We will be looking at the BTC price history and market predictions in order to try and formulate a Bitcoin price prediction for June 2020.

Bitcoin Overview

Bitcoin is the number one crypto according to a market cap of $179,549,652,875 and a trading price of $9,767.97. There are currently 18,381,475 BTC in circulation out of a total of 18,381,475 BTC. $34,814,284,029 worth of Bitcoins has been traded in the last 24 hours.

Bitcoin Price Prediction: Analysis

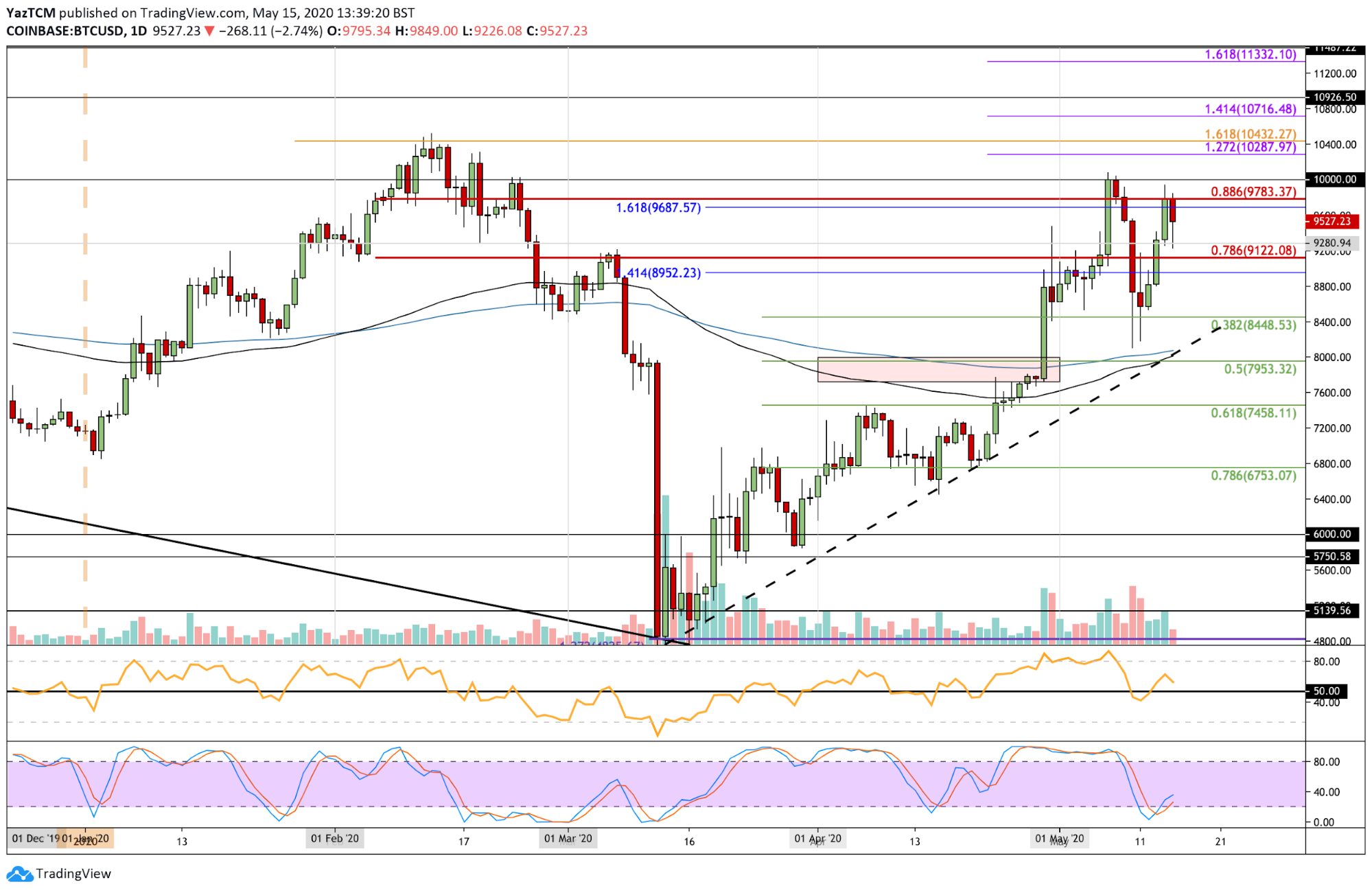

Bitcoin started May at a price of $8,600, and in the first week of the month, Bitcoin worked mostly towards getting past the $9,000 resistance level. On May 6th, BTC rallied up to $9.411,47, closing at $9.268,76. The next day, Bitcoin saw another bullish run, reaching $9.992,66, but going back down to $9.951,52. Another push towards $10,000 was made on May 8th, with the coin once again touching $9.996,74.

The following two days, Bitcoin experienced some sharp losses, as on May 10th, one day before its halving, BTC went below the new support level of $9,000, reaching a low of $8.395,11.

After the Bitcoin Block Halving, BTC traded mostly between $8,600 and $8,700, briefly touching the $9,000 resistance level. On May 12th, Bitcoin traded under the $9,000 level, and on May 13th, the coin rallied up toward the end of the day to close at $9,300.

The bullish momentum continued the following day, with the coin rallying up to close at a price of $9.733,72.

Investors are still waiting for Bitcoin to get past the $10,000 critical resistance. The coin is still at the support level of $9,500, with BTC having chances to get to higher resistance levels and ultimately make the leap for $10,000.

The current pivot, resistance, and support levels calculated by WalletInvestor are:

- Resistance Level (R3): 10454.42

- Resistance Level (R2): 10119.15

- Resistance Level (R1): 9926.437

- Pivot Point: 9591.173

- Support Level (S1): 9398.457

- Support Level (S2): 9063.193

- Support Level (S3): 8870.477

Developments

One of the biggest events in the history of Bitcoin has taken place on May 11th; the third halving. The protocol of Bitcoin is scheduled to reduce the supply by 50% approximately once every four years to manage the issuing of new Bitcoins.

The event reduced the mining rewards from 12.5 Bitcoin per block to 6.25 units. The halving occurred at the 630,000th block, and the first block from the new batch of 6.25-Bitcoin-per-was mined by Antpool, the fourth-largest mining pool according to total computing power.

The last block prior the halving was mined by f2pool, with the pool embedding in the 629,999th block (the last before the halving) a message in the transaction data which references the current financial crisis: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue”, as an homage to Satoshi Nakamoto’s message in the first block of Bitcoin in 2009.

The mining difficulty adjustment reached a new high of 121 exahashes per second (EH/s) seven days before the event, surpassing the past record of 118 EH/s, according to PoolIn data.

Another interesting thing that was noticed was that mining pools appeared to be holding their cryptocurrency. Korean analytics, CryptoQuant, provided charts and data, which showed that mining pools aren’t sending to convert their coins on exchanges as quickly as before.

Chinese mining pool F2Pool, for example, which produces 17.1% of the Bitcoin blockchain’s total computing power, experienced an outflow of 139 Bitcoins on Wednesday, which is the lowest sum that left the pool in six months. Out of these 139 BTC, only 29 were sent to cryptocurrency exchanges, the fewest sent in the last year.

Bitcoin Price Prediction: Market Opinion for June 2020

A number of crypto forecasting sites made their own Bitcoin price prediction for June 2020. We have included some of these forecasts below in order to deliver a more comprehensive market sentiment concerning the future development of BTC.

Longforecast

Longforecast forecasted that BTC will have a trading price of $10797 at the start of June. They also estimated that the maximum price of the coin for this month would reach $14996, while the minimum price will be around $9934. The monthly average was estimated at a price of $11908. The closing price was calculated to be around $11903, change for June 10.2%.

Digitalcoinprice

Digitalcoinprice‘s Bitcoin price prediction sees the coin reaching a price of $22,027.22 in June, which means an increase of 131.06%.

Tradingbeasts

Tradingbeasts anticipated that Bitcoin would debut in June at a price of $8,386.793. The maximum price for the month placed the coin at $ 0,462.037, while the minimum price was calculated at $7,114.185. Bitcoin was projected to close June at a value of $8,369.630, with a change of -12.20%.

Coinpredictor

Coinpredictor forecasted that Bitcoin will experience a decree of -22.6% in June, meaning that the coin will be trading at $7,137.53.

Gov.capital

Gov.capital estimated that Bitcoin’s trading price for June 1st will be $9785.932, with a maximum price of $11253.8218 and a minimum price of $8318.0422. Below are the rest of the predictions for all the days in June.

| Calendar date | Regular | Least possible price | Best possible price |

|---|---|---|---|

| 2020 June | |||

| 2020 June 01, Monday | 9785.932 | 8318.0422 | 11253.8218 |

| 2020 June 02, Tuesday | 9897.741 | 8413.07985 | 11382.40215 |

| 2020 June 03, Wednesday | 9931.350 | 8441.6475 | 11421.0525 |

| 2020 June 04, Thursday | 9680.084 | 8228.0714 | 11132.0966 |

| 2020 June 05, Friday | 9648.612 | 8201.3202 | 11095.9038 |

| 2020 June 06, Saturday | 9807.682 | 8336.5297 | 11278.8343 |

| 2020 June 07, Sunday | 9856.511 | 8378.03435 | 11334.98765 |

| 2020 June 08, Monday | 9834.266 | 8359.1261 | 11309.4059 |

| 2020 June 09, Tuesday | 9831.661 | 8356.91185 | 11306.41015 |

| 2020 June 10, Wednesday | 9702.995 | 8247.54575 | 11158.44425 |

| 2020 June 11, Thursday | 9603.976 | 8163.3796 | 11044.5724 |

| 2020 June 12, Friday | 9614.243 | 8172.10655 | 11056.37945 |

| 2020 June 13, Saturday | 9567.574 | 8132.4379 | 11002.7101 |

| 2020 June 14, Sunday | 9590.845 | 8152.21825 | 11029.47175 |

| 2020 June 15, Monday | 9648.072 | 8200.8612 | 11095.2828 |

| 2020 June 16, Tuesday | 9803.408 | 8332.8968 | 11273.9192 |

| 2020 June 17, Wednesday | 9911.164 | 8424.4894 | 11397.8386 |

| 2020 June 18, Thursday | 9901.853 | 8416.57505 | 11387.13095 |

| 2020 June 19, Friday | 9962.626 | 8468.2321 | 11457.0199 |

| 2020 June 20, Saturday | 10096.00 | 8581.6 | 11610.4 |

| 2020 June 21, Sunday | 10235.75 | 8700.3875 | 11771.1125 |

| 2020 June 22, Monday | 10430.19 | 8865.6615 | 11994.7185 |

| 2020 June 23, Tuesday | 10403.73 | 8843.1705 | 11964.2895 |

| 2020 June 24, Wednesday | 10380.55 | 8823.4675 | 11937.6325 |

| 2020 June 25, Thursday | 10551.94 | 8969.149 | 12134.731 |

| 2020 June 26, Friday | 10970.20 | 9324.67 | 12615.73 |

| 2020 June 27, Saturday | 10707.04 | 9100.984 | 12313.096 |

| 2020 June 28, Sunday | 10648.67 | 9051.3695 | 12245.9705 |

| 2020 June 29, Monday | 10676.66 | 9075.161 | 12278.159 |

| 2020 June 30, Tuesday | 10743.05 | 9131.5925 | 12354.5075 |

Cryptorating

Cryptorating’s Bitcoin price prediction for June expects the coin to increase with 43.78%, which would place BTC around $13 790.55.

Cryptoground

Cryptoground projects that BTC will reach in June a price of $9,736.8819, signifying an increase of 2.62%.

30rates

30rates made predictions for the first 18 days of April, along with the minimum and maximum values of each particular day.

| 06/01 | Monday | $10015 | $11523 | $10769 |

| 06/02 | Tuesday | $9934 | $11430 | $10682 |

| 06/03 | Wednesday | $10104 | $11626 | $10865 |

| 06/04 | Thursday | $10326 | $11880 | $11103 |

| 06/05 | Friday | $10156 | $11684 | $10920 |

| 06/08 | Monday | $11490 | $13220 | $12355 |

| 06/09 | Tuesday | $11453 | $13177 | $12315 |

| 06/10 | Wednesday | $11582 | $13326 | $12454 |

| 06/11 | Thursday | $11819 | $13599 | $12709 |

| 06/12 | Friday | $11878 | $13666 | $12772 |

| 06/15 | Monday | $11911 | $13705 | $12808 |

| 06/16 | Tuesday | $12504 | $14386 | $13445 |

| 06/17 | Wednesday | $13009 | $14967 | $13988 |

| 06/18 | Thursday | $13034 | $14996 | $14015 |

Bitcoin Price Prediction: Verdict

With this, we have reached the end of our Bitcoin price prediction for June 2020. From the data and predictions we have analyzed, the market sentiment is largely positive for Bitcoin.

Featured image: tokeneo.com

coindoo.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube