We’ve Hit Cruising Altitude

After the impressive rally we had to end the previous week, this week has been rather boring. The cryptocurrency market cap bounced between $120B and $122B ultimately losing about one percent in the week.

Cryptocurrency Market Stats (2/15/19)

Dash (12.38%), Maker (24.19%), and NEO (10.02%) all saw double-digit gains this week while few coins were in the red. The top three were a bit of a mixed bag over the last seven days.

Bitcoin rose 2.15% to bring its price over $3,600.

Ethereum had a monster week with a price increase of 8.13%. It’s now right above $120.

XRP wasn’t as fortunate. News of J.P. Morgan’s new crypto may have been the cause of the coin’s 1.13% slide.

The Virus Is Spreading: Morgan Creek Digital hedge fund launched a Blockchain Opportunities Fund this week that focuses on digital asset investments. The new, $40 million fund includes investments from the Fairfax County Police and Fairfax County Employee’s Pension plans. This investment is the first time in U.S. history that a public pension fund has invested in cryptocurrency.

Morgan Creek Digital founder Anthony Pompliano has long been an advocate of cryptocurrency on Twitter and his podcast, Off the Chain. In a recent thread on Twitter, he outlined additional details of the fund including their investment strategy and more information on the stakeholders outside of the pension funds.

0/ The fund we announced today at Morgan Creek Digital was the product of a lot of work.

Time for a thread 👇🏽👇🏽👇🏽

— Pomp 🌪 (@APompliano) February 13, 2019

Jamie Dimon, You Sly Fox: Just a couple short years after calling Bitcoin a fraud, J.P. Morgan CEO Jamie Dimon appears to be changing his tune, albeit just slightly. This week, the multinational bank announced JPM Coin, a digital token to instantly settle payments between J.P. Morgan clients. The currency is pegged 1:1 with the U.S. dollar similar to the many other stablecoins in the market.

The bank already has already prepared three different use-cases for JPM Coin: international payments for corporate clients, securities transactions, and treasury replacements. The move comes as a surprise to some in the blockchain industry; however, Dimon did previously claim that although he is anti-Bitcoin, he’s consistently been pro-blockchain.

An Exploration of Blockchain Ethics: a Token with Two Sides: There are two sides to every story, good/bad or right/wrong, and blockchain is no exception.

Bitcoin Tourism | How Far Are We From True Borderless Payments?: Bitcoin is touted as a true, global currency. But we may be further away from that reality than some would like to believe.

Reinsurance Blockchain | Simplifying the Complex Insurance Industry: Putting insurance for your insurance on a blockchain. We can’t believe it’s not called insura-ception.

Building a Better Blockchain Environment: Nine out of 10 (probably more) scientists agree: climate change is real. Fortunately, it looks like blockchain may be able to help fight it.

Brock Pierce on Crypto, Blockchain Gaming, Rebooting Mt. Gox, and More: EOS, Mt. Gox revival, blockchain to Puerto Rico – you don’t want to miss our discussion with the legendary figure.

How Are Blockchain Startups Disrupting Real Estate?: There’s a lot of value blockchain startups are bringing to the real estate industry. Let’s take a look at how they’re doing it.

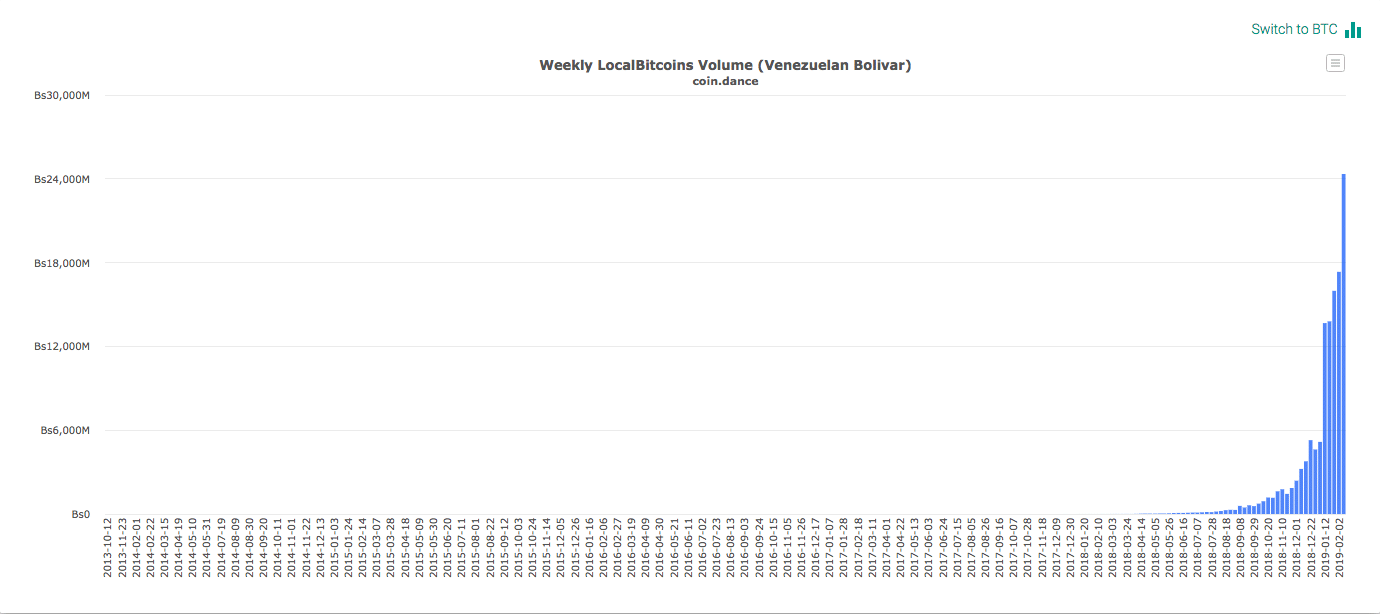

Venezuelan Bitcoin Activity on the Rise: The weekly LocalBitcoins volume in Venezuela hit a new all-time high this week and continues to rise. The over 2.4 thousand BTC volume equates to almost $9 million in weekly trading.

As the Venezuelan economy continues to spiral downwards, it appears as if the country’s citizens are looking towards bitcoin as an alternative store of value. Hyperinflation in the country is expected to reach 10 million percent this year, and government-created Petro cryptocurrency isn’t likely to help. Three million Venezuelans have fled the country in the last five years due to the economic downturn.

Venezuela LocalBitcoins Volume (via Coin Dance)

More Canadian Shenanigans: Just a week after its previous debacle, QuadrigaCX is back in the news again. For those unfamiliar, last week, news surfaced that the CEO of the Canadian exchange passed away leaving $145 million in customer funds unobtainable. Because he was the only person who knew the private keys to QuadrigaCX’s cold wallets, those funds are locked away indefinitely.

Now, according to an Ernst and Young (EY) report to the Nova Scotia Supreme Court, it looks like the exchange has messed up once again. The auditors state, “On February 6, 2019, Quadriga inadvertently transferred 103 bitcoins valued at approximately $468,675 to Quadriga cold wallets which the Company is currently unable to access.” It’s unclear how this mistake could have happened. But, hey, what’s another half a million on top of nearly 150 million anyway?

The post This Week in Cryptocurrency: February 15, 2019 appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube