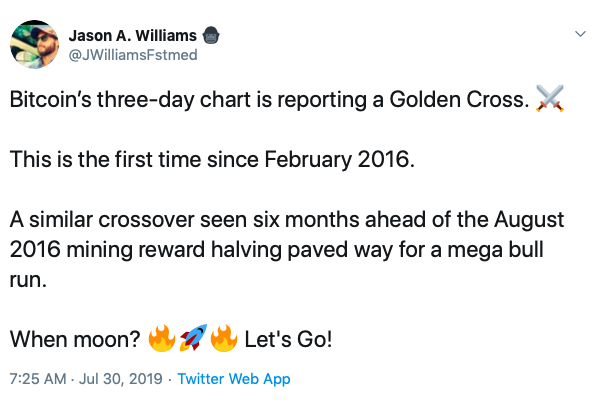

Crypto analysts and investors are growing increasingly giddy about an impending golden cross on Bitcoin’s 3-day price chart.

Is a Trend Reversal on the Cards?

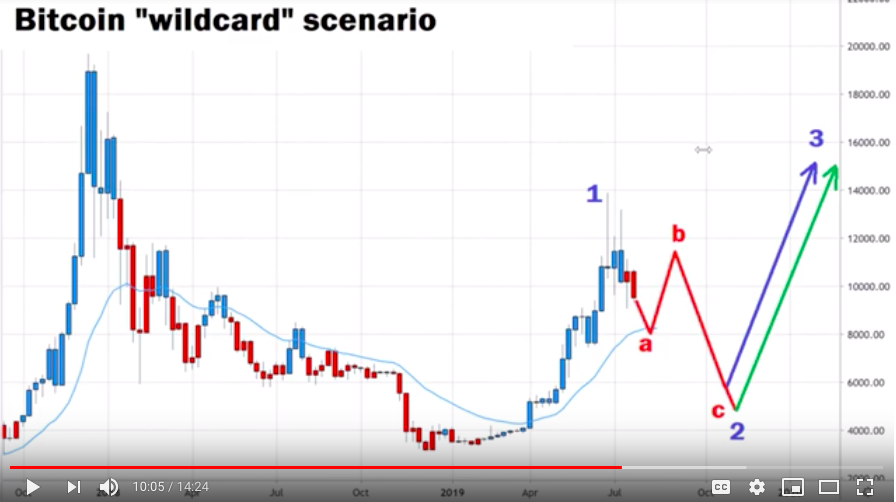

Since topping out at $13,800 Bitcoin has taken a prolonged beating as buying pressure evaporated and bears took control of the wheel. Bearish analysts have predicted that Bitcoin could drop as low as $4,000 before reversing course.

Meanwhile, Bitcoin bulls expect the digital asset to bounce off the 21-day exponential moving average (EMA) at $8,000 to $8,500, then the uptrend could resume.

The golden cross has long been viewed as a long-term indicator of a bull market and the impending cross of the 50-MA and 200-MA (moving average) would be a first since February 2016.

Back then, the golden cross occurred six months prior to Bitcoin halving event and analysts are now wondering whether Bitcoin price will follow a similar trajectory to a new all-time high.

Down, but not out

At the moment, Bitcoin is down approximately 33 percent from its 2019 high but hodlers and long-term investors are not dismayed. It is common knowledge that long-term moving averages and the MACD are indicators that lag behind BTC’s spot price action so the recent crossover could merely be representative of Bitcoin’s moon-like move from $3,200 to $13,800.

With that said, this should not detract from the significance of the golden cross as the one from February 2016 saw Bitcoin rally all the way to $20,000. At the time of writing, BTC trades for $9,650 and analysts seem to agree that the digital asset could make a run at $10,000 over the next 24-hours. At the same time, a close above $11,200 would be needed to restore the bullish uptrend.

As of now, the short-term consensus on Bitcoin price action is relatively bearish and most traders await the much-discussed bounce of the 21-EMA. Recently, crypto-analyst Alessio Rastani advised traders to check their confirmation bias and consider a variety of bullish and bearish outcomes for Bitcoin.

Meanwhile, Pantera Capital founder Dan Morehand predicted that BTC could reach $42,000 by the end of 2019. Morehead also believes Bitcoin could top $365,000 over the next 2 years. During an interview on the Unchained podcast, Morehead elaborated on each prediction by saying:

Graph the price of Bitcoin logarithmically…its trend is going to grow at 235% compound annual growth rate and…that put Bitcoin at $42,000 at the end of 2019. And I know this sounds crazy but we’re essentially halfway back there. I think it’s a good shot that by the end of the year we hit that. And if you just extrapolate that line out for another year it’s $122,000 per Bitcoin and then one more year, $356,000.

Do you think the golden cross is a sign that Bitcoin price is on the path to a new all-time high? Share your thoughts in the comments below!

Image via Shutterstock, Twitter: @JWilliamsFstmed, YouTube: AlessioRastani

The post Impending Golden Cross Could Start The Next Bitcoin Rally appeared first on Bitcoinist.com.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube