The crypto exchange known as BitMEX has on two occasions traded over 1 Million Bitcoin (BTC) in a single day. The first time BitMEX made this milestone was on the 25th of July and they made the announcement via Twitter as follows:

A new BitMEX (and industry) record: 1,000,000 XBT (> $8BN) traded in the last 24 hours!

— BitMEX (@BitMEXdotcom) July 25, 2018

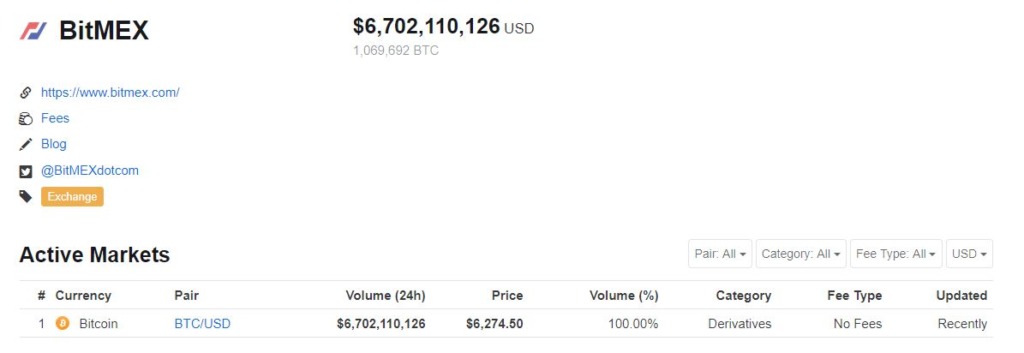

This feat was again repeated on the 8th of August when the exchange once again traded over 1 Million BTC in a single day. This was after the SEC delayed their decision on a Bitcoin ETF. A screenshot of the daily volume on that day can be found below.

The CEO and Co-founder of BitMEX, Arthur Hayes had this to say with regards to the 1 Million BTC milestone when it was reached for the second time:

“Once again meeting our own record of 1 million bitcoin traded within 24 hours is a major milestone for the crypto-coin market and testament to the strong community BitMEX is growing. In continuously engaging with, and truly listening to, the needs our customers, we’ve recognized an overwhelming demand for innovative financial products that give the crypto market greater versatility.”

So how is BitMEX doing 1 Million BTC trades in a day

Further dissecting Mr. Hayes last comment above, we find that the exchange has been offering innovative financial products that give the crypto market greater versatility. This includes products that short Bitcoin. Shorting involves the betting on the fact the price of an asset will continue to decline in a bear market. Rather than trading on an up-trend, you short your position and hope it continues to decline, thus profiting from it.

Further researching on the two dates that BitMEX experienced the 1 Million BTC trades (July 25th and 8th of August), we find that Bitcoin was going through phases of decline in the markets. Therefore, the big question is, is BitMEX to blame for the declining value of Bitcoin or are savvy traders making good use of their shorting capability?

The latter is a more plausible reason as to why BitMEX is trading such a high amount of BTC in a single day. What possibly happens during periods of Bitcoin decline, the majority of the crypto-communities communicate via Telegram and they all head to BitMEX to short Bitcoin en masse. There are plenty of chat groups and channels that advice traders on when it is the best time to short BTC.

Therefore, BitMEX is only providing versatile investment products that hinge on the decline of digital assets. Perhaps it is time we all learned how to short our favorite coins during periods of turmoil so we can also benefit.

For the latest cryptocurrency news, join our Telegram!

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency and read our full disclaimer.

Image courtesy of Pexels

The post Is Shorting Bitcoin (BTC) on BitMEX Hurting The Entire Crypto Market? appeared first on Global Coin Report.

Read more at https://globalcoinreport.com/is-shorting-bitcoin-btc-on-bitmex-hurting-the-entire-crypto-market/

Globalcoinreport.com/ is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube