Digital currencies and their underlying blockchain technology have created new possibilities in a world where almost all online trends have become potential monetization ventures. And now, crypto gambling has enabled gamblers to participate in markets never realized before, such as placing assassination bets on celebrities and political candidates.

Such is the level of potential and democratization offered by Augur, a market prediction platform that utilizes cryptocurrencies and runs on the blockchain. It enables users to place bets on an infinite range of betting outcomes only limited by one’s imagination. It also places no geographical restrictions and provides the added value of anonymity. Right now, Jeff Bezos, Donald Trump, and Warren Buffett are three individuals who already have assassination bets placed on them on the Augur platform.

The Trump assassination wager, for example, reads, “Will Donald Trump (President of The USA) be killed at any point during 2018?”

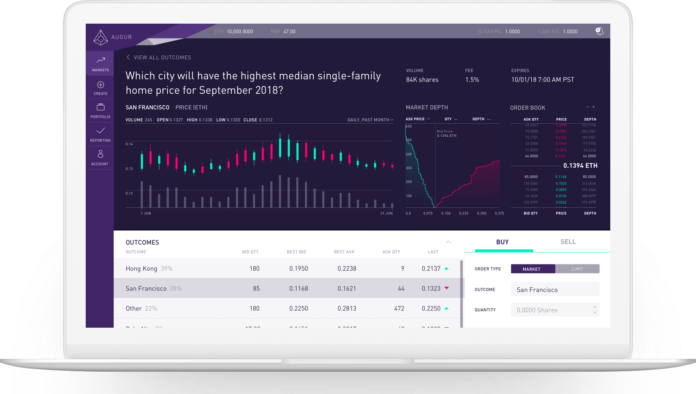

Developed by the Forecast Foundation, Augur allows you to create an event to predict, build a market for it, and then trade shares based on the outcome. The events range from election predictions to natural disasters to market crashes.

Once a user wins an outcome, he can create a report based on the bet, and other users can agree or disagree with it. Winning bets are paid out after the market is resolved. The gambling platform uses the Ethereum cryptocurrency for trading.

Of course, there is the real fear that bets on outcomes such as assassinations could trigger related events in reality. However, these types of wagers have garnered insignificant funding, and offer little incentive for someone to get inspiration from the bets.

Augur Interface

Legislative Issues

That said, the prediction platform does cause another problem. It blurs the difference between online gambling and prediction markets. The former is particularly popular on Augur and based on event predictions, but is prohibited by numerous countries such as China, the United Arab Emirates, Brunei, Japan, Cyprus, and others.

The problem lies in the fact that even if Augur is found to have broken the law by facilitating gambling, or other illegal activities, there are few ways to enforce it.

There are also fears based on the platform’s highly unregulated nature, given that Forecast Foundation, its developer, has actually distanced itself from ownership of the protocol, which it describes as open-source software. Its developers also highlight that they have no control of the peer to peer platform, and have no access to user private keys or personally identifying information. This includes legal names, national ID numbers, email addresses, and wallet balances.

The situation highlights the jurisdictional powerlessness that can be brought on by such a platform in the face of a burgeoning gambling market, catalyzed by popular events like the World Cup.

In regard to the United States, the Commodity Futures Trading Commission is investigating whether Augur’s activities fall under its jurisdiction.

The Crypto Gambling World

The crypto gambling world has been growing steadily over the years, as more and more people become acquainted with cryptocurrencies. In 2013, 50 percent of all bitcoin transactions involved gambling, and since 2014 over 3.7 million BTC valued at $26 billion have been used on betting platforms.

And during the months of June and July this year, there was a significant uptick in crypto gambling activity. This was especially true in countries where online gambling is illegal, spurred on by the World Cup. However, the trend also revealed the potential for abuse given cryptocurrencies’ and their blockchain technology’s unregulated nature.

In China, authorities arrested six suspects suspected of running a World Cup gambling ring based in Guangdong province that had about $1.5 billion in cryptocurrency bets. This is according to a statement released by Chinese authorities.

The scheme, based on the dark web, had been accepting Ethereum, Bitcoin, and Litecoin for 8 months before its operators were nabbed. It lured in more than 300,000 players from different countries and had about 8,000 affiliate marketers to support the network.

The growth of such an operation is an indicator of just how huge a platform such as Augur can become, based on the marginalized market it targets. In countries such as China, for example, both cryptocurrency trading and gambling are illegal. As such, a decentralized betting platform such as Augur requires a regulator. However, it markets itself as a ‘prediction market’, which is a grey area for many countries where gambling is deemed illegal, and so a few legislative issues related to this are bound to crop up.

Moreover, it allows a user to create an event, bet on it, and build a market for it. As such, the user can be a creator, marketer and potential beneficiary as the gambler, all at the same time. This requires a whole new set of complex legislation.

In Britain, for example, the U.K. Gambling Commission (UKGC) classifies a peer-to-peer protocol such as Augur as a remote betting intermediary. However, the classification is not comprehensive enough to conclusively categorize it as such. This is considering the evolved nature of user participation, its underpinning technology, and when the regulations were first set, which was in 2013.

Crowd Wisdom Potential

According to Nolan Bauerle, Director of Research at Coindesk, prediction markets have the potential to tap crowd wisdom in a way few platforms can and have been largely been misunderstood.

According to the executive, they would be an invaluable resource if they were allowed to grow to a global scale, and could potentially provide rare insight on industry trends.

The post Innovation in Crypto Gambling and the Potential Legislation Nightmare appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube