eToro is often referred to as the “Robinhood of Europe,” drawing comparisons to the U.S. Fin-tech unicorn for its user-friend trading experience. For U.S-based eToro users, the platform offers 15 cryptocurrencies for trade, such as Bitcoin and Ethereum. For international eToro users, the offerings expand to stocks and forex.

A few unique features give eToro separate eToro from the cryptocurrency exchange pack: social trading, CopyPortfolio, and CopyTrader– the latter feature allows you to simply “copy” the live portfolio of top cryptocurrency traders on the platform for free. Whereas traditional fund managers are formally accredited and can invest your money for a fee, eToro’s copyable traders are ordinary people that simply have had success or experience trading cryptocurrency.

While the hands-off cryptocurrency investing approach can be fairly attractive, we urge our reader to be very cautious when investing anything. Cryptocurrency is a very risky asset class, and just because your trades are on autopilot doesn’t mean you can’t get rocked all the same (set your stop losses!)

The following eToro review will teach you everything you need to know about the trading platform:

- eToro’s company history

- How to make an account on eToro

- eToro wallets and accounts

- What are eToro fees

- How does trading work on eToro

- What is the eToro Copytrader feature?

- How to make money on eToro

Key points:

✅ eToro is a user-friendly social trading platform that offers United States traders the ability to trade a variety of cryptocurrency, and European traders to trade a wider variety of financial instruments like stocks, crypto, commodities, currencies, and more.

✅eToro is a very beginner-friendly exchange that allows for a direct fiat to cryptocurrency exchange– new users can get started trading cryptocurrency on eToro for as little as $50.

✅ Features like CopyTrader and CopyPortfolio are a pretty hands-off, albeit risky, approach to cryptocurrency trading.

✅ eToro is heavy on “social” trading and encourages users to discuss short-term and long-term cryptocurrency trades.

❌Trading fees are relatively higher than the industry standard for most other exchanges. We call this the “UI Tax”

❌Users can’t actually access their assets, they can only trade them for fiat. Although eToro is a great trading platform, we’re not too big a fan of the lack of custodial ownership over your cryptocurrency.

eToro’s Company Information

A quick walk down the history lane of the rising fin-tech star leads us through a user-first approach to design and a pivot to embrace the growing cryptocurrency market.

When was eToro founded? Founded in 2007 by entrepreneurs David Ring, Ronen Assia, and Yoni Assia in Israel, eToro has since grown to over 500 employees, operations in 140 countries, and over 13 million users internationally.

How much has eToro raised? eToro is fairly well-capitalized and has raised a total of $222.7M in funding in over 10 rounds, with the latest Series E round coming in April 2018.

Which companies has eToro acquired: eToro has acquired two organizations–Belgium-based cryptocurrency portfolio tracker app Delta in September 2019, and Danish smart contract infrastructure provider Firmo in March 2019.

The holding company eToro (UK) Ltd. is based in London, and eToro has additional registered offices in Cyprus, Tel Aviv, New Jersey, Sydney, and Shanghai.

eToro started with a primary focus on trading fiat currencies and commodities, introducing stocks in July 2013 and a broader array of cryptocurrencies in 2017. eToro offered Bitcoin trading in 2013 with CFDs and was one of the few FinTech platforms of the time providing access to the then-nascent Bitcoin.

In February 2017, eToro expanded its cryptocurrency offerings to Ethereum, XRP, Litecoin, and a handful of other cryptocurrencies. With the ensuing mid-2017 cryptocurrency market boom, eToro doubled down on its international customer acquisition to cement itself as a premier exchange in the cryptocurrency community.

eToro launched its eToro U.S. operations in March 2019, starting with a handful of cryptocurrencies available for trading and eventually growing to over 15.

The platform is unique in the cryptocurrency industry because of features like CopyTrader and social trading, allowing traders to share live trading information, copy the portfolios of the best-performing traders, and approach cryptocurrency investing from a relatively “hands-off” approach* we’ll get into it below..

*Let’s reiterate this important caveat:: don’t invest anything you cannot afford to lose, no platform can offer truly 100% guaranteed gains, all investing (particularly cryptocurrency investing) tend to come with a high degree of risk.*

Key Feature #1: What is the eToro Copytrader feature?

In 2010, eToro leaned into the title of being the world’s first social trading platform with the launch of OpenBook, a feature that allowed anyone in the world to copy successful traders using CopyTrader. OpenBook was regarded as a fairly revolutionary concept in FinTech at the time, winning the Finovate Europe Best of Show for 2011.

You may have been hit with a targeted eToro ad with Alec Baldwin before– here it is again for good measure; it’s actually a decent explainer of what the CopyTrader feature does.

CopyTrader, in our humble opinion, stands as one of the best features in FinTech.

Why? Being able to see how and what top traders are trading is something that some companies try to charge thousands of dollars for, or a percentage of assets under management. eToro takes it a step further by making it possible to “copy” their portfolios with one click. If this idea tickles your fancy, make an eToro account and take a look at the traders– you’ll have to access a particular version of the site depending on your location for regulatory reasons: eToro U.S. and eToro International.

The minimum amount to copy a trader is $200, and the max is $500,000. You can copy up to a limit of 100 traders at the same time.

Here’s our run-through of CopyTrader

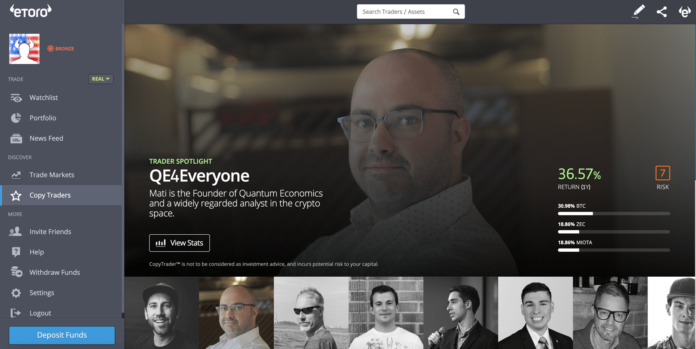

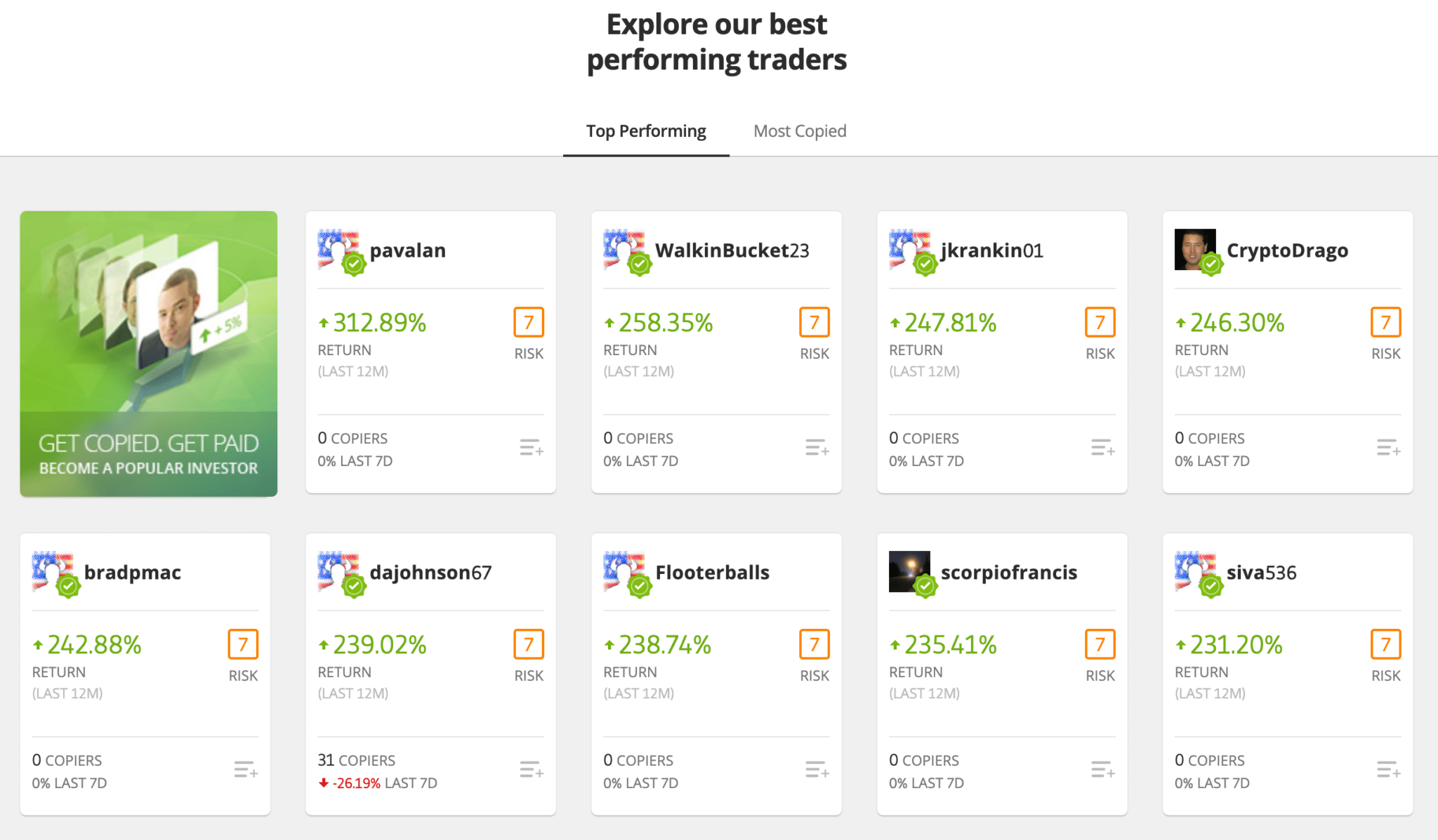

Below, there are two sections: “Top Performing” and “Most Copied”

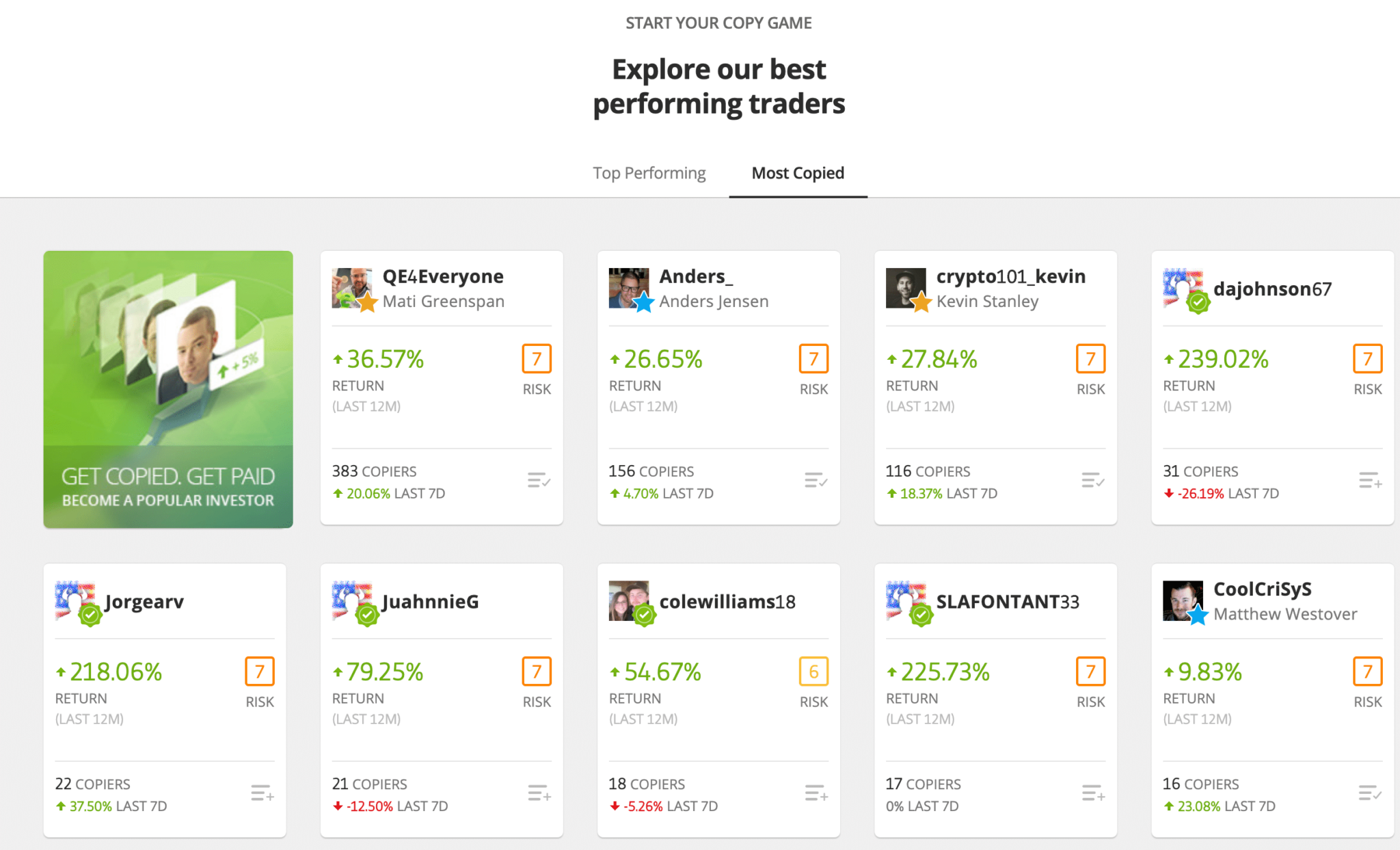

On the Most Copied section, we see the platform’s most popular traders, seemingly sorted in some sort of weighted popularity average rather than percentage gain.

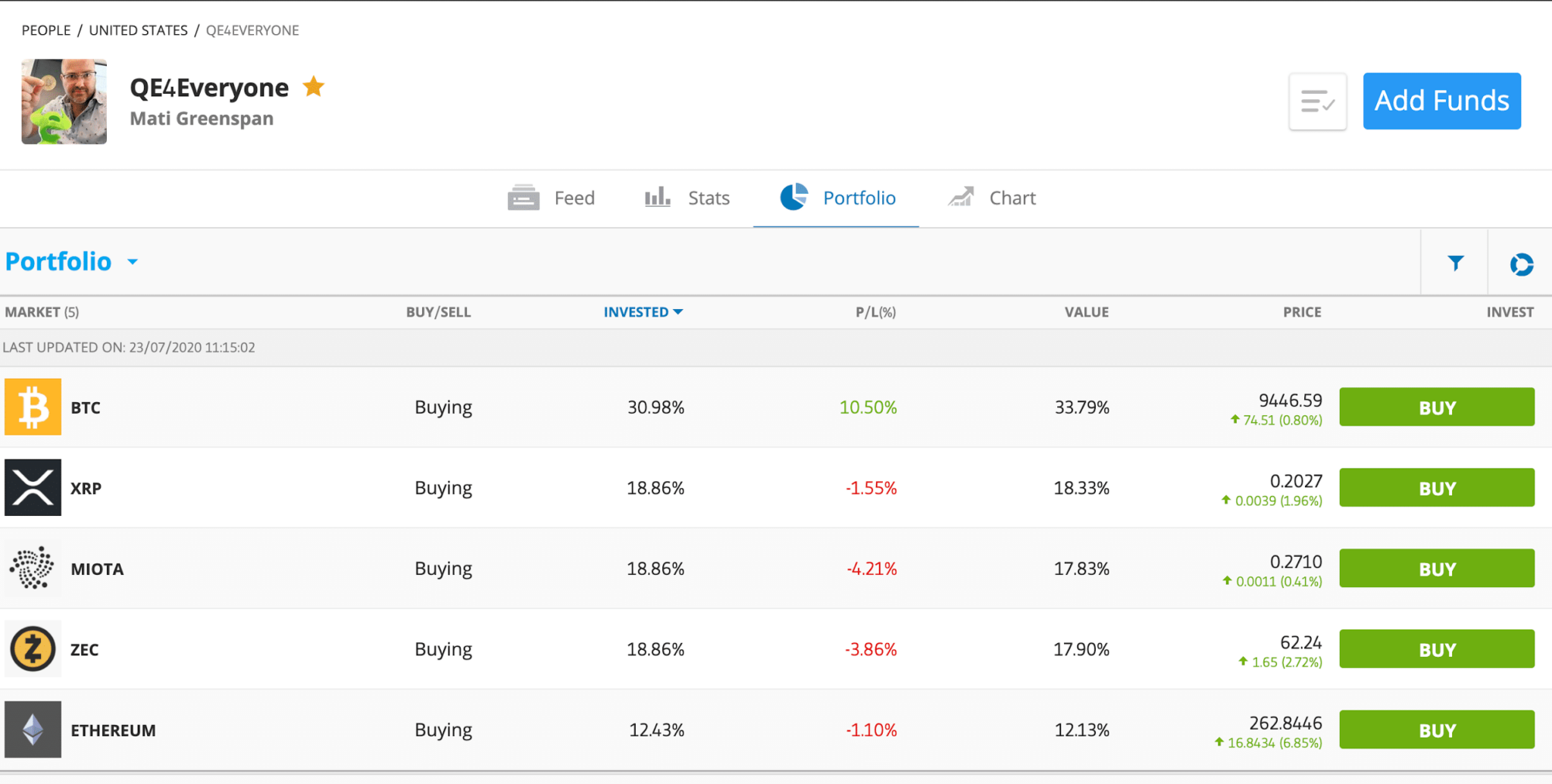

Let’s check out what makes this QE4Everyone (Mati Greenspan) trader so popular.

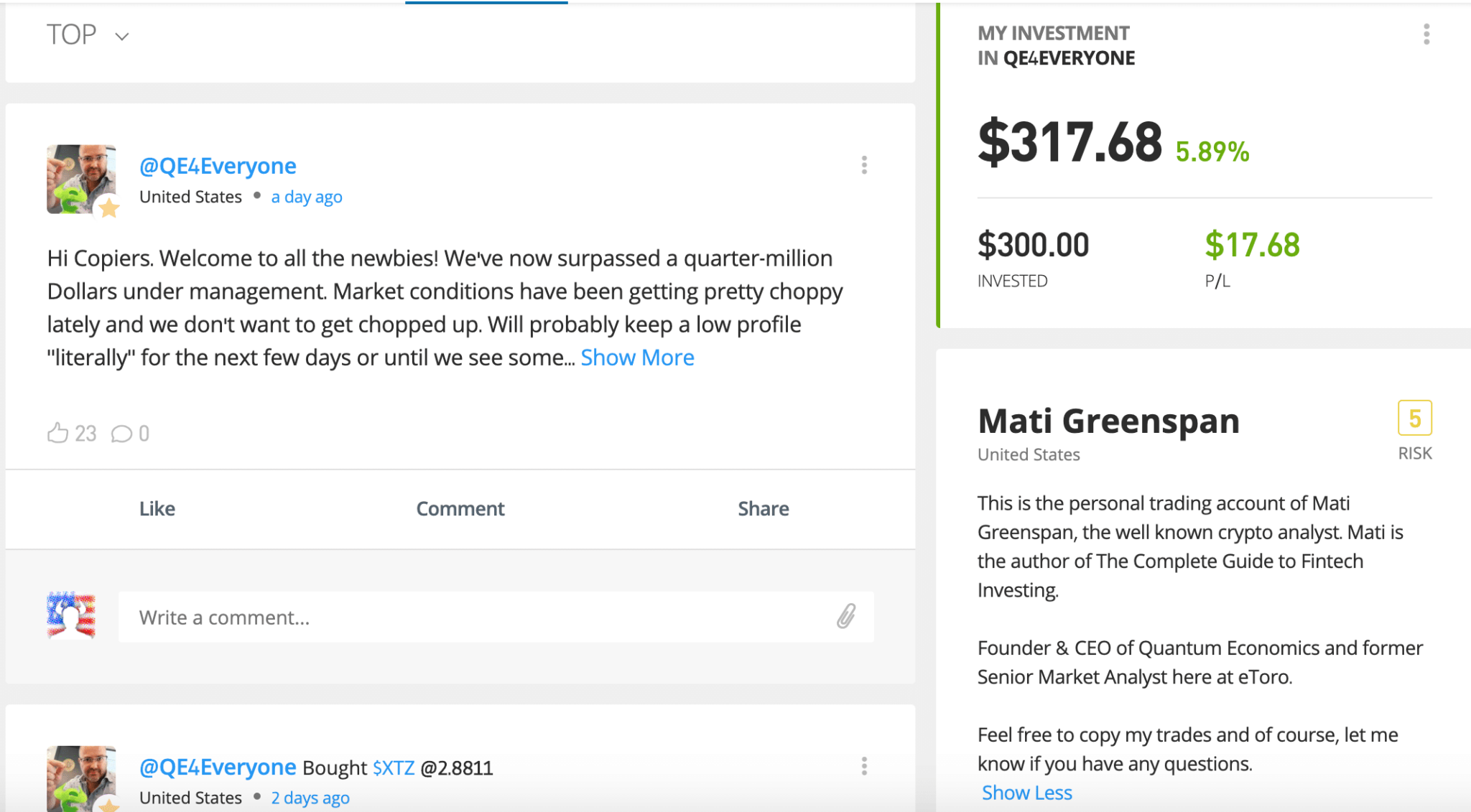

After clicking on Greenspan’s profile, we see his social posts directed towards the eToro trading community, our current investment (we deposited $300 to test this feature) in his copy portfolio and it’s overall performance– thanks for the $17 bucks, Mr. Greenspan. We also see Greenspan’s bio– a published author, Founder & CEO of a company called Quantum Economics, and a former Senior Market Analyst at eToro.

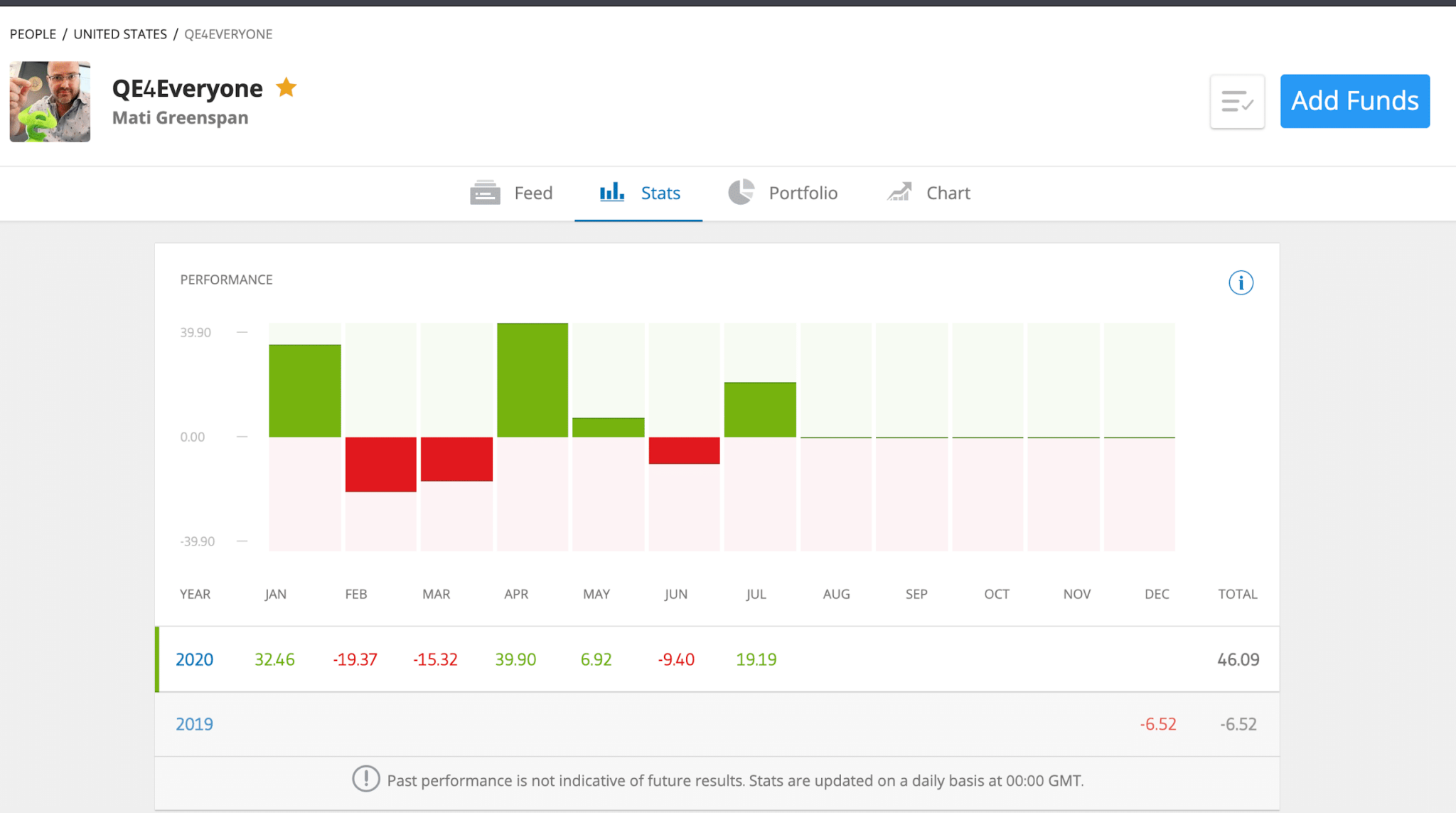

Clicking on his profile stats, we see his cryptocurrency trading performance per month. While the cryptocurrency market itself experienced some volatility these months, Greenspan seems to have handled it pretty well.

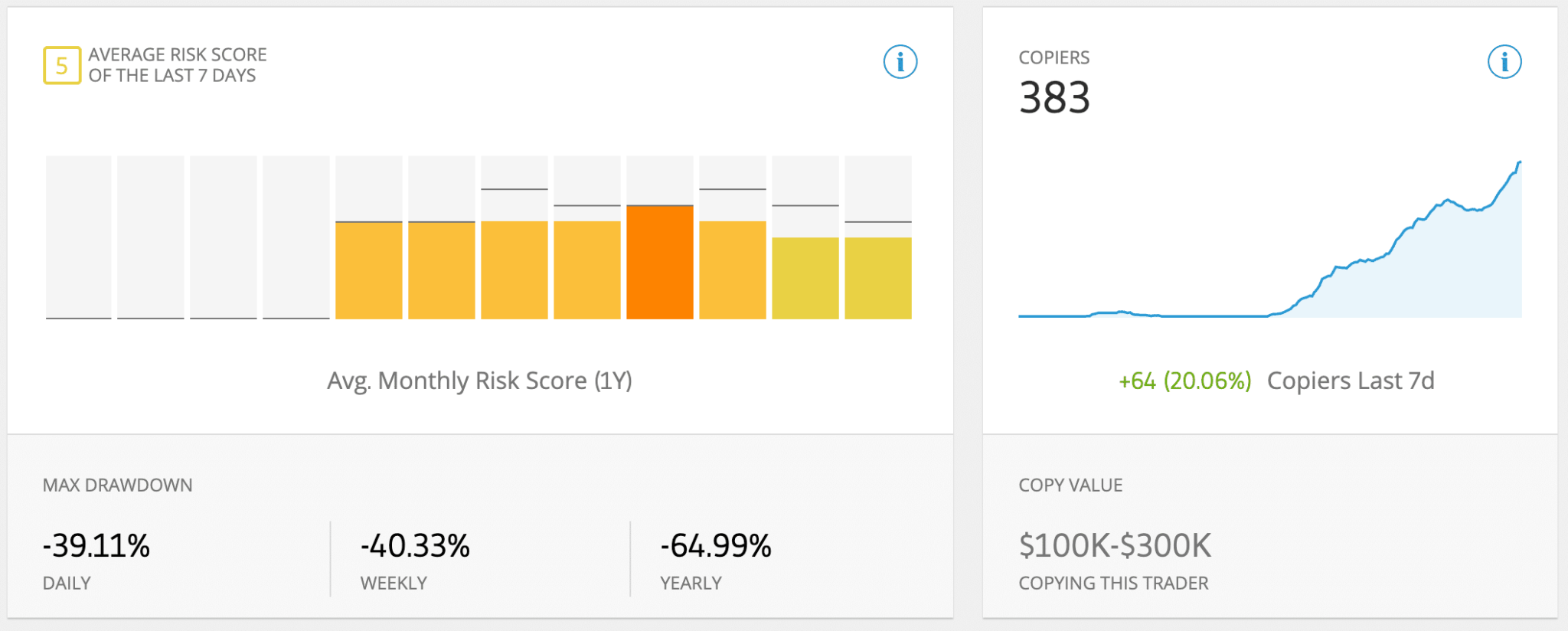

Further, we see how “risky” this trader is with a risk score assigned by eToro, as well as the number of recent trade copiers (of between $100k to $300k in copy value.)

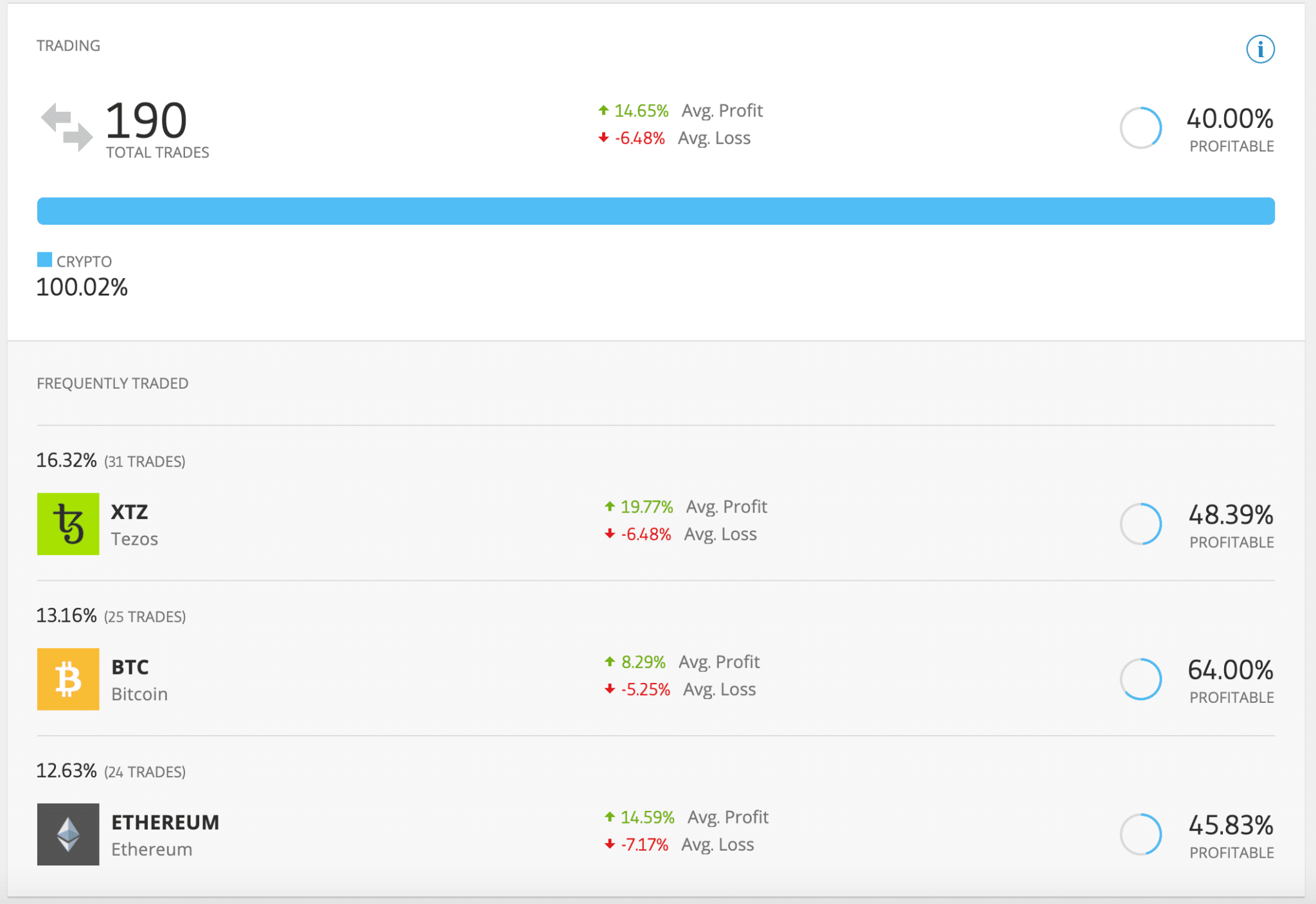

We can get a bit more detail into Greenspan’s trades: we see the total amount of trades in the past year, and his most frequently traded assets.

On the portfolio tab, we see exactly what his trades are at the current moment. From here, we can either buy those same assets manually, or once we add some funds, we can copy Greenspan’s portfolio, and eToro will automatically mirror his trades until you tell it to stop, or until the copy stop loss hits.

While the Top Performing profiles look very appealing, we urge our readers to do the appropriate amount of research on eToro’s platform to understand how they’ve been able to achieve such results.

For example, many of these traders have simply bought one asset months ago that mooned and haven’t launched a trade since. So, by copying their portfolio, you’d basically just be “buying” the asset at its current price.

How to Use eToro’s CopyTrader:

CopyTrader is really simple. Once you’ve made your eToro account (eToro U.S. and eToro International) go to the CopyTrader section, select a trader to copy, and add the funds required.

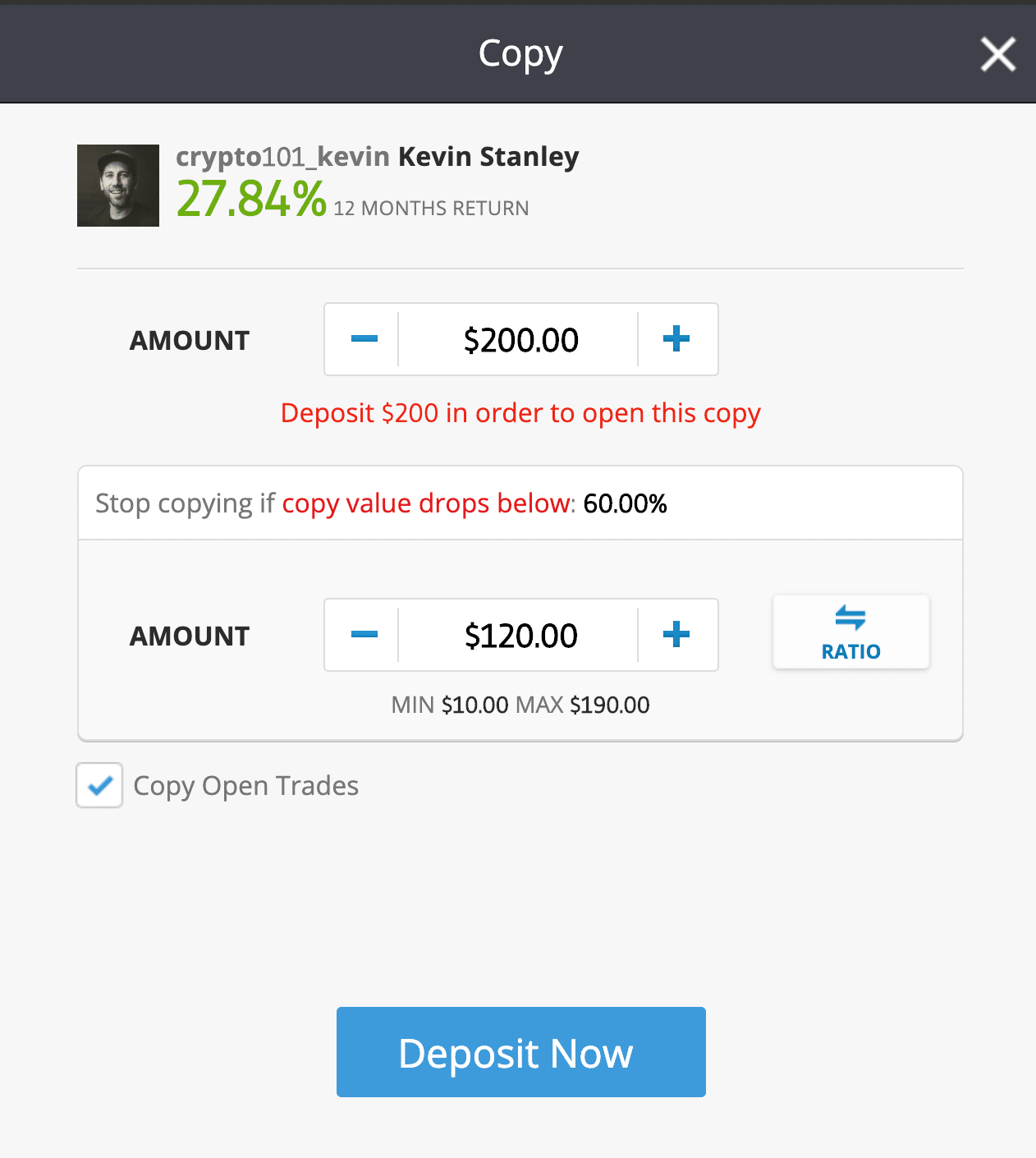

For example, let’s say we want to copy crypto101_kevin (Kevin Stanley). He seems like a nice guy, but more importantly, he has a decent amount of other copiers and a 27% gain for this year so far.

An important risk-management feature here is the ability to immediately stop copying a trader’s profile if the value drops below a certain amount. Let’s assume we’ve decided we can stomach a 60% worst-case-scenario loss on an investment of $200– we would set the amount accordingly and deposit the funds.

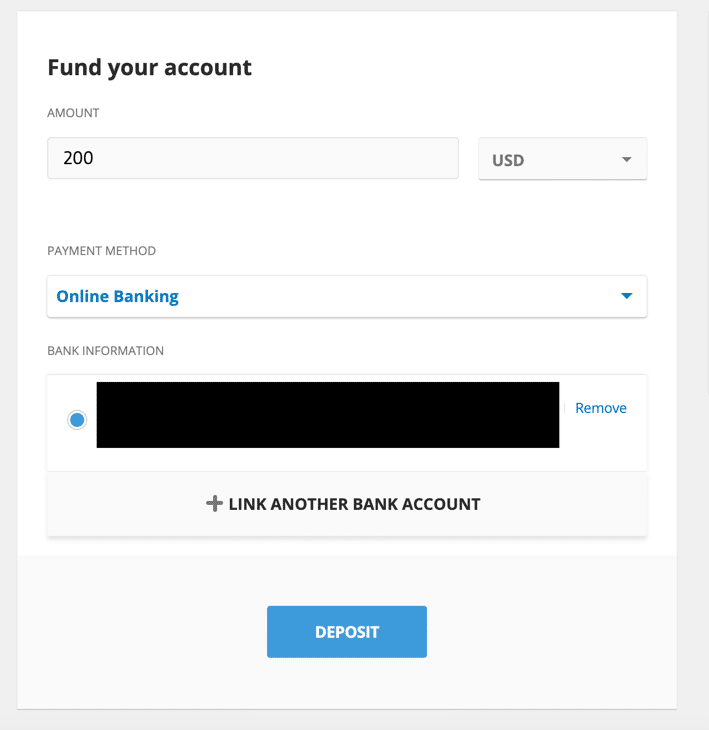

We deposit the USD, and boom– we’re copying a trader.

Key Feature #2: CopyPortfolios

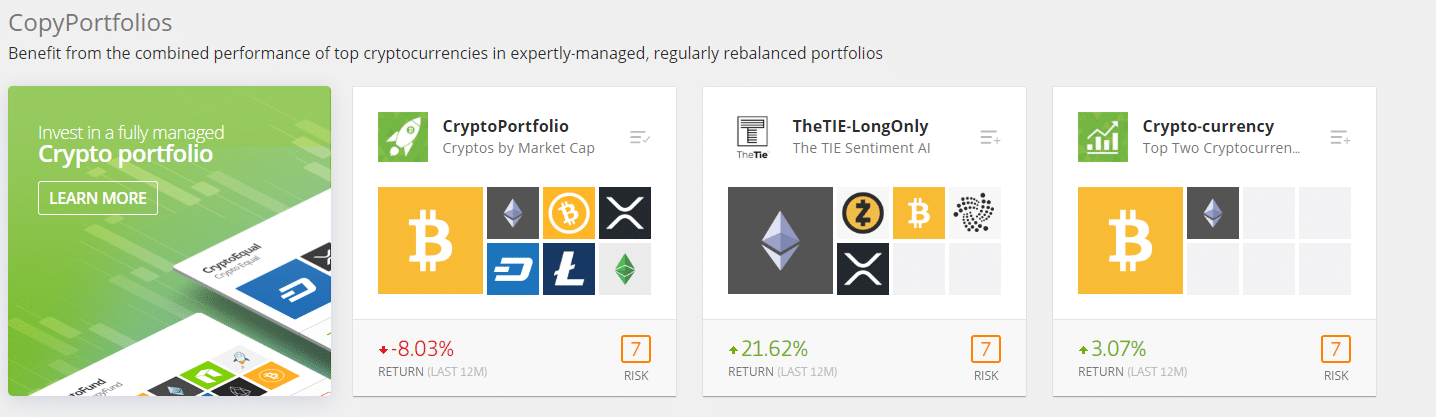

In 2016, eToro furthered its social trading offerings with the release of CopyPortfolios, a long-term thematic investment product of managed portfolios with bundled Top Traders or specific assets using a predetermined market strategy. The majority of eToro’s CopyPortfolios utilize machine learning to seek maximum returns.

There are three CopyPortfolios available in the United States. TheTIE, for example, builds its investment strategy on sentiment analysis, gauging the positive and negative tone of tweets on Twitter.

Key Feature #3: Virtual Portfolio

The eToro virtual portfolio is basically a sandbox, where users receive $100k in fake money to test-drive the platform.

This feature doesn’t seem to be available in the USA just yet.

eToro USA and eToro International

An important distinction to make for our wonderful readers spread all over the world: eToro has two different platforms due to regulatory compliance: one for eToro U.S. and one for eToro International users.

Is eToro available in the US? Yes, but only the cryptocurrency trading aspects. If you’re in the United States, you’ll have access to the same cryptocurrency investment trading platform as everyone else, as well as the CopyTrader and CopyPortfolio features, but you can’t trade stocks or forex (yet).

How to Use eToro in USA – Use the following link to make an eToro USA account.

eToro International: There’s a reason why eToro is often called the “Robinhood of Europe”– but that’s leaving some value on the table: the platform allows international users to trade forex, stocks, and cryptocurrency. If you are outside of the USA, use the following link for eToro international.

How to Sign Up

Ease of Use: A+

Signing up for eToro is a very streamlined experience with the basic “Know Your Customer” (KYC) requirements most exchanges in the US require.

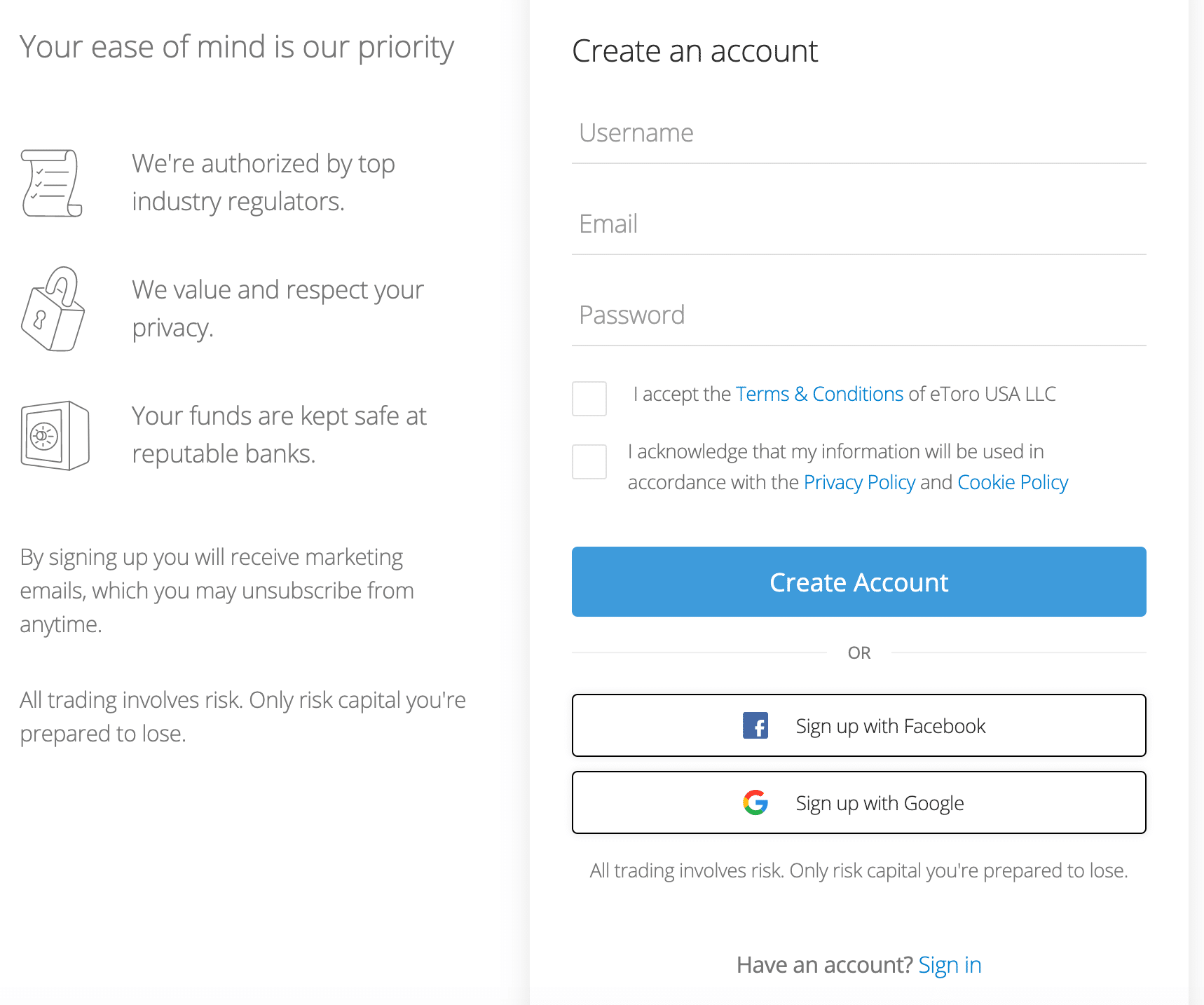

- If you’re in the USA, use the following link to make an eToro USA account. If you are outside of the USA, use the following link for eToro international. You’ll land on a page with Alec Baldwin pointing to his phone

- Hit JOIN NOW and create your account information.

- Before submitting, we recommend taking some time to familiarize yourself with eToro’s Privacy Policy and Terms & Conditions. Once you’ve finished, check the boxes and CREATE ACCOUNT to submit your information.

- Now comes the fun part– KYC! As part of this process, newly registered investors are required to provide Proof of Identity such as a valid passport or driver’s license, and in some cases, Confirmation of Residence (such as a valid utility bill.)

- Further, new eToro users will be requested to fill out a brief questionnaire to help eToro better understand which features are best suited to their investor profile. Questions include things like: investor’s professional status, level of knowledge of the capital markets, financial liquidity, acceptable levels of risk, and investment goals.

- You’re set!

What are eToro’s Fees

eToro’s pricing policies are fairly transparent. They’re higher than the industry standard of cryptocurrency exchanges like Bittrex or Binance, but eToro is technically a different type of platform than just a standalone exchange.

eToro Spread Fees: Spread fees are basically how “no commission” brokers and exchanges like Robinhood and eToro make money– it’s a cost built into the buy and sell price of the cryptocurrency pair you want to trade. The difference of what the asset is on the market (ie. ETH = $200.23) and what it costs to buy it on a certain platform (ie. Buy ETH = $200.45)– the fee would be the additional $0.22 cents.

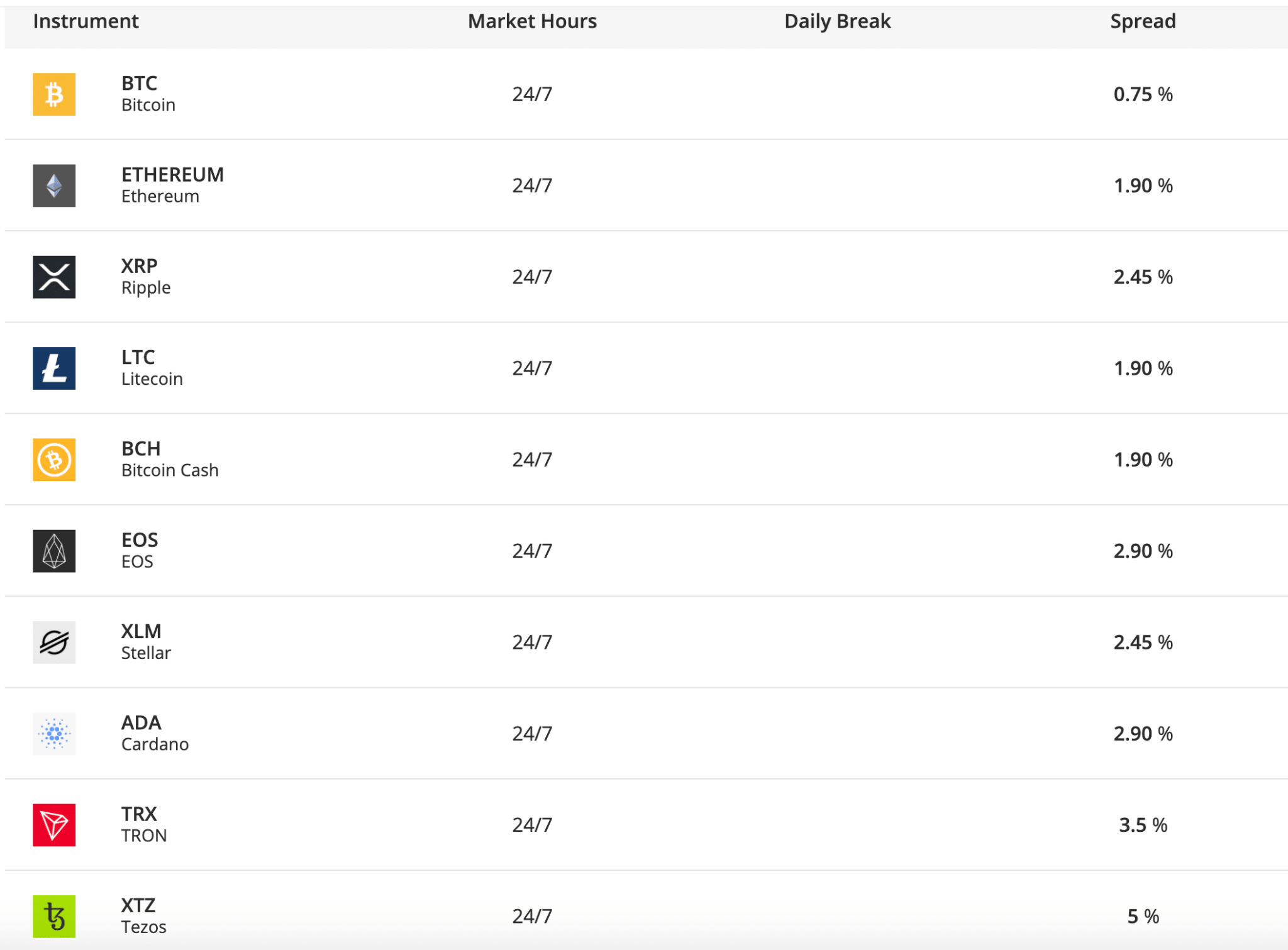

These fees are fairly reasonable for most cryptocurrency assets, currently ranging between .75% for BTC to upwards of 5% for Tezos, the latter of which is really high.

eToro Withdrawal Fees: There are no ($0) withdrawal fees on eToro in the US ($5 withdrawal fee for all other regions), but there is a minimum of withdrawing $30.

eToro Wallet fees: eToro doesn’t charge fees for sending or receiving transactions, although blockchain fees are still applicable. eToro does charge a .1% conversion fee set to eToro market rates.

To learn more about eToro’s fees, visit their fee page.

eToro Fund Security

eToro’s wallets are secured by multisignature and analytic behavior machine learning, which aims to help the platform’s security team identify and prevent potential threats from malicious third parties.

According to eToro, depositing fiar money into your account is safe, private, secure, and for US users, FDIC insured. Cryptocurrency, however, is not covered by FDIC insurance. Transactions are communicated through Secure Socket Layer (SSL), which helps keep personal information safe.

How to Trade on eToro

We’ll preface this section by saying that nothing in the investment world is guaranteed, and placing any cryptocurrency outside of your savings account carries some risk.

That being said, eToro makes cryptocurrency trading and cryptocurrency risk management a relatively passive, but not risk-free, endeavor if you’re using its CopyTrader feature. Pairing the CopyTrader feature with a Copy Value portfolio drop threshold should provide you both a cryptocurrency investment strategy on autopilot (ideally run by an experienced trader) with training wheels in case of a calamity.

Final Thoughts – Is eToro a Good Platform to Use?

Ultimately, eToro is a user-first company with enough venture capital money raised to ensure the platform meets the growing needs of its users. Everything from the open-market cryptocurrency exchange to the CopyTrader features is super intuitive.

We can see this platform being very successful in providing beginner and intermediate users a great user experience.

However, it’s worth pointing out that eToro seems to be primarily designed for trading, and users actually can’t access their cryptocurrency directly. For example, if you bought 1 BTC, you wouldn’t be able to send it to your hardware wallet (you may be able to send it to eToro’s wallet, but that’s another product for another day.) You would have to sell your BTC for USD, and then transfer your USD back to your bank, and then transfer it to an exchange that does allow you to withdraw the digital asset.

That being said, eToro’s CopyTrader and CopyPortfolio make it a pretty awesome product in the arsenal of any cryptocurrency user. The features are free and don’t charge you any fees on your gains, you just have to pay the spread fee as you would on any other exchange.

eToro is geared towards “social trading” where users can learn from each other; as more users join the eToro platform, we predict more experienced traders will be open to having their portfolios copied to build their reputations in the space. If you are an experienced trader looking to join eToro, they have a fairly appealing compensation program for Popular Traders.

If you do decide to use eToro, use one of the following links based on your location: eToro U.S. and eToro International.

The post eToro Review 2020: Is eToro Legit, Safe, and Worth Your Time? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube