Three of China’s biggest Bitcoin mining companies are in the process of going public at a time when Bitcoin mining is becoming less and less profitable, according to Reuters.

Bitmain, Canaan and Ebang

The three companies are Bitmain, Canaan Incorporated and Ebang International Holdings. All three manufacturer devices called ASICs, which are devices specifically designed to mine cryptocurrency. Bitmain also owns a number of Bitcoin mining pools.

Whoa! London Summit’s new site is LIVE

Canaan of Hangzhou filed for its IPO in May. It originally announced a $2 billion target, and later revised it to $400 million. After applying to the Hong Kong Stock Exchange, it was told that it had to make some improvements to its procedures. For this reason it has not yet set a date to meet the listing committee.

In the filing, it reported 2017 revenue of $204 million, of which $56 million was profit. Additionally, the firm raised $43 million in funding in 2017. According to Reuters, Canaan is being supported by financial institutions Credit Suisse, CMB International, Deutsche Bank and Morgan Stanley.

Ebang filed for its IPO in June and will face said committee in September. According to the filing, the company wants to raise up to $1 billion, and claims to control 11 percent of the ASIC market. It also reported $141 million revenue in 2017, 18 times more than in 2016. 94.6 percent of this was from selling ASIC machines.

Impressive as these numbers are, Bitmain dwarves them. Bernstein analysts estimate that Bitmain controls three quarters of ASIC sales, and its mining pools are almost as dominant.

Bitmain, which values itself at $18 billion, aims to make $3 billion from selling its shares to the public. This puts it amongst the biggest IPOs in history, cryptocurrency or not.

Impressive numbers, but out of date

Canaan claims a sixfold increase in profit from 2016 to 2017, and Ebang claims a rise of more than 30 percent. These numbers are impressive, but it is significant that the filings all cite figures from 2017 at the latest.

Suggested articles

Unibright Unites Lufthansa, Microsoft and NEM To Kickstart Blockchain AdoptionGo to article >>

Many cryptocurrency companies reported enormous rises in profit over 2017, a year which saw cryptocurrency explode in value. A single bitcoin would have cost you almost $19,000 in December 2017. Since then however the market has declined considerably; one bitcoin is currently worth $6,724, according to coinmarketcap.com.

According to bitcoinblockhalf.com, the current reward for a successfully mined Bitcoin block is 12.5 BTC, or $84,050 at the current price. This is not all profit, because a huge amount of electricity is needed to complete this task. In March, Finance Magnates published information about how much this operation costs per country – apart from in Venezuela where electricity is subsidised by the government, mining one bitcoin will cost you at the least around $3,000 in electricity, and in some places more than $25,000.

At that time, the price of Bitcoin was above $11,000, and even then it wasn’t profitable to mine in a lot of countries. Now that Bitcoin is worth roughly half that, the list of profitable places to mine has shrunk considerably. In addition to this, the reward for mining a block will be halved in approximately 634 days, as is set by the Bitcoin algorithm.

A viable business?

Reuters argues these figures raise concerns. An IPO is when a company sells its shares to the public for the first time, and authorisation for this is given on the basis of that business having a viable future. It can be argued that in the case of cryptocurrency mining companies, the business model is flawed.

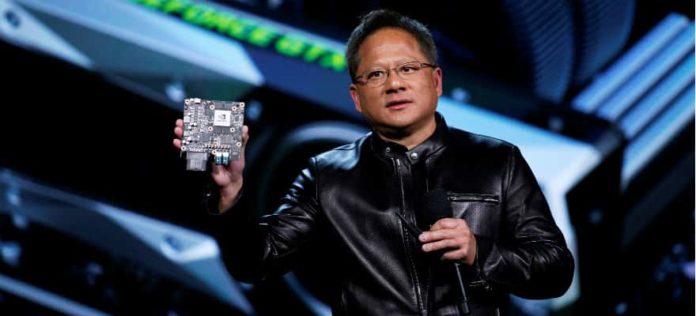

For example, look at US cryptocurrency mining chip manufacturer Nvidia, which saw its profits rise by 56 percent in 2017. In August 2017, CEO Jen-Hsun Huang proclaimed at a company meeting: “Crypto is here to stay, and the market will grow to be quite large. It’s not likely to go away any time soon…We stay very close to the market, and understand the dynamics very well.”

But its most recent earnings report showed only $18 million, where $100 million was expected, according to Reuters. CFO Colette Kress told the outlet that she expects cryptocurrency to offer “no contribution” to the firm’s revenue in the coming months.

At least for Bitmain, its size affords it security. It has also been diversifying its activities as well as dominating the mining sector – it is now involved in AI, advertising, and internet browsers, and is earning from other cryptocurrencies too, namely Bitcoin Cash and EOS.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube