While the cryptocurrency landscape has witnessed some short-term reprieve over the course of the past several days and many have enjoyed a nice bounce higher from lower depths, there are some that have yet to partake in the festivities and continue to lag.

In particular, we have been scouting the entire cryptocurrency universe in search of actionable technical set-up’s that may be displaying both favorable as well as perhaps vulnerable characteristics from a technical perspective and after scanning numerous (hundreds) names, there are two (2) that have caught our eye and that we believe require your close attention, at least from a short-term time-frame.

While we harbor no biases when conducting our scans and or analysis, it is our job as Technicians to merely seek out the very best potential risk/reward opportunities from a probability standpoint and to monitor the action of such for potential action, whether that be entry on the buy-side or perhaps closing-out and existing position and preserving capital. In essence, always engaging in risk management assessment.

With that said, after combing through our scans, both EOS (EOS), as well as Digibyte (DGB), have caught our eye and feel as though both investors/traders would be wise in the close monitoring of the action in the days ahead.

Let’s take a look at the charts of both to see what may be in store moving forward.

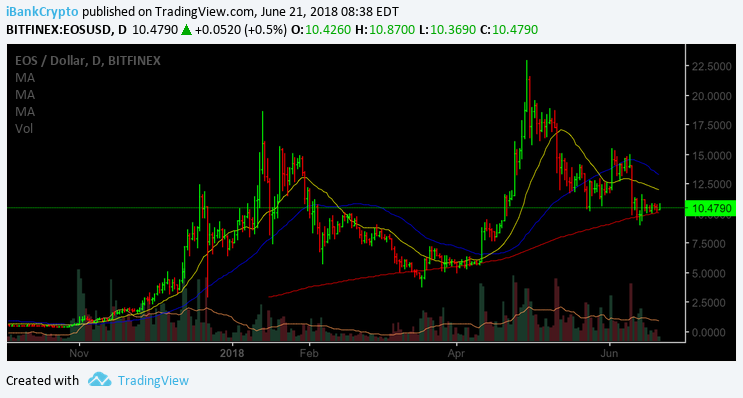

As we can observe from the daily chart above, EOS presently trades below both its 20 (yellow line) and 50 (blue line) day moving averages, while resting on its 200DMA (red line).

In addition, EOS appears to be building-out a potential bear Flag formation that both investors/traders may want to continue to monitor in the days ahead for resolution.

Nevertheless, EOS, while certainly not broken from a technical perspective, surely finds itself in a potentially vulnerable position should the pattern materialize to the down-side.

Thus, if at any time in the days ahead EOS were to violate the 9.00 level, such development, should it materialize, would most likely signal and perhaps trigger a move to its next potential support area located at the 7.80 figure.

If however, EOS is capable of bouncing off its 200DMA and perhaps more importantly, capable of clearing the 11.65 level, such action would be a positive development.

Therefore, both investors, as well as traders, may want to focus their attention on the action should either the 9.00 or 11.65 levels come into play in the days ahead.

When viewing the action of DGB above, we can see that Digibyte is trading below all of its important moving averages 20/50 as well as its 200DMA’s, respectively.

Additionally, much like EOS, DGB also appears to be building-out a potential bear Flag formation and requires close attention with respect to its development in the days ahead.

Therefore, both investors/traders may want to pay particular attention to the following levels for further evidence/clues with respect to direction in the days forthcoming.

If, at any time in the days ahead DGB can clear the .03 hurdle and sustain, such development, should it materialize, would be a positive. On the flip-side of the coin, should DGB violate the .023 figure, lower prices are likely in the offing.

Nonetheless, both EOS as well as DGB find themselves in a potentially vulnerable technical posture at present and require close attention moving forward.

Happy Trading!!

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

Charts courtesy of tradingview.com

The post EOS (EOS) Digibyte (DGB) Technical Analysis – EOS And Digibyte Require Close Attention appeared first on Global Coin Report.

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube