ChainUP’s BitWind creates a pool of liquidity that is comparable to those of top exchanges, thereby helping novice and operating exchanges increase their transaction volumes.

8th April, 2020, Singapore – On crypto exchanges, liquidity basically refers to the ease of conversions between tokens or to cash. Closely related to market depth and exchange transactions, it correlates with the number of users, level of activity and amount of funds that are being transacted. Important in traditional stock markets, liquidity plays an even more crucial role in crypto markets.

Huobi founder Li Lin has declared that, “Asset volume and liquidity are the core indicators of the strength of an exchange”.

In the same vein, founder and CEO of ChainUP, Zhong Gengfa, often mentions how important high-quality assets are to the development of an exchange and how liquidity constitutes the core experience on an exchange.

Beginning with its first client in September 2017, ChainUP has identified how important liquid products are on an exchange. A leading blockchain technology service provider that has formed 8 mature product lines, ChainUP’s realm of expertise include cryptocurrency exchange, liquidity support, public and alliance chains, wallet, mining pool, situational awareness, blockchain cloud media as well as broker services.

Integrating the liquidity of 300 exchanges served by ChainUP from all over the world, the BitWind liquidity brand creates a liquidity experience that is comparable to those of top exchanges, thereby helping exchanges to increase transaction volumes.

The Liquidity Solution

In the second half of 2019, exchanges were confronted with a severe challenge – the competition amongst exchanges for higher liquidity. For professional service providers, this was an unprecedented opportunity. With exchanges focusing on infrastructure factors like technical services, situational awareness services, market software, professional quantitative market-making platforms and decentralized asset derivatives, the trend was for tech service providers to step in.

In a Jinse Finance interview, BitWind Liquidity Product Operations Director Gino shared that “many customers encounter[ed] standard difficulties when they [began] operations.” A typical feedback from BitWind’s increasing base of customers has been “the crucial role liquidity plays in operations.” It was a pivotal pain point that exchanges faced.”

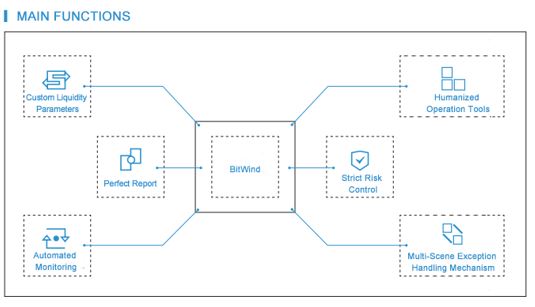

The independent BitWind liquidity brand required more than half a year to hone before it was finally launched. The goal was to meet user needs and provide the best market depth and trading experience, thereby helping exchanges implement operations smoothly. Even though the product was created for B2B businesses, BitWind could cater the range of novice exchange teams to operating exchanges, wallet dealers to brokers, institutional traders and more.

Deeper Liquidity Pools, Capacity to Operate More Freely

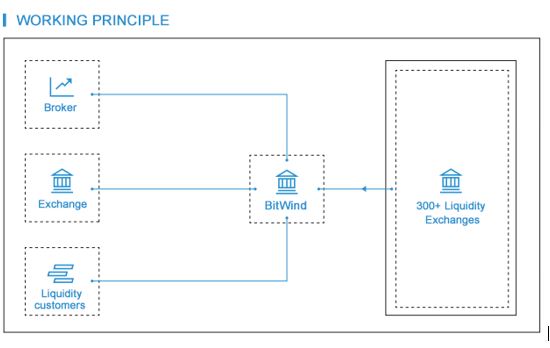

In principle, BitWind is established as the ecology center and aggregates the liquidity of over 300 exchanges. With the ‘upstream’ providing liquidity for the ‘downstream’, the BitWind liquidity product has created a liquidity pool that can service all the mainstream currencies in the market.

To provide trading services to their end-users, exchanges only needed to add a trading entry on their platforms. With that they could access the shared liquidity and aggregation market of the underlying trading network.

The BitWind product supports spot liquidity, the privatized ETF liquidity of ChainUP as well as platform currency liquidity etc. Opening a credit account allows an exchange to access liquidity and also create liquidity more freely from the leverage function. Of special mention, ChainUP has a dedicated network price aggregator that can provide the fastest price quotes as well as ultra-low order delays. Other features include one-click trading, one-second price comparisons and low-buying and high-selling.

Emerging exchanges can access optimal quotes, sufficient traffic, the best market depth, lower spreads and avoid the risk of arbitrage losses while simultaneously increasing trading volume. It canleverage operating and capital value in a bear market, and maintain its competitive edge and grasp market opportunities in a bull market.

Currently serving more than 500 global customers, ChainUP’s customers include 300+ digital asset exchanges and 100+ digital wallet customers, hailing from over 20 countries in Southeast Asia, the Middle East, Europe and America. Millions of customers contribute to the huge aggregated user volume which naturally creates liquidity. The BitWind liquidity brand currently serves more than 150 customers. From the synergies of the various flows in the ecology, siphoning effects are formed that create sustainable positive cycles.

A Differentiated Competitive Advantage

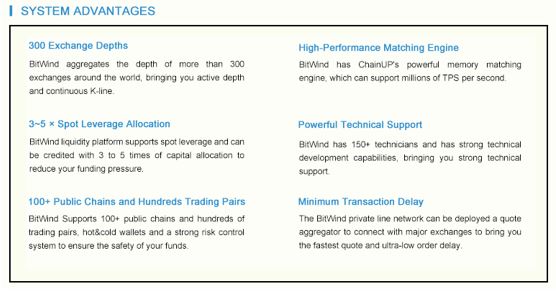

Regarding the competitive advantages of BitWind, Gino points out that BitWind has 300 exchange depths, high-performance matching engines, comprehensive transaction functionalities, 3-5 times spot leverage allocations, minimum transaction delays, powerful technology and support for 100 public chains and 8 major protocols.

In addition, the core technical team of ChainUP hail from BAT (Baidu, Alibaba and Tencent) backgrounds. Founding team members like Jun Du, Hu Donghai and others possess deep and professional industry knowledge and experience. Moreover, ChainUP has always maintained its position as a dedicated technical service provider, not branching off into other areas that might cause conflicts of interest for their customers. These factors have contributed in no small part to BitWind’s competitive advantages.

Liquidity – the Lifeblood of Small and Medium Exchanges

When small and medium exchanges lack users and trading volumes, they will not survive in the industry. By placing large numbers of purchase orders, BitWind plays the role of a large customer on the exchange. The instant liquidity access can savenew exchanges from a cold start. Rather, small and medium exchanges can shift their focus on customer retention, avoiding the risks in market making. In the industry battle for liquidity, BitWind has proved to be an absolute masterstroke for ChainUP.

About ChainUP

ChainUP is a leading blockchain technology solution provider in the world. It owns eight well-developed product lines: digital currency trading (financial derivatives), wallet, situational awareness, public chain and consortium blockchain, mining pool, blockchain cloud media, liquidity, broker, and has constructed an industrial closed-loop from technology service to traffic and traffic commercialization. So far, it has served 300+ exchange clients, 100+ digital wallet clients, 150+ liquidity service clients, which include 50+ million users in over 20 countries from Asia, Europe, America and Oceania. The team members behind ChainUP have worked in top blockchain or internet companies and institutions in technological development and operation management, and are highly experienced in the blockchain industry. It has obtained several rounds of investments from well-known top institutions in the industry, such as Morningside Venture Capital, Joy Capital, Node Capital, Albatross Venture, Taoshi capital, amongst others.

ChainUP Officials:

Official Website: https://www.chainup.com

Facebook Page: https://www.facebook.com/ChainUPTechnology

Facebook Group: https://www.facebook.com/groups/ChainUP

Twitter: https://twitter.com/ChainUPOfficial

LinkedIn: https://www.linkedin.com/company/ChainUP-Technology

Telegram: https://t.me/ChainUPOfficial

Medium: https://medium.com/@_ChainUP

Pinterest: https://www.pinterest.com/chainupofficial

Youtube: https://www.youtube.com/channel/UCTuHHr1n_oJVY_Hg7AxoASw

Media Contact

Cecilia Wong, yourPRstrategist.com

+65-91826605

[newsletter_form lists="1"]