Dollar Cost Averaging (DCA) as a crypto investment method may not be the most thrilling way to speculate on the bitcoin price, but it is one of the most level-headed, according to proponents. Using a simple online DCA calculator, one can choose a plan for buying small amounts of bitcoin at regular intervals. While the technique may result in missing out on some true bottoms, it also avoids compulsive FOMO buying during peaks, and rests on the age-old adage that “slow and steady wins the race.”

Also read: Market Update: Coronavirus Fears, Stock Market Crash, and Bitcoin Price Predictions

How DCA Works

“Dollar cost averaging, not the most sexy thing … but it could be the most powerful thing you read IF you apply it,” states user ManLikeAJ in his recent read.cash post on the topic, entitled: Dollar Cost Averaging – The Most Underrated Approach to Investing.

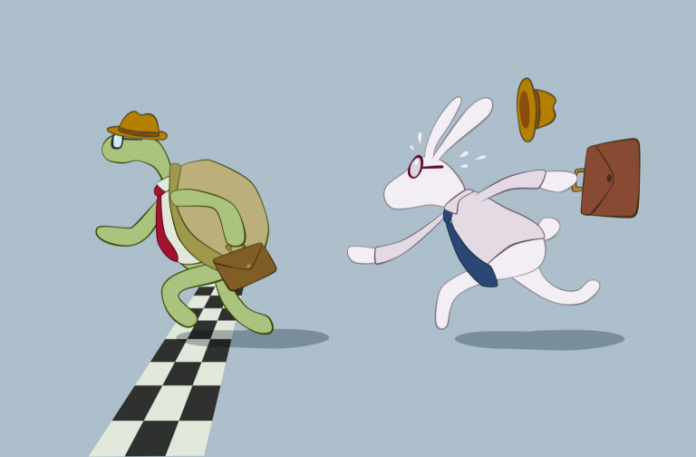

The basic idea of DCA is to rein in the biologically hardwired desire to get rich right away, and take a more measured approach. There’s no shortage of folks in the space who have seen markets spike, bought in compulsively, and then had to turn around and sell most of their crypto savings soon after, when things corrected. Instead, investing small, doable amounts over the long term tends to smooth out the bumps. And in many cases, it puts the “tortoise investors” far ahead of their more sporadic counterparts.

Dcabtc.com provides a nice little resource for calculating (according to historic price data) how much one could have gained if leveraging DCA in BTC investment. For example, the image above shows that someone who started investing $10 a week three years ago, and continued to do this every week for those three years, would have more than doubled their investment by the end, with a 119.49% gain. This means that in 2.5 years someone could have seen $1,500 turn into $3,000, based on the market prices from this interval.

Granted this might not be as thrilling as the mad BTC gains made from cocaine-fueled credit card purchases in 2017, but the investor probably won’t need to sell their last sats to pay the light bill when harder times come, either.

Slow and Steady vs. Random Guessing Games

As ManLikeAJ says: “I overextended myself before, lost my job and then had to sell my BCH to survive. I do not want to EVER experience that again and so I am trying to remain disciplined with a small amount that I know I won’t miss and will remove price swing emotions from.”

Dcabtc.com lays out a scenario where two characters, John and Alice, decide to invest using non-DCA and DCA methods, respectively. John buys up $5,000 of BTC on Jan. 1, 2018, all in one go. The price at the time for one coin was $13,800, so he ends up owning 0.362 BTC. Alice, “instead of investing the entire amount today, she decides to purchase $500 every month, for 10 months. 10 months later, Alice owns 0.61 BTC. That’s almost twice as much as John, even though both invested the same amount.”

There are pros and cons to DCA, but the main factor stressed by advocates is that no matter how smart someone is, there’s ultimately no way to predictably and consistently time the markets, which are subject to all kinds of variables. Though some nice bottoms might be missed, so will some instances of buying in too high and taking a loss.

When BTC is examined from a sufficient distance, the average trend is very positive, which regular, measured investment can take advantage of. DCA doesn’t rule out leveraging technical analysis, either, as dcabtc.com points out:

“If you have some experience trading, you’ll quickly realize that you can improve the performance of your dollar cost averaging strategy by making use of some simple tools. When going this route, you would purchase Bitcoin whenever a set of simple technical analysis tools give you a signal, instead of a fixed time interval.”

DCA for Other Coins and Assets

Dcabtc.com presents a nice option of comparing DCA gains in bitcoin to other assets from a selected time frame and investment strategy. The image above shows that in the interval selected BTC was the best performing investment, with a roughly 119% ROI. Gold yielded about a 25% gain, and USD about 18%.

Even for cryptos that don’t yet have the historical ROI of bitcoin core, DCA can work to an investor’s advantage. For example, many see value in the Bitcoin Cash network due to the low fees, active development and strong community which aims to stick to the original bitcoin ethos of economic freedom for the individual. Should the BCH haters be right, and see the whole thing tank to zero someday, dollar cost averaging would nonetheless stand to mitigate high buys along the way for BCH proponents. Conversely, should the “just hodl don’t spend” narrative of core maximalists not end up creating a dependable store of value, DCA combined with shrewd withdrawals could put a pillow in front of the brick wall.

Because investing always involves risk (government fiat money included), it’s not that DCA is a magic bullet, but a generally level-headed approach to a risk an investor has already deemed worthwhile and decided to take. So for the gamblers out there, fear not — you still could lose or gain it all, just a bit more slowly.

What do you think of the DCA method for investing in bitcoin? Let us know your thoughts in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, fair use.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post DCA – The ‘Boring,’ Sensible Bitcoin Investment That Could Double Your Money in 2.5 Years appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube