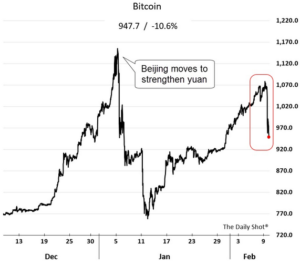

China is showing desperation and has called all Bitcoin exchanges to a closed door meeting looking to shut down the flight of capital from China ( honestly can you think of Indians buying bitcoin to get rid of rupee?)

and this is what happens to Bitcoin

China is looking to deal with the expected trade confrontation with Trump and looking to shut down the flow of capital that has been putting a downward pressure on their currency.

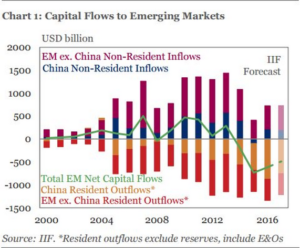

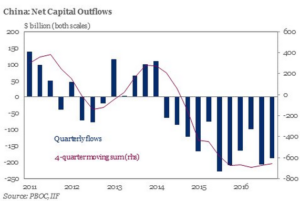

China is heommeraging foreign exchange with its forex reserve down below psychological level of USD 3 trillion

Martin Armstrong writes that China is trying to curb the flight of capital which has contributed to the greenback’s rise for 35 months. However, with Europe tottering on the edge, the next country to withdraw from the EU may set off a collapse of the euro and that will only cause a surge higher yet in the dollar impacting China negatively with regard to trade disputes.

china is between rock and hard place. if they tighten the policy to prevent yuan depreciation domestic economy suffers, if they allow the currency to depreciate Trump will hit them with Trade protectionism.

I believe the next correction in markets will be a function of black swan related event and add this to the long list of potential plack swan created by our central planners

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube