On June 25, Japan’s Minister of Finance, senator Fujimaki suggested that the current tax rate for crypto transactions in the country, which goes up to a maximum of 55 percent, could be swapped with a 20 percent flat tax similar to stocks or forex trades.

While Japan is unsure if the current tax framework should lose its progressive scale — mentioning “tax fairness” as one of the arguments in favor of sticking with the old model — some major markets don’t have clear guidelines for how Bitcoin and altcoins are taxed at all. Here’s how cryptocurrencies are currently levied from the U.S. to Switzerland.

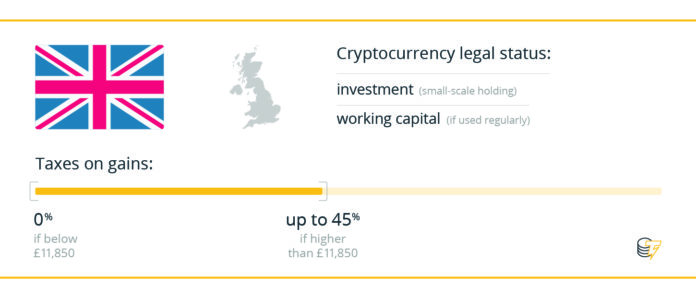

The U.K.

Crypto’s tax status: Investments (small-scale holding); working capital (if used regularly)

Taxes on gains: Free, if below £11,850, then up to 45 percent

Her Majesty’s Revenue and Customs (HMRC), an agency responsible for collecting taxes in the U.K., introduced its guide on the taxation of Bitcoin and other coins in 2014. Thus, income received — and charges related to activities involving crypto — are subject to corporation tax, income tax or capital gains tax, depending on the specifics. As a HMRC representative explained to British media outlet Alphr, “whether any profit or gain is chargeable or any loss is allowable will be looked at on a case-by-case basis.”

Nevertheless, cryptocurrencies normally fall into the capital gains tax category for casual users in the U.K., being considered investments. However, some traders might be liable to income tax, depending on how regularly they trade and the volume of those operations. According to HMRC:

“Where an asset (including Bitcoin) is held as an investment — as opposed to being working capital in a trading activity — the presumption is that any profit or gain on its disposal will be charged to Capital Gains Tax.”

Similarly, crypto-to-crypto transactions are taxable events as well. However, as the HMRC points out, every situation might vary, depending on the circumstances.

Importantly, there’s a tax-free allowance for every U.K. citizen of working age. For the 2018/2019 tax year, for instance, it constitutes £11,850 per person. If the taxpayer exceeds that amount, he or she is liable to pay 20 percent tax on anything earned between £11,851 and £46,350, 40 percent on earnings of £46,351-£150,000 and 45 percent on gains above £150,000.

The U.S.

Crypto’s tax status: Property

Taxes on gains: Calculated based on the coin’s value as of the date it was traded

The Internal Revenue Service (IRS), a U.S. government agency that collects taxes and enforces tax laws, views cryptocurrencies as properties. Therefore, if you sell your coins for a profit you will be liable to pay a capital gains tax.

In 2014, the agency issued general guidance on how cryptos are taxed. According to Notice 2014-21, received or mined cryptocurrencies must be included in computing gross income with fair market value of the virtual currency as of the date it was received. The taxes are calculated based on that value. Hence, gifts, mining and crypto-to-crypto swaps are all taxable events, estimated by the value of the coins on the day those events occured.

Importantly, crypto-brokers are not required to issue 1099 disclosure forms — the ones used by the IRS to report income other than wages, salaries and tips — which makes the process of reporting gains more difficult for crypto users. However, U.S.-based crypto exchange and wallet service Coinbase has reportedly sent the form to some of its customers.

The IRS has shown significant interest in cryptocurrencies as a source of revenue over the past few years. For instance, in February 2018, Coinbase sent an official notice to approximately 13,000 of its customers, informing them that their data is being handed over to the IRS per their request. Moreover, the IRS allegedly uses software for tracking purposes and reminds crypto holders to pay their taxes via memos, highlighting the “inherently pseudo-anonymous aspect” of cryptocurrency transactions.

Japan

Crypto’s tax status: Legal method of payment

Taxes on gains: 15-55 percent, based on the volume

Currently, gains made on virtual money — which are classified as a legal method of payment — in Japan are classified as “miscellaneous income,” according the Japanese National Tax Agency, the country’s chief tax agency.

Essentially, that means that Japanese crypto holders have to pay between 15 and 55 percent on their profits declared on their annual tax filings. The top amount applies to people who earn more than 40 million yen ($365,000) annually.

According to Bloomberg, such regulation prompted some crypto investors to move to countries where no capital gains tax on long-term investments in virtual money is charged, such as Singapore. The media outlet also spoke with Hiroyuki Komiya, who runs a blockchain consulting firm in Tokyo, who said that he managed to decrease his taxable income by “a few million yen” through using an “overall average” rather than a “moving average” to do his estimations. Komiya explained that he’s still uncertain about some nuances in terms of declaring crypto gains, as there are no clear official guidelines on the matter:

“The government hasn’t clarified certain details, so you’re left unsure whether you’ve got it right or not.”

However, the tax laws for crypto users in Japan might change in the future. On June 25, Japan’s Minister of Finance discussed the prospect of changing the progressive tax rate. Senator Fujimaki asked Japan’s Deputy Prime Minister Taro Aso if crypto transactions should be taxed via a “separate settlement taxation,” instead of their present classification. That means that the current taxation framework would be swapped with a 20 percent flat tax similar to stocks or forex trades. Nevertheless, Aso expressed his disbelief that the public would react positively to the change, citing “tax fairness.”

The current tax rate for crypto transactions has a maximum of 55 percent, and changing its category would bring it to the 20 percent flat tax applied to stocks or forex trades.

South Korea

Crypto’s status: Legal method of payment

Taxes on gains: None at the moment

Currently, there’s no tax framework for crypto investors in South Korea, and no information from local government agencies explicitly stating that gains from crypto trading should be reported for tax purposes at this point, although there’s a 24.2 percent tax for cryptocurrency exchanges in the country.

However, in April the Fuji News Network (FNN) reported that South Korea’s Ministry of Strategy and Finance announced that a general taxation framework for cryptocurrencies will be published by the end of June. Thus, according to the FNN, the South Korean government’s crypto tax task force has proposed a “transfer income tax that levies taxes on profits” made from crypto sales. Additionally, “if income from virtual currency transactions is considered temporary and irregular, other income taxes may be imposed.”

While the agency still hasn’t made any official announcements regarding the policy, local news outlet Chosun reported on June 22 that a capital gains tax of 10 percent was going to be introduced in the future. However, this was soon refuted by the Ministry of Strategy and Finance itself.

Russia

Crypto’s status: Not defined

Taxes on gains: 13 percent (personal income tax)

At this point, there’s no definite tax framework for cryptocurrencies in Russia, although various general crypto bills have been introduced this year at the state level.

Nevertheless, on May 17, the Ministry of Finance published a document stating that citizens should estimate and declare capital gains tax on cryptocurrencies “independently” before an official regulatory framework for the crypto market is introduced. Personal income tax in Russia is levied at 13 percent.

South Africa

Crypto’s status: Assets of intangible nature

Taxes on gains: 18 percent (capital gains tax); 18-45 percent (normal income tax)

The South African Revenue Service (SARS) — the country’s tax watchdog — perceives cryptocurrencies as assets of an intangible nature. In early April 2018, the SARS declared it will “continue to apply normal income tax rules to crypto.” Essentially, the agency anticipates South African crypto users to declare their gains or losses as part annual taxable income, including virtual currencies acquired through mining.

In the memo, SARS additionally noted that, while there’s no regulatory framework for cryptocurrencies at the moment and Bitcoin is not legal tender, “there is an existing tax framework that can guide SARS and affected taxpayers on the tax implications of cryptocurrencies, making a separate Interpretation Note unnecessary for now.”

Thus, according to Ettiene Retief, Chairman of the National Tax and SARS Committee at SAIPA, regular crypto gains usually fall into “normal income tax,” while long-term investments are normally slapped with a capital gains tax. The latter constitutes 18 percent in 2018 and 2019, while normal income tax is fluid and depends on the income.

Canada

Crypto’s status: Intangible property

Taxes on gains: 50 percent (capital gains tax); 25 percent (self-employed)

According to the government of Canada, “using digital currency does not exempt consumers from Canadian tax obligations,” which means that cryptocurrencies are subject to the Income Tax Act.

That involves selling cryptocurrencies for a profit, mining and doing crypto-to-crypto transactions — in that case, if, for instance, Bitcoin is used to buy Ethereum, Bitcoin is considered to be sold for its value in Canadian dollars at the time of the transaction.

Taxes for investments, which apply to cryptocurrencies, suggest 50 percent for any such gain in Canada. High-volume traders will have to file their taxes with the Canada Revenue Agency as being self-employed, setting aside around 25 percent of their income.

Brazil

Crypto’s status: Not defined

Taxes on gains: 15 percent (income tax; imposed if more than BRL 35,000 is declared)

In 2014, the Central Bank of Brazil declared that cryptocurrencies are not legal tender and, hence, are not to be regulated legally. Nevertheless, Bitcoin and other coins are subject to tax regulation. Therefore, Receita Federal (the Federal Revenue Service) requires local crypto users to file their gains.

If more than BRL 35,000 is gained through selling, the earned amount must be filed under income tax, and 15 percent of the profit’s value is collected by the state via annual tax returns. In other cases, tax exemption is applicable.

Germany

Crypto’s status: Private money

Taxes on gains: 0 percent (if held for more than a year), 25-28 percent (capital gains tax)

Cryptocurrencies are not legal tender in Germany, but they have been recognized as ‘private money’ by the German Finance Ministry since 2013.

Thus, any profit made through trading, mining or exchanging Bitcoin or altcoins is subject to a capital gains tax, which is 25-28 percent in Germany, including a solidarity surcharge.

However, according the German Income Tax Act, if the assets (cryptos) are held for more than one year, they become tax exempt.

Switzerland

Crypto’s status: Not defined

Taxes on gains: Wealth tax (determined at the end of the year, based on income)

As Selva Ozelli, an international tax attorney, previously wrote in an Expert Take for Cointelegraph, in Switzerland, “cryptocurrencies are neither money nor a foreign currency, nor a financial supply for goods and services tax (GST) purposes”.

Cryptocurrencies are an asset for capital gains tax (CGT) purposes. However, this only applies to citizens who qualify as professional traders based on the amount/frequency of crypto-related operations they perform annually. Nevertheless, crypto users are subject to a wealth tax at a rate determined by the tax authorities on December 31 of the fiscal year.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube