Spend enough time in the crypto-community and you’ll witness debates over Proof of Work (PoW) and Proof of Stake (PoS). Fans of PoW will argue that it’s the transaction system Satoshi Nakamoto had in mind for cryptocurrencies. Those in favor of PoS, on the other hand, will argue that mining is outdated, inefficient, and insecure compared to staking.

So you might be wondering, what’s the difference, is one actually better than the other, and why is it better? Well like most things here at Coin Central, we’re not here to give you our unsolicited opinions, but we are here to give you some objective information that might help you determine for yourself which proof has best proven its worth.

Proof of Work

When Satoshi Nakamoto created Bitcoin in 2009, he envisioned a currency that would rely on a trustless and distributed consensus system. This would allow Bitcoin to be decentralized both in technological and financial terms. For instance, when you transact money through a trusted system, a third-party (think banks, credit/debit cards, PayPal) handles these transactions in terms of debit and credit. If Mark sends Sally $100 dollars, the institution will debit Mark’s account $100 dollars and credit Sally with $100. All of the money is handled by and within the third party, so none of the transacted funds belong to either Mark nor Sally until they are withdrawn from the system.

Bitcoin differs from traditional financial hubs by being trustless. This is not to say you can’t trust Bitcoin and blockchain with your money. In fact, it’s quite the opposite. Bitcoin’s trustless nature allows for a peer-to-peer exchange without the need for a third-party mediator.

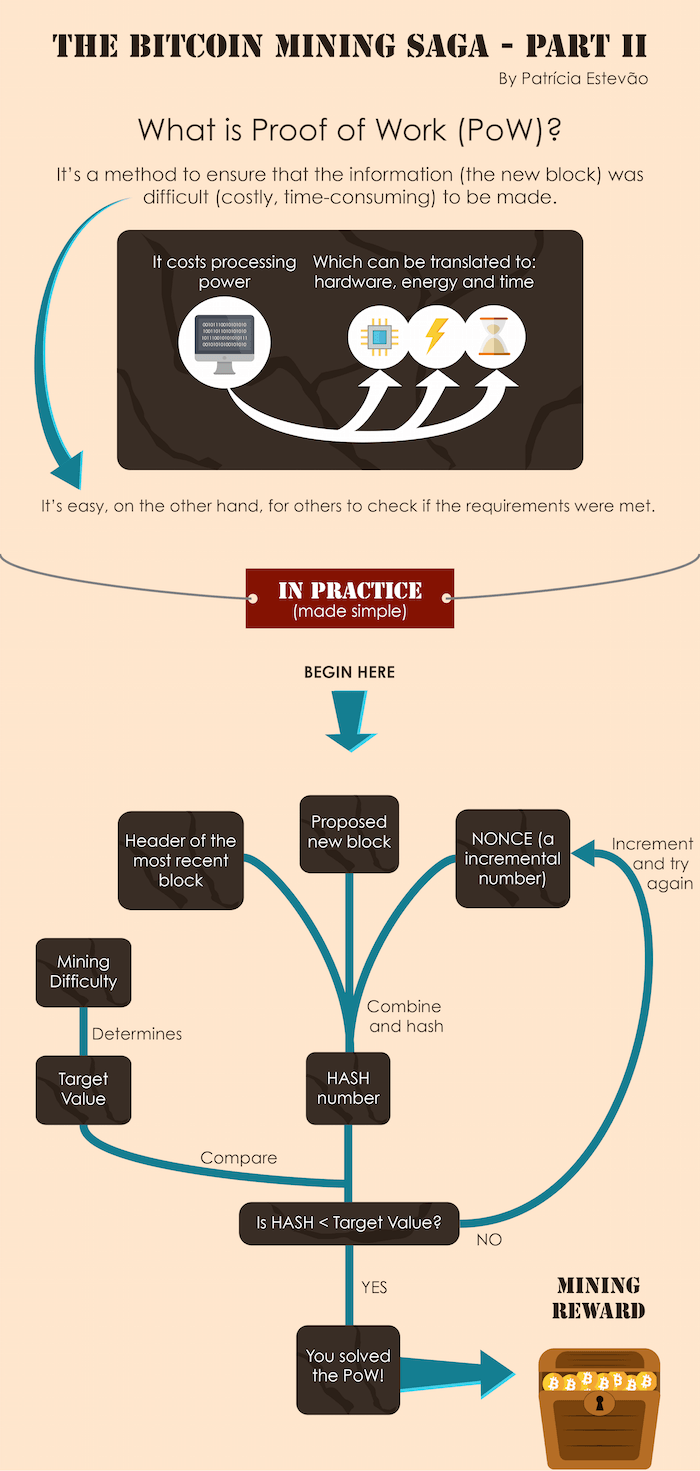

The traditional mediators are replaced with miners, and these miners work on behalf of Bitcoin holders to see that transaction are successfully processed. In order to see that these transactions are approved, miners commit their computer’s processing power to solve the encrypted algorithms within each transaction. This is what we mean by Proof of Work.

Under a Proof of Work system, miners compete to verify that all the transactions within the candidate block (the block currently being built) are legitimate. To do this, they must solve the encrypted puzzles that verify the integrity of the transacted coins. The first miner to solve these puzzles receives an amount of the transacted currency, also known as a block reward. Once the problem is solved, the transactions create a block that is stored as a public ledger on the blockchain, and the miner announces the solution to the entire network.

As you can see, PoW is dictated by competition and computational output. Imagine an international math competition wherein a previously unsolved proof (the block) is given to the competitors (the miners). Whoever solves this proof first is awarded a prize (block reward), and the solved proof is then posted on the internet for all to see (the block being established in the blockchain).

Proof of Stake

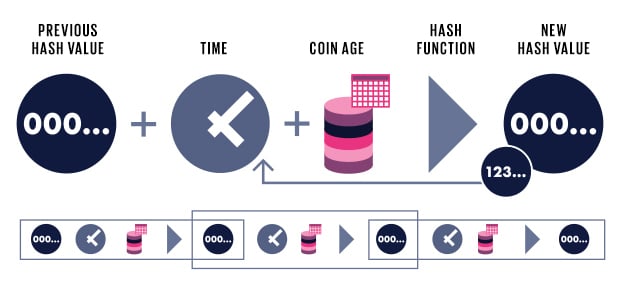

Proof of Stake differs entirely from Proof of Work. Instead of building blocks through work output, the creator of a block is determined by their share, or stake, in a currency.

Under this system, forgers (the PoS equivalent of a miner) are chosen to build blocks based on their stake in a currency and the age of that stake within the blockchain’s network. For instance, let’s say you hold 500,000 QTUM. First of all, allow me to hypothetically congratulate you on your fat stacks. Getting back to the example, under the Proof of Stake system, you’d be more likely to create the candidate block than someone with 100,000 QTUM. To go even further, if you had been holding your 500,000 QTUM in the same address for a year, you’d be more likely to generate the next block than someone who also has 500,000 QTUM but who has been holding it in a network address for half a year.

To give you another analogy, imagine if your odds to win the lottery increased based on a) how much money you put into it and b) how long you had been buying tickets. Now, you won’t make millions of dollars by staking your favorite PoS currency, but you can make some nice passive income on top of your investment gains.

It’s important to note that, for a stake to be chosen, it must be held on an address within the coin’s network. So if you were holding QTUM like in the above example, you would need to store it in QTUM’s core wallet. There are also no block rewards in the PoS system. Seeing as there’s no work-centric incentive to outcompete other miners, forgers are only awarded transaction fees.

There’s also a marked difference between Delegated Proof of Stake and regular Proof of Stake, but that’s for another article at another date.

PoW Coins:

PoW/PoS Hybrids:

–Dash

-Stratis

–Pivx

PoS Coins:

-OmiseGo

–QTUM

-Ardor

Key Differences and Takeaways

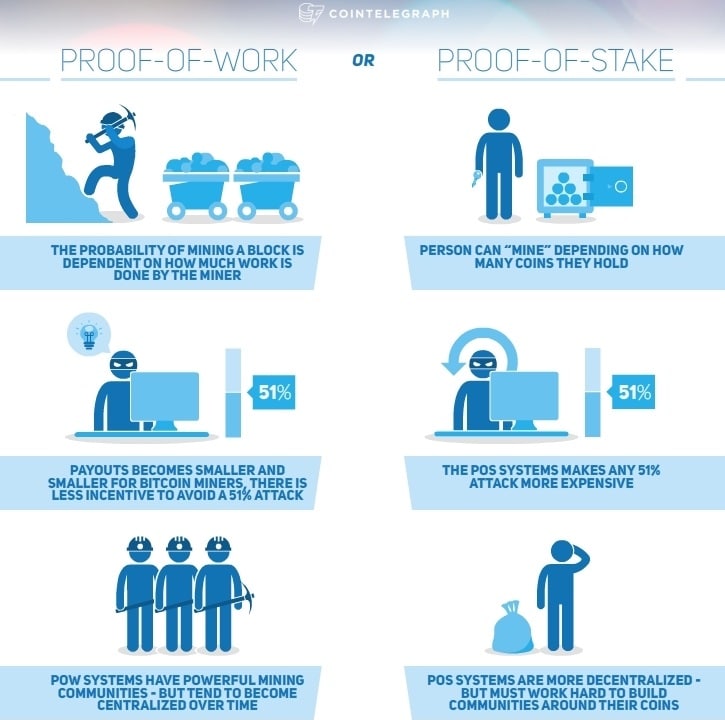

Proponents of PoW will tell you it allows crypto to more effectively function as a currency. The PoS model, they argue, incentivizes users to stake their coins for extended periods of time, thereby making them inactive.

PoS fans, however, will defend their system’s overall superiority. For starters, it solves the problem of energy consumption that Bitcoin has created. As more transactions and users are added to Bitcoin’s network, more computing power will be needed to accommodate growth. The more computing power that is added to the network, the more the hashrate increases in difficulty. With more difficulty comes an increase in the amount of work a computer must generate to generate blocks, and this increased output leads to greater energy consumption. Bitcoin’s growth and mining difficulty are exponentially tied to energy consumption, and critics see this as an unsolvable issue under the PoW model. It’s the reason that Bitcoin’s network alone consumes more energy than 159 countries.

Proof of Stake also defends against 51% attacks on the blockchain. As we’ve seen with the recent Bitcoin Cash and Bitcoin civil war, disproportionate mining power can lead to de facto centralization of a blockchain’s network. In order to control a majority of a PoS blockchain, a validator would have to own 51% or more of that crypto’s overall supply. So in order for someone to attack Cardano’s blockchain, for instance, they would have to $609,286,157.643 worth of Cardano to do so. We don’t see that happening.

Both PoS and PoW have their ups and downs, and we’ll be excited to see how the market responds to coins that utilize either system or a hybrid of both. One last thing to keep in mind for PoW, however, is that once all a currency’s coins are minted and circulated, block rewards will cease to exist. This may incentivize PoW coins to update to a PoS model, but only time will tell.

Related

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube