Coinbase Review: Is Coinbase a Safe Way to Buy Cryptocurrency?

Is Coinbase Safe?

If you’re reading this Coinbase review, chances are this is the main question you’re asking. The short answer is yes, but we’ll take a closer look at this in three parts below.

Company Legitimacy

As a company operating in the United States, Coinbase is required to comply with U.S. laws and regulations, at both a federal and state level. Here are some of the laws, regulations, and regulatory bodies that Coinbase complies with:

- Registered as a Money Services Business with FinCEN.

- Complies with the Bank Secrecy Act.

- Complies with the USA Patriot Act.

- Complies with state money transmission laws and regulations.

These regulations and laws force accountability onto Coinbase, something that may be lacking from some of their offshore competitors in other countries with less strict regulations.

It’s also worth noting, Coinbase has many trustworthy investors backing the company. These investors include Alexis Ohanian (Reddit Co-Founder), Bank Of Tokyo, Blockchain Capital, and Digital Currency Group.

Safe Keeping of Funds

Coinbase segregates customer funds from company operational funds. These customer funds are held in custodial bank accounts. This means they will not use funds of yours to operate their business. They also claim, “Even if Coinbase were to fail as a business, the funds held in the custodial bank accounts could not be claimed by Coinbase or its creditors. The funds held in those accounts would be returnable to Coinbase’s customers.”

98 percent of customers’ cryptocurrency funds are stored in secure offline cold storage. These cryptocurrencies are held on multiple hardware wallets and paper wallets. The physical cryptocurrency wallets are then stored in vaults and safety deposit boxes around the world. These measures protect customers’ funds from being lost or stolen by hackers.

The remaining portion of cryptocurrency that’s stored online is fully insured by a syndicate of Lloyd’s of London.

United States residents who use Coinbase’s USD wallet are covered by FDIC insurance, up to a maximum of $250,000.

It’s important to note that, despite all of this, customers are still liable if their personal accounts are compromised. This is why it’s typically recommended to store your cryptocurrencies in an offline cold storage wallet that you control. You can view our recommended wallets here.

Personal Account Security

Coinbase offers its you a variety of features to secure your personal accounts. ou should also use a strong, unique password.

Multiple 2-factor authentication (2FA) methods are available to help secure your account. The most basic 2FA option is through SMS texts, but we recommend setting up a third party 2FA app. Options for this include Google Authenticator and Authy.

You can also track the activity of your account and get notified if a new device or IP address attempts to access your account.

Customer Support

Coinbase offers customer support through email or phone. Email responses from support typically arrive within 24-72 hours. For general questions, they also have an extensive FAQ section on their site.

Supported Countries

Coinbase serves customers in the following countries:

Andorra, Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, United States

Buy and Sell Limits

Buy and sell limits can vary by user location, payment method, and verification status. You can view your limits at any time, by viewing your account’s limits page. As a verified U.S. customer, you likely will be able to get these weekly limits fairly easily:

- $5,000 Buy through Bank Account.

- $50 Buy through Credit/Debit Card

- $50,000 Sell

You can apply for higher limits if these limits don’t meet your needs. Your limits for instant purchases may not be able to be increased.

Coinbase Info

| Key Information | |

|---|---|

| Site Type | Easy Buy Methods |

| Beginner Friendly | |

| Mobile App | |

| Company Location | San Francisco, CA, USA |

| Company Launch | 2012 |

| Buy Methods | Debit Card, Bank Transfers |

| Sell Methods | Bank Transfers, PayPal |

| Available Cryptocurrencies | Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, +many more |

| Community Trust | Great |

| Security | Great |

| Fees | Average |

| Customer Support | Good |

| Site | Visit Coinbase |

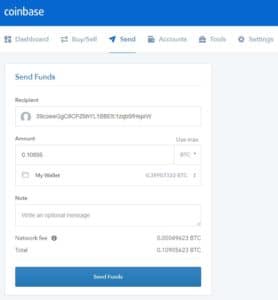

Sending Cryptocurrency From Your Coinbase Wallet

The wallet on Coinbase allows you to easily store, send, and receive cryptocurrency. Sending BAT, Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Zcash, and ZRX from your wallet can be completed in just a few steps:

The wallet on Coinbase allows you to easily store, send, and receive cryptocurrency. Sending BAT, Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Zcash, and ZRX from your wallet can be completed in just a few steps:

Note: Coinbase is constantly adding support for new cryptocurrency, so this list of coins will most likely grow.

- Navigate to the Send tab of your account.

- Choose the wallet you want to send from, effectively choosing what cryptocurrency you’re sending.

- Enter the amount you’d like to send.

- Enter the address you wish to send funds to.

- Send funds.

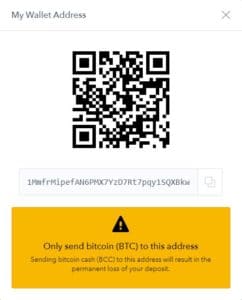

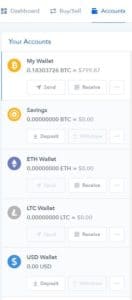

Receiving Cryptocurrency to Your Coinbase Wallet

Receiving Cryptocurrency to Your Coinbase Wallet

Receiving cryptocurrency is also easy using Coinbase.

Navigate to your Accounts tab. Then, find the wallet where you want funds to go and click the Receive button.

You will then be provided with your account’s wallet address. Use this address in the send field of a transaction to receive cryptocurrency.

Be Careful Where You Send Funds From Coinbase

Coinbase has been known to track where their users send their cryptocurrency and ban users for certain transfers. Coinbase has shut down accounts for the following activities:

- Sending cryptocurrency to gambling sites.

- Sending cryptocurrency to LocalBitcoins.

- Sending cryptocurrency for darknet purchases.

In situations where Coinbase has closed accounts, users are almost always paid back to their bank accounts.

While we’re not condoning using cryptocurrency for illegal activity, we don’t think a business should decide how you can spend your cryptocurrency. This is another reason the community recommends storing your cryptocurrency in a wallet you control.

Coinbase Review Summary

To summarize this Coinbase review, we think Coinbase is a great place for newcomers to buy cryptocurrency. Newcomers will find Coinbase easier to use than an exchange while being able to use more payment methods. However, we do recommend storing your cryptocurrency on a wallet you control if holding large amounts.

Pros

- Easier to use than an exchange

- Buy cryptocurrency faster than most exchanges

- Buy cryptocurrency with debit cards (in addition to bank transfers)

- Lower fees than “easy buy” competitors

- Trustworthy and regulated company

- Safely stores customer funds

Cons

- Monitors how you spend your cryptocurrency

- Wallets are less secure than a wallet you control yourself

- Slightly higher fees than most exchanges

Coinbase Rating

-

Beginner Friendliness -

Customer Support -

Community Sentiment -

Fees -

Payment Methods -

Available Cryptocurrencies

Summary

Coinbase is a great beginner friendly option for buying many of the most popular cryptocurrencies.

Get $10 When You Open A New Coinbase Account

When you click the link below and open a new Coinbase account, you will receive $10 immediately funded into your account.

Don’t miss free cash – even $10… click the link below today to get started.

How to Use Coinbase to Buy Cryptocurrency in 5 Simple Steps (just follow the bouncing ball)

In this step by step guide, I’ll show exactly how to buy cryptocurrency through Coinbase.

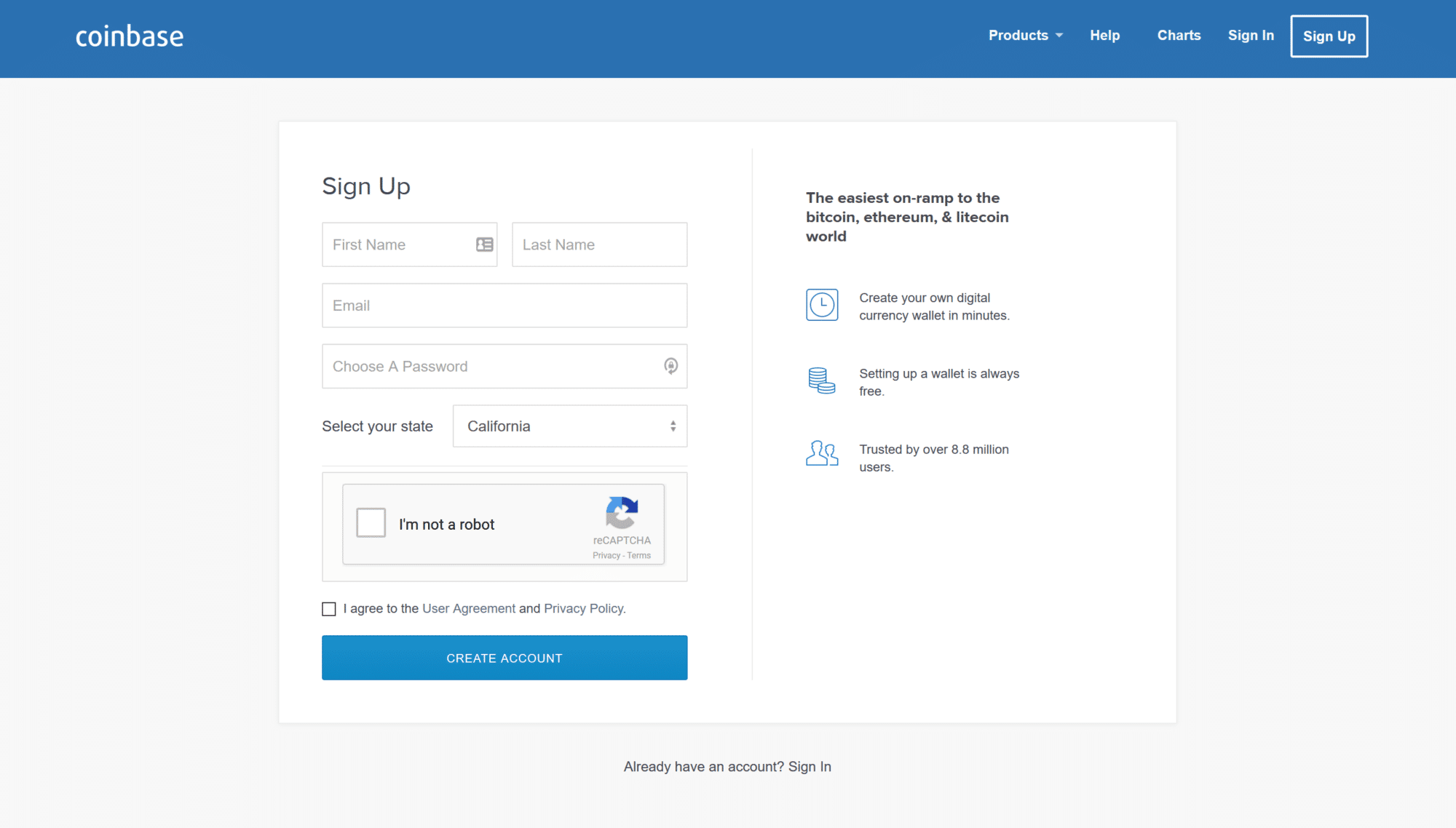

1) Signup and Verify Your Email Address

The first step is to create an account. Initially you will only be asked for your name, email, password, and state.

2) Choose Your Account Type

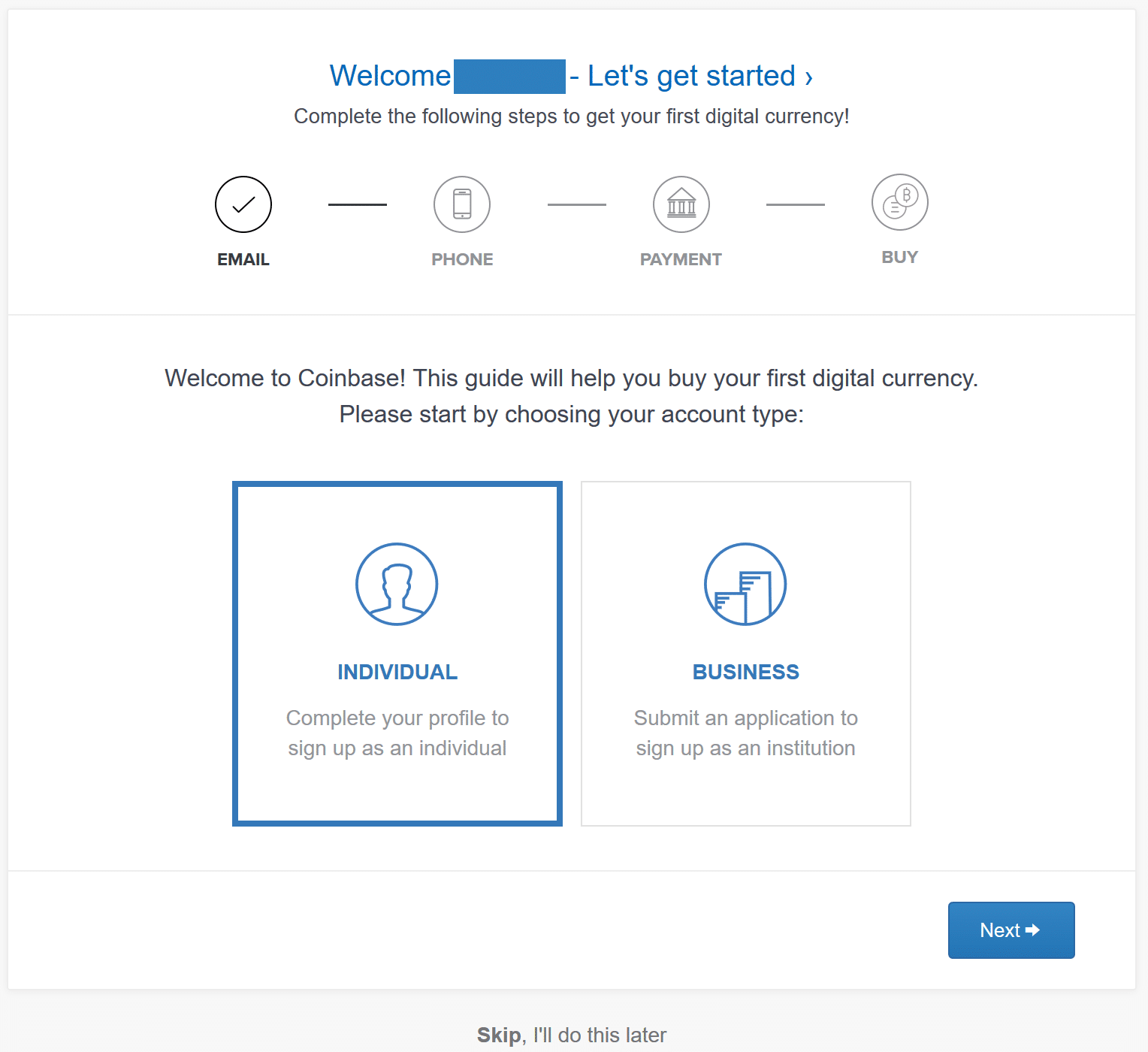

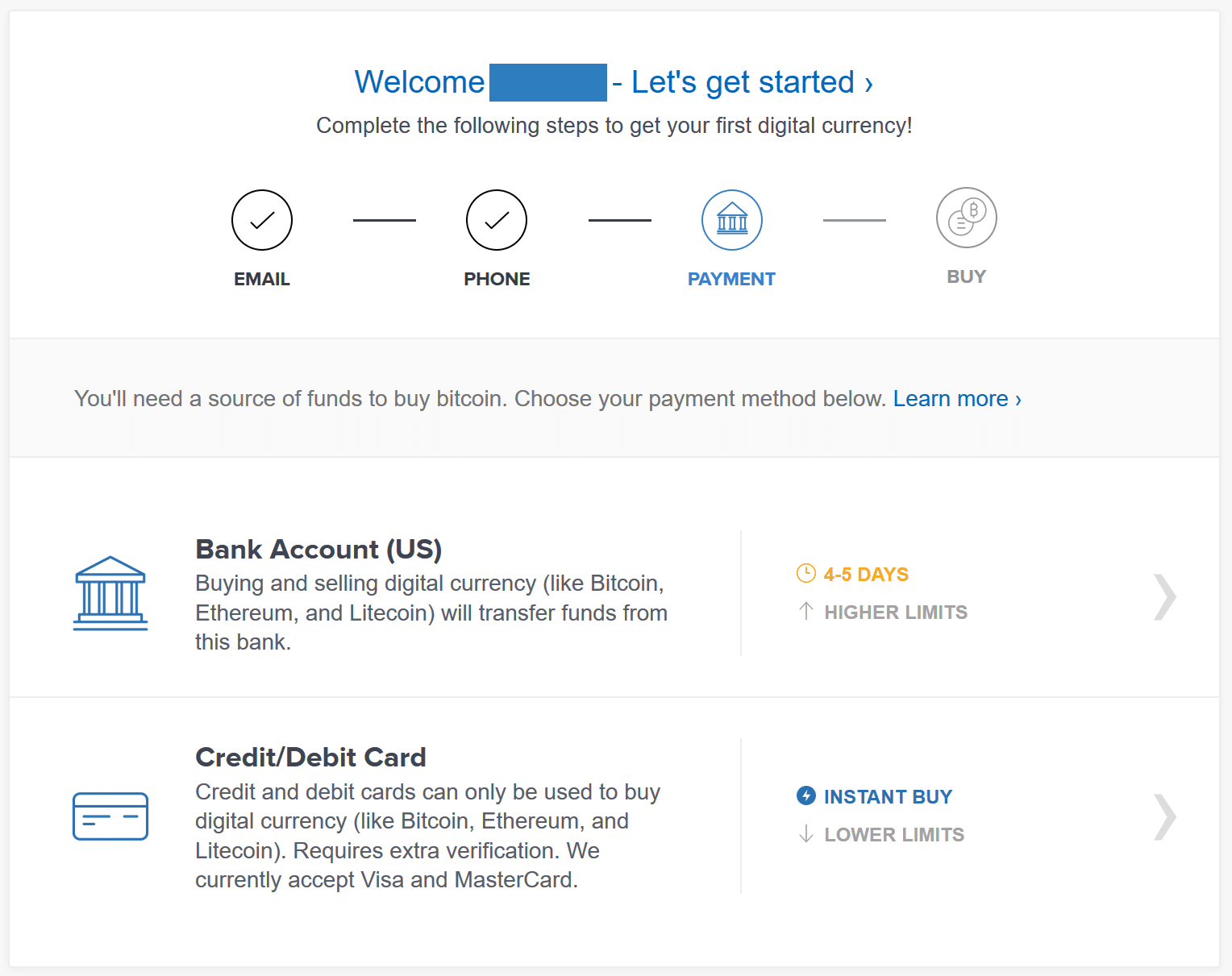

After you confirm your email address, you will be taken through a 4 part process to buy.

Choose whether you want to create an individual or business account.

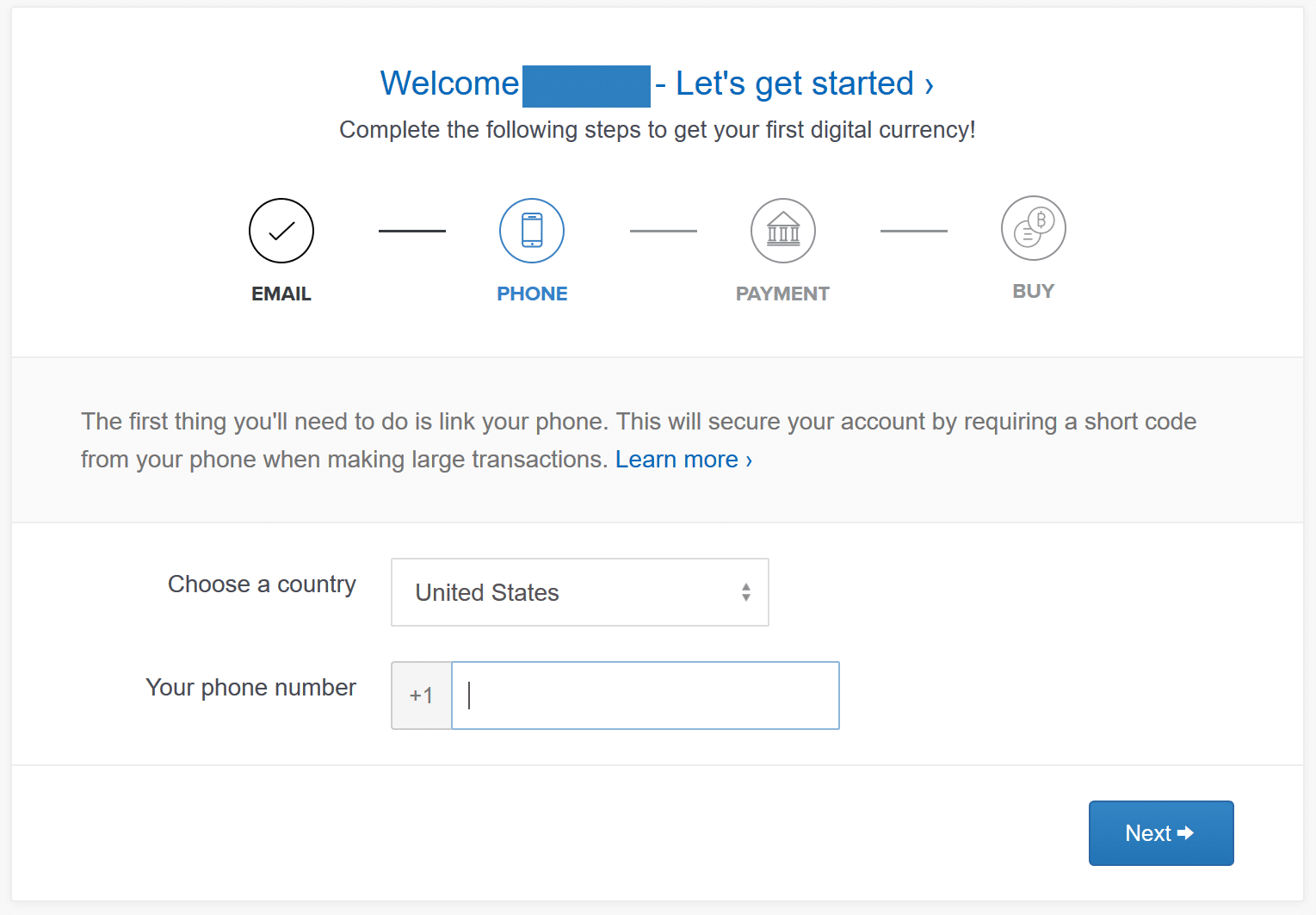

3) Verify Your Phone Number

You will then need to verify your phone number. This is used as a form of 2-Factor Authentication, helping to secure your account.

4) Set Up Payment Method

The next step is to set up a payment method.

Coinbase accepts payment through bank transfer and credit card. Both payment methods may require verification.

When setting up your bank account with Coinbase, they may first initiate two small transactions, then require you to verify the amounts.

When setting up a credit card, you’ll likely need to upload pictures of your credit card.

Both methods may require you to verify your identity. This is required by almost all cryptocurrency exchanges who handle fiat currencies (USD, EUR, Etc.), to comply with various government regulations.

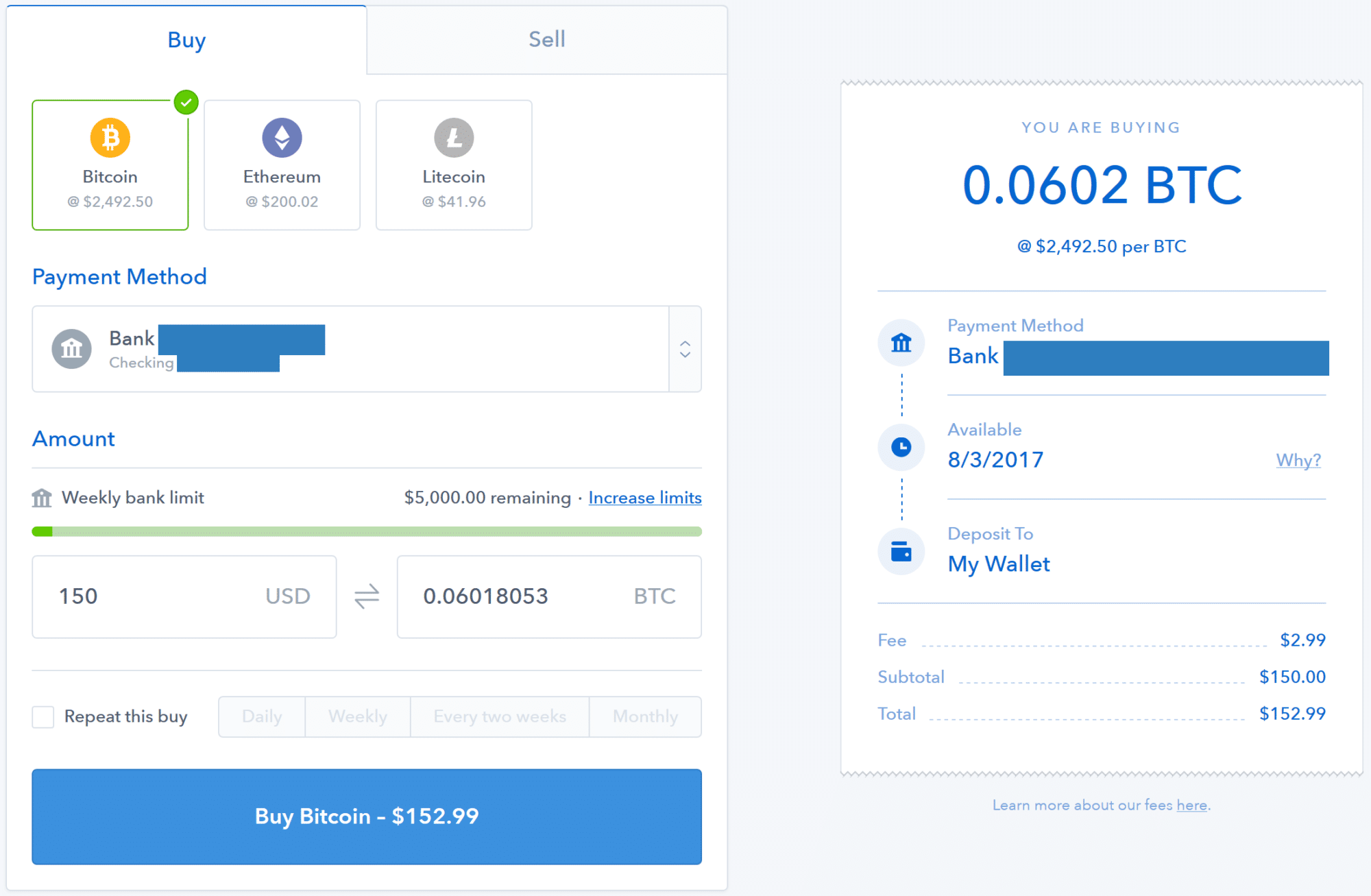

5) Buy Bitcoin, Ethereum, and/or Litecoin

Lastly, it’s time to make your cryptocurrency purchase. The price and all Coinbase fees are clearly stated at the time of placing your order.

If you made your purchase via bank transfer, your cryptocurrency will arrive after your bank transfer has been processed.

Note: This process may have changed slightly by the time you’re signing up to Coinbase. They have continuously made small adjustments to their design and sign up process, but we’ll be sure to update any major changes.

Get $10 When You Open A New Coinbase Account

When you click the link below and open a new Coinbase account, you will receive $10 immediately funded into your account.

Don’t miss free cash – even $10… click the link below today to get started.

The post Coinbase Review: Is Coinbase a Safe Exchange to Buy Cryptocurrency? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube