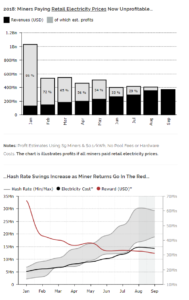

A new report from Diar reveals that Bitcoin miner revenues are already up to nearly $5 billion this year, and total miner earnings from 2017 were surpassed just in the first 6-months of 2018. However, Diar’s research suggests that electricity prices, along with greater involvement in the space from big corporations, are pushing small time mining operations out of the market.

Bitcoin mining rewards have already reached $4.7 billion this year, nearly $1.5 billion more than all of 2017. But to the disappointment of small time mining operations, the growing cost of electricity to support increasingly advanced computing mechanisms for mining are turning Bitcoin mining into a losing investment.

“China, who has an average cost of $0.08 kw/h at retail, and estimated to be half that at wholesale, is currently one of the handful of countries that would make economic sense to mine for Bitcoins with retail prices,” reads a recent research report from Diar. “Even then, however, equipment, salaries, rents, overheads could push inexperienced mining operations into the red.”

The clear-cut leader in the world of cryptocurrency mining is the China-based tech giant Bitmain. In preparation for its upcoming IPO, Bitmain reports that it has generated $2.5 billion in revenue in 2017. The company runs two of the largest mining pools in the world, makes up an estimated 42 percent of Bitcoin’s total hashrate and is backed by huge corporate investors like ViaBTC. Bitmain has a total of 11 mining facilities in China with over 200,000 mining units. In Q1 of 2019, Bitmain plans to open several more mining farms across the United States in Washington, Texas and Tennessee.

The clear-cut leader in the world of cryptocurrency mining is the China-based tech giant Bitmain. In preparation for its upcoming IPO, Bitmain reports that it has generated $2.5 billion in revenue in 2017. The company runs two of the largest mining pools in the world, makes up an estimated 42 percent of Bitcoin’s total hashrate and is backed by huge corporate investors like ViaBTC. Bitmain has a total of 11 mining facilities in China with over 200,000 mining units. In Q1 of 2019, Bitmain plans to open several more mining farms across the United States in Washington, Texas and Tennessee.

Bitmain also has a dominant hold over the sale of cryptocurrency mining equipment, the sales of which make up an estimated 95 percent of the company’s total revenue.

Bitmain reports that 51.8 percent of its mining equipment is sold to international clients. The company estimates to make up 75 percent of all mining equipment sales globally. While Bitmain depends heavily on outside mining operations to buy their mining equipment, they have, for better or worse, begun to run these smaller miners out of the space.

“It’s unlikely then that the recent tapering out of the Hash power to last. With big mining operations on low electricity costs running at anywhere between 50-60% gross profit from Bitcoin revenues, the market has a lot of room left to grow and, profits to squeeze,” the Diar report concludes. “Bitcoin mining has, at least for now, and most likely in the future, moved into the court of bigger players with deep pockets.”

For the latest cryptocurrency news, join our Telegram!

Unhashed.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube