Bitcoin has failed to break out into the $10,000 territory for the second week since hitting $8,000 values and is subsequently set to shatter a flurry of optimistic price predictions.

A collective of crypto market analysts strongly believe that a rally past the $10,000 mark will trigger considerable FOMO and subsequently propel the prime coin to new heights.

ThinkMarkets crypto market analyst, Naeem Aslam, is among the main proponents of this theory and just last week he told his subscribers that real FOMO would begin after bitcoin’s value hit the vital price point. According to the exec, “The bitcoin price is about to blast past the level of $10,000, recovering half of its losses from its all-time high.”

He predicted that the milestone would most probably be reached in a week or two.

Fundstrat Global Advisors co-founder, Thomas Lee, also supports the $10,000 resistance argument. According to his explanation, the pivotal market price has only ever been sustained for a total of 3 percent of all days, meaning it is a transitional point to a major market change, in this case, a likely FOMO trigger.

He elaborates that the $10,000 value mark is comparable to BTC’s $4,500 price in 2017 that precipitated a sustained upward trajectory. The momentum propelled bitcoin to its all-time $19,500 peak.

Bitcoin’s value stands at $8,499 at press time. This is a loss of about 5 percent from its 12-month peak attained on May 30. Despite the brief plunge that has sent chills across the cryptosphere pro-bitcoin crusaders remain adamant that a $10,000 price is near.

Of course, there is a significant likelihood that bitcoin will trade between $7,000 and $9,000 for a while and it may take a white swan event for BTC to move past $10k within the next few weeks.

Bitcoin to Remain Within the $7,000 and $10,000 Price Threshold

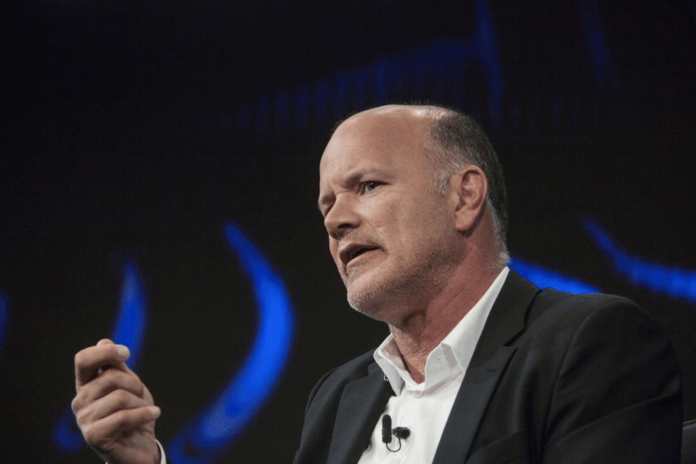

Billionaire Mike Novogratz predicts that BTC will remain within the $7,000 and $10,000 threshold for some time but sheer excitement surrounding the recent upward trend may push prices higher.

Speaking to Bloomberg, he underscored that the main catalysts behind the current positive market trend are widespread acceptance of the new asset class by major Wall Street companies as well as an increase in blockchain use-cases.

Billionaire Mike Novogratz predicts that BTC will remain within the $7,000 and $10,000 threshold for some time. (Image Credit: Bloomberg)

He cited Facebook’s rumored crypto project and Microsoft’s blockchain-powered user identity program as notable projects that are bringing major credibility to the industry.

Forces That Directly Determine Prices

Whales Determine Short Term Price Positions

The nascent bitcoin market is still highly volatile and susceptible to price movements caused by whales and institutionalized players who are able to make tens of millions of dollars in buy and sell orders.

The most recent price hike that occurred on April 2 led to a change from approximately $4,100 to $5,078.52 within 48 hours. It is believed to have stemmed from a single $100 million buy order sent across multiple major exchanges, subsequently pushing up prices.

As expounded on by crypto industry researcher Willy Woo, the latest price rally to $8,000 was largely orchestrated by professional market traders. This was via a tweet indicating the following.

“This last exponential rise & crash was NOT organic. We have a blockchain to show capital movements. There weren’t any. It was an orchestrated short squeeze to milk profits. That requires immense capital to buy up all the shorts. It’s done by pros.”

This last exponential rise & crash was NOT organic. We have a blockchain to show capital movements. There weren’t any. It was an orchestrated short squeeze to milk profits. That requires immense capital to buy up all the shorts. It’s done by pros. https://t.co/58cpr00Iyh

— Willy Woo (@woonomic) May 17, 2019

Manipulative Strategies Used to Shift Markets in the Short Term

There are fears that algorithmic trading tools are going to be used to abuse market loopholes. This is because they can be used to execute fake buy orders on a grand scale to dupe investors. The technique, widely known as flash trading is illegal in regulated markets because it gives a false notion about the value of an underlying asset.

The main problem facing the sector right now is that there are few checks and balances and so such schemes will continue to be commonplace thereby adding to market volatility.

Pump and dump strategies are also going to be used to influence markets in the short term. They are designed to mislead investors into buying a set of assets with the suggested prospect of a huge price increase.

Long Term Price Drivers

The Halving Episode

Industry experts are pointing to the halving episode as a crucial event that could push the bitcoin price past $20,000. The phenomenon limits the supply of bitcoins in the market by doubly increasing the mathematical complexities involved in processing BTC. This causes demand for the remaining coins in circulation to increase subsequently increasing the price.

The next halving event is set to occur in May 2020 and will cause rewards to diminish from 12.5 coins per block to 6.25. The episode automatically occurs after every 210,000 mined blocks and right now, there are about 51,300 remaining.

The BTC network protocol was programmed to start at 50 bitcoins reward per block which was the rate when it was developed back in 2009. It halvens after the set number of processed blocks. Today, about 17,733,563 coins have been mined.

Mining stops at 21 million according to set network parameters. The price of bitcoin is expected to increase steadily after this because of limited supply.

Only about 3 million bitcoins remain and there is no telling what the BTC rate will be especially in a few years time when scarcity increases substantially driving both demand and prices.

(Featured Image Credit: Pixabay)

The post Bitcoin Price Predictions, Uncovering the Real Crypto Market Drivers appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube