Bitfinex and Tether Under Fire

- Bitfinex and Tether say this is a routine “legal process” with a no comment policy

- Tether damaged relationship with auditors and failed to certify $2.3 billion in reserves

According to Bloomberg, the U.S. Commodity Futures Trading Commission delivered subpoenas on Dec. 6 to major exchange site Bitfinex and digital asset firm Tether, sister companies that share a CEO.

While the exact contents of the subpoenas are unknown at this time, regulators are questioning whether or not Tether, a broadly traded token supposedly backed by the value of the U.S. Dollar, truly has these backings in reserve.

“The company has yet to provide conclusive evidence of its holdings to the public or have its accounts audited” stated Bloomberg. In an email to the news giant, Bitfinex and Tether said: “we routinely receive legal process from law enforcement agents and regulators conducting investigations…it is our policy not to comment on any such requests.”

Effect on the Market

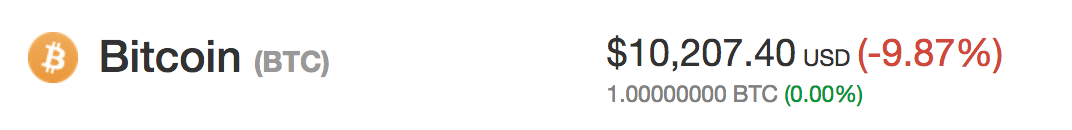

As allegations in the matter continue to surface in the media, the price of Bitcoin fell more than $1000 to nearly $10,000, its lowest since November. Many in the industry have been questioning the authenticity of Tethers reserve holdings for quite some time, with critics citing that unraveling the true “scam” of Tether could drive the price of Bitcoin down nearly 80%.

In accordance with the claims, blockchain applications risk and compliance creator, Barry Leybovich stated that trading Tether for Bitcoin at Bitfinex is a partial reason for Bitcoins meteoric rise. Leybovich is currently a product manager at IPC Systems Inc.

A “Final Tether Consulting Report” compiled by accounting firm Friedman LLP shows that Tether held roughly $443 million in various bank accounts on Sept. 15. At the time, Tether tokens were valued around $420 million, according to CoinMarketCap. However, the names of the actual banks these funds were supposedly in are concealed and Friedman LLP did not examine the accuracy of Tethers records.

Tether said in a statement “given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame.”

As of Tuesday, roughly $2.3 billion worth of Tether are outstanding, and Friedman LLP no longer works with Tether.

The post Major Exchange Site Bitfinex and Tether Subpoenaed by U.S. Regulators appeared first on CoinCentral.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube