Eight months after it shut its doors, the oldest Chinese cryptocurrency exchange, BTCC, is now up and running, with an ambitious rewards system that aims to attract more users to the platform.

Formerly known as BTC China, the company was basically forced to cease its cryptocurrency exchange amid a crackdown on Bitcoin and cryptocurrency trade in China toward the end of 2017.

While the company was able to continue operating its mining pool and mobi wallet after the closure of exchange, the business was bought out by a Hong Kong-based blockchain investment fund in January 2018. With a new team at the helm, the dust was brushed off the cover of the old exchange and was re-launched this week.

Ambitious rewards system

The new exchange supports Bitcoin, Bitcoin Cash, Litecoin and Ethereum trade against the U.S. dollar and cryptocurrency pairings. Before its closure last year, the old BTCC exchange supported over 90 different cryptocurrency pairings.

The major talking point of the relaunch is BTCC’s point-based reward system, which has garnered a lot of interest in the crypto community.

For a limited time, new users who register verified accounts on the exchange and make a deposit along with their first trade will earn BTCC points. These points will then be converted into BTCC tokens later, which will be the native token of the exchange. It is not yet clear when these native tokens will be launched. Users will also be rewarded points for referrals and other activities on the platform.

The system comes in the wake of some interesting moves taken by a couple of competitive exchanges. Both Coinbene and Bit-Z temporarily flew to the top of overall trade volume at the end of June, after implementing a transaction-fee mining system.

Users are basically given the sum of the transaction fee on a trade in the exchange’s native currency. Clearly the move has been met with great interest, as users flocked to make trades in lieu of the promised return in native tokens.

However, BTCC is not operating in the transaction-fee mining model, but it has promised a zero-fee trading scheme for the first three months of the exchange’s operation.

The world’s largest cryptocurrency exchange by trade volume, Binance, has set high standards in the very short time it’s been in existence.

Launched in July 2017, Binance is famous for its 50 percent discount on trading fees for users utilizing its native BNB coin. As Binance CEO Changpeng Zhao told Cointelegraph in an exclusive interview last month, it’s a big factor in the exchange’s popularity:

“With token economics, now our people who participated in our ICO — who bought the BNB tokens using the platform — are adding more value to the platform, which, in return, increases the value of the BNB coins. The fact they’re using our system [means] they are now investors, coin-holders, and users at the same time. They benefit from the fact that they’re using our system. While they’re paying the commission fees to trade on the platform, they’re also realizing a lot more value to the Binance cost. This is an economy that’s never existed before.”

Reward points suit the BTCC model

BTCC marketing manager Aaron Wen told Cointelegraph that the exchange’s reward-points system was preferred to the transaction-fee mode that has been adopted by a number of other Chinese exchanges.

At this stage, with the launch only a few days ago, the company is of the opinion that it is the best incentive system to attract users, both old and new:

“The trans-fee model is very popular, especially for Chinese exchanges at the moment. There’s still a business risk, so our management is reviewing this model and analyzing how it can be sustained in the long run. For now, giving away points for trading that can be converted into our token in the future is what we think makes sense for our business.”

What remains to be seen is when the exchange will finally launch its native token for the platform. When that happens, a decision would be made on the longevity of the reward-points system:

“The reward-points system will be reviewed upon the issuance of the BTCC tokens (reward points are fully convertible to BTCC tokens). Our ultimate goal is to give back to our community, so the reward points were developed to reward our early supporters. We want our users to be incentivized every time they use our platform. We want to ensure that the system is fair for our users and will provide updates accordingly.”

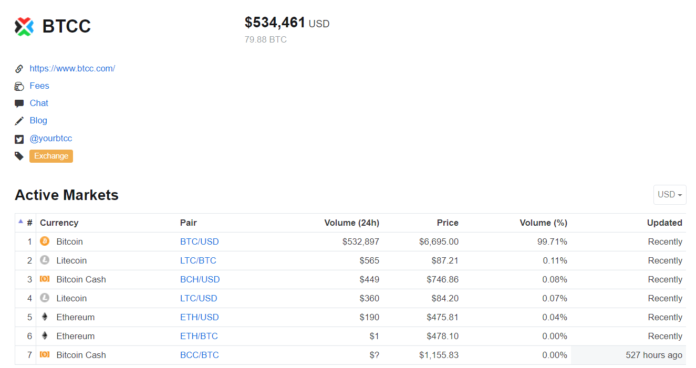

BTCC current trading data

Image source: Coinmarketcap

BTC China — before BTCC

Before it was forced to shut down its initial exchange in 2017, BTC China became a popular platform that was revamped by self-proclaimed ‘Bitcoin Maximalist’ Bobby Lee, who took over the platform that was initially developed back in 2011.

Lee bought into the business in 2013 and took it to higher and higher heights. Although BTCC is now owned and operated by a Hong Kong-based investment fund, Lee still serves as an advisor to the company, which he confirmed in an exclusive interview last month:

“There’s a new management in place. I’ve stayed on as an advisor to the company, so I’m just helping them out on some strategic projects. In terms of their actual day-to day stuff, I don’t have that visibility to share.”

At the time of the acquisition of BTCC by the Hong Kong-based blockchain fund, Lee was quoted as saying he was “very excited about the resources this gives BTCC to move faster and aggressively grow [its] businesses in 2018 and beyond.”

Before it ceased its exchange operation in September 2017, BTC China’s exchange was the second largest in the country.

Return of a Chinese staple

In its day, BTC China was an early trendsetter for Chinese cryptocurrency exchanges. Its 2017 closure was not a result of a technical failure at the exchange, but rather political and economic pressures in the country itself.

What this could demonstrate is the power that regulation can have on the blockchain industry as a whole. BTCC was a well-run, popular exchange that was of the view that it didn’t have a better option than to close the doors of the exchange.

As Lee told Cointelegraph, big countries like China need to take a page from the book of smaller countries that are more accepting of cryptocurrencies and blockchain technology.

“Some of the small countries who are more risk-prone, they are doing it right. They are doing it by a laissez-faire approach. They are welcoming companies to set up a jurisdiction in their country, and to set up entities and licensing it all. Some are doing it more aggressively than others. That’s just how things are. Because different countries will choose different paths, whether they will take a strong adoption approach or whether they will take a more reserved wait-and-see approach. I think China is of the wait-and-see approach.”

Nevertheless, BTCC is back and the success of its revival could only be gauged in the next few months.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube