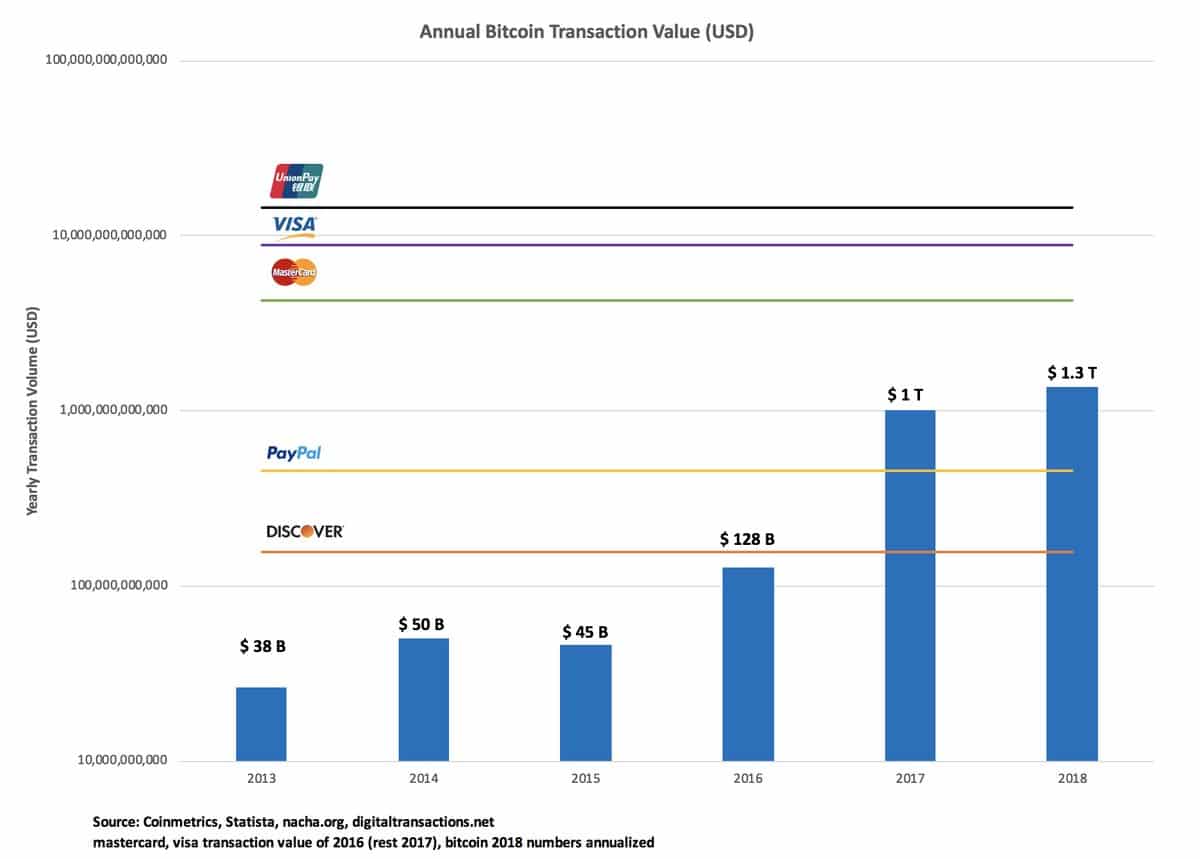

With the cryptocurrencies are maturing in front of our eyes, the transaction volume has grown a fair bit in the past few years. As a result, we have Bitcoin’s transacted value hovering around the $1.3 trillion mark in 2018 alone, outpacing those of giant payment processors such as PayPal and Discover while coming in close second after Visa.

According to Yassine Elmandjra, a cryptocurrency analyst at ARK Invest, the seemingly relentless growth foretells a rather interesting future for Bitcoin and most other cryptocurrencies.

Join the Leading Industry Event!

Elmandjra published a graph showing the No. digital currency transaction volume compared to that of Visa, UnionPay, Mastercard and the Discover cards. Along with that, he tweeted “Bitcoin’s base layer transaction volume doesn’t compare to Visa’s, MC’s et al. But it was never supposed to.”

Suggested articles

Startups Covering Operational Costs Without Selling Their Digital AssetsGo to article >>

Bitcoin, and even the combined transaction value of all cryptocurrencies, appears to have a long road ahead to compete with Visa, which handled $8.9 trillion of transaction value in 2016. However, with a few coins finally cementing the asset class’ place in the payment ecosystem, it is only a matter of time before we see some big changes.

According to data from Blockchain, Bitcoin market has made nearly 80 percent increase per year in the last five years, reaching its peak in 2017 with an eightfold increase in transaction value. This is definitely pretty impressive for an asset class a lot of financial experts deem to be a niche market.

If the same growth rate could be achieved in the years ahead, interesting things will be bound to happen in the future, including that Bitcoin will overtake Visa by the end of 2022, as the rate theoretically puts the cryptocurrency on target to surpass $13 trillion in transactions.

This does not mean people are or will actively spend trillions using cryptocurrency on goods and services, as a big portion of Bitcoin transactions are merely used for speculative trading. But such milestones in itself are a big step forward, as it shows how cryptocurrencies are scalable, while its use cases are being disputed by those who call them a fraud, a bubble, or worse.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube