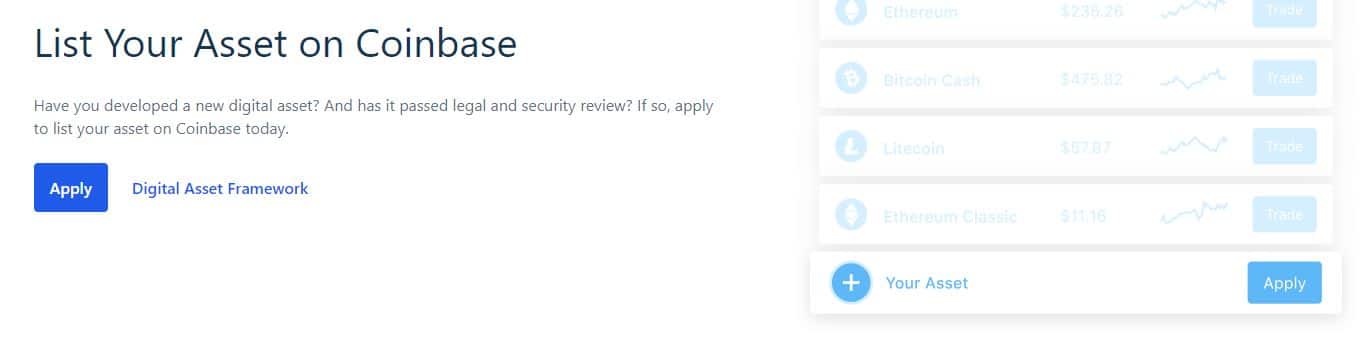

List your asset on Coinbase

The text states that the company’s goal is to “rapidly list all assets that meet our standards and are compliant with local law”.

Tokens will be judged according to guidelines that the company has written – the ‘Digital Asset Framework’. The website requires that applicants define their tokens by ticking boxes under the following subject headings: technology, legal/compliance, market supply, market demand, and ‘cryptoeconomics’. This last word refers to economic incentives and token sale structure of the applying token.

No more pumping?

One reason that this is significant is because Coinbase will no longer need to announce the listing of a new cryptocurrency, which could end the inevitable accusations of price-pumping. CEO Brian Armstrong said in a recent interview: “I certainly look forward to a day when we add a new asset to Coinbase and it’s a non event…routine and boring.”

This has been an issue in the past. To give two examples: in December 2017, Coinbase began trading Bitcoin Cash, but a massive and sudden jump in price led to accusations of insider trading. Coinbase denied the allegations but temporarily de-listed the coin. And then in March 2018, when Coinbase Pro was still called GDAX, ERC20 token support was added. Despite the dact that Coinbase specifically refrained from mentioning any specific cryptocurrency as being of interest, the price of a token called 0x exploded (by 40 percent) because a few former Coinbase employees were involved with that project, which was enough evidence.

Suggested articles

B2Broker’s Arthur Azizov: ‘Finteсh Startups Do Not Need to Reinvent the Wheel’Go to article >>

Missing volatility

CEO Brian Armstrong first mentioned the plan to list large numbers of tokens a few weeks ago at the ‘Disrupt’ conference in San Francisco. He said in an interview: “…I think there’s going to be hundreds [of tokens] on the platform within years and I think there could be millions some day.”

Now, it should be noted that the volatility of the prices of the biggest cryptocurrencies has declined of late, which is good in that it makes them more closely resemble actual currencies. However, stability is bad for business; it is instability that attracts people to trade them.

Thus, the footfall seen by some cryptocurrency exchanges has suffered as customers turn to unregulated businesses overseas to try their luck. Especially affected by this trend are Coinbase, Bitstamp and Kraken, according to Diar.

Currently Coinbase Pro offers only Ethereum, Bitcoin, Bitcoin Cash, Ethereum Classic and Litecoin. It has handled $135.2 million in trading volume over the last 24 hours, according to coinmarketcap.com, making it number 18 in the world. Compare that with Binance of China which offers no fewer than 383 different cryptocurrencies for trading – its equivalent figure is $1.3 billion.

It can be argued that Coinbase’s move is a response to this trend, and it wants currencies which are less stable.

This is an interesting shift in philosophy. Cryptocurrency businesses, especially in the US, have been eager to project an image of respectability in their efforts to win the approval of the authorities. This is why some only list the most well-known and stable cryptocurrencies. Now that this is hurting profits, something has to change.

For the latest cryptocurrency news, join our Telegram!

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube