If 2017 was crypto’s year of growth and exposure, 2018 is certainly the year of its regulation and maturity. The fledgling industry spread its wings for the first time last year, but flew a little too close to the sun–now, governments around the world are focusing their regulatory efforts to create a safer and more mature crypto industry.

The United States has acted rather slowly to institute sweeping standards or regulations. A few states have taken steps toward making themselves more friendly toward the blockchain industry (like New York with its BitLicense), but nowhere in the US has truly managed to create regulatory ground fertile enough to really kick off a home-grown blockchain industry.

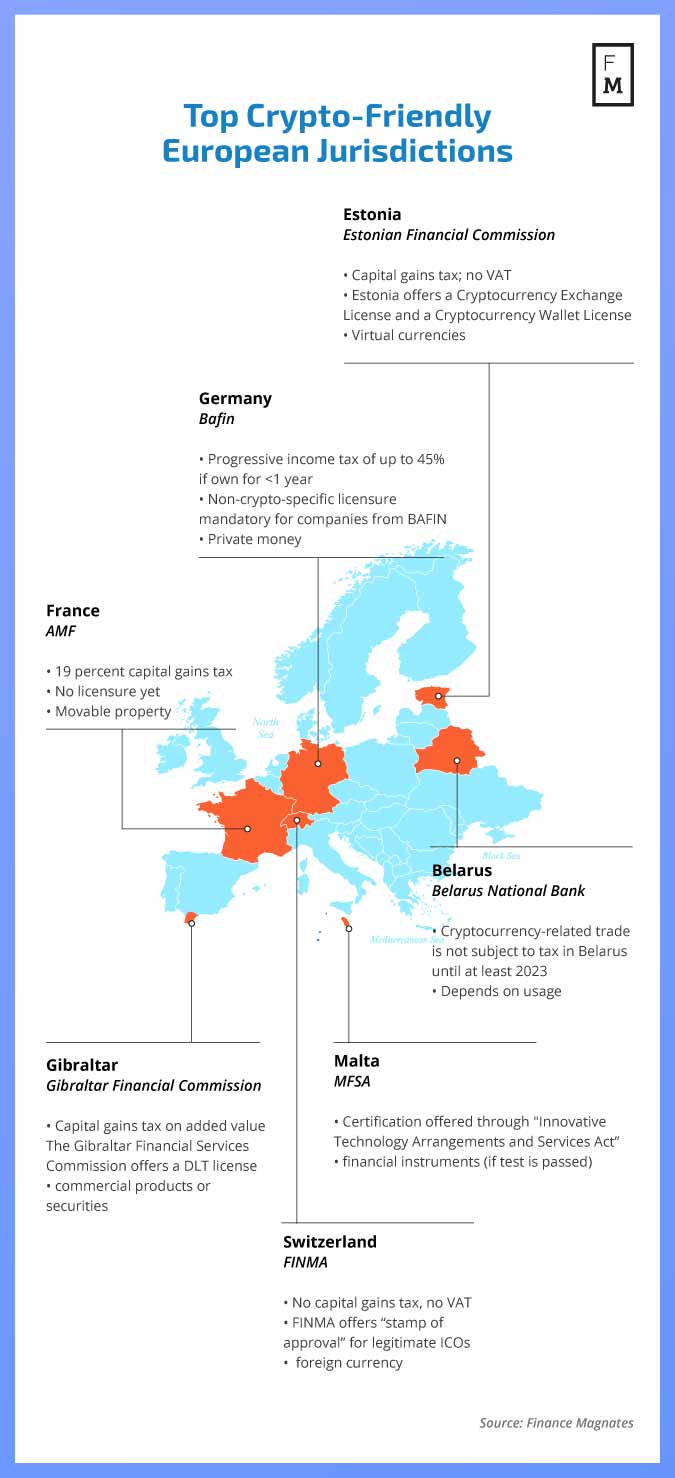

Europe is an entirely different story. It’s been argued that because EU member state governments and other governments in Europe have greater freedom to operate independently of the Union than states in the US, regulators can move with great agility to welcome new industries.

Such is the story of the blockchain industry in many EU member states. While the US has struggled to create effective legislation to support the growth of the cryptocurrency industry, certain governments across the EU have positioned their jurisdictions as extremely blockchain-friendly.

I. Switzerland

The first country to really put itself on the map as a global hub for the blockchain industry was Switzerland. The country operates as the home base for a large number of well-known cryptocurrency firms and organizations, including the Ethereum Foundation, Ethereum Enterprise Alliance, Bitcoin Suisse, and many others; it’s estimated that for the past several years, 14 percent of the ICO market has originated in Switzerland.

Berkowitz also sees Switzerland as “leading the [regulatory] pack.” The country’s unique system of governance, which places emphasis on local jurisdictions called ‘Cantons’, has allowed the government in places like Zug to quickly adapt to the needs of the blockchain industry.

Additionally, “FINMA, which is the Swiss financial regulator in charge of the licensing of financial entities operating from Switzerland was actually one of the first regulators which addressed the matter of token classifications in ICO’s and published its official position with respect to the matter earlier in the year.” FINMA currently offers a ‘stamp of authenticity’ for ICOs that successfully pass through reviews.

Is the Swiss “Crypto Valley” “the world’s most promising tech hub”? Learn more about the place of Switzerland in this new technological revolution below.https://t.co/cq9W1kmyqk

— Swiss Embassy (@SwissEmbassyUSA) January 7, 2018

Berkowitz argues that Switzerland is “using its progressed financial industry and openness for innovative technologies which will affect the financial markets. Not only that, but it seems that the financial authorities in the country are actively promoting this industry and are providing it with a clear path to developing ventures in this field.”

The Switzerland-based Hypothekarbank Lenzburg has also recently announced that they will become the first bank to officially offer business accounts for blockchain and crypto firms.

II. Malta

Malta made headlines in early May when it (which has a human population of less than 500,000) topped charts as the country with the single-highest cryptocurrency trading volume in the world. The discovery was made by Morgan Stanley’s Sheena Shah, who mapped out cryptocurrency trading by volume in each country.

This was a consequence of the fact that Binance, the world’s largest cryptocurrency exchange, had recently moved to the country.

In fact, an increasing number of high-profile blockchain firms and startups have flocked to Malta as a result of its crypto-friendly legislation. Recently, the country passed three new pieces of legislation that were targeted toward supporting the growth of the crypto industry: the “Virtual Financial Assets Act,” which focused on making ICOs safer for investors; the “Malta Digital Innovation Authority Act,” which established the Malta Digital Innovation Authority and made regulatory procedures for the crypto industry official; and the “Innovative Technology Arrangements and Services Act,” which provided guidelines for the registration and certification of technology service providers.

In late June, three pieces of legislation were passed to make the country even more inviting for cryptocurrency firms. This, “combined with Malta’s effective tax regime and the country’s local banking system which is open to boarding blockchain ventures offer companies in the field a comfortable solution for setting up their operations,” said Kulechov.

Today Maltese Parliament unanimously approved 3 bills on DLT/blockchain, a 1st in the World. Honored to have driven these bills. Announced that Mr Stephen McCarthy will be the CEO of the new #Malta Digital Innovation Authority. #BlockchainIsland -SS

Suggested articles

Wisebitcoin Shows Growth in its User Base Around the WorldGo to article >>

— Silvio Schembri (@SilvioSchembri) June 26, 2018

III. Estonia

Stani Kulechov, founder and CEO of ETHLend, told Finance Magnates that his company decided to incorporate in Estonia because the country “has a one of the most competitive tax policies in the region, the operational costs are low, legal authorities are approachable and cooperative.”

He also cited Estonia’s progressive e-residency program, “which is the most attractive feature for startups and entrepreneurs, allowing to launch an online business and get incorporated with less than €5,000.” E-residency is a program by which individuals and companies can register as residents and incorporate in Estonia without ever actually setting foot in the country.

However, in a self-published review of Estonia’s laws, ‘Bitcoin’ Lawyer Adam S. Tracy pointed out a few drawbacks for crypto in the country: “any transaction in Estonia that’s more than €1,000 requires customer identification,” he noted. The country also received heavy criticism from the crypto community when the government made the decision to shut down the Btc.ee exchange several years ago. The country offers some licensure for cryptocurrency firms, including an exchange license and a crypto wallet license.

IV. France

France has stayed relatively quiet in the blockchain space, but the country has recently started to make itself more attractive for crypto firms. In fact, Kulechov said that while “many countries have declared war on ICOs, France is taking a different approach: they are working to make Paris the capital of ICOs.”

Indeed, the French Ministry of Finance announced that it was working on drafting a legal policy to appropriately regulate ICOs in March of this year. “This framework will likely allow ICOs to choose whether or not to apply for a license issued by the AMF,” said Kulechov.

Reuters reported that the proposed framework would grant the Autorité des marchés financiers (AMF) the ability to officially authorize companies to raise funds through token sales, provided that they meet a set of standards outlined to protect investors. The country has also considered tax cuts in order to attract cryptocurrency industry players.

“Our target is simple: enter into the world of finance of the 21st century by guaranteeing all players the necessary security for their development … we should not miss out on the blockchain revolution,” wrote French Finance Minister Bruno Le Maire in an op-ed piece for French news website Numerama in March.

V. Germany

Germany is another country that isn’t often in the headlines in the cryptosphere. However, this could just be a consequence of insufficient marketing: the country’s tax laws are among the friendliest toward crypto gains in the world.

“Germany is a cryptocurrency tax haven,” Kulechov told Finance Magnates. “The German government has established crypto-friendly laws, one of them being the 0% tax on payments made with cryptocurrencies, along with 0% tax for holding any digital asset for more than one year. Moreover, Bitcoin is considered a legal currency for tax and trading purposes.”

However, Berkowitz said that despite the fact that cryptocurrencies are widely used in Germany, “the local financial regulators have yet to offer a designated legislation for blockchain and cryptocurrencies.” Although it is true that “companies currently offering financial services in the cryptocurrency spaces are currently required to be licensed by BAFIN, the local financial regulator.” There is no licensure that has been created specifically for cryptocurrency firms; rather, the firms must apply for more general financial licensing.

VI. Belarus

“Belarus’s government [has offered] blockchain-related ventures a tax exemption for numerous years,” Berkowitz said. However,”Besides this offering, the jurisdiction has little to no benefits for companies working in the space, given the country’s reputation and lack of supporting infrastructure for Blockchain related ventures (banking, advisory services, workforce, etc.”

Still, the tax exemption might just be hefty enough to attract companies for at least several years to come: “the tax for cryptocurrencies is locked at 0% until 2023, which gives cryptocurrency holders peace of mind and certainty on the future,” explained Kulechov.

In a decree entitled “On the Development of the Digital Economy,” the president of Belarus legalised the buying and selling of cryptocurrencies.

Interestingly, smart contracts are considered legal documents in Belarus.

VII. Gibraltar

Gibraltar has also managed to put itself on the map as a global hotspot for crypto. Berkowitz explained that through initiatives that include the Digital Ledger Technology (DLT) Regulatory Framework that was passed in early 2018 “Gibraltar has managed to offer blockchain related ventures with a complete eco system comprised of adequate financial licensing and legislation for crypto ventures, skilled advisors, banking and even a local exchange (the Gibraltar Blockchain Exchange) which will list ICO tokens and which is sponsored by the Gibraltar securities exchange.”

Kulechov added that “the most attractive feature of Gibraltar is the no tax on capital gains or added value, entrepreneurs are only required to pay tax based on their income.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube