In our Expert Takes, opinion leaders from inside and outside the crypto industry express their views, share their experience and give professional advice. Expert Takes cover everything from Blockchain technology and ICO funding to taxation, regulation and cryptocurrency adoption by different sectors of the economy.

If you would like to contribute an Expert Take, please email your ideas and CV to [email protected].

For crypto maximalists, the idea of banks getting involved in cryptos is contrary to the very principles on which Bitcoin was created. Cryptos are supposed to replace banks, not enrich them. But the reality is that cryptos are not yet ready to take over a financial system that took decades to develop. Whether crypto supporters like it or not, cryptos will have to adapt to existing regulations.

Even crypto maximalists need good old banks and institutional investors to get in on cryptos to see the value of cryptos increase. On their side, regulators realize more and more that there is no putting the crypto genie back in the bottle, the financial system will have to learn to coexist with cryptos.

The challenge for traditional banking will be to adapt to this new world, whose infrastructure and core principles are so completely different from what has ever been done in a pre-Blockchain era. To understand how the two ecosystems need to evolve to accommodate each other, it is necessary to first understand how each of them works.

You are your own bank, but…

The whole point of cryptos is that you do not need to trust a third party to hold your crypto assets. As long as you control your private keys, you are the only one able to initiate transactions and you do not face any counterparty risk, you are effectively your own bank. While this is great for individuals who want to reclaim their “monetary sovereignty” to quote Trace Mayer, this is not ideal when it comes to institutional investors.

Trusting institutional investors’ internal systems to safe-keep potentially billions of dollars in cryptos is a scary prospect. All it would take is one tech savvy employee to steal the cryptos. Remember that in the decentralized world of cryptocurrencies, transactions are final and immutable once recorded on the blockchain (unless the community decides to carry a hard fork, but let’s not get there). It is therefore not advisable that each institutional investor develop its own solution to hold the private keys of the cryptos it owns.

Enter custodians

In the past few months, while the market was dealing with the aftermath of the crypto frenzy of late 2017, solutions were quietly being built to allow institutional investors to finally get in. According to Mike Novogratz, founder of Galaxy Digital, 98% of the trading activity so far has been driven by retail investors. This is not how it was supposed to happen, at least not according to Wall Street. Retail investors usually come last to the party, after VCs, Wall Street and institutional investors. But this time institutional investors had no way of investing in cryptos. Legacy regulations all over the world usually require these investors to rely on custodians to safe keep their assets or to build in-house custodial solutions. This has been designed to protect investors against fraud by separating asset managers from asset custodians. This way, asset managers cannot lie on what is in their portfolios nor their valuations as third parties are actually holding their securities on their behalf. It also greatly simplifies trading activities as securities are being held by a few global custodians on behalf of millions clients. Instead of having millions of individual investors all over the world each owning stocks or bonds, a few giant custodians hold most of the global financial assets on behalf of millions of customers (Bank of New York Mellon has custody of $33 trillion of assets while JP Morgan has $28 trillion under custody).

Many companies have been making announcements at or after the Consensus conference. Ledger has developed technical solutions for custodians while Coinbase is launching a custodial service for example. Once these solutions are up and running and provided that institutional investors get approval from their investment committees to enter the crypto space, the market is likely to see large inflows of fiat currency. Having to rely on a few and most likely heavily regulated custodians will reduce the risk that smaller, less tech savvy institutional investors get targeted by hackers. At the same time, the larger the custodians, the more they will pose a systemic risk to the whole sector in the event of a massive theft of their cryptos…

Crypto exchanges having been wearing too many hats

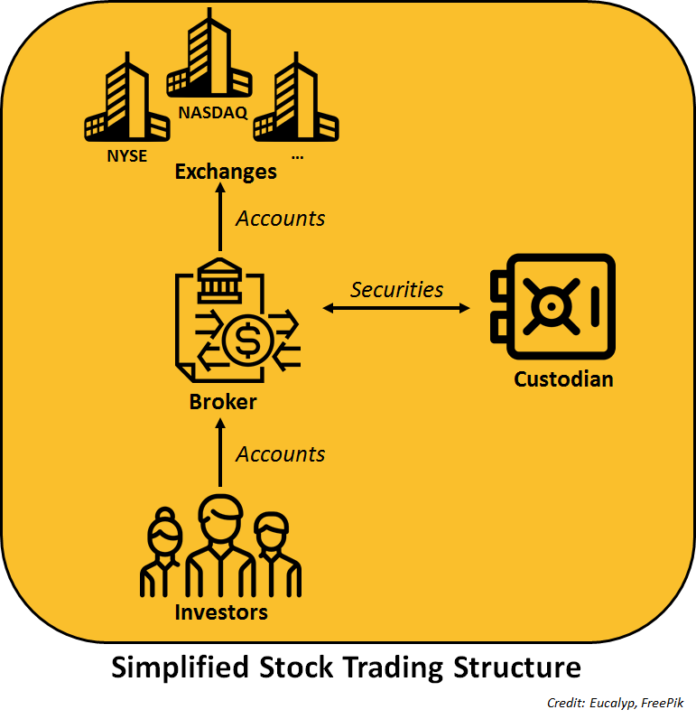

Investing in the stock market has been made easier and easier in the past decades. What many investors may not realize is the mechanics that underpin the simple act of buying stocks. When one wants to invest in stocks, one simply opens a brokerage account, funds it with fiat currency and one can subsequently start buying and selling stocks. When a buy or sell order is initiated by an investor, the broker is going to route it through several exchanges in order to find the best execution price. Once the trade has been executed, it usually takes a few days to settle (yes, days…). Once the trade has been settled, the stock is effectively transferred to the brokerage account of the buyer. The trader may not even be aware of which exchange has been used to execute the trade. Whether NASDAQ, NYSE, IEX or any other exchange was used does not matter, the stocks bought are registered to the brokerage account of the trader. Investors do not need to have any account with any exchange, the brokerage firm is the one with accounts with the various exchanges. But this is not how it works in the crypto space, not at all.

In the crypto ecosystem, exchanges have been playing all three roles of brokerage firms, exchanges and custodians, a recipe for disaster. There are many reasons why financial markets evolved the way they did. Over the course of decades of financial crises, bankruptcies and frauds, regulations have been refined to protect investors. In the traditional finance world, exchanges do not hold any of the assets that are traded on their platform, all they do is provide an engine that matches buy orders with sell orders. But since exchanges are the gateway to cryptos, most people have assumed that they were no different from their brokerage accounts and that they benefited from the same level of protection as with a regular brokerage account, not understanding the concentration of risks underneath.

Centralized exchanges have been and will remain at the mercy of hacks because of the vast amounts of cryptos they control. It can never be said enough, if you leave your cryptos on an exchange, they are not really your cryptos. As long as an exchange is holding your cryptos on your behalf, you do not control them and you are at the mercy of hackers that are attempting to steal private keys from the exchange. Once you buy cryptos from an exchange, you should immediately withdraw them to your own wallet, this way only you control your private keys and you are shielded from hacks that may target exchanges.

“In the crypto ecosystem, exchanges have been playing all three roles of brokerage firms, exchanges and custodians.”

To solve this problem, a second generation of exchanges is emerging: decentralized exchanges such as IDEX or EtherDelta. These exchanges do not hold your cryptos on your behalf but simply provide the trading engine. Through smart contracts, traders can exchange cryptos without having to rely on a third party in the middle to hold their cryptos. This type of exchanges have become increasingly popular for ERC-20 tokens built on top of the Ethereum Blockchain.

The large number of crypto exchanges has also created a very fragmented market where price inconsistencies can be exploited by arbitrageurs. However, large arbitrage opportunities are unlikely to last for long as more and more brokers are entering the market with new trading platforms. These new solutions will enable institutional investors to execute large trades over multiple exchanges, which will enable them to optimize the price at which they buy or sell cryptos.

The blocks are falling in place

Over time, it is likely that the crypto ecosystem is going to look more and more like the traditional finance ecosystem with brokers and custodians, at least for institutional investors, which means that exchanges may go back to simply being matching engines instead of the one-stop-shops they are today.

Even though current prices are not reflective of the progress made in the whole crypto ecosystem over the past few months, the market is maturing fast and does not look anything like it did one year, two years or three years ago. Cryptos are on the radar of regulators all over the world, and it is a good thing because it is going to force the whole ecosystem to grow up from its current state of infancy. When and how this may end up being reflected in crypto prices is a much more difficult question to answer.

The views and interpretations in this article are those of the author and do not necessarily represent the views of Cointelegraph.com and the World Bank.

Vincent Launay is a finance specialist at the World Bank in Washington DC. He holds an MSc in Finance from HEC Paris and a CFA charter.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube