Technical analysis of price trends is a topic ever electrifying the world of crypto investment with, dynamic debate on social media and beyond. While there are no guarantees, there are fundamental methods for looking at data which can provide valuable insights, such as analysis of price support lines and resistance, as well as proposed approaches for making the most of bear markets such as the Mayer multiple.

Also Read: Bakkt’s Bitcoin Futures Shatters Records Amid Spot Market Turmoil

Support and Resistance

“The voyage of the best ship is a zigzag line of a hundred tacks. See the line from a sufficient distance, and it straightens itself to the average tendency.” So wrote the American essayist and transcendentalist philosopher Ralph Waldo Emerson in 1841 in his seminal essay Self Reliance. While Emerson had no way of knowing about a future full of heated crypto Twitter debates, his point here nonetheless bears relevance not only for one’s personal life journey, but in the context of support lines for bitcoin as well.

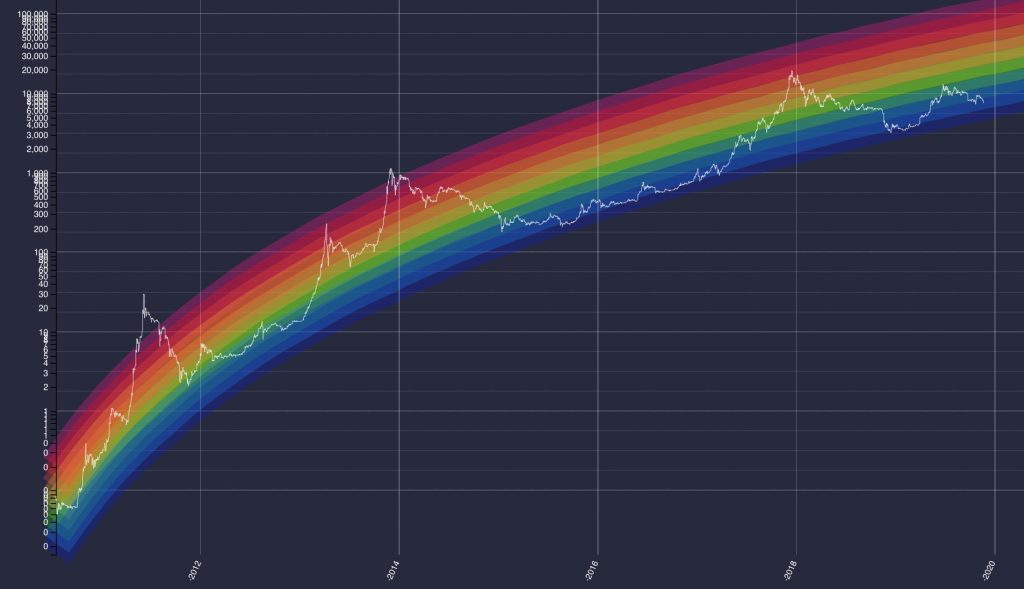

What are known as “support” lines in technical analysis of price trends are levels at which dips in price are said to test a low level and return upward, not wanting to sink back below said level. While there’s endless debate and speculation on what are thought to be new supports or resistance (a level that prices tend to hit and then recede from), a broader, macro look at historical data can be enlightening.

Bitcoin’s parabolic uptrend which started in January 2015 is still intact. Now nearly touching support again, for the first time since March 2019. #buythedip pic.twitter.com/ohMOPEEjiR

— Tuur Demeester (@TuurDemeester) November 22, 2019

Examining BTC’s historical trend since January 2015 as depicted above by Founding Partner of Adamant Capital, Tuur Demeester, a general uptrend on the logarithmic chart can be seen which appears to be testing a basic line of support; another area of which could be tested soon should BTC fall to ~$6,400. It is important to note, however, that even from a macro perspective, there are no guarantees. As Demeester himself points out:

As Bitcoin slowly approaches maturity/saturation, its price uptrend will gradually slow down, which causes parabolic trendlines to fail. In other words, a violation of the trendline above won’t be proof that the secular bull market in bitcoin is dead.

Some view the foregoing analysis as too optimistic, as even more long-term, secular trends are themselves subject to unpredictable market changes and variables. Demeester’s conclusion that the parabolic uptrend is still intact is qualified by his claim that even if the trend is broken, it doesn’t really matter (over an even longer period of time). This leads to a kind of speculative infinite regress where, no matter what the situation, it can merely be viewed as a correction leading to even greater, if more gradual, growth and gains in the future. Still, even in the current situation, with cryptos hemorrhaging billions over the past week, bitcoin achieving a $7,000+ valuation at all was merely a wild dream for many just years ago.

The Mayer Multiple and Other Factors

What is known as the Mayer Multiple in bitcoin is a historical price analysis system developed by self-described philosopher, entrepreneur, and investor Trace Mayer. The multiple is found by dividing the current bitcoin price by the moving price average of the previous 200 days, and its indications are used by some as a rough guide for understanding buy signals in the BTC market. At press time the multiple sits at 0.77.

According to mayermultiple.info, Mayer ran simulations and “determined that in the past, the best long-term results were achieved by accumulating Bitcoin whenever the Mayer Multiple was below 2.4.” The site goes on to warn, however: “Since the simulations were based on historical data, they are purely educational and should not be the basis of any financial decision.”

Beyond the Mayer multiple and technical analysis of charts, other factors related to price and value potential such as community, use cases, and government regulations can have effects on assets that are hardly predictable. Even painstaking and genuine efforts at technical analysis have been jokingly said to have all the reliability of a daily horoscope reading. Such analysis is nevertheless an attempt to make sense of a vast confluence of interrelated factors relevant to price movements, and the insights gained thereby are often based on logically conceived, rational methods which are used by traders as they navigate the stormy sea of crypto.

Where do you think the bitcoin market is heading? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, fair use.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Despite Market Turbulence, Bitcoin’s Support Lines Remain Intact appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube