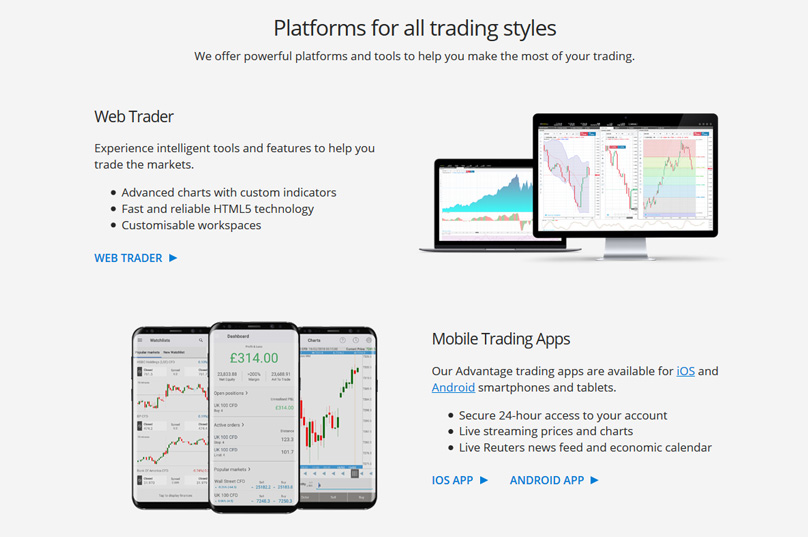

All City Index clients can choose between the Advantage Web, applications for iOS and Android, MetaTrader 4, and AT Pro. Clients in the UK also have the option of Web Trader.

Web Trader includes intelligent tools, fast and reliable HTML5 technology, customizable workspaces, and advanced charts featuring custom indicators. It also has smarter trade tickets that include advanced risk management options. The platform’s customizability extends to the ability to personalize and configure multiple workspaces, switch between those workspaces in a single click, use precision drawing tools, trade via the charts, and overlay multiple markets. Other tools include a real-time margin calculator and the ability to define stops and limits by price, P&L, or points. There are also 360-degree market view pages, helping you find key trading opportunities, see market analysis from Reuters, and view the latest market details with pricing, news, and charts.

The mobile applications for City Index are available for both Android and iOS, offering secure 24-access to accounts, the live Reuters news feed, the live economic calendar, and live streaming prices, plus charts. The two mobile platforms have similar features, including one-tap dealing via the charts, real-time notifications and price alerts, and intelligent trade tickets. The applications also support live in-app chat and personalized watchlists. You can switch between your devices seamlessly while trading, including smartphones and tablets, for added versatility.

AT Pro is a desktop platform that will appeal to advanced users who want the most powerful trading tools. It includes enhanced efficiency and speed, an advanced charting package, and your choice of trading templates. Or you can create your own trading template with Visual Basic, .NET, or C#. Enjoy the charts with more than 100 indicators and use the extensive drawing tools. There is also a back-testing excel tool that lets you see how trading signals performed based on historical data. AT Pro uses 15 timeframes that you can easily switch or zoom across. It also incorporates the various trading tools right into the platform, such as the customizable economic calendar.

Or you can trade using MetaTrader 4, with its impressive array of features. MetaTrader 4 is available for Windows, iOS, and Android. It is among the most popular forex trading platforms thanks to its intuitive and feature-rich nature. It includes custom indicators, trading signals, professional charting, and support for Expert Advisors.

Orders Types

City Index strives to offer clients a range of order types to make it possible to preprogram the price that you want to use to enter and/or exit the market. Stop loss orders can automatically close trades and therefore limit losses when the market moves in a direction against you. Limit orders can automatically close trades at better prices than the one currently available, leading to a profit. Stop and limit entry orders can let you enter the market when it hits your chosen price level.

One cancels another (OCO) orders let you simultaneously set a limit and stop order, canceling one order when the other is fulfilled. Guaranteed stop loss orders will guarantee your specific execution level, no matter gapping in the market, but do cost a small premium. Finally, trailing stops trail current market prices by a specified number of points, letting you minimize losses without also limiting your potential gains.

City Index lets you personalize trade settings to better fit your trading style. You can activate one-click trading mode and easily toggle back and forth between this and two-click settings. You can also adjust the price tolerance for each instrument, decreasing or increasing your acceptable slippage when the execution price moves from the order level.

City Index Trading Tools

To help clients make informed trades and improve their chances of success, City Index offers a range of trading tools. These include a portal for technical and fundamental analysis, powered by Recognia. The technical analysis research portal works to scan the markets in search of chart patterns before presenting you with the best sell and buy opportunities, saving you time spent conducting your own research. The fundamental stock analyzer displays whether a stock is likely overvalued or undervalued at a glance.

To help you easily spot the best trading opportunities, the portal lists the best buy opportunities first. There are detailed company metrics, including earnings and revenue history, debt to equity ratios, and earnings per share. You will find global data and can filter opportunities. There are even “what if?” analysis tools.

City Index has a partnership with Faraday Research, which provides clients with a free 30-day trial of UK FX Daily Trading Signals or UK Equities, perfect for those who do not have the time to research the markets themselves. These signals are sent via email and SMS.

If you choose to use the AT Pro trading platform from City Index, you will get access to more than 100 trading signals to help you find opportunities. You can choose from options like the Heikin-Ashi candlesticks reversal system, a MACD fast line/signal line cross system, and moving averages cross system.

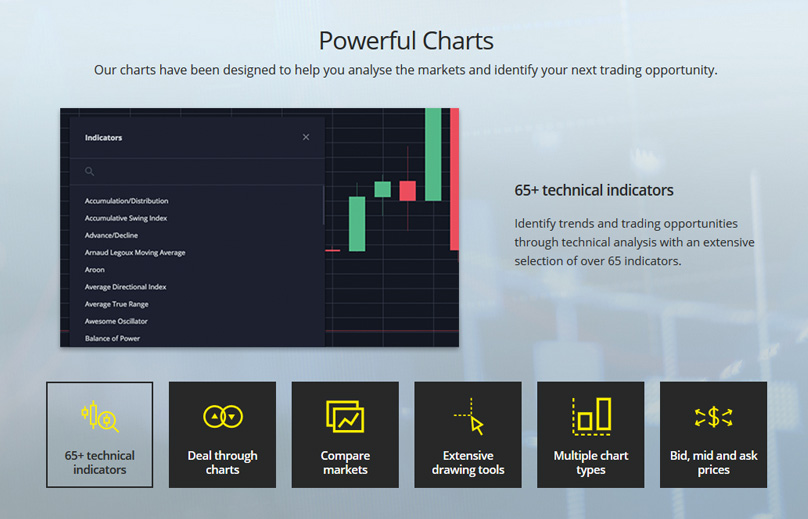

Additionally, the charts within the City Index trading platforms are incredibly powerful, featuring the tools you need to analyze markets and create a plan. There are more than 65 technical indicators and the ability to trade directly from a chart. Your limit orders, stops, and positions are displayed on the chart, with the choice to adjust them by dragging lines. The charts let you use a single chart to compare multiple markets to each other, including their relative performance and price action.

You can also take advantage of the extensive drawing tools to draw things like Fibonacci retracements and trend lines, letting you find key resistance and support levels. Save your chart customizations within your user profile, so you can seamlessly apply them to future charts. Unsurprisingly, there are also multiple chart types to choose from, such as Candlestick, Point & Figure, and Heikin-Ashi. Choose the chart you prefer to show key levels and trends. The chart will always display the basic information you select, such as bid, mid, and ask price.

City Index Market Intelligence Tools

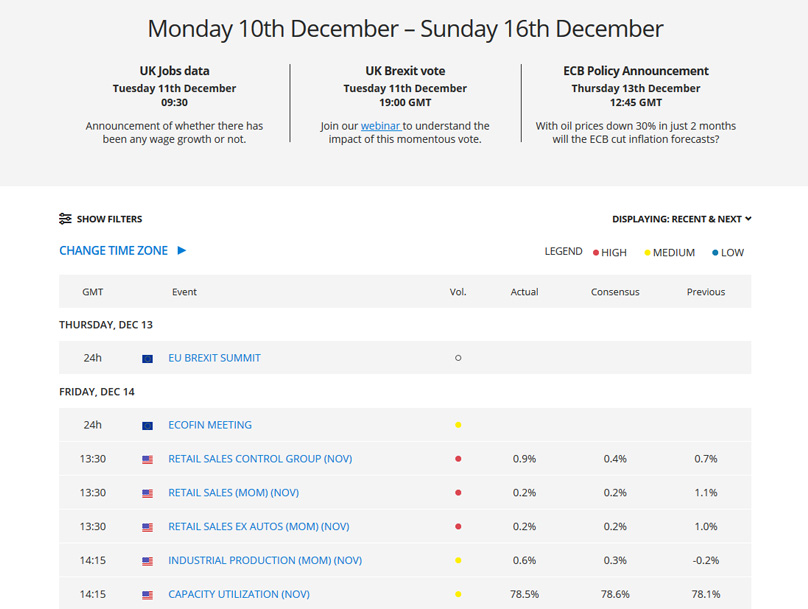

City Index provides account holders with real-time financial data, news, and market reports from Reuters, incorporated right into the trading platforms. There is also a customizable City Index economic calendar, which is designed to help traders understand market-moving events, so they can plan their trading strategies better. The economic calendar has color-coded dots for high, medium, and low volumes, as well as categories for actual, consensus, and previous figures. Of course, it also displays the name of the event, the country, and the date and time.

You will also find expert market analysis from the City Index global research team, which identifies information driving the markets to help you predict price movements and take advantage of opportunities. The Market News & Analysis section includes sections for company earnings, the daily briefing video, the economic calendar, and Brexit. The main page for market analysis displays the most recent and top stories. Near the top of the stories, you will find categories to view, including news specific to indices, shares, FX, the UK, and the U.S., plus Brexit updates, webinars, and “our analysts.” You can also filter out the news stories by market, topics, author, or region, with the option to save your filters.

Clicking on the category for Company Earnings will show you the dates that major companies release or released their earnings reports, with the companies divided into the UK, the U.S., and the EU. Clicking on the Daily Briefing Video will take you to a page titled “The Day Ahead.” This takes you to a video outlining the day, including the biggest moves during the week in the markets. Below the video is a list of key topics/markets covered, as well as at what time in the video they are overviewed. This means you do not have to watch the whole video if you are only interested in a few of the markets.

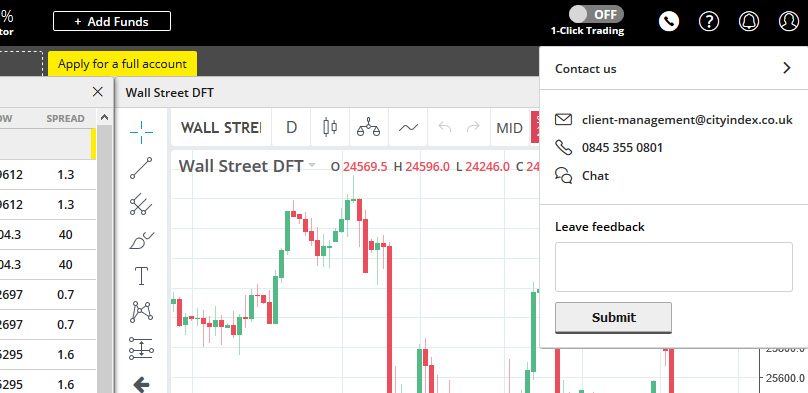

City Index Customer Support

If you trade using the mobile applications, you can chat with customer support live inside the application for convenience. When on the City Index website, you can click on “Contact Us” at the top of the page. This will take you to a page with the City Index address and phone number, as well as a phone number and email address for account opening and support. Or you can scroll to the bottom of any page on the City Index website, where you will see a chat icon, the support email address, and a phone number.

City Index Regulations

The Financial Conduct Authority (FCA) regulates and authorizes City Index. Thanks to this regulation, traders can count on City Index to follow the client money rules of FCA, including segregating client money. Additionally, clients can receive compensation of as much as £85,000 from the Financial Services Compensation Scheme (FSCS) in the unlikely event that liquidation occurs.

Accounts opened in Australia are regulated and authorized by the Australian Securities and Investments Commission (ASIC), which does not include a deposit compensation scheme. Accounts opened in Singapore are authorized and regulated by the Monetary Authority of Singapore (MAS) and do not offer a deposit compensation scheme, either. The complaints authority for all City Index accounts is the Financial Ombudsman Service (FOS), except for accounts opened in Singapore, in which case the complaints authority is the Financial Industry Disputes Resolution Centre (FIDReC).

Is City Index Safe?

Following the guidelines of the Financial Conduct Authority, City Index segregates the client money bank accounts. That means that the funds owned by retail clients are fully segregated from the company’s funds via separate accounts. This is true for every City Index account, regardless of where it was opened. City Index also makes it simple to stay on top of your funding and finances with safe and free deposits and withdrawals. It also offers a secure funding portal where you can view your funds and submit deposits and withdrawals.

City Index Awards

City Index recently took part in the Online Personal Wealth awards 2019 and won “Best Trading Platform for Professionals” and “Best Trading Tools”.

Competitors

City Index is in competition with our similar brokers which have covered before, as follows:

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

Conclusion

City Index offers spread betting and CFD trading to traders around the world. The online provider is based in the UK. Established in 1983, it has earned a strong reputation since its inception.

With City Index, you can access more than 12,000 markets with competitive spreads and your choice of several different platforms.

The City Index website is very comprehensive with a wide range of trading tools and market intelligence information at your finger tips. The web trader interface is well designed and easy to use and you also have the option of using AT Pro or Meta Trader if you prefer.

The parent company GAIN Capital Group is a well established and respected entity in this field, regulated in the UK by the FCA, so you can be very confident when choosing this broker.

Please Note: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The post Beginner’s Guide to City Index: Complete Review appeared first on Blockonomi.

Blockonomi.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube