$20 Billion Are Set to Flow into Crypto Custody Services

The Gaping Hole in Crypto Custody and the Firms Trying to Fill It

Crypto Custody Firms Race to Greet a “Herd of Institutional Investors”

According to a Bloomberg report published yesterday, Goldman Sachs is the latest company to throw its hat into the ring of the crypto custody game.

“In response to client interest in various digital products we are exploring how best to serve them in this space,” said a spokesperson for the company. “At this point we have not reached a conclusion on the scope of our digital asset offering.”

The timing of the alleged exploration into the cryptosphere is somewhat odd, considering that GS chief investment officer Sharmin Mossavar-Rahamani said that “our view that cryptocurrencies would not retain value in their current incarnation remains intact and, in fact, has been borne out much sooner than we expected.”

But but but 3 days ago Goldman said https://t.co/3hZCGl9Jgf

— NINK (@NINK) August 6, 2018

Nevertheless, sources close to the matter said that discussions about the project are ongoing and that no official timeline has been set. However, Goldman Sachs’ entry into the crypto custody space is evidential of at least one thing: there is money to be made.

What is Crypto Custody and Why is it Necessary?

Simply put, custodial services for cryptocurrency are services that keep cryptocoins in safe storage with insurance–that’s really it. However boring this particular service may be, it is absolutely vital to the survival of cryptocurrency industry, both for practical and legal reasons.

Despite the bearish trend that has plagued most crypto hedge funds this year, the crypto hedge fund industry is still charging forward. More than 250 such funds have appeared over the past year and a half; hedge fund manager and billionaire Stephen Cohen placed his bets on crypto hedge fund Autonomous Ventures as recently as last month.

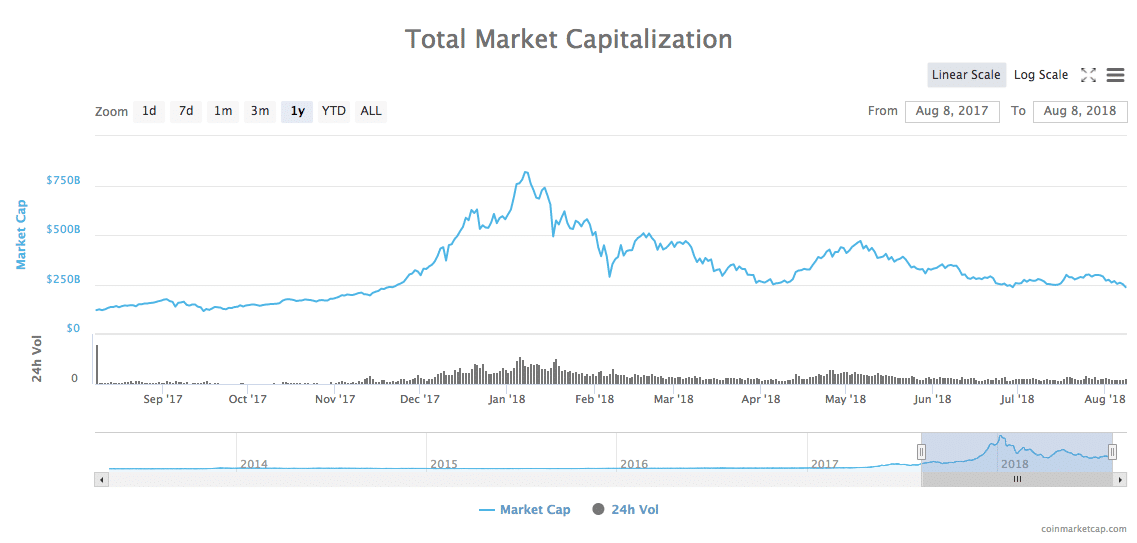

Indeed, even though the crypto markets haven’t managed to recover from the bloodbath that took place during the first quarter of 2018, total market capitalization is still double what it was a year ago; the price of Bitcoin sat at $6,630 at press time, nearly double its valuation of $3,431 on the same day last year.

The Exploding Crypto Markets in 2017 Left Some Crypto Hedge Funds Out of Compliance

When many of these funds originally appeared last year, the astronomical upward leaps and bounds that were happening across cryptocurrency markets suddenly created a compliance problem: hedge funds worth more than $150 million are legally required to store their assets with a qualified custodian.

This was reiterated in a letter published by the SEC in January of this year. “The 1940 Act imposes safeguards to ensure that registered funds maintain custody of their holdings,” it said. “These safeguards include standards regarding who may act as a custodian and when funds must verify their holdings.”

Therefore, a number of “small” crypto hedge funds found themselves outside of compliance. American computer scientist and entrepreneur Mike Belshe told Wired that at least two dozen hedge funds were out of compliance as of February, but this number may have shrunk in the subsequent months.

On a more fundamental level, security remains one of the cryptocurrency industry’s main pain points. Binance CEO ChangPeng Zhao said that security is “paramount” to the survival of the cryptocurrency industry. “I don’t think it’s a key component for mass adoption, I believe security is the fundamental pillar for the industry to continue existing. It’s paramount for crypto and blockchain’s survival,” he told Forbes last week.

Some Estimate that the Advent of Widespread Crypto Custody Services Will Bring Big Money to Crypto

Indeed, the need for secure storage options for institutional investors may be more pressing than it ever has been. Last month, founder of crypto merchant bank Galaxy Digital Mike Novogratz said that a “herd of institutional investors” is coming straight for the cryptocurrency space.

Suggested articles

SoPay App Released, Offering Fast Transactions and SoPay’s Assets MiningGo to article >>

If he’s right, they’re going to need crypto custodial services to accommodate them.

Once an array of reputable custodial services have been established, even more investors will make their way into the cryptosphere. “There are a lot of investors where custodianship was the final barrier,” Samani said in a phone interview. “Over the next year, the market will come to recognize that custodianship is a solved problem. This will unlock a big wave of capital.”

An Estimated $20 Billion Will Be Held in Crypto Custody Services

Indeed, Kyle Samani, a managing partner at Multicoin Capital, told Bloomberg in June that “there are a lot of investors where custodianship was the final barrier.”

“Over the next year, the market will come to recognize that custodianship is a solved problem. This will unlock a big wave of capital,” he added.

In any case, Goldman Sachs isn’t the only major Wall Street firm to have its eye on the crypto custodianship market. JPMorgan Chase & Co., Northern Trust Corp., and Bank of New York Mellon Corp. have all been exploring crypto custody services of their own.

Additionally, crypto firms Ledger and Global Advisors joined with investment bank Nomura Holdings Inc. to create a custodial consortium called Komainu.

Coinbase launched its institutional-grade custody service in July. Sam McIngvale, who is leading the project, told Bloomberg that he estimates that $20 billion will make its way into crypto custody services once they’re widely available.

Coinbase was allegedly in talks with Anchor Labs, a digital custody startup, before deciding to offer its own service. However, the conversation eventually fizzled out. Axios later reported that Anchor received an unknown amount of funding from Andreessen Horowitz to launch its own digital custody services.

Coinbase Custody is officially open for business, providing secure storage of crypto assets for institutions in both the US and Europe. Before the end of the year, we hope to bring this offering to Asia as well. https://t.co/KDtMQ5TT3B

— Coinbase (@coinbase) July 2, 2018

Bankex announced the launch of its own cryptocurrency custody service in June; Trustology plans to launch its service in September. Dozens more are on the way.

Small, Agile Early-Adopter Companies Gear Up for Competition with Major Wall Street Firms

Big-name Wall Street firms and fintech companies may be the most well-known entities to enter the crypto custody race, but they certainly were not the first.

Greg Gilman, co-founder of incubator and investment firm Science Inc., told Wired that “people that were willing to take risks relatively early and stake out a little claim were able to grow significantly, while more established and larger, name-brand firms have been very quickly passed by in this area.”

“You had to have guts and faith to do this 12 months ago. It didn’t require a lot of either to do this six months ago.”

One of these early players in the crypto custody sphere, Kentucky-based Kingdom Trust, was founded all the way back in 2009. Although the firm didn’t start offering custody services for cryptocurrency until late 2017, the company described its crypto holding services in a Wired report as its fastest growing asset class “by far.” Eventually, the company was acquired by BitGo.

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, established its custodial services for crypto as far back as 2016.

The Early Bird Gets the Worm

While a vast number of companies are developing or exploring the creation of crypto custody services, the firms who have managed to establish themselves within the space early-on have reaped the benefits of a sparse market.

In other words, competition hasn’t yet become fierce enough to drive prices down. For example, customers of Coinbase’s custody service must pay a $100,000 setup fee in addition to 10 basis points per month. They must also maintain a balance of no less than $10 million. Gemini charges a minimum fee of either 0.964% or $100,000, whichever is higher.

These figures are considerably higher than those charged by custodians of more traditional assets. However, the crypto custodians argue that their higher fees have been designed to cover the higher risks associated with cryptocurrency.

Either way, the companies headed for this space may be in to make some serious cash–even if the hedge funds whose assets they are protecting are not.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube