Last week cryptocurrency prices bounced around after a majority of coins dropped in value on August 21. Today on August 26, digital currency markets have gained around 1.52%, gathering $4 billion since the initial slump. Despite the volatility, cryptocurrencies have consolidated and a few speculators believe a breakout is on the cards that could send prices sky-high or plunge below the current support.

Also read: Send Token Payouts With Ease Using Bitcoin.com’s SLP Dividend Calculator

Top Crypto Coins Slowly Move Northbound

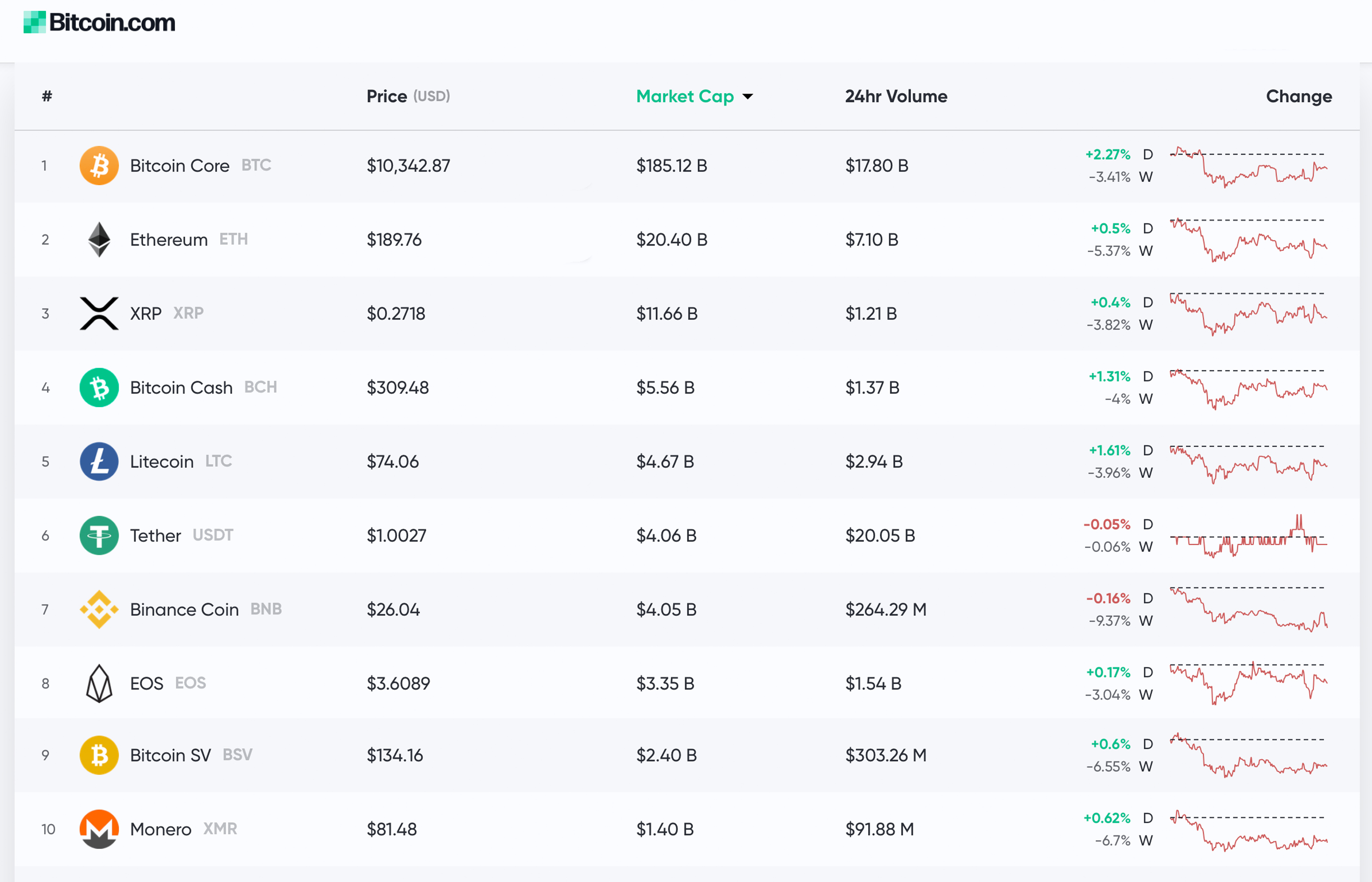

On Sunday, August 25, the price of bitcoin core (BTC) gathered steam again after tumbling below the $10K zone. During the late evening trading sessions, BTC prices vaulted upwards $500 in a matter of minutes and many other markets also saw gains. Currently, the price of BTC is hovering around $10,342 per coin and there’s more than $17 billion worth of trade volume today. BTC’s market cap is $185 billion this Monday, which is 69% of the $267 billion dollar market cap of all 2,000+ coins.

BTC/USD markets are up 2.27% today but are down 3.4% for the week. Following BTC is ethereum (ETH), which is up 0.5% today and down 5.3% over the last seven days. ETH is trading for $189 a coin and has an overall market valuation of about $20.4 billion. Ripple (XRP) is selling for $0.27 and prices have dipped in value over 3.8% in the last week. The fifth largest market valuation is held by litecoin (LTC) which is swapping for $74. LTC lost 3.9% last week but over the last 24 hours, LTC is up 1.61%.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) markets have been holding steady and at press time one BCH is swapping for $309. BCH/USD is up 1.31% today but lost 4% over the course of the week. On Monday, August 26, BCH is the sixth most traded coin below EOS and above XRP with $1.37 billion in trade volume. USDT is the strongest pair trading against BCH with 56% of all global trades. This is followed by swaps with BTC (26%), USD (7.7%), ETH (6.4%), KRW (1.9%), and EUR (0.43%). The exchanges swapping the most bitcoin cash include Coinbene ($182M), Hitbtc ($70M), Okex ($50.4M), Digifinex ($46.6M), and Bibox ($38M). Bitcoin cash transactions in the last 24 hours were around 39,310 with a daily average this week just above 40K.

With a Possible Economic Crisis on the Horizon, Will BTC Act as a Safe Haven Asset Like Gold?

As the global economy shudders and prepares to embrace a looming recession, precious metal markets have rocketed while cryptocurrencies have seen lighter inflow. Some digital currency influencers are not so sure BTC is a safe haven asset right now. Speaking in an interview on the financial newswire Bloomberg, Spencer Bogart, a Blockchain Capital executive, is not quite convinced that an economic crisis is on the horizon. “When you think about really severe crises taking place, a liquidity crunch, another global financial crisis, I think that bitcoin will struggle to do very well from a price perspective,” Bogart explained. Despite the possible struggle, Bogart thinks in the “longer term bitcoin will absolutely be a safe haven.”

In another interview on Nasdaq Trade talks, Nelson Minier, Kraken’s over-the-counter (OTC) lead executive, shared similar opinions. “I’m not so sure that it’s a safe haven asset yet, but I do think that it’s starting to act like one. I think that people are starting to portfolio manage, are starting to come in slowly. And when the market is getting shaky you saw Bitcoin rise, I mean, you wouldn’t see that before, it was trading like a risky asset,” Minier said. Just like Bogart, however, Minier remarked that BTC will likely fall into that category, stating “we’re heading that way for sure.”

BTC Price Reacts in Real-Time to Trump Trade War Tweets

On August 23, U.S. President Donald Trump told the American public that the trade war between the U.S. and China would continue to escalate. Immediately after the Trump tweets the price of BTC/USD spiked and well-known macro trader Alex Krüger noticed a chart milestone. “Today was the first time BTC reacted sharply in *real-time* to a Trade War breaking headline or USD/CNY fix,” Krüger tweeted. “As far as I can recall, this, in fact, is the first time BTC reacts in real-time to any event outside of crypto,” the trader added.

…Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

— Donald J. Trump (@realDonaldTrump) August 23, 2019

Similarly to gold, some speculators believe digital currencies can act as a safe haven asset in order to hedge against macroeconomic uncertainties. The tensions between the U.S. and China also made the price of gold jump more than 2.4% and the price per ounce of gold (Au) right now is $1,530.

Bitcoin Cash (BCH) Markets Still Indicate an Upward Trend

According to cryptocurrency price analysts, bitcoin cash (BCH) looks poised to break out northbound. The trader Mehak Punjabi explained on August 26 that the price of BCH may continue to rise higher and could target a price of around $330 per coin. “By comparing the price of BCH coin from its lowest value which was $283.29 on 15-Aug-19 at 05:00 UTC and the current trading price, BCH indicates a bullish trend by 10%,” Punjabi said. “The CMF indicator also reflects that the bitcoin cash price is indicating an upward trend. The 7-day high price of the coin $326.88 points the next target of BCH towards $330.” The analyst added:

Trading in the BCH for a long term will yield great returns and dividends.

Crypto Markets May Experience Extreme Economic Fallout for the First Time

Overall, most crypto supporters are still positive about the long term game but are still uncertain about the current period and whether digital currency markets will remain vibrant during a deep economic recession. Currently, the economies in Latin America are floundering and many countries in South America are dealing with severe inflation compared with the rest of the world. Economic growth in India is falling below average and the country’s Finance Minister Nirmala Sitharaman has plans to focus on priming lending and foreign funding. Moreover, Time reports that 34% of U.S.-based business economists are concerned that the U.S. will see a deep economic recession within the next two years. Most of the economists who participated in the National Association for Business Economics survey believe that America will see the economy tumble hard by the end of 2021.

With the macroeconomic uncertainty in the air and signs of distress, it is still hard to picture what crypto markets will do during an economic fallout. Bitcoin itself was born from the ashes of the 2008 economic crisis and has yet to experience a global recession of that magnitude. For now, with all the ‘doom and gloom’ happening worldwide, seeing a macro hedge spur from gold markets is normal. Despite over-exuberant optimism, no one really knows if cryptocurrencies such as BTC will act in the same manner if the global economy worsens. For now, it’s a case of wait and see.

Where do you see the price of bitcoin cash and the rest of the crypto markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Crypto Fear & Greed Index, Trading View, Bitcoin.com Markets, and Coinlib.io.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Update: Economists Envision Global Recession While Crypto Prices Soldier On appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube