Bitmain, a major Bitcoin mining firm based in China, has been value at $12 billion following the recent closing of a Series B round funding.

Local news source Caixin reported that the round brought in somewhere between $300 million and $400 million in new funds, led by US-based hedge fund Coatue, Sequoia Capital China, and EDBI, an investment fund backed by the government of Singapore.

This latest round of funding i considerably larger than the $50 million raised in Bitmain’s Series A funding round in July of 2017–Sequoia was listed as a main contributor in that round as well, along with IDG Capital.

According to Caixin, the mining firm is also planning to conduct a pre-IPO funding round in the future, although no specific details have been given as to when that will happen. If the plans are confirmed, Bitmain will join the ranks of Ebang Communication and Canaan Creative, two other Chinese mining firms that have both applied to hold IPOs with the Hong Kong Stock exchange.

Bitmain’s Power Appears to Be Growing

Bitmain, which was also named as one of the 21 EOS block producers earlier this week, is recognized by analysts as the single most powerful mining force on the Bitcoin blockchain.

Suggested articles

Capital Markets Wins Best ECN Broker for 2018 at China FOREX EXPOGo to article >>

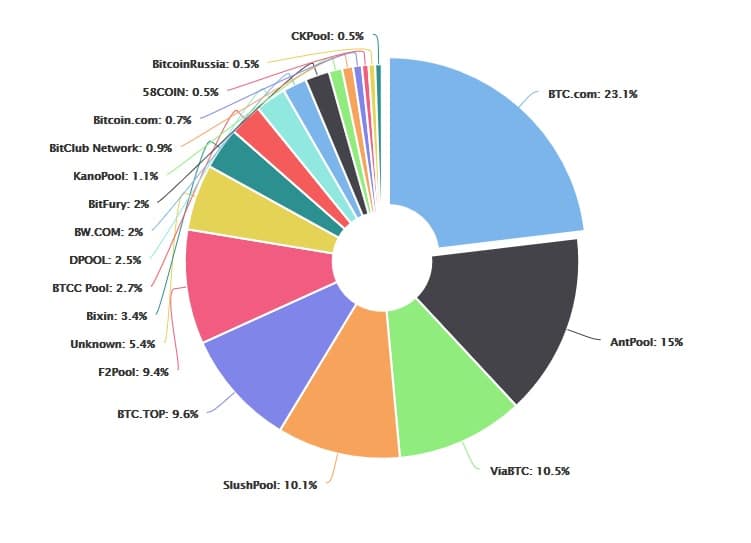

In addition to high-volume sales of ASIC chips and ‘Antminer’ mining devices, Bitmain also controls AntPool and BTC.com, two mining pools that Ethereum World News reported to control 15 percent and 23 percent of the hashpower on the Bitcoin network, respectively. Bitmain also holds shares in ViaBTC, which is reported to control around 10 percent of Bitcoin’s hash power.

Just heard from QA! 77 miners, with a minimum hashrate of 10kSol/s ±5%, have passed testing (report in pic). We will ship these on a first-paid-first-ship basis (payment times in pic) as soon as the custom formalities and paperwork is complete. Stay tuned.#Z9QA pic.twitter.com/Rxdh2wSk2J

— BITMAIN [Not giving away ETH] (@BITMAINtech) May 27, 2018

Theoretically, the company’s holdings in hash power would make it possible for it to carry out a 51-percent attack. However, Bitmain co-founder Jihan Wu asserts that Bitmain would be foolish to carry out such an attack because of the economic losses that would result.

Image source: https://ethereumworldnews.com/bitmain-eos/

Image source: https://ethereumworldnews.com/bitmain-eos/

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube