Lamborghinis and trips to the moon

– Really?

Cryptocurrencies are booming. The amount of searches for Bitcoin, Ethereum or other cryptocurrencies on google has skyrocketed.

Tons of new investors are entering the community every day. The excitement for blockchain technology beggars belief.

New projects acquires funding within minutes, more developers transition into cryptocurrencies and Bloomberg, Forbes and other iconic financial news outlets write about Bitcoin and Ethereum on a daily basis.

However, every upside has a downside.

A large part of the cryptocurrency communities have gone from constructive feedback on new developments and fact based price speculation to fantasising about trips to the moon, lamborghinis and trash talking currencies you personally aren’t invested in.

Many investors lack prior experience and invested because of overly optimistic members of the community spamming memes instead of relevant information.

Admittedly, I’ve myself become carried away with the insane returns of cryptocurrencies this spring, even with a lot of prior experience of investing and have at times been too heavily invested in a range of cryptocurrencies. Most investors have biased flaws in their investment strategy. Overconfidence or emotional attachment in investments are common, but detrimental to your returns.

The issue with the lamborghinis and trips to the moon is the fact that all of those memes make us more emotionally invested, and leaves less room for rational behaviour. Those things do not contribute anything to the community except a few laughs, but instead hurt it by giving investors with less experience hubris to the point of no return.

I urge more people to contribute to the community by creating quality content, sharing ideas and informing each other about relevant events in the cryptocurrency world. I discourage people to talk about lamborghinis, prior returns and unfounded price predictions. Those things are only self serving, making yourself feel better about your investment.

Successful trading – 5 Ways to become rational [Investing]

I will not give you any magic advice to become a crypto-millionaire. Nor will I teach you technical analysis of price-graphs or pitch you a new altcoin and claim it will rise 1000% before October 2017.

What I will do is help you become the best investor you can, with limited resources and time. There are some simple tips I’m sure most have heard many times before. Many of you have listened and learned, but somewhere down the road flew off to the promised lambo-land. Our goal is to become completely rational. We won’t succeed, but we will improve.

1. Educate yourself

Never invest in something without knowing what you’re investing in. This should go without saying but a lot of people simply invest in cryptocurrencies or a new ICO without properly researching. Read the whitepaper, learn about the core developers and most importantly – find out what purpose it serves. Price is what you pay, value is what you get. If what you are investing in does not solve a problem or serve a purpose, it offers no value. It may rise in price temporarily, but if it does not offer any value it is not sustainable.

Educating yourself is important, regardless of what asset you are investing in. In cryptocurrencies, it’s far more important. For example in the stock-market, edges are smaller and investors rarely make huge mistakes because price adjusts more efficiently. In cryptocurrencies, a lot of value comes from speculation, hype and inexperienced investors. If you are wrong, the risk of ruin is a lot bigger than your common stock-pick.

2. Invest in value

After educating yourself on cryptocurrencies, identify a few projects you believe in. Listen to what other people have to say, but make sure to form your own informed opinion. The wars between maximalists of different cryptocurrencies can easily sway you one way or another, so be careful of who you listen to on twitter or other social media outlets. Make sure the project you invest in offers value, solves a problem, has a serious core development team and an active community.

Many new currencies and ICOs are simply money grabs (read Scott Shapiros 5 issues with ICOs), they create a product, provide a fancy whitepaper and video and voila, they’re worth tens of millions of dollars. Making sure the development team and community are serious, reduces the risk of investing in scams.

3. Hodl. Yes, seriously. Do not attempt to day-trade.

Once you have decided to invest in a currency or ICO, do not attempt to day-trade. Hold the investment for a longer time period and only sell for reasons other than selling high, buying the dip. The swings in cryptocurrencies will entice you to trade on a daily basis, but in such a speculative and irrational market you will likely lose money as a beginner. Members of the community post detailed technical analysis on reddit and twitter every day, but the technique has little support from studies conducted on regular forex-trading, and no studies exist on cryptocurrency.

If you invest in something you understand and believe in, it is a lot easier to mentally withstand the ups and downs.

4. Diversify

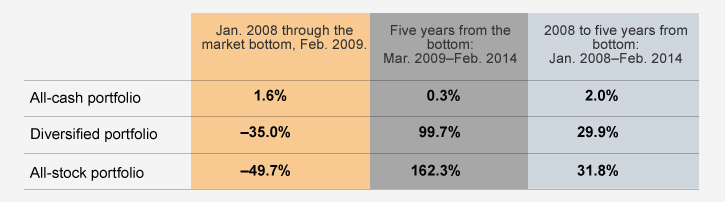

As any book on investing will tell you, do not put all of your eggs in one basket. Everyday I see people write and brag about how they’ve put all of their invested money into a single currency. It doesn’t matter if you invest in Bitcoin, Ethereum or go all in on a new alt-coin, you should never put 100% of your investment into one asset. If you do not believe me, there are plenty of studies that support this notion. A diversified portfolio will reduce risk without sacrificing much of your potential returns.

Example from the 2008 financial crisis, by Strategic Advisors Inc.

Even more so in cryptocurrencies. In a speculative market, a large portion of start-ups, or in this case currencies, will fail. To become a successful investor in such a market, you should invest in many assets to raise the chance of hitting the one that makes it big.

5. Never invest to the point of emotional commitment

Our last step to becoming rational cryptocurrency investors is this: never invest an amount of money that you would feel bad about losing. Investing too much money steers us from our rational path and makes us emotionally committed. Cognitive bias caused by emotional commitment has many brought investors and companies down. When our bodies experience stress, it inhibits the rational part of our brain, and a more emotional part takes over. Emotional investing results in terrible decisions, and it is costly.

Variance and risk

We have outlined how we can become more rational (successful) investors. There are still some fundamental factors to investing you need to understand. In every investment, there is variance and risk. Cryptocurrencies are likely one of the most high variance and risky investments there is. There are a million different outcomes as to how your investment will end up. The U.S may decide to ban all trade on Bitcoin and Ethereum, the price would plummet and we all lose a huge chunk of our investment. China may decide to make Litecoin their official currency, and all Litecoin holders become rich.

Some risks and opportunities are more likely than other (risk of U.S regulation risk of China implementing Litecoin as their currency), but nonetheless no one is able to predict with a 100% certainty, or even 50% for that matter, what will happen. Bold claims of future prices, based on nothing but pure speculation and emotional investment blinds us for other potential outcomes. You may make the best possible investment, but still lose 90% of it because of an unforeseen event no one could predict. It is all part of the investment game, and something you have to deal with.

Conclusion

The cryptocurrency community has to move from hubris and memes to support and share technical developments and real analysis of the market. If a majority expects to sit back and get rich, it will not happen. Become a rational investor and contribute to the development of this amazing technology. Be aware of the risks and invest amount you are comfortable parting with in case things go south.

Make sure to follow us on Facebook to stay up do date on the latest news about Bitcoin and Ethereum!

If you are looking to invest, see our top rated exchanges!

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube

Very good article. One thing I’d mention is that crypto markets do still tend to move in lockstep, with altcoins exaggerating the movements of bitcoin. So after you’ve done your research and carefully made your picks, you might still be caught up in an awful down-draft that takes your coin(s) down along with the whole market, irrespective of their value. Show me an altcoin that bucked the downtrend from 2014-2016 for example. This reinforces the advice to HODL and not panic during corrections large or small.

Excellent advice based on open ended experience and wisdom.