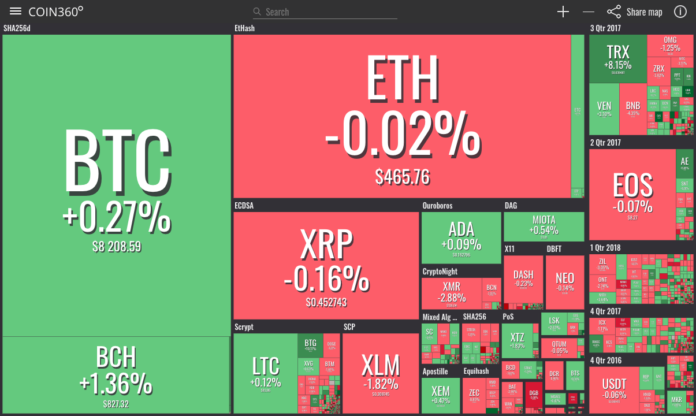

Sunday, July 29: crypto markets have seen diverging trends over a 24 hour period, with nine out of the ten top cryptocurrencies by market cap slightly in the green, according to Coinmarketcap.

Market visualization from Coin360

Bitcoin (BTC) is slightly up by less than one percent over the past 24 hours and is trading at around $8,206 at press time, with an intraday high of $8,285. The major cryptocurrency reached as high as $8,431 this week, following the crypto market rebound that started in mid-July. Holding the some of the biggest gains among the top ten coins over the past week, Bitcoin is now up almost 39 percent over the past month.

Bitcoin 1 month price chart. Source: Cointelegraph Bitcoin Price Index

Bitcoin’s market dominance over altcoins also keeps growing, currently amounting to almost 47.5 percent.

Percentage of Total Market Cap (Dominance). Source: Coinmarketcap

Ethereum (ETH) is down a negligible percentage over a 24 hour period, trading at around $466 at press time. The top altcoin keeps fluctuating around $460, having seen its intraday high of $470. Over the past week, ETH reached its peak of $483 on July 25.

Ethereum weekly price chart. Source: Cointelegraph Ethereum Price Index

Total market cap is hovering around $297 billion by press time, after touching $304 billion earlier this week.

Total market capitalization chart. Source: Coinmarketcap

TRON (TRX) has seen the biggest gains over the past 24 hours, gaining almost 8.5 percent by press time. This week, the altcoin has broken into the top ten coins by market cap, with its market cap having surpassed that of Tether (USDT). At press time, TRX’s market cap amounts to around $2.6 billion, while Tether’s market cap has fallen from its intraweek high of $2.7 billion to a current $2.5 billion, according to Coinmarketcap.

Earlier this week, on July 26, the U.S. Securities and Exchange Commission (SEC) officially rejected the Winklevoss twins’ petition looking to review the previous rejection of their Bitcoin exchange-traded fund (ETF) in March 2017.

Subsequently, SEC Commissioner Hester M. Peirce published an official dissent of the second rejection of the Winklevoss’ application. Peirce argued that the financial regulator has overstepped “its limited role” since it focused on the features of the underlying BTC market, rather than the derivatives that the applicant intended to list.

On July 27, Nasdaq held a private meeting with representatives from both traditional finance and crypto industry firms to discuss a way to “get the [crypto] industry on the path to legitimacy.”

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube