Oh, I knew there’d be hell to pay,

But that crossed my mind a little too late…

What was I thinkin?

— Dierks Bentley

If you follow China and Bitcoin, you, like me, have probably been anticipating the events of the past week with some trepidation. Last week, China invited several Chinese Bitcoin executives to meet in Shanghai for a “chat.” A chat with the Chinese government. What a concept. Reminds me of the chats I used to have with my dad behind the garage after the times I was suspended from school for things.

The upshot is, the Chinese government has given the lie to the idea that Bitcoin may not be hacked. And China has further exposed its paranoid fear of a run on the Yuan. According to any meaningful definition of “hack,” China’s government is going to hack Bitcoin in the near future.

How is China like Bitcoin?

If ever two entities were alter egos, it is the government of China and what is, laughingly, called the “governance” of the cryptocurrency, Bitcoin. Both bodies are control freaks. Both bodies vehemently deny this. The Chinese government fools nobody. Bitcoin’s governance mostly fools only itself.

The Great Fear of China. The Chinese government is incredibly paranoid. Like any socialist democracy with Chinese characteristics (China-speak for “totalitarian government”) there is constant governmental paranoia, fear of the population understanding how their government manipulates them. As the old saw goes, “Just because you are paranoid, that doesn’t mean nobody is out to get you.” So it is with the Chinese people and the Chinese government. The Chinese people are very aware of the failings of the Chinese government. And lately, the Chinese people are watching their government do backflips trying to prevent a run on the renminbi yuan.

The Chinese government has thus dispatched thousands of Dutch boys with Chinese characteristics to stick a finger in the dike that prevents people’s yuan from escaping China. It is this effort that produced last week’s “chat” with the leaders of Bitcoin-based operations in China.

The Great Fear of Bitcoin.

Bitcoin mavens make four primary claims to Bitcoin’s financial significance:

- Bitcoin is a means of conducting transactions without using a bank or other intermediary.

- It cannot be hacked.

- It has no physical location and thus cannot be regulated by government.

- It is not subject to human foibles such as corruption.

Bitcoin’s governance is also paranoid, since its value has ballooned to the point where billions now rest on the validity of these four propositions. I suggest that each these propositions is quite tenuous. Bitcoin’s paranoia is also not without foundation.

The DAO hack. Another cryptocurrency, Ethereum, with governance exhibiting social skills kindred to those of the governance of Bitcoin, was runner-up to the US dealer banks in my annual contest, “The Too Smart Award” for 2016. This is the award I give to the entity that stands out in finance over the course of the year by meeting the following criteria:

- They are self-acknowledged to be blindingly smart.

- They do something that is incredibly stupid because their vision does not go far beyond their own noses.

If you follow the cryptocurrencies, but do not drink the kool aid yourself, you know that the code developers that dominate the leadership of the cryptocurrencies easily meet criterion 1. Ethereum received the Too Smart runner-up award for creation of the DAO. DAO is nominally an acronym for Distributed Autonomous Organization. But since the DAO proved not to be distributed, not autonomous, and was never an organization, it’s best to forget the whole acronym thing and just call it DAO.

What was the DAO? It was a fiasco. The DAO claimed to be code. Not a group of people. Not legally tied to any group of people. The code was a group of instructions buried within the parent cryptocurrency, Ethereum. What made normally harmless computer code go nuclear is that people were encouraged to give the code their money. And they did. In the tens of millions of dollars in value.

This reminds us of a few crucial facts of human nature. 1. A fool and his money are soon parted. 2. Some writers of code are notably unaware of the world around them. Apparently, nobody considered that the DAO might legally be an investment fund. If an investment fund is incorporated in the United States, say, there must be a prospectus, a governing body, legal representations of fund objectives, and so on. Ethereum, however, claims the DAO is not managed by humans. Thus, those rules can’t apply.

So, here’s the problem. When the code surprised the Etherium Overlords (Yes. Overlords. It turns out that when things go awry at Ethereum, a single t-shirt wearing guy, Vitalik Buterin, decides what to do), the code that theoretically rules, doesn’t. Why not? It’s code. Code can’t decide things. And somebody, one of the DAO investors, who understood Ethereum code better than the other investors in the DAO, was walking away with the other DAO investors’ money.

As it was reported, Buterin phoned other Ethereum Overlords. They, in turn, got an informal OK from the “miners” (who pay the freight at Ethereum) and all agreed to change the code. Problem solved? Nope. The miners changed their mind the next day. The result was chaos – and it is to be hoped, an end to Ethereum. But don’t count on it. There are at least two proposed new Ethereum DAOs.

Is Bitcoin similarly vulnerable?

Yes. Despite warehouses full of “white papers” that claim that Bitcoin is different from Ethereum, the answer is “yes.” Bitcoin may also be hacked.

“Hack” is a poorly defined term. But most of us have the basic idea that when an actor outside the “system” of transactions and information contained within Bitcoin alters the behavior of participants involuntarily in the Bitcoin network, changing the alternatives of Bitcoin users, that is a hack. If that actor changes Bitcoin’s source code substantively, known in the Bitcoin world as a “hard fork,” Bitcoin mavens will claim that it’s something other than a hack, since hacks cannot happen. This is rank dissemblance.

How did Bitcoin come to be compromised? It is quite accurate to describe Bitcoin as code. But code is inevitably written by people. And may be changed by people. Moreover, the ingenious method that enables Bitcoin mavens to proclaim that it cannot be hacked, is based on a very human motive. People generally try to enrich themselves. Almost everywhere, this economic principle applies. And where violence is not an option, the desire for wealth is one dominant force that governs human behavior. Even ethics, which modifies excesses of enrichment behavior, is based on the concept of collective desires for wealth.

Bitcoin is based upon the principle that would-be hackers, when presented with the Bitcoin system, invented by Satoshi Nakamoto, where their efforts to prevent hacks are more profitable than the alternative of hacking Bitcoin; are driven by greed to eliminate hacking. For the economically inclined, this is known as a “Nash Equilibrium.”

But there is a counter-to-fact assumption which is the bulwark upon which Bitcoin’s invulnerability is based. To wit: There is no larger, external economic force that may coerce or bribe the actors that use and run Bitcoin from pursuing their economic interest within Bitcoin itself.

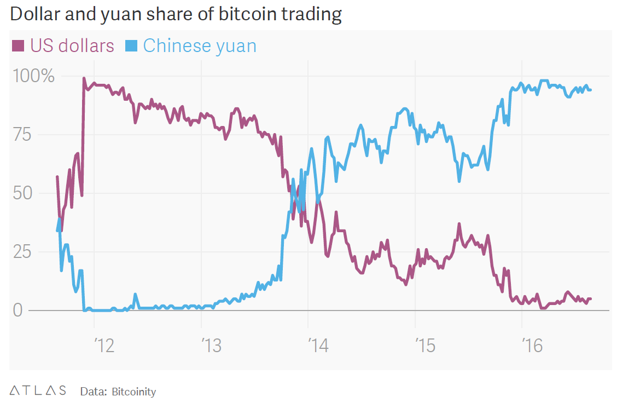

A few years ago, the idea of non-interference from outside economic actors might have seemed reasonable. However, all are aware that the risk of governmental involvement is a possibility. Today the prospect of government involvement has been multiplied, because the Chinese public’s demand for bitcoin trading is more than 90% of the total, with bitcoin mining about 70% China based, as reported here.

Despite the increasing value of bitcoins and the fascination of Chinese investors, the escape from yuan through the Bitcoin network is small potatoes compared, for example, with phony import-export transactions. But paranoia makes sense only to the paranoid. Following the reported chat with Chinese regulators, OKCoin joined fellow Chinese bitcoin exchange BTCC in calling for more regulation of Bitcoin from the Chinese government, reported here. Why am I reminded of Ford Motors’ (NYSE:F) decision not to open a plant in Mexico, and President-elect Trump’s congratulatory tweet?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube