Do you make thousands of short-term crypto trades every year? Do you day trade throughout the trading session? Are you consistently trading on at least five or six days during the week? Are several hours of your trading day devoted to market research and trade accounting? Is at least one of your crypto accounts exclusively devoted to your hyperactive trading regime, one intended to earn a full-time living for you? If audited, could you honestly substantiate all of the above to support your trading activities? If so, it’s time for you to learn how to trade crypto as a business via IRS trader status.

Key Differences Between Investors and Traders

The Internal Revenue Service (IRS) treats investors differently than they do traders, and now (tax year 2018) that investment expenses are no longer deductible, active crypto traders have good reason to seek trader status.

Investors are essentially anyone not trading full-time and not earning their primary living by way of frequent cryptocurrency trading (as described in the opening paragraph).

Here are the main drawbacks of trading crypto as an investor rather than as a trader:

- You can only deduct $3,000 per year in capital losses. Imagine having a really bad trading year, getting smacked with $24,000 in short-term capital losses. It will take you at least eight years to fully offset those losses. Even worse, you can only offset short-term losses against short-term gains and long-term losses against long-term gains.

- You can no longer deduct a portion of the cost of newsletters, trading advice, tax prep, trading software, data feeds or other investment-related expenses as in previous tax years. Ouch.

Potential Advantages of Trader Status with a Section 475 MTM Election

The word potential looms large here. The reason is that the IRS presently classifies cryptocurrencies as property and not as a securities or commodities. If and when the tax folks declare cryptocurrencies to be a security or a commodity, then taking the Section 475 mark to market (MTM) accounting election becomes an easy decision.

- By electing to use MTM, your crypto capital gains and losses will be taxed as ordinary gains and losses.

- You’ll no longer be affected by the $3,000 maximum annual capital loss deduction applicable to investors.

- All of your trading expenses will be deductible on Schedule C (profit or loss from business). Computers, monitors, internet, data feeds, cell phone, furniture, educational expenses, seminars, professional subscriptions, tax preparation, legal fees, depreciation, car and truck expenses, pension and profit-sharing, taxes and licenses, travel and meals, etc. are all potentially deductible expenses for your crypto trading business. You’ll also receive a home office deduction for business administrative functions performed within it.

More Business-Friendly Goodies

- If you actually rent or buy an office (not in your home), then you’ll also get to deduct rent, insurance, mortgage interest, utilities, and property taxes. If you have employees, their pay and benefits will also be deductible business expenses.

- Your health insurance premiums will be deductible on Schedule C as a business expense.

- If you’re a sole proprietor or operating as a single-member LLC, you’ll need to pay self-employment tax (Schedule SE). Half of the tax amount will be deductible on Form 1040. This doesn’t help you now, but it should boost your social security payout, come retirement.

- When you trade crypto as a business via trader status, you’re allowed to create a retirement account such as a Solo 401-k, etc. Contribution limits for Solo 401-k plans dwarf those of IRA and Roth IRA accounts, a big plus for you.

That’s a very generous slate of potentially profitable tax advantages for your crypto trading business. Depending on how you actually structure your business (S-Corp., LLC, C-Corp, sole proprietor, etc) those tax bennies could prove lucrative.

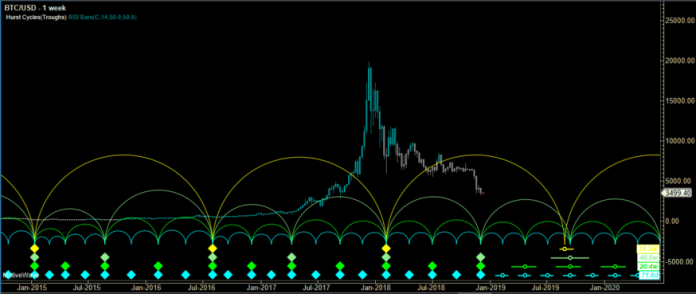

Consider putting Bitcoin’s powerful bull and bear cycles to work for you as a business owner, rather than as an investor. Image: MotiveWave Ultimate.

Seek Pro Tax Counsel Before Electing Trader Status and MTM

Assuming you’re a highly profitable, hyperactive crypto trader, it’s wise for you to seek out and pay for the best tax advice available. Particularly when electing trader status with MTM and doubly more so if attempting to do so for a crypto trading operation.

Many firms offering specialized trader tax preparation also offer C-Corp., S-Corp. and LLC formation services. Make sure they are highly skilled on both the crypto trader tax and the company formation sides of the equation. Company formation may be costly if going this package-deal route, however. Instead, consider creating any one of those business structures at one of the low-cost legal websites.

Many pro traders use an S-Corp. or an LLC to run their enterprises. You can do likewise, even combining the two structures together for added flexibility (and more paperwork!). Both offer personal asset protection. However, a nice plus of the S-Corp. is the ability to issue shares of stock to raise capital. LLCs cannot sell stock to investors in exchange for capital but they can sell interests in the company itself.

You don’t need a fancy watch or a silk suit to trade cryptocurrency as a business, but you will need expert tax and company formation advice to do so successfully. Photo by Adeolu Eletu on Unsplash

Trade Crypto as a Business via Trader Status

All told, electing IRS trader status with MTM appears to be a winning strategy for active crypto traders. You’ll save on taxes, convert capital gains and losses into ordinary gains and losses, be able to deduct big trading losses immediately (why wait eight years?) and write-off every single trading expense as the cost of doing business.

Deducting health insurance premiums and starting a Solo 401-k retirement plan are additional perks offered by switching from crypto investor to crypto trader. Going further, you can also protect your personal assets by creating a corporation or LLC for your trading biz.

Investigate the track record and reputation of the tax preparers who claim to be experts in trader tax matters. Ask them how many crypto clients they’ve assisted in obtaining IRS trader status. Compare their fees for corporation and LLC formation with those of ordinary legal websites. You could save hundreds of dollars by forming your S-Corp. or LLC with the latter, rather than the former.

Whichever route you go for crypto trader status counsel and company formation, make sure to get expert, IRS-approved advice.

The post Trade Crypto as a Business via Trader Status appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube