Steady As She Goes

The market has closed out our Friday-to-Friday stretch in the green. Recovering from the dip the market took last week, currencies around the board are up on their 7-day charts. Crypto’s total market cap gained a healthy 11% over the course of the week, climbing to $284 bln at the time of writing.

As always, time will tell if this rally has legs. If and when we continue to climb, keep an eye on Bitcoin’s key resistance levels ($7,600, $7,800, $8,000, etc.) to see if the market can surpass and stay ahead of these numbers. For the time being, being above $7,000 has been a blessing and a half; for the future, we’ll have to see if buy volume can keep up with this welcomed rise.

Bitcoin: At $7470, Bitcoin gained 17% on the week, the largest weekly gain we’ve seen in a while for any of our three top assets.

Ethereum: Ethereum was doing better in the middle of the week when it poked its head above $500. Still, it’s up 6% this week with a price of $462.

XRP: Positive but nearly insignificant, XRP rose 2% on the week to $0.45

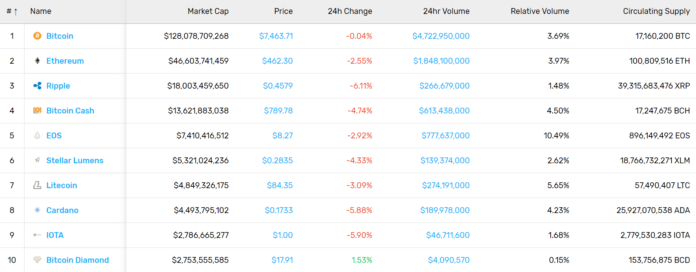

Cryptocurrency Market Stats (7/20/18)

Domestic News

Report: US Ranked as Most ICO-Friendly Country in the World: The United States government has been relatively quiet regarding crypto regulations, and the looming threat of a security classification has been the fear of many an ICO and cryptocurrency startup. Even so, research conducted by analysts in league with the Crypto Finance Conference found that the US is the most ICO-friendly of any nation in the world. The report sifted through 100 of the most-funded ICOs to date, finding that 30 of them were launched in the United States, with Switzerland (15) and Singapore (11) coming in second and third, respectively.

NY Department of Financial Services Awards BitLicense to BitPay: Cryptocurrency payment processor Bitpay has received a coveted BitLicense from New York State regulators. The license will allow the company to provide its services to businesses and individuals within the state, and it will also make it legal for businesses to use BitPay’s platform to accept cryptocurrencies from their customers. “New York state has one of the strictest policies around businesses involved in cryptocurrency and working through the approval processes to obtain a License was important to BitPay. We believe this hard work will pay off as New York presents significant business opportunities for BitPay,” BitPay CEO Stephen Pair said in a statement.

US Congress Holds Another Crypto Hearing, Industry Leaders Weigh In With Testimonies: The United States House of Representatives has held yet another hearing on crypto, this time picking the brains of some of the industry’s leading experts and entrepreneurs. Held by the House Agriculture Committee, it featured testimonies by Joshua Fairfield, William Donald Bain Family Professor of Law, Washington and Lee University School of Law; Amber Baldet, Co-Founder and CEO, Clovyr; Scott Kupor, Managing Partner, Andreessen Horowitz; Daniel Gorfine, Director, LabCFTC and Chief Innovation Officer, CFTC; former CFTC chair Gary Gensler, Senior Lecturer, MIT Sloan School of Management; and Lowell Ness, Managing Partner, Perkins Coie LLP. Each testimony seemed to represent a consensus that current regulations do not provide a sufficient framework for the emerging industry.

Missed the Congressional hearing about how cryptocurrencies are impacting the U.S.? Here’s a list of what you need to know: https://t.co/9yv4V4cEDI by @RossowEsq pic.twitter.com/9MH4xj6kYo

— Forbes Crypto (@ForbesCrypto) July 19, 2018

Steve Bannon Wants to Launch a Token–No Joke: Trump’s former Senior Advisor and the co-founder of Breitbart News, Steve Bannon, has gotten into crypto. So much so, that the right-wing political figure is working on his own coin. In a recent interview with CNBC, he revealed that he holds an undisclosed amount of bitcoin and is working on building a cryptocurrency for populist movements. “We are working on some tokens now, utility tokens, potentially for the populist movement on a worldwide basis. But they have to be quality,” he stated in the interview.

Patent-palooza Round I: Major Banks File for Blockchain Tech Patents: Bank of America, JPMorgan & Chase Co., and Wells Fargo all filed for blockchain-related patents this week. Marking its nearly fiftieth patent, Bank of America’s looks to secure rights for a blockchain-based system to validate external data. JPMorgan’s own looks towards the blockchain to store and transact digital receipts tied to bonds and other assets, while Wells Fargo wants to use the technology to protect and store sensitive data.

Patent-palooza Round II: Barclays and Mastercard Seek Out Their Own Blockchain Patents: UK-based bank Barclays has filed three patents with the United States Patent and Trademark Office. The three related patents seem to create a framework for incorporating cryptocurrencies into traditional banking practices and could also pave the way for a stablecoin. Meanwhile, Mastercard filed its own patent for a blockchain network the features a two-layered solution for users to store both cryptocurrency and fiat and swap between the assets with ease.

What’s New at CoinCentral?

Coinbase Considering Adding Cardano, BAT, Stellar Lumens, Zcash, and 0x: The exchange came out in a blog post and revealed that it was looking at technical standards for the five coins.

Blockchain Logistics – Changing the World or Just Marketing Hype?: A look into how blockchain could redefine how we do logistics and supply chain.

Win or Lose: The Gamble Some Are Taking to Become Bitcoin Billionaires: From taking out second mortgages to leveraging student debt, people have risked fortunes trying to “make it.”

The Entertainment Industry and Blockchain Create New Possibilities: Ticket sales, content monetization, artistic licensing–blockchain opens up all kinds of possibilities for the entertainment industry.

Blockchain and the Battle Against Corruption & Fraud: In one of our latest features, we examine how blockchain can fight fraudulence, both in the virtual and real worlds.

Hiring Blockchain Developer Talent Is the New Industry Challenge: As demand rises, developers are in short supply.

What is DECENT (DCT)? | Beginner’s Guide: DECENT is a decentralized application (DApp) ecosystem comprised of the DCore blockchain and DCT altcoin.

How Can Marketplaces Benefit from Blockchain?: We know about the crypto market, but what can the industry’s technology do for traditional, everyday-goods marketplaces?

EOS Developer Block.One Attracts Investments from Peter Thiel and Jihan Wu: Block.One has even more capital to work with now after a round of generous donations from two of the space’s leading voices.

IBM and Stronghold Partner to Release USD-pegged Stablecoin: Stronghold USD will make use of Stellar’s network to operate, Stronghold itself acting as an anchor on the network.

Beyond Crypto Valley – Find out Why Switzerland Is the Blockchain Capital of the World: The country has quickly become a go-to for fledgling and veteran crypto companies alike for its unobtrusive legislation.

Internet of Things (IoT) and Blockchain – What Are the Possibilities?: Are the two systems bound to be used in unison?

Kodak Bitcoin Mining Rig Kashminer Stopped by SEC: Recently revealed as a scam, the Kodak mining rig has been shut down by the SEC

How to Get into a Bitcoin Business that Works: Want to start a business in the industry? Here’s where to start.

Zcash Cryptocurrency Mining Is Four Times More Profitable Than Bitcoin: Ready to re-target your miners to something more profitable?

Hong Kong’s Banking Sector to Get a Blockchain Platform by September: The Hong Kong Monetary Authority, the region’s currency board and central bank, is set to launch a live blockchain-based trading platform in September.

Cryptocurrency App Checklist for 2018: Take your Game to the Next Level: In this cryptocurrency app roundup, we take you on a journey through the information platforms keeping traders, enthusiasts, developers, speculators and casual observers alike clued into the world of virtual currencies.

Cryptocurrency News From Around the World

Russian Miners, Investors Will Likely Be Subject to Existing Laws: According to local reports, the Russian government has come close to a consensus for regulating aspects of the cryptocurrency industry. A bill, which lawmakers expect to pass through Russia’s legislature this fall, subjects miners and investors to existing taxation laws laid out in Russia’s Internal Revenue Code. Anatoly Aksakov, Chairman of the Duma Committee on Financial Markets, indicated in an interview that legal entities will be taxed according to their businesses and that, if the situation should call for it, the government may consider separate tax codes for the industry.

In a Down Market, Crypto-Jacking and Mining Malware Follows Suit: A report released this week by security firm Malwarebytes found that mining malware is becoming less common, and the market is likely to blame. The study found that mining malware attacks have decreased by 40% from Q1 of 2018 to Q2, and the firm speculates that this trend will continue to stabilize or stagnate according to the crypto market’s own movements. “In nearly every malware category for both business and consumer detections, we saw a decrease in volume, corroborating our general ‘Dang, it’s been a little too quiet in here’ sentiments since starting the new year,” the report states.

China to Lead New International Coalition for Research on Blockchain and IoT Tech: China is slowly inching further towards a position as a global blockchain leader, and this week, it inched even closer. A committee jointly comprised of the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) approved the research group this week. Lead by Chairman Dr. Shen Jie, the research group also includes professionals and experts from the US, UK, France, and Germany among many others.

New Report Finds that Majority of ICOs Don’t Deliver on Promises and Remain Centralized After Launch: A study undertaken by researchers at the University of Pennsylvania Law School may lead you to think twice about those lofty promises laid out in ICO whitepapers. The report, authored by Shaanan Cohney, David A. Hoffman, Jeremy Skarloff, and David A. Wishnick, finds that the vast majority of ICOs fail to live up to their whitepaper’s expectations; what’s more, the report argues that they don’t even stay decentralized or trustless. “Our inquiry reveals that many ICOs failed even to promise that they would protect investors against insider self-dealing. Fewer still manifested such contracts in code. Surprisingly, in a community known for espousing a technolibertarian belief in the power of “trustless trust” built with carefully designed code, a significant fraction of issuers retained centralized control through previously undisclosed code permitting modification of the entities’ governing structures,” the report reads.

Study Shows Many ICO Protocols Fail to Match White Paper Promises https://t.co/LggmzJx5Z6 #Bitcoin pic.twitter.com/z3F1ZFzWvO

— Bitcoin News (@BTCTN) July 19, 2018

Malta Stock Exchange, OKEx Partner to Build Security Tokens Platform: The Malta Stock Exchange (MSE) is partnering with OKEx, which has its headquarters in Malta, to bring security tokens to the market. MSE recently launched MSX PLC, the exchange’s investment arm to enter into joint ventures with other companies. For its first joint venture using MSX PLC, the MSE and OKEx signed a memorandum of understanding to work towards building the security token platform in Q1 of 2019. MSE is also partnering with Neufund, a German-based crypto service platform, to tokenize equities, as well.

Big Four Auditing Firms Collaborate With Taiwanese Banks to Pilot Blockchain Platforms: Deloitte, Ernst & Young, KPMG, and PwC are teaming up with 20 Taiwanese banks to trial blockchain auditing platforms. The pilots will look to streamline audit confirmation times for financial reports. Instead of obtaining and verifying a company’s transactions with other entities manually, the pilot will allow auditors to reference transaction history using the blockchain’s distributed ledger. Working alongside Taiwan’s Financial Information Services Co., the coalition of banks believe that the pilot could reduce audit confirmation times from a couple of weeks to a single day.

The post This Week in Crypto: July 20, 2018 appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube