Digital currency markets are coasting along after an enormous move on Friday of more than 20-40%. The entire cryptoconomy is hovering around $249 billion as it gained a whopping $30 billion very quickly this week. Crypto prices corrected a touch since the spike, but are still well above the lows seen just a few days ago.

Also read: FATF Starts Checking How Well Countries Implement Crypto Standards

Digital Currency Market Prices Hold New Foundations

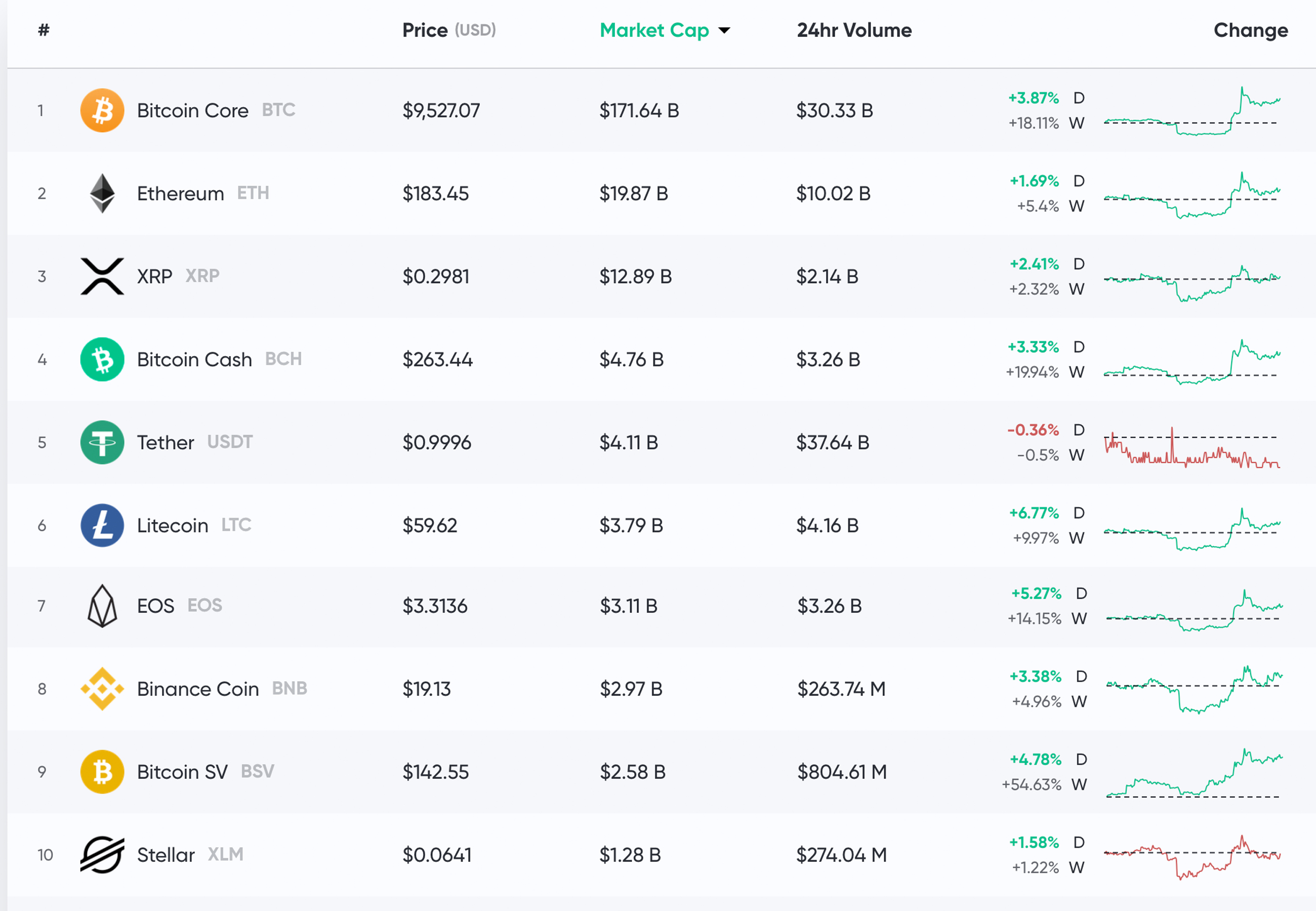

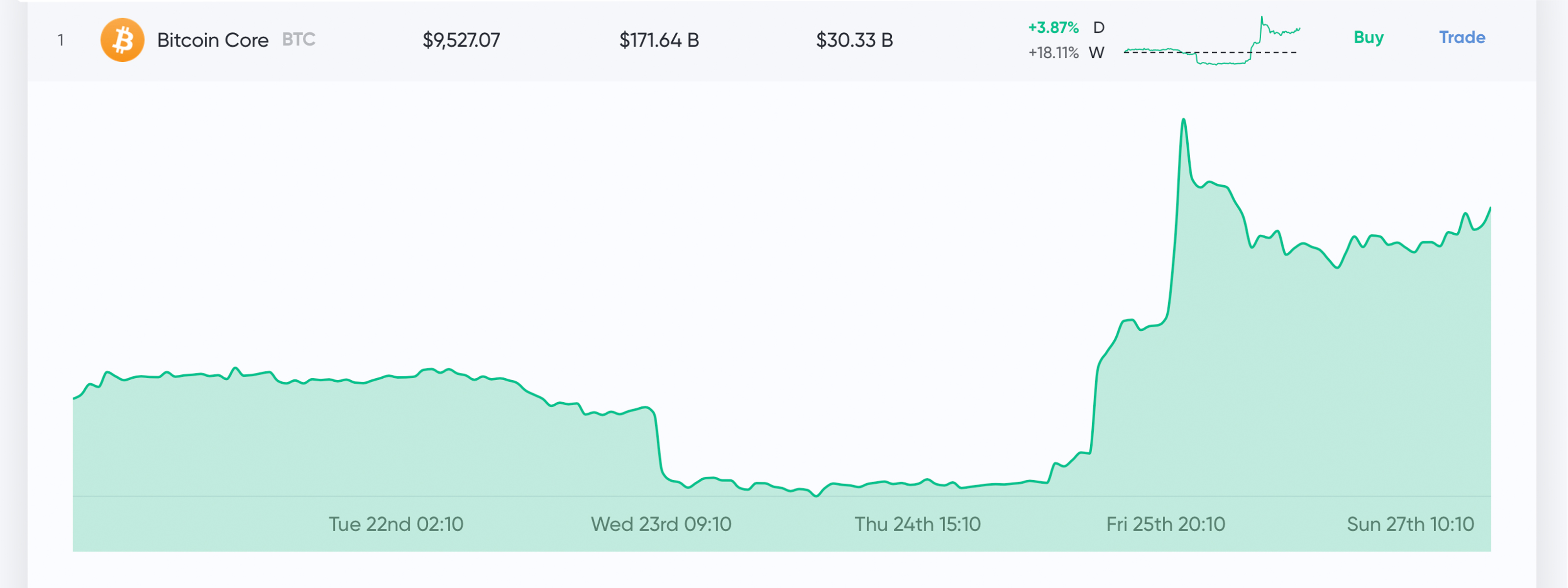

Over the last three days, digital currency prices have seen the biggest price jumps in over a month and cryptocurrency enthusiasts are far more optimistic toward the future. For instance, on Friday, October 25 the price of BTC increased from a low of $7,300 to a high of $10,295 during the afternoon trading sessions. Bitcoin cash (BCH) saw prices lift from $215 to a high of $277 per coin. Since then, prices retraced a hair southbound losing some value, but crypto prices are much higher than they were during last week’s bearish cycle. At the time of writing, the price per BTC is roughly $9,527 per coin and the digital asset is up 18% for the week. Behind BTC is ETH which has gained 5.4% during the course of the last seven days. One ETH is swapping for $183 a coin and there’s $10 billion in ETH trades worldwide.

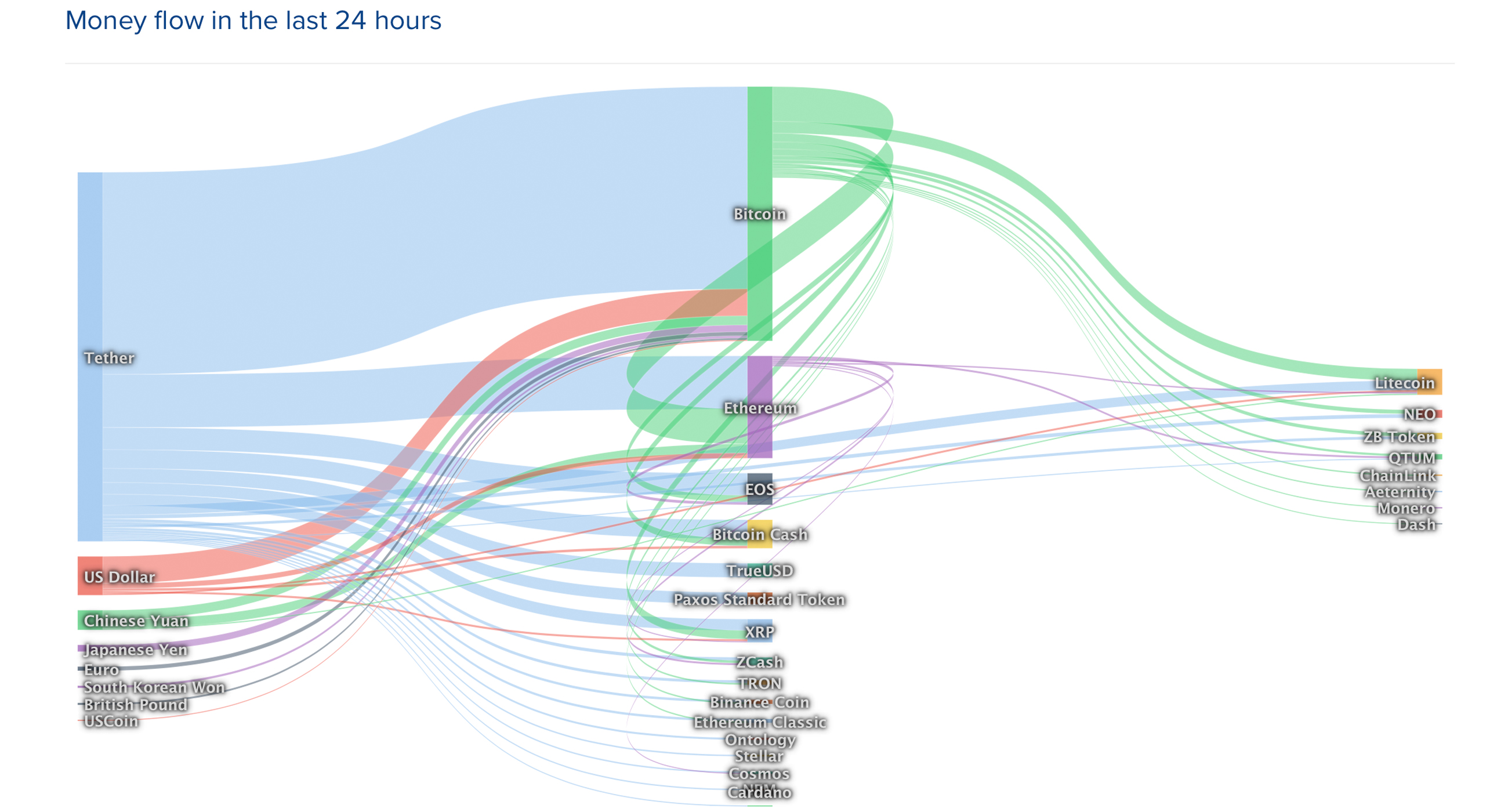

Ripple (XRP) saw the least gains this week, only climbing 2% so far. Each XRP is trading for $0.29 and there’s around $2 billion in global trades this Sunday. Lastly, the fifth position is held by tether (USDT) after bitcoin cash (BCH) bumped tether out of fourth spot. According to Coinlib.io, tether is capturing just a little less than two thirds of every trade between nearly every top digital currency. Tether has around $36 billion of worldwide trades which is roughly $7 billion more than BTC.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) captures the fourth position in the top 10 market caps this Sunday as each BCH is swapping for $262 per coin. With $3.25 billion in global trades, BCH is the fifth most traded coin today below LTC and above EOS. BCH is up 2.8% on Sunday and the coin has gained 19.3% during the last seven days of trading sessions. The decentralized cryptocurrency has an overall market valuation of around $4.74 billion which is considerably higher than it was three days ago. The top trading pair with BCH today is USDT which is commanding roughly 62% of BCH swaps. This is followed by USD (17.7%), BTC (13.5%), ETH (2.58%), and KRW (2.38%). Right behind the top five pairs against bitcoin cash are the euro and honestcoin (USDH).

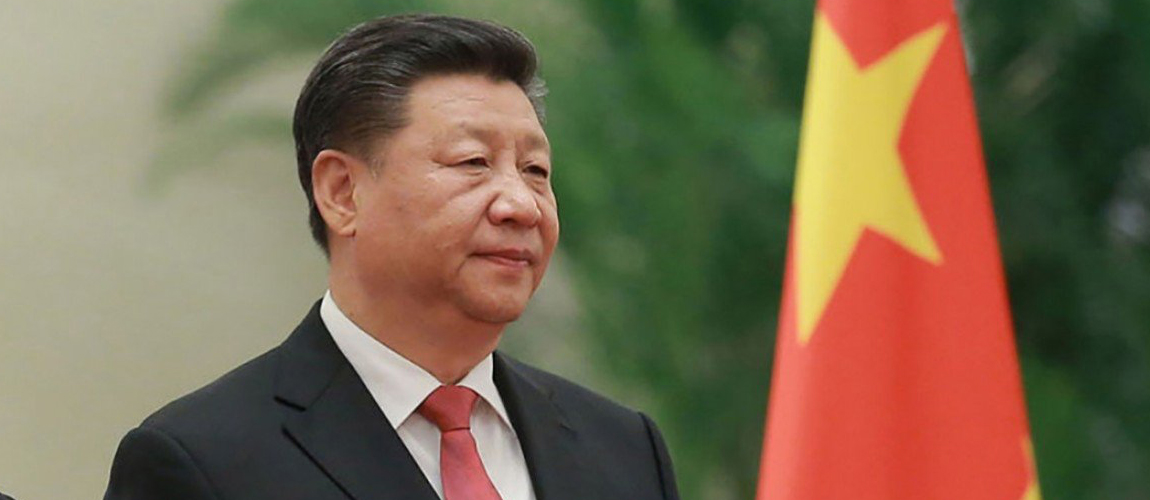

Chinese President Xi Jinping Embraces Blockchain Technology

In the last 48 hours, traders and speculators have been trying to guess why the price of BTC and many other coins spiked considerably on Friday. Some people have attributed the jump to the President of the People’s Republic of China Xi Jinping’s comments on blockchain technology. Xi Jinping’s comments follow the ban against trading cryptocurrencies in 2017 and the Chinese government has previously been negative towards the technology.

However, despite the angst against digital currencies and initial coin offerings (ICOs), the government has allowed blockchain projects to flourish. At the 18th Political Bureau of the Central Committee collective study in Beijing, Xi Jinping said that a “rule of law” should be applied to distributed ledger technology platforms.

“We must take the blockchain as an important breakthrough for independent innovation of core technologies,” Xi Jinping emphasized at the event. The President added:

We must clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.

John McAfee Doubles Down His Prediction

The infamous John McAfee doubled down on his forecast that the price of BTC will touch $1 million per coin at the end of 2020. McAfee says the price will reach $2 million by the end of 2020 as he’s changed his prediction three, times raising it every time. At first, McAfee said the price would be $500,000, but quickly upped the prediction and even told the public he would chop off his family jewels on live television if the price didn’t make it that high. “Run the f***ing numbers — If bitcoin is less than $2 million by the end of 2020, then mathematics itself is a flawed disappointment,” McAfee explained.

Xi Jinping’s Comments Helped Bitcoin Skip the Death Cross

According to a few analysts, three days ago BTC was heading toward a death cross scenario where the 50-day moving average dropped below the 200-day moving average. However, many market pundits believe Xi Jinping’s statements were the driving force behind the BTC price push. “Leading up to Mark Zuckerberg’s Libra hearing, bitcoin had sold-off as many traders put on bearish positions,” John Todaro, director of digital currency research for Tradeblock, said after the spike. “The technical set up looked negative, but then President Xi Jinping’s commentary around blockchain technology was an unexpected positive catalyst that caught some bearish traders off guard in my view, leading to the upward movement which likely brought in more speculators as BTC traded above key thresholds.”

The managing director of crypto derivatives platform Amulet, Marouane Garcon, agrees that the Chinese President’s optimism toward blockchain is a breath of fresh air.

“There were quite a lot of liquidations but I think it’s still mostly about President Xi’s announcement because people know that his green light will cause a ripple effect across China,” Garcon explained to the media. “The space needs China’s involvement — If China would’ve never banned crypto trading and exchanges the space would be a lot bigger today — Having China onboard, in my opinion, is just as good if not better than having America onboard.”

2016 Crypto Market Revival

After the past few weeks of bearish sentiment and the sudden bullish upswing this week a few observers believe things are looking an awful lot like 2016. The CEO of Sibex, Daniel Haudenschild, detailed that the spike is due to the BTC halving that’s forthcoming. It is estimated that the BTC block reward will chop in half on May 14, 2020, depending on the hashrate processing power.

“We are coming into a time where the Bitcoin price is being affected by halving, with Bitcoin’s inflation rate recently dropping from 3.8% to 1.8%,” Haudenschild remarked. “Prices typically increase significantly leading up to the halving and have been followed both times by a 10x move just a few weeks later. The 2016 halving started a rally that brought BTC prices from $600 to $19,000 just one month after the halving.”

Overall the market prices of all 2,000+ digital assets have improved a great deal which has given enthusiasts and traders more hope. Today crypto bulls are trying to press past upper resistance as Sunday’s trading sessions have been feverish. Global trade volume has doubled and there’s now been $100 billion worth of cryptos traded in the last 24 hours.

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency prices referenced in this article were recorded at 11:45 p.m. EST.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Getty, Coinlib.io, Wiki Commons, bitcoinblockhalf.com, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Update: Crypto Prices Hold Steady After Massive Bullish Spike appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube