The drivers behind AMD’s Q2 blowout

There have been many investor related and technical articles that outline AMD’s (NASDAQ:AMD) new products, but there’s some question as to what drove AMD to exceed expectations in Q2 and what is behind the forecast for Q3 and Q4 2017. While the main driver behind the quarter is known only to AMD, at least one analyst speculated that the beat was due to the Ethereum mining rush, where Ryzen played a distant second fiddle. What’s the truth though?

AMD was recently reiterated a value of $9 by Barclays, which may have influenced the company’s stock down 9% from $13.40 to $12.15. In the research note, Barclays argued that AMD may see a large negative effect due to the end of the Ethereum mining boom created from the growing digital currency market based on blockchain technology.

The research note came to the conclusion that AMD’s recent Q2 growth in its computing and graphics segment was driven by GPU sales and not by CPU (Ryzen) sales.

They write:

We are revisiting AMD’s last earnings release with an analysis of the [Ethereum] tailwind, which now appears to be the source of the better revenue in June/Sept [guidance], and why investors should place very little value on this earnings stream.

This may have led them to the conclusion that AMD must have overestimated their newly projected revenue for the third and fourth quarters should the likely scenario that the Ethereum mining rush comes to an end.

They write:

We believe estimates could be too high next year should this [Ethereum] tailwind dry up.

To come to those conclusions, Barclays may have made these assumptions:

1. That Ethereum mining will follow the trend that occurred with Bitcoin, ALTCoin, and Litecoin mining, where the price of video cards was pushed up beyond the reach of gamers and where these cards were then dumped on the second-hand market when mining became unprofitable.

By itself, this assumption isn’t unreasonable as it has happened several times before. To explore why this time is different, one requires knowledge of how Ethereum is different from previous cryptocurrencies. For instance, Ethereum doesn’t mine coins like the previous cryptocurrencies, as each year there are a set percentage of coins that can be mined, and that percentage doesn’t decrease over time like it does with Bitcoin block rewards. Ethereum is much faster than Bitcoin in both transactions and processing power. It’s only two years old and already handles 50% of the transactions that Bitcoin handles, even though Bitcoin is seven years older. Ethereum is being touted as NET 3.0, the next major evolution of the Internet, thanks to blockchain technology. Blockchain technology will be big; it’s an entirely new way of computing where individual computers are added to a processing network to increase processing power, kind of like parallel processing on the computer level as opposed to more cores in a CPU. Which means that blockchain is applicable to more than just finance.

While it’s not immediately clear how AMD can exploit the potential of blockchain technology, it does have considerable market share and product recognition in among miners as the video card technology of choice. It builds video cards, based on the Polaris architecture, that are especially good at processing blockchain code. And AMD just released new drivers for its new GPU “Vega” which has improved the mining performance of that card as well. Blockchain transactions by all likelihood will easily eclipse the size of the worldwide gaming market. Blockchain technology is NET 3.0 because it brings to the Internet unlimited secure, lightning fast, financial transactions, or transactions of any type.

What does this mean though, what’s going on with blockchain? While I don’t claim to know, I will point out that neither does Barclays or anyone else for that matter. What’s clear though is that mining is designed to be sustained during the lifespan of Ethereum. Mining remains a critical component of the currency; it’s not just some coin generation thing where the earliest adopters win the majority of the value of the currency, such as with Bitcoin. It’s many times more powerful and versatile than Bitcoin. It’s difficult to conclude then exactly how AMD will be affected from an Ethereum mining crash should one occur. Let’s explore this possibility as the market has shown concern for it.

2. That in the event of an Ethereum mining crash, the introduction of the second-hand RX 480 and RX 580 video cards, among others, will spoil AMD’s market.

First off, we need to identify that the second-hand market is high risk. Second-hand video cards have some components (such as the microchips) that actually perform better from constant use (where turning the card on or off creates wear), and other components (such as the fan) where the reverse is true. This is provided that the card was cooled sufficiently. As such, cards sold on that market are at a reduced rate, but generally are sold with an intact warranty. So we’ll call that market limited, but it’ll have an effect on GPU sales.

Of course, if you’re upgrading your GPU (then you own a desktop), many people would also take the opportunity to upgrade their CPU since we’re entering a completely different chapter based on parallel processing (ZEN). So by this same logic, CPU sales will be up, and those sales are higher margin anyway, so we’re still seeing a net positive. AMD is also trying to gain market share in order for game programmers to adopt the specific technology in their video cards so that they perform better. A second-hand market can also be positive for AMD.

Finally, it’s a little uncertain as to how the Ethereum mining rush will play out. The game has changed from previous cryptocurrencies and that fact needs to be acknowledged. A mining bust followed by used GPU cards flooding the market may not play out the same as it has in the past.

There’s another factor. The custom desktop computer is a small market. People who tend to buy brand name systems don’t typically look into upgrading their video cards, and just replace the whole system when it gets slow. Video cards in laptops cannot be replaced. So the question is, once name brand systems start selling, and once laptops start selling, where will the majority of AMD revenue come from, the tiny custom desktop computer market? I don’t think so. That’s not where Intel (NASDAQ:INTC) makes its money, and I don’t think that’s where AMD will be making its money either. This limits the impact that an Ethereum mining crash would have on AMD.

It’s also important to note that brand name desktop builders will not be paying AMD the market price for AMD GPUs, they’ll be paying something lower than the AMD MSRP, and you can bet that AMD will fill the GPU orders for brand name system over orders from the desktop parts market, because it’s the brand name machines that will push AMD’s market share and provide incentives for software companies to build AMD tech into their software. The custom market also already had a head start with earlier sales (which started in April).

3. That revenue growth was due to GPU sales driven by Ethereum and not CPU sales driven by Ryzen (ZEN).

AMD’s quarterly report does not separate revenue from its computing (CPU) and graphics (GPU) business, so nobody knows the exact sales AMD made with respect to GPUs and CPUs. There is however information out there that can provide a clue as to what drove sales, such as:

a) In the Q1 2017 quarterly report, one month of Ryzen sales accounted for the lion’s share of the $133 million increase in reported revenue.

The quarterly report is clear on that:

Computing and Graphics:

• Revenue was $593 million, up 29% y/y and down 1% q/q. The y/y increase was primarily driven by higher sales from Ryzen desktop and graphics processors. The better than seasonal q/q decrease was due to lower mobile and graphics processor sales largely offset by Ryzen desktop processor sales.

The y/y increase in revenue is $133 million, as stated most of that was due to Ryzen sales.

In Q2, the revenue for the unit was $659 million, an increase of $224 million y/y, with a full quarter of Ryzen 7 sales and more than two months of Ryzen 5 sales, and unseasonably higher GPU sales due to the Ethereum mining rush.

Here’s where we can do some reasoning to estimate what the CPU portion of the sales were. If Ryzen captured most of the Q1 revenue, then the 133 million can be said to be mostly due to Ryzen 7 sales. Certainly in Q2 with Ryzen 5 available, this number will at least be the same if not higher, so we’ll proceed with this assumption.

Looking at Q2 y/y increase in revenue of $224 million, subtracting what Ryzen sales are most likely worth from Q1, and we get $91 million. GPU sales are potentially worth $91 million, if Ryzen sales from Q1 to Q2 stayed the same or increased. We only have to verify if this assumption is true.

b) That while AMD sold more GPUs in the Q2, it did not benefit from the jump in cost of the graphics card to the end user. AMD does not sell directly to the end user and is insulated from gaining extra revenue from increases in the end user price of graphics cards due to an increase in demand. If it was able to charge more for its GPUs due to demand, then Q2 would have seen a corresponding increase in margin (because AMD did not forecast the Ethereum mining rush) over the 33% forecasted in the Q1 financial report. Most investors covering AMD make this mistake repeatedly.

This is stated in the Q2 2017 financial report cautionary statement, and probably every report before that.

“AMD relies on third parties to manufacture its products, and if they are unable to do so on a timely basis in sufficient quantities and using competitive technologies, AMD’s business could be materially adversely affected”.

Therefore, it’s the third parties or the merchants making the final sale that will benefit from any increase in perceived value of graphic cards due to the Ethereum mining rush.

c) During the CFO commentary, Lisa Su not mentions Ryzen before GPUs every single time she talks about that segment of the company. She mentions that both Ryzen sales and GPU sales saw double-digit percentage growth, but that GPU sales has seen continued double-digit growth for the last six quarters. It’s customary to put your best foot forward when giving a report. Nobody likes to hear about uninteresting news when they’re waiting to hear the headline story. To say that she did this when GPU sales were the driving force behind the high revenue in the quarter is misleading to investors.

She talks about Ryzen related products for over a minute (from 3:30 min) while doing so uses strong words such as “significant ramp”, “strong sell-through”, “richer mix of shipments”, and that “sales improved significantly over a year ago”. She goes on to talk about how Ryzen inventory is ready with name brand system offerings and widespread availability for back-to-school sales.

When she talks about GPU sales, it’s for less than a minute (from 4:50 min), she says “strong demand” attributed to gaming and mining, and then goes on to talk about new graphics products for both consumer and professional markets including data centers. The point is that Lisa Su stressed Ryzen sales over GPU sales.

d) During the same CFO commentary at (10:43 to 11:00), Devinder Kumar says:

“Gross margins rose 33% due to a richer product mix and a higher percentage of revenue from computing and graphics segment driven by Ryzen processor sales”.

He made no mention of GPU sales, hence GPU sales were not significant with respect to margins.

e) When asked directly about the Ethereum mining rush effect on GPU sales (19:06), Lisa Su says that sales where seasonably higher and that graphic card stocks around the world were lean. She reiterates this when asked again about cryptocurrency at 30:34 min into the CFO commentary.

This suggests that the Ethereum mining rush created a high demand during a seasonally slow season when graphic card inventories are low to begin with. This is because overproduction is much worse than underproduction. A company will only produce the number of units it thinks it can sell during any specific quarter; read this report from Tom’s Hardware.

f) There is no indication that AMD is expecting a continuation of the Ethereum mining rush, and having gone through several cryptocurrency mining booms and busts already, the company may have some plans on how to mitigate the fallout. It’s doubtful that its third or fourth quarter results will be significantly off due to a drop in Ethereum mining.

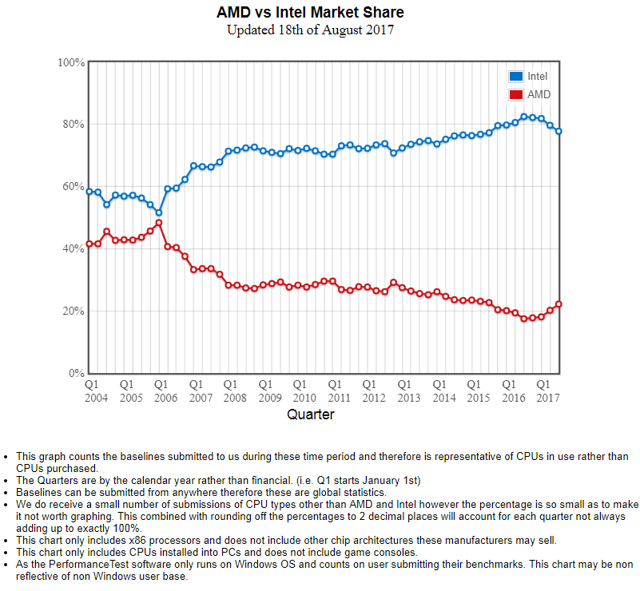

g) Passmark shows that this last quarter (Q2 2017), AMD stole somewhere between 10% and 2.1% market share from Intel in the CPU category. AMD did this by only selling custom built desktop computers, as brand name desktop systems were not yet available and the mobile version of Ryzen won’t be released until the fourth quarter. Intel numbers include laptops, custom desktops, and brand name desktops.

If you don’t like Passmark, as it doesn’t count CPU sales, we can look at Amazon (NASDAQ:AMZN). Today Amazon.com shows that AMD has 7 of the 20 top spots for CPU sales. On April 25th 2017, Amazon showed that AMD had 7 of the 20 top spots for CPU sales, but the top spot was 6th place for the Ryzen 7 1700, followed by the Ryzen 7 1800X at spot 12. Today it has the Ryzen 5 1600 at 4th, the Ryzen 7 1700 at 5th, and CPUs in spots 8, 9, and 10, which it didn’t have in April. So sales are improving by a large amount. Amazon sales in other countries are much higher with respect for Ryzen; the UK for instance has Ryzen 5 in 2nd spot.

Ryzen is being touted as the most successful product launch in the AMD’s history. While there’s a lot of recent focus on Vega, AMD’s real money-maker is ZEN. Don’t get me wrong, Vega is great for AMD and the market, regardless of ridiculous comments of it “being late”. Vega will still make a lot of money for AMD as the various technical reviews on Vega are good.

This stock cannot possibly be done moving up because the bulk of CPU sales from Ryzen and Epyc have not yet been realized, and financial analysts have baked into the market the expectation of failure, using only two arguments 1) that Intel is big and bad, and 2) that AMD for the last several years has had very poor financial performance (in the face of Intel clearly breaking competitive laws). They’re saying this during a time when AMD is clearly making outstanding sales while they argue that they aren’t making any traction in the market. AMD will be seeing large profits once it regains access to the brand-name desktop, and laptop markets, as what typically occurs when you enter a market with a superior product. And let’s not beat around the bush, with Zen AMD having a vastly superior product to Intel, that Intel will have no answer too until mid-late 2018.

Disclosure: I am/we are long AMD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube