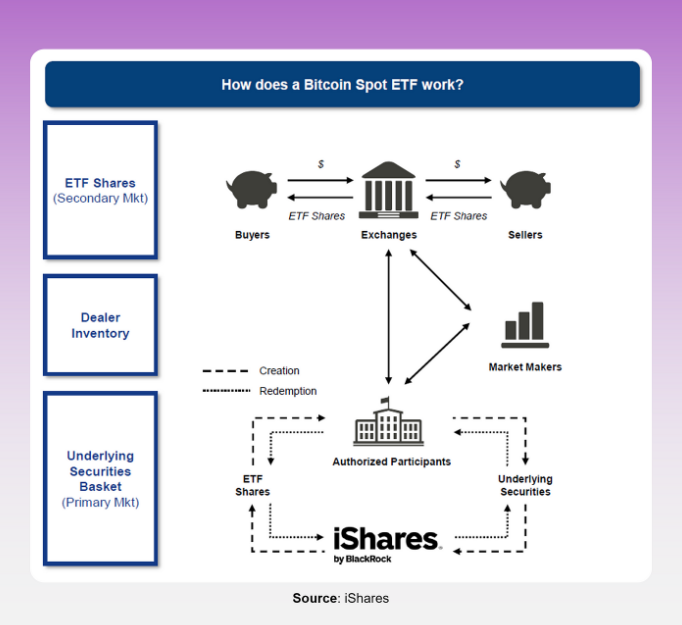

The topic of Bitcoin Exchange-Traded Funds (ETF) and their approval around the world has become a part of many debates recently. These financial instruments have emerged as a potential game-changer, offering a bridge between traditional finance and the world of digital assets. In this article, we explore the concept of Bitcoin ETFs, their significance, and the impact they could have on the broader digital asset ecosystem. A Bitcoin ETF is a type of investment fund that tracks the price of bitcoin, allowing investors to gain exposure to the leading digital asset without actually owning it. Unlike traditional investments in virtual currencies, where investors must manage private keys and digital wallets, Bitcoin ETFs simplify the process by offering a familiar investment vehicle. Investors can buy and sell shares of the ETF on stock exchanges, just like any other traditional exchange-traded fund.Bitcoin ETFs provide an easier and much less complex way for investors to put their money on BTC via regulated platforms. Moreover, for institutional investors and traditional asset managers who may have been hesitant to dive directly into the volatile and unfamiliar world of digital assets, these ETFs provide a regulated and familiar entry point.The volatility of the digital asset sector and the regulatory uncertainty of trading platforms are some of the biggest hurdles faced by investors, and Bitcoin ETFs address these concerns. This accessibility is a crucial factor in attracting a broader investor base, potentially contributing to the mainstream acceptance of bitcoin. As mentioned above, Bitcoin ETFs provide indirect exposure to investors to the price action of BTC, allowing them to bypass the hassle of buying and selling the digital asset. There are some steps involved in the creation of a Bitcoin ETF: An asset management firm or financial institution decides to create a Bitcoin ETF and registers the ETF with regulatory authorities and exchanges where it intends to list the fund.The ETF provider needs to secure custody of the actual bitcoin that will back the ETF. This involves partnering with a trusted custodian to hold the bitcoin treasury securely. In the case of BlackRock’s iShares Bitcoin Trust, the asset manager partnered with Coinbase.Once custody is secured, the ETF provider creates shares of the ETF. Each share is typically designed to represent a certain fraction of BTC. Thereafter, the ETF is listed on traditional stock exchanges.Investors can buy and sell shares of the Bitcoin ETF on the stock exchange, similar to trading traditional stocks. This provides a familiar and regulated way for investors to gain exposure to bitcoin without directly holding the cryptocurrency.Also, investors will have to pay fees to cover the costs associated with managing the fund. These fees can include management fees, custodial fees, and operational expenses.What are Bitcoin ETFs?

How do Bitcoin ETFs Work?

Benefits of Bitcoin ETFs

One of the key advantages of bitcoin ETFs is their potential to reduce barriers to entry for retail investors. Leading digital asset exchanges like Binance and Coinbase can be intimidating and complex, especially for those new to the space. Nevertheless, with ETFs, investors can leverage their existing brokerage accounts to gain exposure to bitcoin without the need to create new accounts on exchanges.

Additionally, the liquidity of Bitcoin ETFs can contribute to a more stable and mature market for the underlying digital asset. The bitcoin market is considered extremely volatile, and sometimes liquidity can be an issue. Therefore, Bitcoin ETFs can enhance the existing liquidity. With time, as more investors participate through ETFs, the overall trading volume and liquidity of the ETF shares increase, potentially leading to more stable price movements for bitcoin.It is crucial to note that the United States Securities and Exchange Commission (SEC) has received dozens of applications over the years for the approval of a Bitcoin Spot ETF by asset management firms like ARK Invest, 21Shares, Fidelity, BlackRock, Invesco, Grayscale, and WisdomTree. However, approval is yet to be seen.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube