Earlier this year we covered two exciting new entrants into the field of cryptocurrency-backed loans. Ethlend and SALT were launched at roughly the same time towards the end of 2017. And now that some of the dust has settled from their respective ICOs, proper development is underway.

After almost a year of operation, we decided to revisit these platforms and see how they stand up to each other in this evolving market: Ethlend vs SALT.

All areas of traditional finance are making their way into crypto. But crypto loans offer a particularly interesting opportunity for investors who want to maintain their assets on the blockchain. Let’s get started with a few definitions to keep you in the game:

Collateral (n): An asset promised when a loan is taken out; the asset is forfeited if the borrower cannot repay the loan.

Loan-to-value ratio (n): A financial term used by lenders to determine the riskiness of a loan. The loan amount divided by the collateral amount gives you the percentage ratio.

What is Ethlend?

Ethlend is a decentralized cryptocurrency loan platform. The real beauty of Ethlend lies in its peer-to-peer lending network. While this means it won’t be compliant with most country, state and provincial laws, it does, however, create a far more accessible system to people around the world. And this is really at the heart of the cryptocurrency revolution.

Since Ethlend works exclusively through Ethereum smart contracts, no money is ever held by Ethlend. Furthermore, this means that borrowers and lenders can only use Eth and Eth-based assets such as OmiseGo and Augur when committing to a contract.

This is perhaps the biggest drawback of a cryptocurrency-only ecosystem. Most of us still transact in daily life with paper currency and will most likely want a loan in USD, Euro or some other local currency. Of course, we need to remember that there’s always some element of centralization when introducing a fiat gateway into the equation. So this is either a good or a bad thing depending on your point of view.

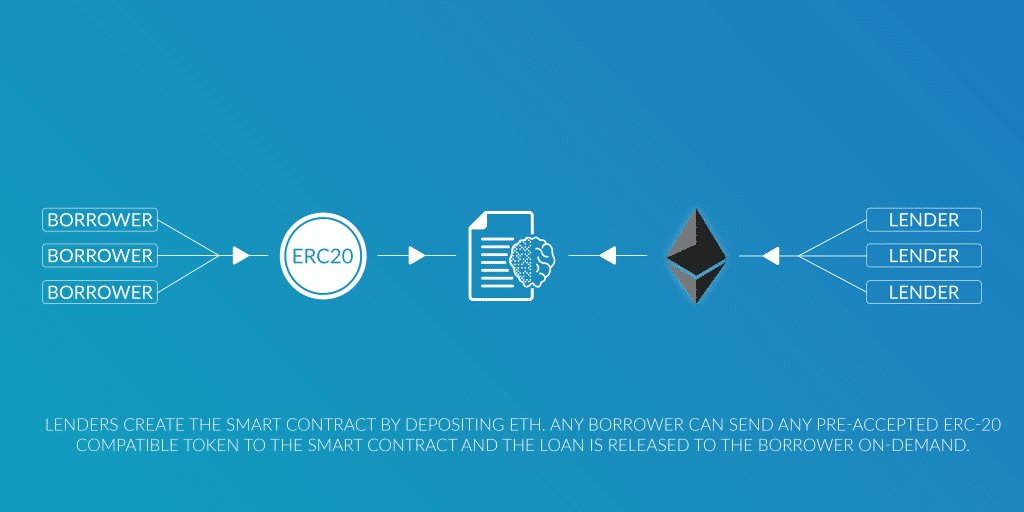

The loan process is fairly straightforward. Two parties will initiate a smart contract and agree to terms for rates, collateral and so on. Borrowers will then typically post their Ethereum-based tokens and lenders their Ethereum. Once everything is confirmed the Ethlend network will transfer the Ethereum to the borrower who will be required to pay back the Lender in Ethereum (with interest) on a regular basis.

The basic process for borrowers and lenders on the platform is as follows:

The Ethlend process

For a deeper look at Ethlend check out our in-depth Ethlend guide.

What is Salt Lending?

SALT is a centralized cryptocurrency loan platform. The major drawcard for SALT borrowers is the ability to borrow cold, hard cash against their crypto assets. This is a lot more practical for the man on the street.

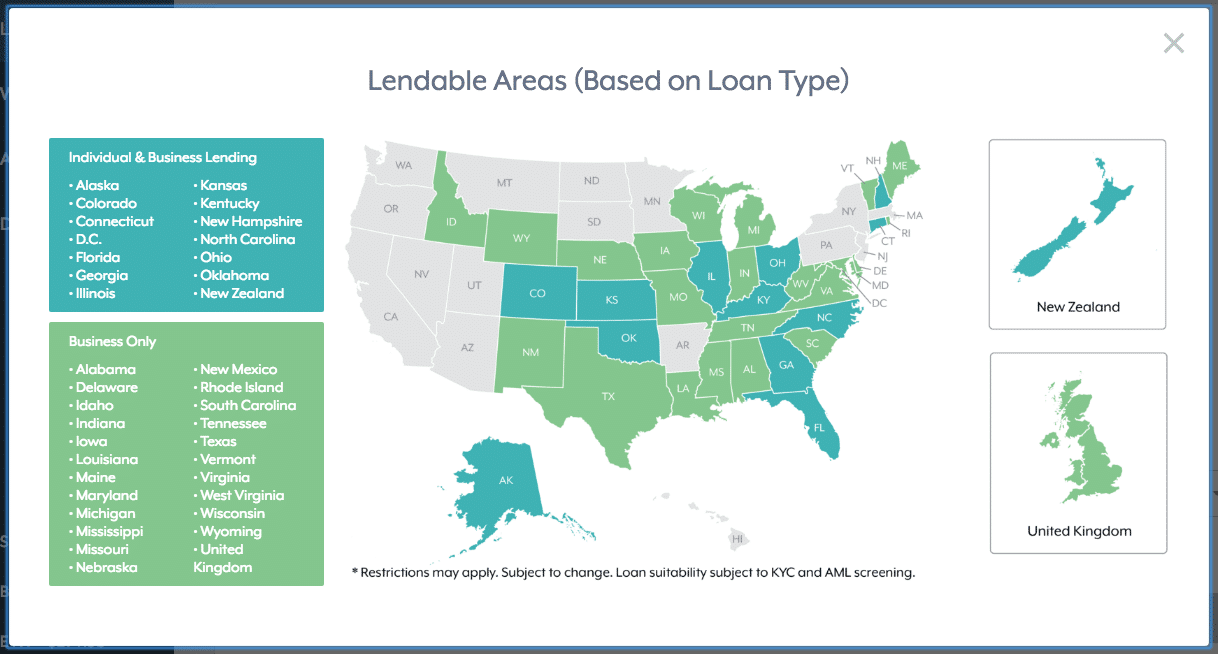

The network does, however, have some stricter requirements if you plan to go this route. For starters, only customers in certain US states, the UK and New Zealand are supported:

The limited loan areas available via the Salt platform

While this does create some safeguards for users, clearly the lack of available locations will cause users around the world to look for alternative solutions.

Secondly, you can only become a lender if you are an accredited investor. In the US this means you’ll need to prove a net worth of at least $1 million. Finally, SALT will require KYC/AML (Know your customer/Anti-money laundering) verification before you can create contracts on their network.

The SALT loan process differs only to Ethlend’s by way of crypto vs fiat collateral instead of pure cryptocurrency. Once the loan terms are agreed upon and approved, the lender will deposit for eg. USD in the borrower’s bank account while a smart contract locks up the borrowers crypto. The borrower will be required to make USD payments on a regular basis and in the event of a default, his/her assets will be transferred to the lender.

At this stage, only Ethereum or Bitcoin are supported as collateral. For a breakdown of SALT check out our in-depth SALT guide.

The Benefits

Leveraging Your Crypto Assets

Perhaps the biggest benefit of using your crypto as collateral is the long-term price appreciation against fiat currency. Another worldwide financial crisis is potentially looming and holding onto solid crypto assets like Bitcoin and Ethereum makes a lot of sense in the case of such an event.

Sometimes you need cash at short notice, it’s inevitable – a car breaks down, there’s a medical emergency, or a friend needs your help. Now, you don’t necessarily need to sell your crypto to get cash in hand. Of course, this only applies to SALT for now but in the future, if crypto is used for daily expenses, well then expect Ethlend to gain in popularity.

Tax Deferral

Crypto-related tax is a rather sticky issue in many countries. Investors still don’t have clarity in many cases and regulators are still coming to grips with how to deal with this unexpected new asset class. In addition, they tend to take their sweet time standardizing things for the general public.

Virtual asset loans allow you to defer your capital gains tax until you actually have to sell your crypto on a fiat exchange. Of course, you are paying interest on your loan so going this route without genuinely needing a loan doesn’t really make sense on its own.

Some Potential Risks

Exchange Rate Risk

Every crypto loan requires two different assets for the smart contract to be valid. It stands to reason then during the period of the loan there is a very big possibility of exchange rate risk.

Let’s illustrate with an example: A user needs to borrow $500 for an emergency. He has 2 Eth which can be used as collateral (currently trading at ($275 per Eth). The loan-to-value ratio = $500 / $550 ($275 per Eth) = 90.9%.

If the value of Ether drops dramatically after the contract is in place and consequently the ratio moves above the 90% level, you will be called upon to make a collateral maintenance call. In other words, you’ll need to provide more blockchain assets or pay off more of the loan to bring this level back down.

You can already see the kind of pressure this would put on both the borrower and in particular the lender. The lender has to wait for the SALT team to step in and deal with the borrower before she can take possession of the collateral. If she would like her fiat currency back, well, she would have to wait to receive her crypto, then move it to an exchange, sell it and finally transfer it to her bank account. By this time the asset could be worth a lot less than the amount she loaned in the first place.

Poor Usability & Process

Both projects suffer from poor explanations surrounding the use of their service. The loan industry has always been bloated with technical terms and unclear processes. Ethlend vs Salt is no different here. Both websites appear to launch you into the borrowing process without clearly laying out how cryptocurrency loans work, ie how they work for the common man! Not the loan expert. Both projects desperately need to employ some usability design.

Security & Censorship

At this stage, Ethlend only supports Metamask for the transfer of blockchain assets. MetaMask is currently not the safest method for transferring your cryptocurrency. Several users have been hacked or phished in the past and until an excellent level of browser-based security for Ethereum wallets becomes available, it remains a security issue. The community would prefer to see a decentralized hardware wallet solution used in projects like AirSwap.

In addition, Google recently pulled MetaMask from the Chrome store without explanation. This hasn’t really been much of an issue since the launch of MetaMask. However, if Google has the power to completely remove the addon whenever they want, where does that leave the borrower and lender when they need to transfer assets?

Arbitration

In theory, decentralization can solve many of the issues found in the loan industry. However, in the case of a dispute, some kind of central authority or arbitrator will still need to resolve a problem between two parties. Who will that be? SALT or Ethlend employees? Independent arbitrators? These issues will rear their ugly heads at some point. And both projects will need to address them in a fair and transparent way for the system to work.

Final Thoughts: Ethlend vs Salt

SALT has a more centralized feel to the project. That does not, however, make it inferior. In fact, it is a far more polished network than Ethlend and with a top-quality team and advisors to boot, it also has the greater pedigree. The interface is slick and has a real air of professionalism. But the centralized management and lack of locations around the world where cash loans are available will cause cryptocurrency borrowers to look for other solutions.

Ethlend, on the other hand, will appeal to users worldwide because it is far more decentralized. Aspiring entrepreneurs who have traditionally been excluded from an elite banking system may for the first time have access to capital. It wouldn’t be a surprise to hear of people building new virtual businesses with only a few Ethereum and a dream. Of course, the project is a lot less professional and presents a greater security risk to users. The lack of fiat backed loans is also a major disadvantage.

Now, you may have landed here in hopes of finding the exact solution to your question, “which is the better crypto lending platform?” Unfortunately, the answer isn’t really that simple. After careful consideration, it appears that there really isn’t a definitive choice. Ethlend vs Salt is a stereotypical apples to oranges comparison – it’s all a matter of preference.

The post Ethlend vs Salt: Which is the Better Crypto Lending Platform appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube