The Huobi crypto exchange has announced that it will add Bitcoin SV (BSV) contracts to its derivatives platform.

According to a post made last week, Huobi revealed that it will be launching Bitcoin SV derivatives contracts beginning with this Friday.

“Dear valued users,

Huobi Derivative Market (Huobi DM: https://www.hbdm.com) will launch BSV contract at SGT 18:00 p.m. on August 16th (next Friday)”.-read the post on the exchange’s website.

Source: Huobi

Source: Huobi

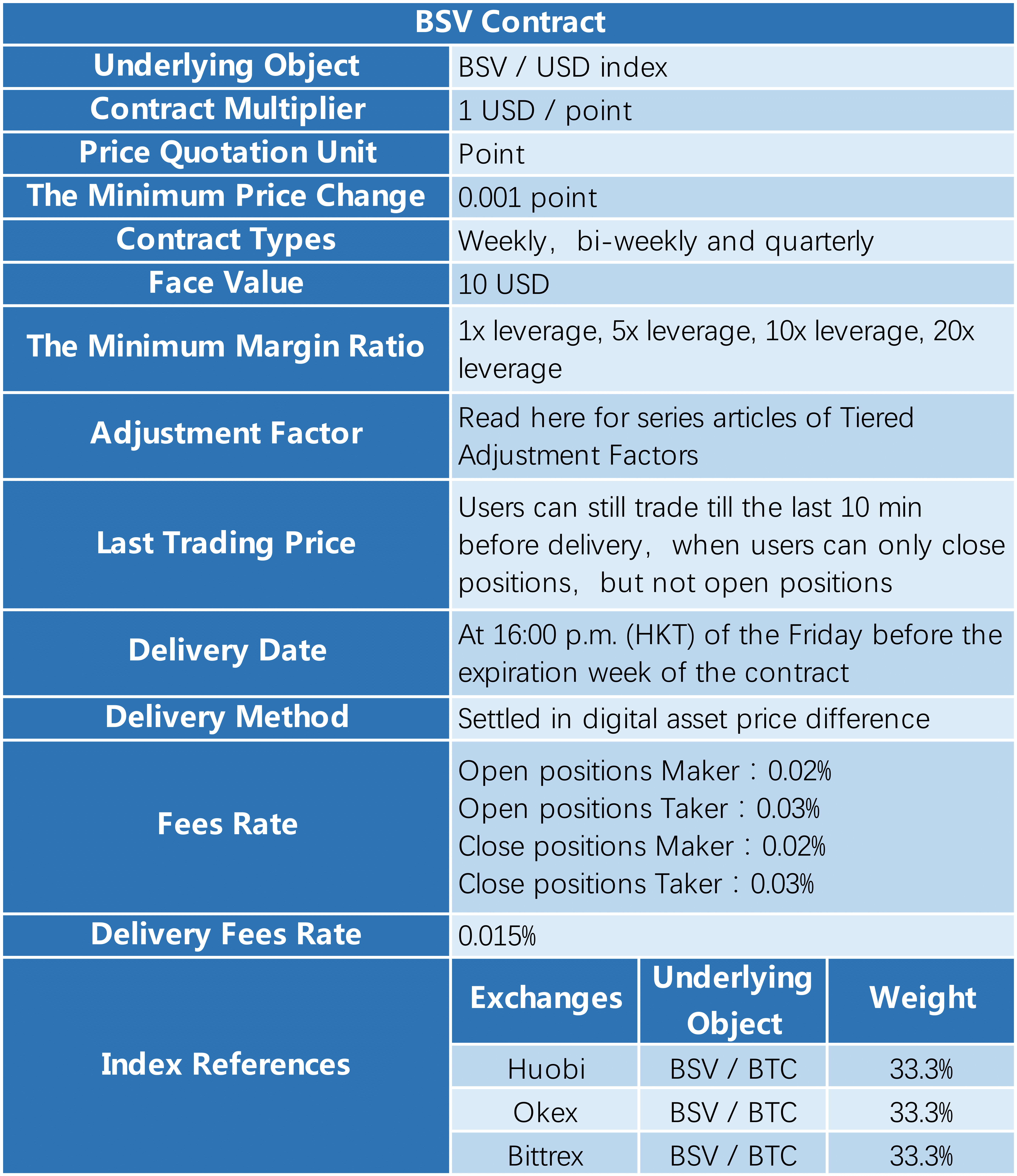

The contract will come with a multiplier of one US dollar per point with a minimum price change of just 0.001 point. Contracts will be available on a weekly, bi-weekly and quarterly period, at a face value of 10 US dollars.

Contract settlements are made in the price difference of BSV and are executed each Friday before the week in which the contract expires. The fees for open maker positions are 0.02% and takers have to pay a fee of 0.03%. Closed position fees are makers and takers are also 0.02% and 0.03%, respectively, with deliveries having a fee of 0.015%.

The derivatives are evenly weighted between an index which includes Huobi, Bittrex, and OKEx. Each exchange contributes 33% to the index, and are based on BSV/BTC comparisons.

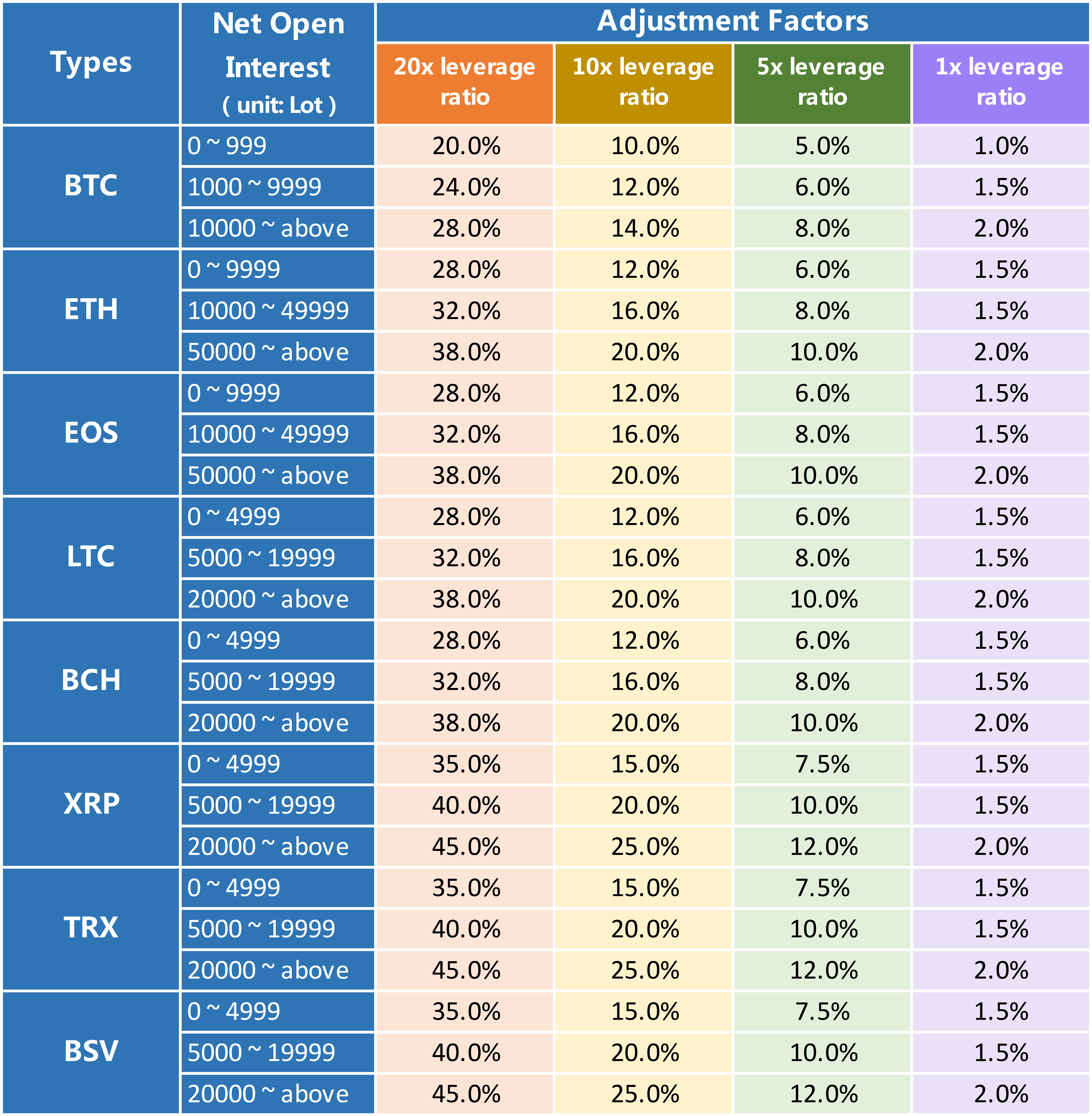

Huobi recently launched a “tiered adjustment factors” on its derivatives platform. The factors went live on July 19 and have been created “to prevent users from system’s margin call losses.”

“Huobi DM adopts Tiered Adjustment Factors mechanism, in which there are three tier of adjustment factors. As users with higher net position, then he/she will be in higher tier of adjustment factor with higher risk.”-stated Huobi.

Source: Huobi

Source: Huobi

Featured image: BlockPublisher

coindoo.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube