Stephane De Baets visualizes a future where every asset, whether a small business or property, can be tokenized and sold on the blockchain– and he’s putting his tokens where his mouth is.

Stephane is a Belgian-born real estate, hospitality, and investment entrepreneur with a penchant for standing out in each respective industry. As the Founder and President of Elevated Returns, an international asset management firm, Stephane launched the first major tokenized commercial real estate auction to sell a portion of his ownership stake in one of his properties– the idyllic Aspen St. Regis Resort in Aspen, Colorado. Stephane is also the Founder and Owner of Chefs Club, a restaurant group with a rotating residency of world-class chefs at its locations in Aspen and New York City.

Stephane De Baets in a pool, courtesy of https://twitter.com/stephanedebaets

Stephane believes the tokenization of the St. Regis will lead to an avalanche of interest from real estate developers and mainstream investors into the blockchain industry. As a self-described “ultra-conservative old man in capital markets,” Stephane posits that his colleagues just need to see tangible proof of tokenized assets in action to see the value of allocating capital to blockchain-based investments.

“Blockchain is about giving people the tools to do something that was restricted to a few selected individuals,” says Stephane. “Blockchain is a similar evolution as going from fax to email– was for communication. It made it easier and more efficient. People started finding new applications for communication through email, and then SMS.”

Stephane’s decade-long journey into blockchain isn’t just about making more money– there’s a rebellious element to his investment philosophy. Stealing fire from the gods and democratizing access for the masses is a sentiment not unfamiliar to those in the cryptocurrency industry. In Stephane’s case, this prodigal fire is the ability to invest in projects generally outside the purview of the ordinary investor. At the heart of Stephane’s key message is the disintermediation of the finance industry and creating a direct path for the creation and sharing of value between businesses and their customers.

“At Elevated Returns, we think the current world is too elitist,” says Stephane. “Access to capital is limited to a very few privileged individuals. Giving access to this upper echelon of investing on a democratic basis, a la tokenization, would go a long way towards promoting equality. It’s not normal that five companies control an amount of wealth that is greater than the rest of the NASDAQ 100 combined. I think tokenization is low hanging fruit. I have a great deal of trust and conviction that sooner or later, there will be a great disintermediation that takes place no matter what, and the people should be ahead of it.”

The St. Regis Aspen, the hotel that the AspenDigital tokens represent partial ownership of.

Editor’s note: The following article is written as educational and informational, and is not to be construed as an endorsement, sponsorship, or investment advice for any of the entities discussed within. Cryptocurrency is an inherently very risky asset class, and always do your own research and consult a licensed financial advisor before making any investment or purchase.

Luxury Real Estate 101: A Walk Through with Stephane De Baets

Stephane walks us through the traditional process for luxury real estate entrepreneurship.

“If you want to own a hotel, you realistically need to be plugged into a very selective network of people that can show you what’s available for sale,” says Stephane. “Then, you need to raise the capital– typically a portion of debt and a portion in equity. Then you need to do your due diligence, bid for the asset, negotiate the contract, execute the contract, and if you’re successful, you will own property. Making an income on that property means you must also be good at effectively managing the asset to turn a profit, which is the excess of cash flow over the debt servicing and other expenses. When you flip the property, you make a capital gain.”

This is the old way of higher-end commercial real estate, and according to Stephane, a small, incestuous world with a limited number of players.

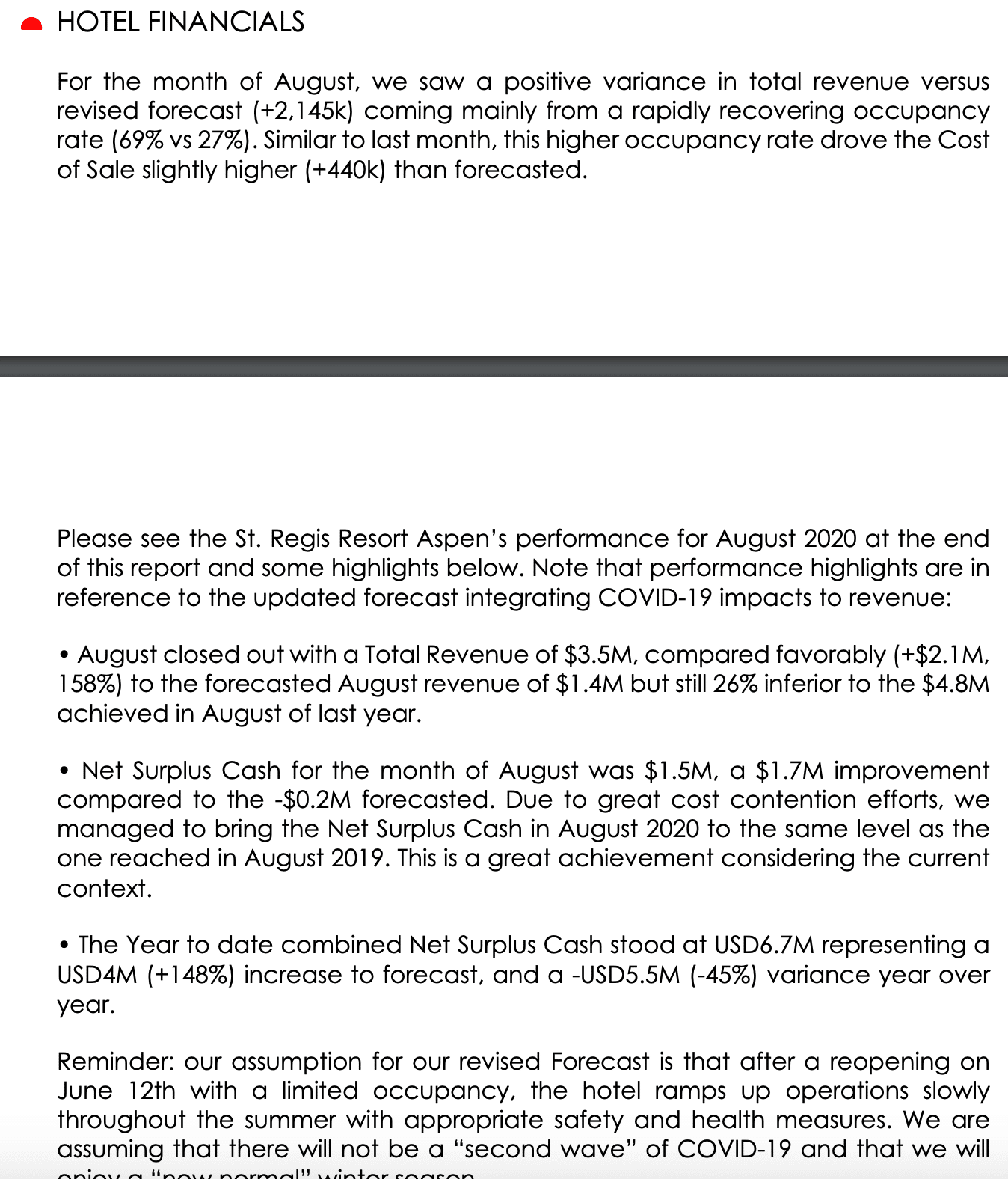

A screenshot of The AspenCoin August 2020 disclosure statement on tZERO

“There isn’t much value added beyond solving those cashflow inefficiencies,” says Stephane. “Tokenization changes the game completely. As a retail investor, you can go to a marketplace and choose a token corresponding to a property. For example, you can go on tZERO and look at AspenCoin, the digital token for the St. Regis. There is a disclosure statement, and you can see the performance of the asset.”

tZero, is a project launched by Overstock that functions as a platform for asset holders to tokenize their assets. This system allows average investors to piggyback on the work of someone like Stephane, a process usually done privately.

So, what incentivizes someone like Stephane has to allow the public to reap the fruits of his labor?

Stephane describes the experience of owning a luxury property as wonderful in terms of bragging rights, but short-lived.

Owners like Stephane can relish the beauty of their property, but this romanticism is soon dampened with the understanding that they aren’t able to access their equity without the tremendous amount of complications that come from selling the property.

“Owning a property basically means you have a balance sheet that tells how much you owe the bank and the value of your equity,” says Stephane, reducing the glamour of luxury property ownership to accountant-speak. “There is no price discovery, nor is there a way for you to monetize that equity position other than selling the hotel. When you tokenize your asset as the asset holder, you have price discovery and know the full value of your equity. Better yet, you have liquidity. Let’s say you get married and are starting a family. You can sell off a few tokens of your asset. If you think the token price is too cheap, you can buy them back.”

Having your money locked in an asset rarely caters to the ebbs and flows of life; as the owner of a tokenized asset, Stephane suggests, you have the flexibility to increase or decrease your position and know the current going rate of your equity. To that end, giving asset owners the luxury of liquidity also makes that asset that much more attractive to hold.

What is AspenDigital?

AspenDigital is the token associated with Stephane De Baet’s tokenization of the St. Regis in Aspen, Colorado– a prestigious getaway for society’s pinky-up upper echelon tucked into the Rocky Mountains.

How has the tokenization of assets been applied so far?

“We created a digital security as part of an ownership privilege program,” says Stephane. “For us, it’s wonderful because we’re able to reward token holders like a true owner. We save on marketing costs, travel agent costs, and so on. The cost to us, the property owner, is minimal and the benefit to the consumer is maximum.”

According to Stephane’s description of the tokenomics of AspenDigital,

- If you own 10,000 tokens for 30 days or more, you’re entitled to a 20% cash rebate on your spend during your stay.

- If you own 100k tokens: 35% cash rebate.

- If you own half a million tokens:50% cash rebate.

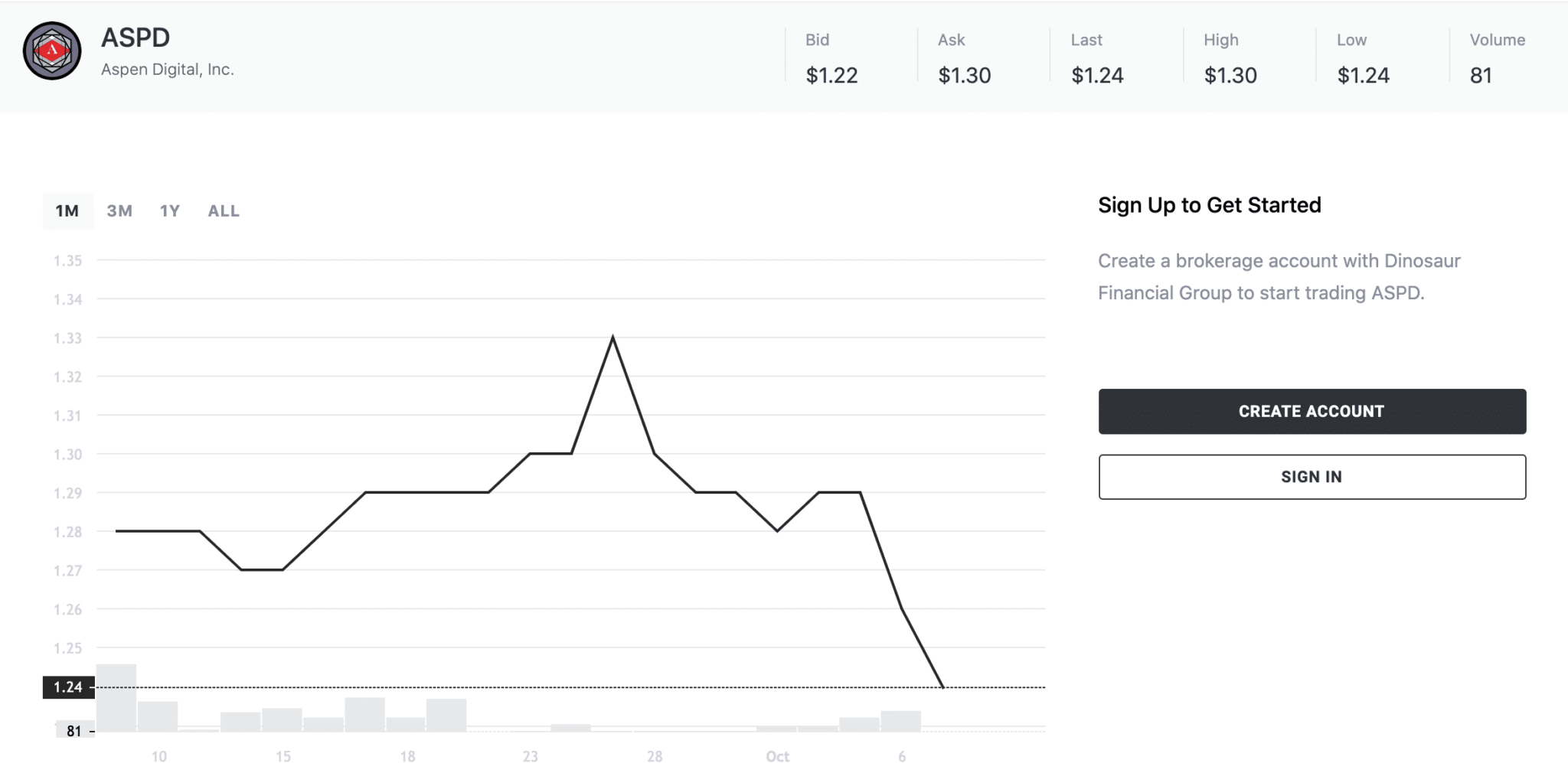

Stephane implores us to think about a patron spending Christmas or New Year at the St. Regis: The average room costs about $2,000 per day around this time, and if you come to stay for seven days with a family that requires two rooms, you’ll be looking at a $28,000 bill. If the current price of one of these tokens on tZERO is $1.31, 10,000 tokens will run you about $13,100.

AspenDigital on tZERO

This lump sum of tokens entitled you to 20% cashback on your stay, or about $5,600 back, which is a bit over 42% return on the value of your tokens for that one stay.

I’m dreaming of a world where I don’t have any bank loans, and I’m just sending rebates to people buying pre-paid stays at my hotel. I will prove that this is a cheaper way for an owner to finance a property than a traditional mortgage.

In other words, Stephane wants to cut bank loans out of the hospitality industry, and build the infrastructure for business owners to raise capital from their top customers.

“We want to find a way to repay a hundred percent of our debt and yield the benefits of savings on your cash flow to the consumer,” says Stephane. “All that the bank is doing is bridging a mismatch in cash flows as entrepreneurs build businesses to provide services to customers. Your consumer is actually the party giving you cash to pay your employees, pay your bank loans, and make a profit. The ultimate line of disintermediation is to get funding right from the consumer.”

Direct fundraising from consumers is not a new concert. For example, Elon Musk did it recently with Tesla, selling the Roadster at a high price point to raise capital. Selling your future product tends to be the cheapest source of capital.

How can an asset holder leverage the perks of tokenization?

The problem with the current system is that value that would otherwise be devoted to improving the business-consumer relationship leaks into the coffers of third-party intermediary banks.

“If you raised capital from banks and private investors, you must factor loan obligations and interest into the equation,” says Stephane. “The bank will say, Stephane, I need my 6% interest payment. And then you have private investors and partners asking for their 15% return on their money. So, as an asset manager, I’m primarily incentivized to pay my debts first, and this often isn’t aligned with providing the absolute best experience for the consumer.”

You need to make sure you can pay your owners and investors, or otherwise, you’re in a hot seat.

The service provider and consumers are tainted by that evil intermediary called banking. If we can remove the bank out of the equation and have consumers fund us directly, we can focus our efforts on building a better relationship between us as a service provider and our consumers.

How can security tokens or utility tokens change the world of real estate? When businesses are funded by customers directly, Stephane asserts, an entire asset class can be changed:

- The valuation of the asset becomes somewhat irrelevant. Someone buys an asset because they want to use it in the future at a better price. They want a good deal. They don’t want to own the asset, they want to access a service in the future at a more attractive price.

- Tokenization simplifies the relationship between a service provider and a consumer. For example, as a hotel provider or hotel operator, your job is to provide the best service to your consumer. You want them to be very happy with the experience he receives at your establishment. If you’re raising money from your customers, who now become partial owners of your property, you’re better incentivized to invest further into the customer experience. Similarly, your customers are incentivized to support your business.

“In order to offer perks, you need to own the asset,” says Stephane. “If someone is promising perks on someone else’s asset, I get uneasy. In order to be successful in the model we’re developing, you need to be ready to own the asset you’re offering perks on.”

This is why, Stephane concedes, traditional banking relationships will always have a place in business. In order to hold assets without your own capital, you need someone to lend you money. However, lending must evolve with the world, not antagonize it.“I see the lending market changing significantly in the next decade,” says Stephane. “Think about it; if you buy Aspen Digital, you have the leverage which is basically the mortgage of the asset. Let’s assume I pay the mortgage tomorrow and issue more tokens. You should be able to show a lender you own tokens that represent unlevered ownership over a hotel and ask for an increase of leverage on your wallet. I think you’ll eventually start seeing asset-based leverage moving to consumer base leverage.”

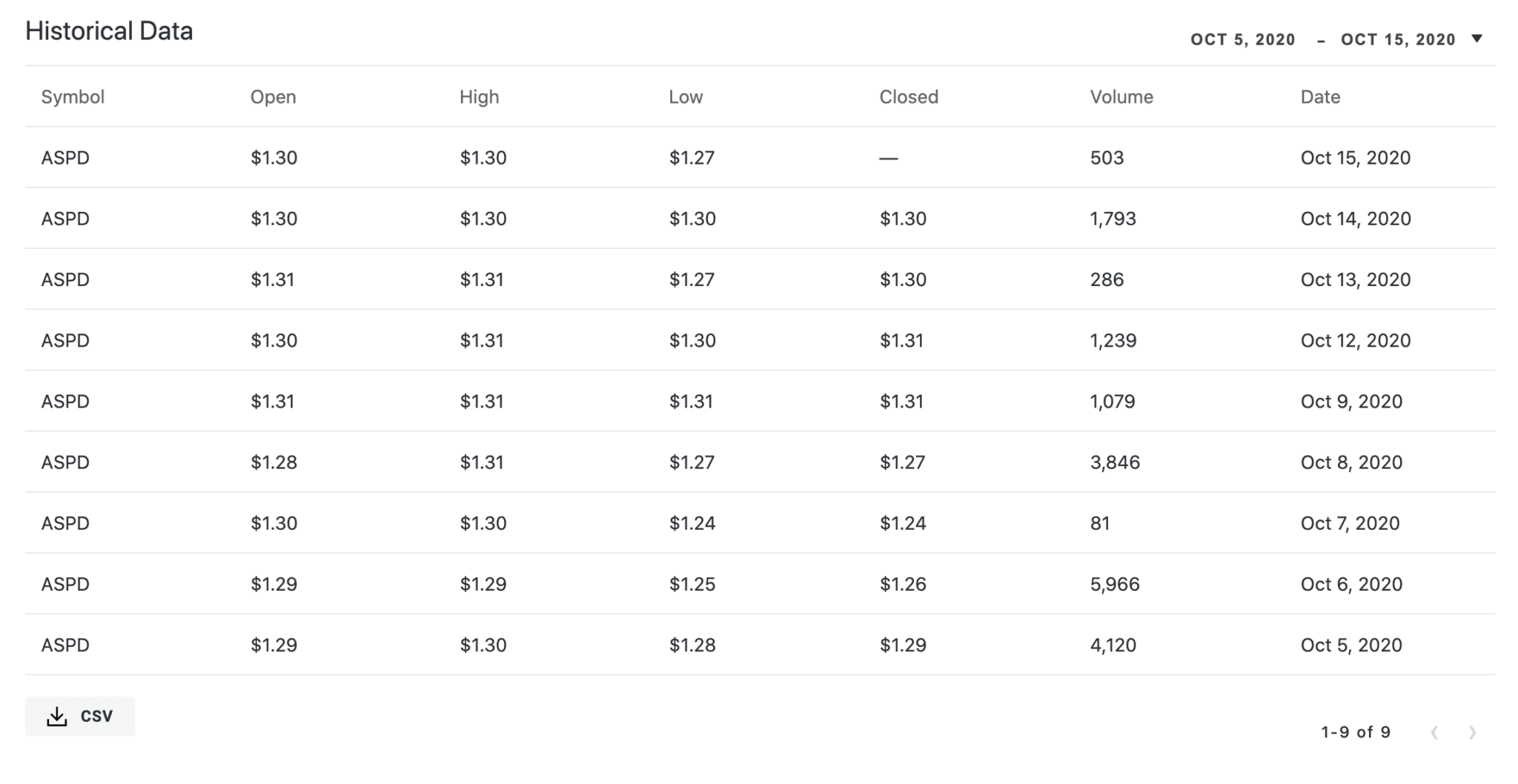

A screenshot of AspenDigital’s trading history on tZERO.

Stephane sees a future where digital asset holders, whether that be Bitcoin or a coin representing a luxury mountain hotel, can seamlessly take out loans from mainstream banks.

*Note: There are a few cryptocurrency loan providers such as BlockFi and Celsius that provide crypto-collateralized loans on cryptocurrency deposits.*

There is also a significant utility of these tokens, Stephane posits, that shouldn’t be overlooked.

“Utility means people have a use for it, which creates natural liquidity into the asset class,” says Stephane. “The perks you receive from your tokens can grant token holders a value much greater than potential capital gains.”

Waxing philosophical, Stephane describes cash as merely a medium to acquire goods and services in the future.

“Cash is an instrument to create an exchange,” says Stephane. “If you don’t need that instrument because you have access to the services simply by holding the asset and not spending it, you’ll change the relationship between people and money.”

In other words, instead of value slipping out of the business-customer relationship into the hands of third-party intermediaries, customers can achieve entirely new benefits usually only granted to the high-rolling owners.

Regulation and Innovation: A Historically Toxic Relationship

Stephane’s journey into blockchain seeking an alternative to a very aging capital market and banking system, a search spanning decades.

“The fact that we’re still relying on the Securities Act of 1933, dealing with paper securities, and using a clearing agent is amusing in that it’s nearly 100 years old. The whole finance industry and derivative of finance were really ready for a revolution, and I believe the ability to tokenize assets on the blockchain is a rallying cry.”

Stephane encourages a future where regulation grows alongside innovation, rather than impeding it.

Stephane De Baets PHOTO CREDIT: BENJAMIN LOZOVSKY

“As entrepreneurs, we need to be respectful of the authorities and regulators, because while innovation can open new doors, it can also enable scam, fraud, and abuse,” says Stephane. “Collaborative regulation ensures we don’t shut down an entire enterprise just to protect the masses from a very small few negative actors.”

To truly stimulate the evolution of a landscape, you need a healthy regulatory environment, infrastructure to onboard new users, and market leaders.

“If you consider 2017 as the first mainstream wave, we’re looking at the second one now,” says Stephane. “We’ve had the perfect element of a relatively stable economy to allow innovation to stabilize before this second wave, and now this more unstable economic environment pushes the need to deliver financial aid straight to the hands of the people. It brings us to consider what are the actual strengths of the legacy banking environment, and how well-suited is it to the people’s best interests?”

Coming from capital markets, Stephane argues, this revolution isn’t a matter of if; it’s a matter of when, who, and how.

“I can say within five years, everything’s going to be digital, including the Dollar and Euro,” says Stephane. “We will have a digital wallet in our hands and we will be able to manage our assets without having to go to the bank or an ATM machine and withdraw money or deposit money.”

Final Thoughts

Access to capital isn’t equally distributed across the world, and as Stephane notes, it’s a very small network of people that tend to have the highest access. The businesses that bring in the highest returns aren’t usually available as investment options for the everyday Joe.

The primary lever of any business relationship sits in the hands of the party who holds the capital. This capital has historically rarely left the grips of banks and society’s ultrawealthy, and the barrage of tax breaks and bailouts in the United States, in particular, have made sure that big money stays put.

However, by getting rid of the capital intermediaries by democratizing access to investments by tokenization, the luxuries of society’s ultrawealthy will finally trickle down to the masses. At least, that’s the argument Stephane De Baets is making with the tokenization of the St. Regis hotel.

These intermediaries, a category the Elevated Returns Stephane De Baets admittedly falls into, don’t act in the best interest of the Hotel Owner Stephane or the Customer Stephane. However, the multi-faceted Stephane seems to align his professional identities under one banner: the democratization of access and the disintermediation of the engorged third-party of banks, and he wants to use AspenDigital to revolutionize the real estate industry.

The post Stephane De Baets Owns the St. Regis Aspen Resort, and You Can Too: Enter Tokenization appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube