All eyes have been glued to cryptocurrency markets over the last week as a great majority of digital asset values plummeted to their lowest prices since last year. There’s been a slight price recovery and some consolidated sideways action taking place as some market observers have noted an attempt to reverse the trend may be in the cards. However, others think even though we could see a slight comeback it could end up materializing into another “dead cat bounce” leading to a bit more capitulation.

Also read: Content Creators Can Earn BCH Using the Honest Cash Platform

The Top Cryptocurrencies Have Been Suffering From Deep Losses

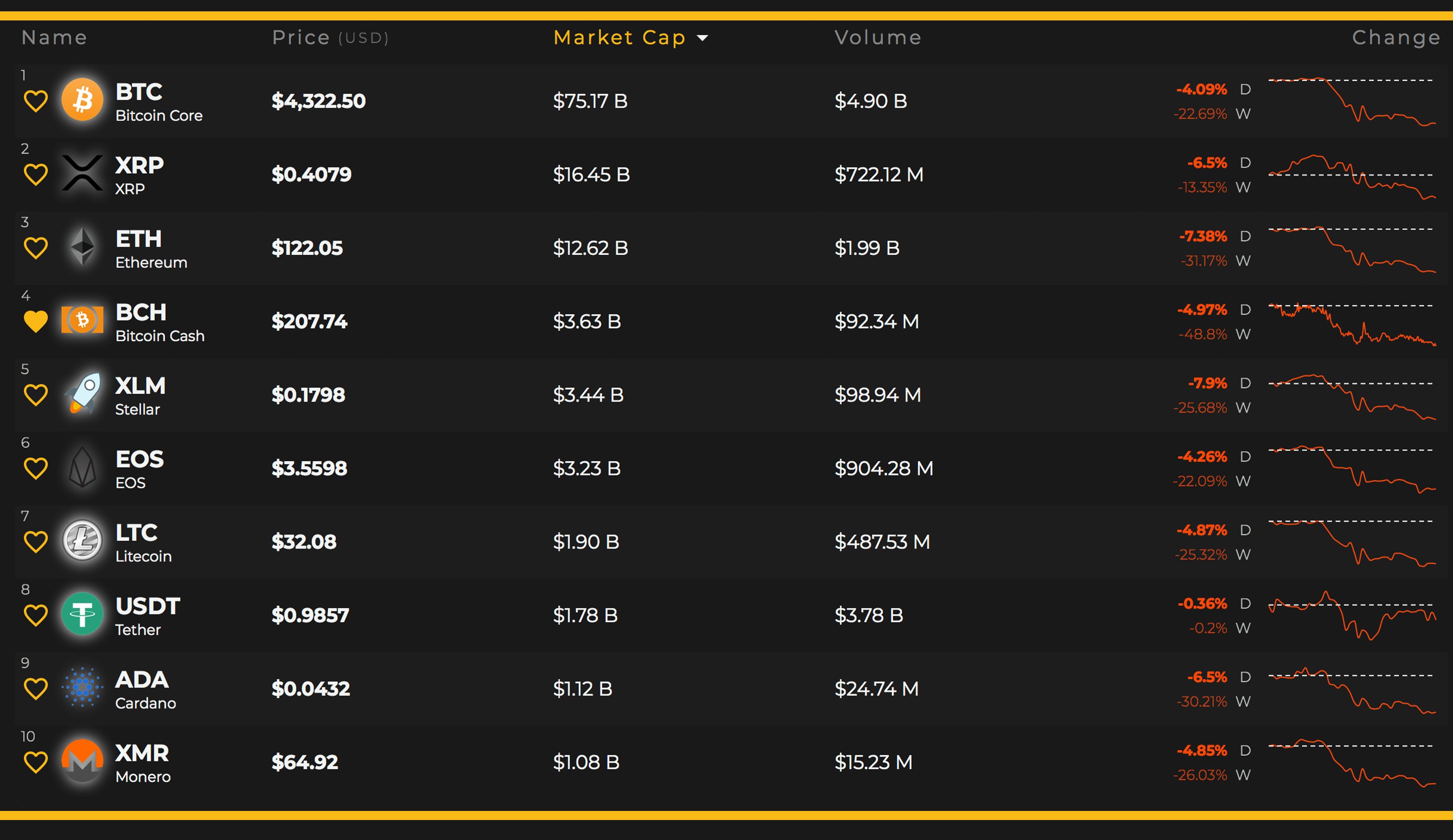

For those who were hoping for some bullish cryptocurrency markets toward the end of the year, looking at the charts right now may be a bit depressing. The entire digital asset economy has lost well over $70 billion in the last two weeks and the plunge has come to a halt for now. This Friday, Nov. 23, the top digital currencies are down between 4-8% over the last 24 hours and the entire crypto-market capitalization is hovering around $144 billion. Cryptocurrency global trade volume, in general, is weaker than last week with only $14.8 billion swapped over the last 24 hours.

Bitcoin core (BTC) markets are down 4% today and one BTC is averaging a spot price of around $4,322. BTC has lost 22.6% over the last seven days and commands a total market valuation of about $75 billion. Ripple (XRP) commands the second spot today as each XRP is trading for $0.40 per coin. The currency’s market capitalization currently sits at $16.4 billion and has lost 13% over the course of last week. Ethereum (ETH) is showing a spot price of about $122 per ETH and seven-day charts show ETH markets have lost 31%. Lastly, Stellar (XLM) holds the fifth position but has been moving back and forth for the fourth position with bitcoin cash (BCH) a few times already. XLM is trading for $0.17 per coin and markets have dropped around 25.6% over the last seven days.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) commands the fourth position among all 2000+ coins but as we mentioned above the cryptocurrency has been battling with stellar (XLM) in order to hold the fourth spot. At the time of publication, bitcoin cash is trading for $207 per BCH but markets are down 4.9% over the last day. BCH markets have also lost 48% over the course of the last week since the fork that took place on Nov. 15, which ended up splitting the chain.

Volume has gradually been climbing back up, however, as many exchanges are coming back online allowing BCH deposits and trading. At the moment, over the last 24 hours, BCH global trade volume is around $92 million. Similarly to our last two market updates, ethereum (ETH) is still the top traded currency pair with BCH today. ETH commands 39.2% of the global BCH trade volume and this is followed by BTC (34.7%), USDT (15.5%), KRW (7%), and the EUR (2.5%).

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart on Bitstamp shows bears have managed to push the value down extremely low. The Relative Strength Index (RSI -39) still indicates oversold conditions and the MACd is meandering in the middle as well. The two long and short-term Simple Moving Averages (SMA) on the 4-hour BCH/USD chart show the two have recently crossed hairs. Currently, the short-term 100 SMA is above the longer term 200 SMA, indicating the path toward the least resistance is the downside.

However, both trendlines are very close and could seemingly cross hairs again in the near future. Order books on both sides are pretty massive right now, which means there’s plenty of resistance above and some foundational support below the current vantage point. Bulls need to muster up some extraordinary strength to surpass the current position all the way until $260 for some smoother seas. On the backside, bears don’t have it so easy either, as there is pretty solid support up until the $165 region.

The Verdict: End of the Year Cryptocurrency Trend Reversal Becomes More Uncertain

Overall, there is uncertainty for those hoping for cryptocurrency markets to show bearish-to-bullish trend reversal toward the end of 2018. Digital assets are not the only markets hurting, as traditional assets worldwide have also seen deep price declines over the last two weeks. For instance, tech stocks and high yield bond markets have seen fervent selling and drastic drops in value across the globe. In addition to economic uncertainty on the global front, Tom Lee, the co-founder and head of research at Fundstrat believes certain circumstances have led to cryptocurrency market sliding. “Crypto-specific events have led to greater uncertainty in the crypto market, including the contentious hard fork for Bitcoin Cash,” Lee explained the day before the BCH split.

Do you think cryptocurrency market prices will recover any time soon? Let us know what you think is in store for digital asset markets in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Markets Update: Crypto-Capitulation Causes Uncertainty Toward Year End Prices appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube