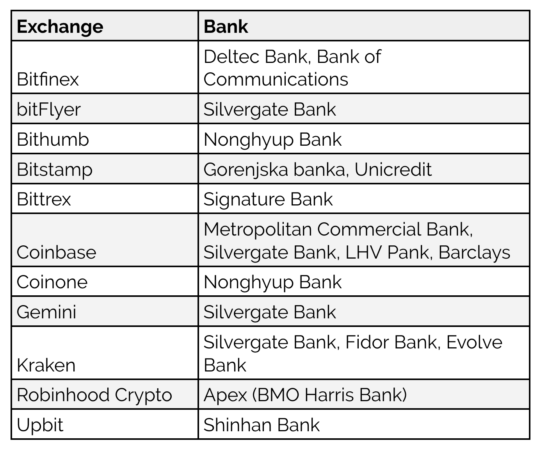

The Block has published a new report detailing where some of the world’s largest cryptocurrency firms house their holdings. The report specifically notes interesting trends happening with cryptocurrency exchange Bitfinex, whose financial practices have been the subject of controversy this year.

Bitfinex previously banked with Noble Bank, but recently switched over to Deltec Bank. Tether also banked at Noble Bank, before it was put up for sale, and has also moved over to Deltec Bank. At the same time, Bitfinex’s deposits are currently being processed through the Bank of Communications via a private shell company. Bitfinex also tried banking with HSBC for a short time.

The shell game Bitfinex has played with its stored holdings has generated criticism from customers in the past. Public criticism of Bitfinex reached its peak last month when deposits and withdrawals were being heavily delayed, with rumors circulating that the exchange had become insolvent. Similar criticisms were launched at Kraken when the exchange reported shortages during the crypto boom last year.

Finding suitable banking solutions has been an ongoing struggle for many cryptocurrency firms. When crypto companies move their business between banks, it shakes the confidence of investors and opens the door to possible illicit activity. This has historically been one of the many criticisms launched at the digital money market by institutional investors.

Most exchanges are aiming to ameliorate these concerns by being more transparent with the public when it comes to the movement of funds. However, an investigation by The Block suggests that Bitfinex is the only major exchange to open accounts “using alternative names.”

Suggested Reading : Learn what we believe to be the best crypto exchanges.

One big-name exchange missing from the list is BitMex. The exchange is one of the largest by trading volume but operates out of the remote Seychellas islands. BitMex does not offer USD trading, thereby forgoing the frustrations stemming from US banking.

However, banking difficulties aren’t only encountered in the US. Unhashed has been closely covering the ongoing frustrations for crypto firms in dealing with the Reserve Bank of India (RBI). Earlier this year, the RBI pressured Indian lawmakers into instituting outright bans on any bank in the country conducting any crypto-related business.

Unhashed.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube