You can count on it. Whenever a major financial market struggles for survival in a deep, enduring bear market, undertakers with access to the financial press gleefully pronounce its imminent demise. For Bitcoin, such dire pronouncements have been arriving at a steady pace since summer 2018. Simultaneously, plenty of big names in the financial world envision Bitcoin as an unstoppable, universal digital currency that will benefit every person on Earth. So, who’s right? Is anyone right about any of this? Is the Bitcoin future one of widespread acceptance? Or is it one forever relegated to the shadows of the worldwide financial system?

Perhaps the truth lies somewhere in-between these two extremes.

Why Such Bitcoin Pundit Polarization?

Here are recent excerpts demonstrating this black or white, but definitely not gray mindset:

“Crypto is the mother or father of all scams and bubbles.”

– Nouriel Roubini, October 11, 2018

“(Bitcoin) is the greatest store of value ever created.”

– Lou Kerner of CryptoOracle, November 21, 2018, CNBC interview

“I come to bury Bitcoin, not to praise it.”

– Paul Donovan, Chief Economist at UBS, November 2018

“I don’t make significant price predictions. But it’s (Bitcoin) certainly going to be worth a great deal more than it’s worth today. I am long in the market.”

– Jeremy Allaire, CEO, Circle.com, CNBC interview, December 14, 2018

“You should outlaw it (crypto). I am personally surprised that regulators haven’t stepped in harder.”

– Andreas Utermann, CEO, Allianz Global Investors, December 11, 2018

“It (Bitcoin) wasn’t tulips. It was a mania built on something that’s real. Most bubbles are built around things that are real. The Internet bubble felt like mania, and whoa, did the Internet change our world. When I look ahead, I’m pretty constructive.”

– Mike Novogratz, Bloomberg Television interview, December 17, 2018

Without attempting to call anyone out for agenda pushing, might not there be some financial or ideological motivations behind such weighty pontifications?

The Naysayers

Paul Donovan and Andreas Utermann are key figures at a major bank and investment house, respectively. Their firms likely do well in times of central bank financial stimulus (money-printing). That’s because of increased financial speculation and more demand for loans. Central banks don’t like Bitcoin (and cryptos in general) as they fear competition to their centralized means of planning in the world economy and financial markets. Nouriel Roubini is an economist, professor, and former advisor to the World Bank, the IMF, and the Federal Reserve. None of those monetary superpowers are noted for outbursts of Bitcoin praise and adoration.

The Ever-Hopeful

On the other hand, witness Bitcoin’s cheerleaders. Lou Kerner recently said that Bitcoin is the “greatest store of value ever created.” Try feeding that line to the poor HODLR who jumped into Bitcoin at $10,000, $15,000, or even $19,000 in 2017. Not much value left in their portfolios now, is there?

BTCUSD, monthly: Never base your Bitcoin decisions on one-sided, guru or naysayer predictions. Base your Bitcoin trading decisions on proven technical criteria, after evaluating all fundamentals. Image: Motivewave.com

How about Mike Novogratz and his recent statement, “It wasn’t tulips.” Bitcoin’s price chart might have a pronounced disagreement with Mr. Novogratz. Its technical chart eerily resembles the famous tulip bubble chart of the 1600s, despite his claim to the contrary.

Jeremy Allaire, CEO of Circle seems very confident that Bitcoin will be worth “a great deal more” than it is today.

A More Realistic Assessment?

Somewhere in Bitcoin’s dull, boring, gray area may reside the best depository for Bitcoin truth. Some of these truths are potentially disturbing. Others are hopeful, while still others suggest a very bright future for Bitcoin.

In early 2018, writer and professor Paul De Grauwe painted a stark picture of Bitcoin’s inability to function as a universal currency. He cited Bitcoin’s supply limitations as a major stumbling block. For example, in the financial crisis of 2008, central banks added vast amounts of liquidity (currency units) to shore up the banking and economic system. He says Bitcoin, with a fixed supply, would prove useless as a financial crisis panacea.

In his own words,

More generally, the problem of a Bitcoin economy is that in times of financial crisis, which one can be sure will arise again, there is a generalized flight into liquidity. That’s when a central bank is needed to provide all the liquidity needed. In its absence, individuals scrambling for liquidity sell assets, leading to asset deflation and insolvency of many. A Bitcoin economy does not have this flexibility and therefore will not withstand financial crises. A Bitcoin economy will not last in a capitalistic system, which regularly generates financial crises.

De Grauwe also claims that Bitcoin’s fixed supply would create massive global deflation, rather than the inflation normally seen in times of economic expansion. Finally, he points out the huge demand for electricity needed to support Bitcoin mining operations as wasteful. Most currency today is digital (cash is a small percentage of worldwide transactions) and needs less in the way of natural resources to produce and maintain than either paper money or Bitcoin mining. Therefore, De Grauwe views Bitcoin as a redundant, inefficient, and impractical means of replacing the current, digital incarnation of government-sponsored fiat currency.

More Optimistic Views

Bitcoin continues to obtain favor from merchants willing to accept the coin as payment. Transactions for consumer goods in Bitcoin are lackluster compared to early 2018 but are still significant. Payment processors like Square and Circle (can Triangle be far off?) have fully embraced cryptos as a payment mechanism and may one day become a meaningful percentage of their business.

You know that big money has a big say in what occurs in politics, business, and even in your own life. So consider the fact there are plans for two new Bitcoin futures contracts in 2019. One will trade on the NASDAQ exchange, the other on ICE’s Bakkt exchange. The SEC is still toying with the approval of a Bitcoin ETF. Perma-bulls Tom Lee, John McAfee, and other Bitcoin biggies continue to offer rational (usually) reasons for Bitcoin to go on to new all-time highs.

Can you imagine the jolt that a newly-approved Bitcoin ETF might bless Bitcoin’s price with? Imagine several billion dollars flowing into that ETF in a space of only thirty days. Do you think that 2019’s Bitcoin futures contracts are a random idea? Or are they the carefully thought-out brainchildren of big-money interests seeking to make a ton of cash from Bitcoin speculators?

Bitcoin as Official Currency vs. Pure Speculation

So, let’s say that Bitcoin’s future as sovereign currency may be doubtful. At least for now. Okay, but so what?

Bitcoin still looks to have a great future as a trading and investment vehicle. Big money will not be denied their perceived due, and if the spigots truly open and institutional cash races into Bitcoin, Bitcoin futures, and the Bitcoin ETF, a new generation may embrace the crypto markets the same way the Baby Boomers once embraced the US stock market.

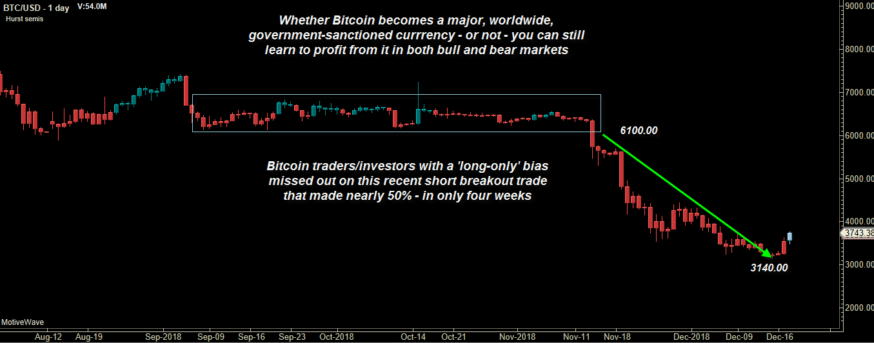

BTCUSD, daily: By maintaining an open mind, you can still profit from Bitcoin’s bull and bear market price action. Image: Motivewave.com

Think of the US stock market. For a century, mutual funds, brokers, and even the government all promoted the idea of investing in America, or of owning shares in a corporation, etc. Then in the late 90s, the era of day trading arrived. That’s when traders realized that owning shares in a company forever wasn’t as attractive as flipping stocks for five- or ten-percent weekly gains. Ownership? Who cared? Dividends? Who needs ‘em? Bull or bear market? No difference at all for a trader.

Does Bitcoin Have a Future?

Don’t get so caught up in the idealism that drives some folks to invest in Bitcoin for the long haul. Sure, put some to work for your retirement goals, but also realize that Bitcoin trading and investing is like putting money on the line in a big casino. You get to make your own odds. You have the opportunity to employ swing trading, trend-following, and dollar-cost-averaging strategies. Like a pro, you can even short Bitcoin when necessary, hedging your long-term holdings. Best of all, you can learn how to profit, regardless of whatever Bitcoin’s future is. Learn the essentials of position sizing, risk control, and money management. Find a good Bitcoin trading mentor and learn all you can from them.

Learn to think and invest for yourself and never trust anyone else’s view of Bitcoin’s future more than your own good opinion. Then, you can enjoy a potentially prosperous future, regardless of what Bitcoin’s ultimate destiny may be.

The post Does Bitcoin Have a Future? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube